Automatic Bottle Filling Equipment: The Ultimate 2025 Sourcing Guide

Introduction: Navigating the Global Market for Automatic Bottle Filling Equipment

In the high-stakes landscape of consumer packaged goods (CPG), a production line is only as viable as its slowest bottleneck. For growing manufacturers across the USA and Europe, the transition from manual or semi-automatic processes to fully automatic bottle filling equipment is the definitive step toward scalability.

While pneumatic bench-top units and manual gravity fillers serve a purpose for boutique operations, they often fail to meet the rigorous demands of mass distribution. The problem is twofold: inconsistency and inefficiency. Manual variance in liquid levels damages brand perception and compliance, while slow cycle times cap your revenue potential. Whether you are packaging viscous industrial fluids or thin food-grade spirits, the inability to automate precision filling results in wasted product and inflated labor costs.

Navigating the market for world-class equipment—such as Italian-engineered Spagni systems—requires a clear understanding of your specific production variables, including viscosity, bottle geometry, and flash points.

This guide provides a strategic framework for procurement, covering:

- Technology Types: Distinguishing between gravity, pump-driven, and pneumatic filling systems.

- Operational Fit: Matching equipment to product viscosity and container material (e.g., glass vs. large PET).

- ROI Factors: Evaluating throughput (Liters/Hour), electrical standards (110V vs. 220V), and facility footprint.

Read on to secure the machinery that transforms your bottling process from a liability into a competitive advantage.

Illustrative Image (Source: Google Search)

Top 10 Automatic Bottle Filling Equipment Manufacturers & Suppliers List

1. Best 8 Industrial Filling Machine Manufacturers in 2025 – LIENM

Domain: lienm.com

Registered: 2012 (13 years)

Introduction: PACKO Filling Systems is renowned for automatic filling line manufacturers worldwide. Their industrial liquid filler manufacturers combine ……

2. The Best 10 Bottle Filling Machine Manufacturers-Yundu

Domain: yundufillingmachine.com

Registered: 2024 (1 years)

Introduction: Which 10 companies are the best filling machine manufacturers? · 1.COESIA · 2.Yundu · 3.Pacific Packaging Machinery · 4.Krones · 5.GEA Group · 6.KHS ……

3. Top 10 Liquid Filling Machine Manufacturers – HonorPack

Domain: honorpack.com

Registered: 2009 (16 years)

Introduction: Top manufacturers include HonorPack, Krones, KHS GmbH, Accutek, JBT, Romaco, GEA, Syntegon, Watson Marlow, and I.C. Filling Systems….

4. Bottle Filling Machines & Equipment – Filling Equipment …

Domain: fillingequipment.com

Registered: 1997 (28 years)

Introduction: We specialize in the design, sale, and repair of filling machines, as well as cappers, used in bottling food, drinks, spreads, chemicals, and cosmetics….

Illustrative Image (Source: Google Search)

5. Bottling & Filling Equipment Manufacturer – ACASI Machinery – Acasi

Domain: acasi.com

Registered: 2001 (24 years)

Introduction: ACASI offers bottle unscramblers, fillers, cappers, labelers, neck banders, conveyors, accumulation tables, liquid filling, and bottle handling equipment….

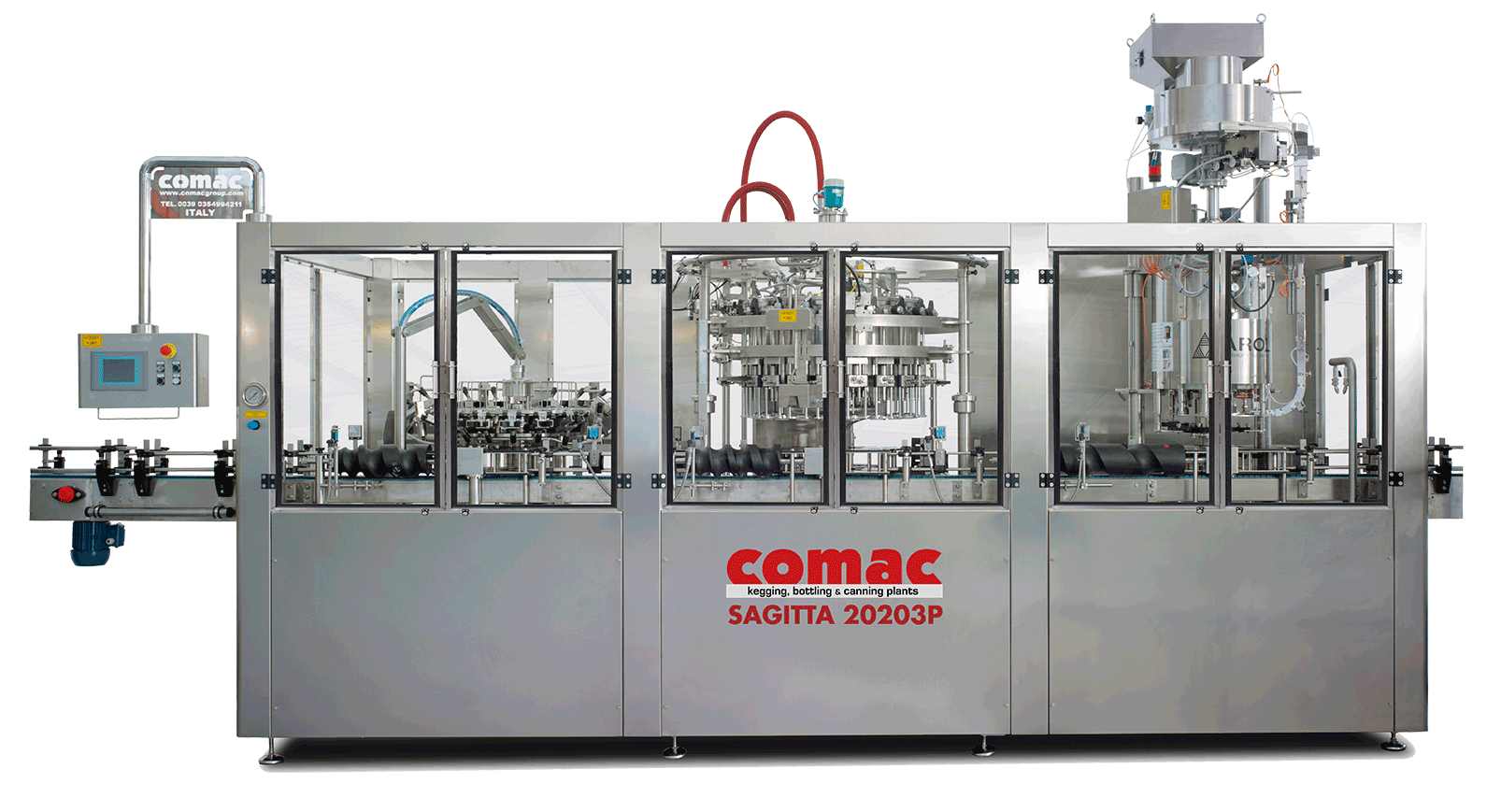

6. Automatic bottle filling machine – Co.Mac. – Comac Group

Domain: comacgroup.com

Registered: 2002 (23 years)

Introduction: Comac’s automatic bottle filling machines are scalable, customizable, and can package any bottle size and type, with electro pneumatic filling valves….

7. Bottle Fillers, Automatic Bottle Filling Machines – Cru Bottling Systems

Domain: crusystems.com

Registered: 2016 (9 years)

Introduction: 30-day returnsCru Systems offers pneumatic bench-top, gravity, and semi-automatic bottle fillers, including models for thick gels, creams, and various bottle sizes….

8. Bottling & Filling Equipment Manufacturer | E-PAK Machinery

Domain: epakmachinery.com

Registered: 2001 (24 years)

Introduction: E-PAK Machinery manufactures quality liquid filling machines, including cappers and labelers, for the bottling industry. Buy equipment and parts online….

Understanding automatic bottle filling equipment Types and Variations

Understanding Automatic Bottle Filling Equipment Types and Variations

Selecting the correct automatic bottle filling equipment requires matching the machine’s operating principle to the viscosity of the product and the desired production speed. While designs vary from pneumatic bench-top units to full-scale rotary systems, most equipment falls into distinct categories based on how the liquid is metered and dispensed.

The following table outlines the primary types of filling equipment relevant to the US and European markets, catering to products ranging from free-flowing beverages to viscous industrial fluids.

Comparative Overview of Filling Technologies

| Type | Key Features | Typical Applications | Pros & Cons |

|---|---|---|---|

| Gravity Fillers | Uses atmospheric pressure to fill to a specific level or time. Simple mechanics; often stainless steel construction. | Thin, free-flowing liquids: Water, wine, juice, solvents, spirits. | Pros: Cost-effective, easy to clean, low maintenance. Cons: Cannot handle viscous products; slower with thicker fluids. |

| Pneumatic / Piston Fillers | Utilizes compressed air to drive a piston for volumetric filling. High force generation for heavy products. | Viscous liquids: Creams, gels, heavy sauces, pastes, oils. | Pros: Excellent for thick products and particulates; high accuracy. Cons: More complex cleaning; requires compressed air source. |

| Pump-Assisted Fillers | Integrates a pump to move liquid from a supply source (often floor-level) to the nozzle. | High-volume containers, large PET bottles, oils, syrups. | Pros: Versatile placement of supply tanks; consistent flow rates. Cons: Pump components require maintenance based on product abrasiveness. |

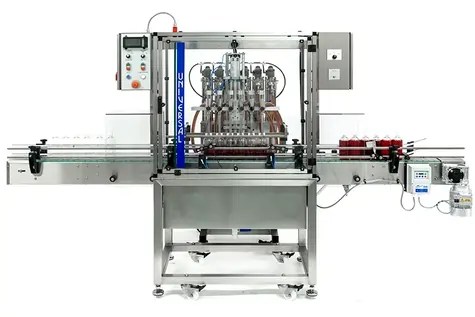

1. Gravity Filling Machines

Gravity fillers are the industry standard for non-carbonated, low-viscosity liquids. These systems rely on the natural force of gravity to move the product from an overhead tank into the bottle. As the valve opens, the liquid flows until a pre-set time is reached or a specific fill level is achieved.

- Operational Mechanism: The supply tank must be positioned above the nozzles. When the bottle engages the nozzle, the valve opens, allowing fluid to flow freely.

- Equipment Highlight: Modern iterations, such as Spagni stainless steel gravity fillers, are engineered for precision. For example, units designed for large PET bottles often utilize larger nozzles (e.g., 16mm) to ensure rapid flow rates without creating excessive turbulence or foam.

- Best For: Facilities bottling water, spirits, or thin chemical products where consistent fill levels are prioritized over volumetric precision.

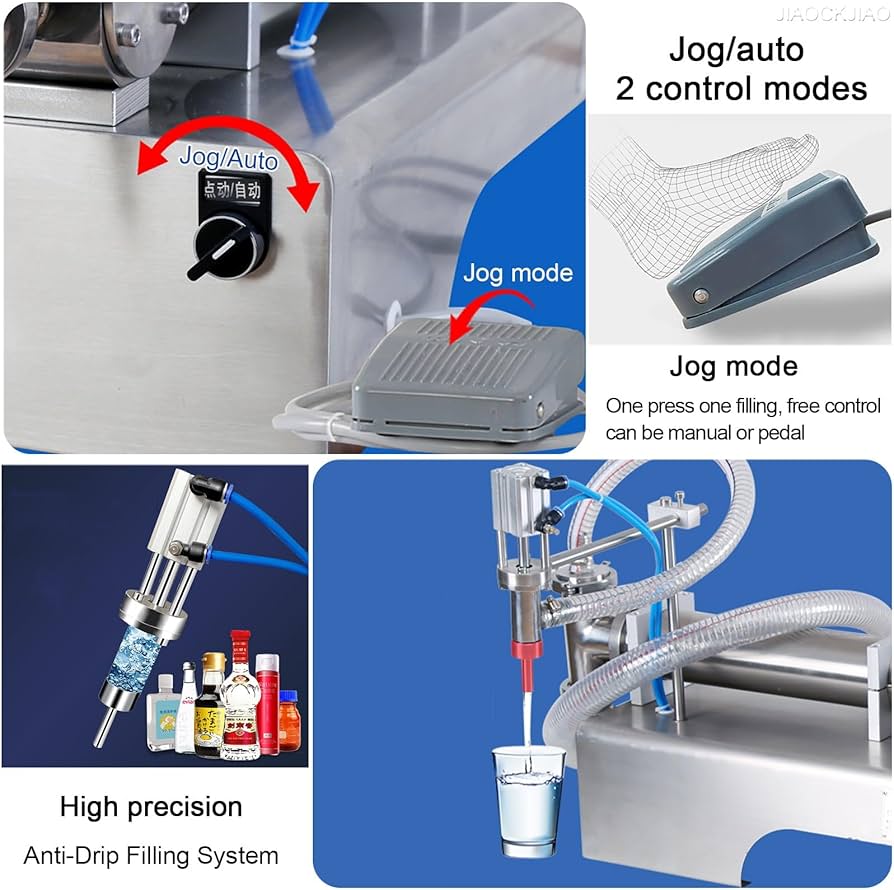

2. Pneumatic and Piston Filling Machines

When dealing with products that resist flow—such as cosmetic creams or food pastes—gravity systems are insufficient. Pneumatic filling machines employ compressed air to drive a piston or cylinder, forcing the product into the container.

Illustrative Image (Source: Google Search)

- Operational Mechanism: These machines draw a specific volume of product into a cylinder and then push it out through the nozzle. The pneumatic drive provides the necessary torque to move thick liquids that would otherwise clog a gravity system.

- Versatility: As noted in industry specifications, these units are capable of handling a spectrum from “thin to viscous,” making them ideal for contract packagers who switch between different product types (e.g., from thin oils to heavy lotions) on the same line.

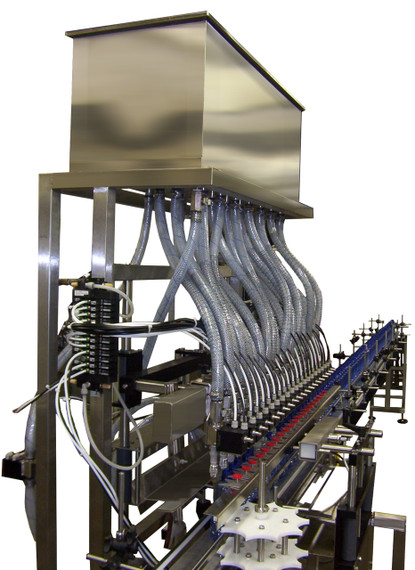

3. Pump-Assisted Filling Systems

Pump-assisted fillers bridge the gap between gravity and forced-displacement systems. These are particularly essential when the bulk product supply is located below the filling machine, requiring active lift to reach the nozzles.

- Operational Mechanism: A dedicated pump draws liquid from a floor-level drum or tote and delivers it to the filler manifold or directly to the nozzles.

- Throughput Capabilities: These systems are designed for higher volume efficiency. For instance, a 3-nozzle pump-assisted configuration can achieve outputs of approximately 1,200 liters per hour (400 liters per nozzle), significantly optimizing the bottling process for medium-sized operations.

- Safety and Compliance: When operating pump-assisted electric fillers, B2B operators must verify the flash point of their product. Unless explicitly certified as “explosion-proof,” these machines should not be used with volatile solvents or flammable liquids. Proper ventilation and adherence to electrical safety standards (e.g., 110V/60hz single-phase requirements in the US) are mandatory.

Key Industrial Applications of automatic bottle filling equipment

Key Industrial Applications of Automatic Bottle Filling Equipment

Automatic and semi-automatic bottle filling equipment is critical for scaling production from bench-top operations to full industrial lines. While specific machinery configurations—such as gravity fillers or pneumatic piston fillers—vary based on viscosity and container type (e.g., glass vs. large PET), the core applications span several high-demand sectors.

The following table outlines the primary industries utilizing this technology, their specific liquid applications, and the direct operational benefits.

Industry Application Matrix

| Industry Sector | Typical Liquid Applications | Key Operational Benefits |

|---|---|---|

| Food & Beverage | • Juices, wines, and spirits • Edible oils (olive, avocado) • Thin sauces and dressings |

• Consistency: Ensures uniform fill levels for shelf appeal. • Hygiene: Stainless steel construction (e.g., Spagni systems) meets food safety standards. • Versatility: Gravity fillers handle free-flowing liquids efficiently. |

| Personal Care & Cosmetics | • Shampoos and conditioners • Lotions and creams • Essential oils and serums |

• Viscosity Management: Pneumatic systems handle products ranging from thin oils to thick creams. • Aesthetics: Prevents foaming and dripping to protect label integrity. • Flexibility: Adaptable nozzles for various bottle shapes and sizes. |

| Household & Industrial | • Liquid detergents • Soaps and sanitizers • Non-flammable cleaning agents |

• Volume Precision: Accurate filling for large containers (e.g., 1,200L/hr output capabilities). • Durability: Equipment designed to withstand corrosive properties of cleaning agents. • Scalability: Modular designs allow for increased throughput as demand rises. |

| Pharmaceuticals | • Liquid supplements • Syrups • 50ml – 100ml tinctures |

• Dosage Accuracy: Critical control over fill volume to meet regulatory labeling requirements. • Contamination Control: Closed systems and easy-clean nozzles reduce cross-contamination risks. |

Detailed Application Analysis

1. Food and Beverage Production

In the F&B sector, the transition from manual to automatic filling is driven by the need for speed and sanitation.

* Gravity Filling for Thin Liquids: For products like wine, water, and juices, gravity fillers are the industry standard. These systems utilize the natural flow of the liquid, making them ideal for non-carbonated, free-flowing beverages. Equipment featuring individual stainless-steel shelves and adjustable nozzles allows for the handling of large PET bottles or standard glass containers without changeover downtime.

* Viscous Food Products: For thicker products like honey or heavy sauces, pneumatic piston fillers are utilized to push product through the nozzle, ensuring consistent flow rates that gravity alone cannot achieve.

Illustrative Image (Source: Google Search)

2. Personal Care and Cosmetics

The cosmetic industry demands high aesthetic standards; a bottle filled to the wrong level is often rejected by consumers.

* Handling Varied Viscosities: A single production line may need to fill thin toners and thick body butters. Automatic fillers with adjustable pressure settings and nozzle diameters (e.g., 16mm nozzles for higher volume flow) allow manufacturers to switch between product types efficiently.

* Container Flexibility: Cosmetic packaging varies wildly. Bench-top and semi-automatic solutions offer the flexibility to fill unique, design-centric bottle shapes that may not fit standard conveyor rails.

3. Chemical and Industrial (Non-Flammable)

Safety Note: Standard gravity and pneumatic fillers are generally not explosion-proof. They are best suited for water-based or non-volatile industrial fluids.

* Large Format Filling: Industrial clients often require filling bulk containers (4L to 20L). Systems equipped with pumps can manage high-volume throughput—up to 1,200 liters per hour—making them essential for producers of bulk detergents or automotive fluids.

* Corrosion Resistance: Equipment manufactured with high-grade stainless steel is essential to prevent chemical reactions between the machinery and the product, ensuring long-term asset viability.

3 Common User Pain Points for ‘automatic bottle filling equipment’ & Their Solutions

3 Common User Pain Points for Automatic Bottle Filling Equipment & Their Solutions

Investing in automatic bottle filling equipment is a critical step for Small to Medium Enterprises (SMEs) in the USA and Europe looking to scale. However, selecting the wrong machinery often leads to operational friction.

Below are three frequent challenges manufacturers face when integrating filling systems, accompanied by technical solutions.

Illustrative Image (Source: Google Search)

1. Viscosity Mismatch and Fill Inaccuracy

Scenario: A beverage manufacturer attempts to switch from filling water-based products to thicker syrups or oils using the same machine, resulting in slow flow rates and uneven fill levels.

The Problem:

Not all filling principles are universal. Gravity fillers, like the Spagni Tall 3-Nozzle mentioned in the reference, rely on the weight of the liquid and are excellent for free-flowing, low-viscosity liquids (wine, water, spirits). Using gravity systems for viscous products causes flow resistance, leading to under-filling, excessive foaming, or pump burnout if the equipment isn’t rated for the fluid’s thickness.

The Solution:

* Match Principle to Viscosity: For thin liquids, utilize gravity fillers. For viscous products (creams, heavy oils), specify piston fillers or pump-driven systems designed to force product through the nozzle.

* Nozzle Sizing: Ensure the equipment offers interchangeable nozzles. As seen in the Spagni specifications, utilizing a larger diameter nozzle (e.g., 16mm) is essential for maintaining flow rates (up to 1,200 liters/hour) when handling slightly thicker liquids or larger volume containers.

2. Safety Hazards with Volatile Solvents

Scenario: A cosmetic or chemical producer purchases a standard electric filling machine to bottle a solvent-based perfume or cleaning agent, only to discover it violates safety codes.

Illustrative Image (Source: Google Search)

The Problem:

Many standard filling machines are not explosion-proof. As highlighted in the Cru Bottling Systems reference data, standard electric pumps and fillers can ignite flammable vapors if the product has a low flash point. Using non-certified equipment for volatile liquids creates a severe fire hazard and violates OSHA (USA) or ATEX (Europe) compliance regulations.

The Solution:

* Verify Flash Points: Before purchasing, determine the exact flash point of your liquid.

* Pneumatic vs. Electric: For volatile substances, opt for pneumatic (air-driven) bench-top fillers rather than electric pump systems. Pneumatic systems eliminate the electrical spark risk.

* Ventilation: Ensure the facility meets ventilation standards regarding the machine’s footprint (e.g., 61x64x161h cm) to prevent fume accumulation.

3. Throughput Bottlenecks vs. Equipment Footprint

Scenario: A growing bottling plant needs to increase output to meet retailer demand but has limited floor space and cannot accommodate a massive rotary filling line.

The Problem:

Balancing speed with space is a primary friction point. Manual filling is too slow, but fully automatic rotary lines are too large and expensive. Operators often struggle to find a “middle ground” machine that increases Liters Per Hour (LPH) without dominating the facility floor.

Illustrative Image (Source: Google Search)

The Solution:

* Linear Semi-Automatic Systems: Implement multi-nozzle linear fillers. A 3-nozzle system can triple output compared to single-nozzle setups without tripling the physical footprint.

* Calculate LPH Metrics: detailed planning requires calculating flow per nozzle.

* Example Calculation: If one nozzle fills 400 liters/hour, a 3-nozzle system delivers 1,200 liters/hour.

* Vertical Utilization: Look for equipment that utilizes vertical space (tall gravity tanks) rather than horizontal conveyor space to maintain a compact footprint (approx. 60cm x 60cm base) while maximizing gravity pressure for speed.

Strategic Material Selection Guide for automatic bottle filling equipment

Strategic Material Selection Guide for Automatic Bottle Filling Equipment

Selecting the correct construction materials for automatic bottle filling equipment is not merely a matter of durability; it is a critical compliance, safety, and operational requirement. For B2B buyers in the USA and Europe, material selection dictates the machine’s longevity, sanitation cycles, and compatibility with specific liquid formulations.

This guide analyzes the primary materials used in professional bottling systems, specifically focusing on gravity and pneumatic fillers.

1. Structural Integrity: Stainless Steel (AISI 304 vs. 316)

The industry standard for professional bottle fillers—such as the Spagni systems utilized by Cru Bottling Systems—is stainless steel construction. This material is non-negotiable for food, beverage, and cosmetic applications due to its resistance to corrosion and ease of sanitation.

Illustrative Image (Source: Google Search)

- AISI 304 Stainless Steel: The standard for general bottling (water, wine, oils, non-acidic juices). It offers excellent structural rigidity and resistance to oxidation.

- AISI 316 Stainless Steel: Required for highly acidic products, pharmaceuticals, or saline solutions. It contains molybdenum, which increases resistance to pitting and crevice corrosion.

Strategic Insight: For large PET bottle filling operations, stainless steel bottle shelves and nozzles provide the necessary weight capacity and stability to prevent bottle deformation during the fill cycle.

2. Fluid Path and Nozzle Composition

The nozzle is the direct contact point between the machine and the final package.

* Stainless Steel Nozzles (16mm+): Ideal for high-volume filling of large containers. They are durable and can withstand high-pressure cleaning.

* Anti-Drip Materials: High-viscosity liquids often require pneumatic shut-off nozzles. These may utilize internal PTFE (Teflon) seals to prevent product stringing or dripping, ensuring accurate fill levels (e.g., 400 liters per nozzle/hour).

3. Seal and Gasket Compatibility (Chemical Resistance)

One of the most common points of failure in bottling lines is the degradation of seals due to chemical incompatibility.

* EPDM/Silicone: Standard for food-grade applications and neutral PH liquids.

* Viton (FKM): Essential for oils, select chemicals, and higher-temperature fills.

* PTFE (Teflon): The most chemically resistant material, used for aggressive fluids.

Warning on Solvents: As noted in standard gravity filler specifications, many stainless steel machines are not explosion-proof. If your product contains solvents or has a low flash point (is volatile/flammable), standard rubber seals and standard electric pumps are insufficient. You must specify explosion-proof (ATEX or Class 1 Div 1) components.

Illustrative Image (Source: Google Search)

4. Pneumatic vs. Electric Components

For facilities in the USA (110V/60hz) and Europe, the choice between pneumatic and electric actuation impacts material requirements.

* Pneumatic Bench-Top Systems: Rely on compressed air. These are often safer for semi-volatile liquids as they reduce the presence of electrical sparks, provided the construction materials are conductive and grounded.

* Electric Pump-Driven Systems: Require robust casing materials to protect motors from liquid ingress (IP ratings).

Material Application Comparison Matrix

The following table outlines the strategic application of materials based on product type and machine component.

| Component | Material | Best Application | Limitations / Strategic Notes |

|---|---|---|---|

| Frame & Chassis | Stainless Steel (AISI 304) | General Food & Beverage, Wine, Spirits | Standard for hygiene. Not suitable for extremely corrosive environments (chlorides). |

| Fluid Contact Parts | Stainless Steel (AISI 316) | Acidic Juices, Pharmaceuticals, Saline | Higher cost, but necessary for regulatory compliance with aggressive fluids. |

| Seals & Gaskets | EPDM / Silicone | Water, Wine, Neutral Beverages | Degrades rapidly if exposed to oils or petroleum-based products. |

| Seals & Gaskets | Viton (FKM) | Essential Oils, Viscous Liquids, Cosmetics | Excellent heat and oil resistance. |

| Tubing/Hosing | Food Grade PVC / Tygon | General Transfer, Gravity Feed | Must be monitored for stiffening or discoloration over time. |

| Pump Impellers | Stainless Steel / Flexible Rubber | Viscous liquids (creams, heavy oils) | Flexible impellers wear over time; stainless gears are durable but cannot handle particulates. |

| Bottle Shelves | Stainless Steel | Large PET or Glass Bottles | Rigid support is crucial for “Tall” fillers to prevent bottle tipping during the fill cycle. |

Procurement Tip: Always review the Flash Point of your liquid product. Standard stainless steel gravity fillers are designed for non-flammable products. If your material safety data sheet (MSDS) indicates flammability, you must request explosion-proof materials and intrinsically safe electrical components.

In-depth Look: Manufacturing Processes and Quality Assurance for automatic bottle filling equipment

In-depth Look: Manufacturing Processes and Quality Assurance for Automatic Bottle Filling Equipment

For buyers in the USA and Europe, understanding the fabrication lifecycle of bottle filling machinery is critical for assessing long-term ROI. High-end equipment, such as systems engineered in Italy (e.g., Spagni), relies on a strict manufacturing protocol to ensure hygiene, precision, and durability.

The following sections detail the standard manufacturing phases and quality benchmarks for professional-grade filling equipment.

1. The Manufacturing Lifecycle

The production of automatic and semi-automatic bottle fillers follows a four-stage engineering cycle designed to minimize tolerance errors and maximize throughput.

Phase 1: Material Preparation and Sourcing

- Raw Material Selection: The primary construction material is high-grade Stainless Steel (typically AISI 304 or 316). This is non-negotiable for compliance with FDA and EU food safety regulations.

- Chemical Compatibility Analysis: Before fabrication, engineers review the intended liquid viscosity and volatility. As noted in equipment specifications, standard gravity fillers are often not explosion-proof. Therefore, materials for gaskets and seals are selected based on the product’s flash point and solvent properties to prevent degradation or safety hazards.

Phase 2: Component Forming and Machining

- Precision CNC Machining: Critical components, such as the 16mm nozzles and metering pumps, are shaped using Computer Numerical Control (CNC) to ensure micro-precision.

- Chassis Fabrication: The structural frame is laser-cut and welded to support heavy loads (e.g., large PET bottles). Manufacturers prioritize a rigid footprint (e.g., 61x64x161h cm) to prevent vibration during high-speed operation, which can negatively impact fill-level accuracy.

Phase 3: Mechanical and Electrical Assembly

- Pneumatic and Hydraulic Integration: Systems utilizing pumps for supply elevation are integrated with pneumatic controls. For gravity fillers, the tank height and nozzle geometry are calibrated to maintain consistent flow pressure.

- Electrical Configuration: Technicians install wiring harnesses compliant with target market grids (e.g., 110V/60Hz for the US market). This phase involves connecting single-phase motors and integrating operator control panels for speed and volume adjustments.

- Hygiene-First Design: Assembly focuses on “clean design” principles—minimizing crevices where bacteria can harbor. Individual stainless-steel bottle shelves are installed to ensure stability during the fill cycle.

Phase 4: Quality Control (QC) and Factory Acceptance Testing (FAT)

Before shipping, equipment undergoes rigorous testing to verify performance metrics.

* Flow Rate Verification: Machines are tested to confirm output matches rated specifications (e.g., 400 liters per nozzle/hour).

* Leak and Pressure Testing: The entire fluid path, from pump to nozzle, is pressurized to detect seal failures.

* Safety Interlock Checks: Verification of emergency stops and ventilation requirements, particularly for machines handling volatile non-flammable liquids.

2. Quality Standards and Compliance (USA & Europe)

To export to Western markets, manufacturers must adhere to strict regulatory frameworks regarding machinery safety and food contact materials.

Illustrative Image (Source: Google Search)

| Standard / Certification | Region | Relevance to Bottle Filling Equipment |

|---|---|---|

| ISO 9001:2015 | Global | Certifies the manufacturer’s quality management system, ensuring consistent production processes and error documentation. |

| CE Marking | Europe | Mandatory conformity mark indicating the machine meets EU safety, health, and environmental protection requirements (Machinery Directive 2006/42/EC). |

| FDA 21 CFR | USA | Governs materials in contact with food/pharmaceuticals. Stainless steel surfaces and nozzle gaskets must be FDA-compliant. |

| UL / CSA | North America | Electrical safety certification required for motors, pumps, and control panels to prevent fire and shock hazards. |

| GMP (Good Manufacturing Practice) | Global | Ensures equipment is designed to be easily cleaned and sanitized to prevent cross-contamination. |

Buyer Note on Safety: Standard filling units are often rated for non-flammable products only. Facilities handling solvents or low-flash-point liquids must request ATEX (Europe) or Class I, Div 1 (USA) explosion-proof certifications explicitly during the procurement phase.

Practical Sourcing Guide: A Step-by-Step Checklist for ‘automatic bottle filling equipment’

Practical Sourcing Guide: A Step-by-Step Checklist for Automatic Bottle Filling Equipment

Sourcing automatic bottle filling equipment requires balancing immediate production goals with long-term operational scalability. This checklist is designed for procurement teams and operations managers in the USA and Europe to streamline the vetting process and minimize capital risk.

Phase 1: Internal Audit & Requirement Definition

Before contacting vendors, define the physical and chemical parameters of your project.

- [ ] Calculate Required Throughput:

- Define current Bottles Per Minute (BPM) and projected growth for the next 3–5 years.

- Note: As referenced in Spagni/Cru Systems specifications, operator speed significantly impacts output on semi-automatic or manual-load gravity systems. For fully automatic lines, verify the mechanical rating vs. actual operational rating.

- [ ] Analyze Liquid Characteristics:

- Viscosity: Determine if the product is water-thin (gravity filler) or viscous (piston/pump filler).

- Temperature: Define the fill temperature (hot fill vs. ambient).

- Particulates: Note if the liquid contains pulp or seeds (requires specific nozzle clearance, e.g., >16mm).

- Volatility: Check the flash point. Crucial: If the liquid is flammable or a solvent, the machine must be certified explosion-proof (ATEX in EU, Class 1 Div 1 in USA). Standard stainless fillers are often not rated for volatiles.

- [ ] Audit Container Specifications:

- Material: Glass (rigid) vs. PET (flexible).

- Dimensions: Measure neck opening diameter (determines nozzle size) and bottle height (determines shelf/gantry height).

- Stability: Assess if the bottle is top-heavy (requires pucks or specialized conveyors).

Phase 2: Technical Specification Matching

Match your internal audit against machine capabilities.

Illustrative Image (Source: Google Search)

-

[ ] Filling Method Selection:

| Liquid Type | Recommended Technology |

| :— | :— |

| Thin/Free-flowing (Water, Spirits, Wine) | Gravity or Overflow Filler |

| Viscous (Sauces, Creams, Oils) | Piston or Pump Filler |

| Carbonated (Beer, Soda) | Counter-Pressure Filler |

| High Value/Precise Volume (Pharma) | Net Weigh or Flow Meter | -

[ ] Material Construction:

- Ensure all contact parts are Stainless Steel (304 for standard food/beverage; 316 for acidic/pharma).

- Verify tubing and gasket materials (e.g., Viton, EPDM) are compatible with your specific chemical profile to prevent degradation.

- [ ] Electrical & Pneumatic Standards (USA vs. Europe):

- Voltage: Confirm compatibility.

- USA: 110V/60Hz (Single Phase) or 220V/480V (3-Phase).

- Europe: 230V/50Hz or 400V.

- Air Supply: If the machine uses pneumatic lifts or nozzles, verify your facility’s compressed air capacity (CFM and PSI ratings).

- Voltage: Confirm compatibility.

Phase 3: Vendor Vetting & Logistics

Evaluate the manufacturer and distributor reliability.

- [ ] Origin of Engineering:

- Distinguish between “Assembled in” and “Manufactured in.” European engineering (e.g., Italian manufacturers like Spagni) is often preferred for high-precision mechanics, while domestic US support is vital for maintenance.

- [ ] Certification & Safety Compliance:

- USA: Look for UL (Underwriters Laboratories) listing on electrical panels.

- Europe: Ensure CE Marking compliance.

- Food Safety: Equipment should meet FDA or EHEDG sanitary design standards (e.g., easy-to-clean welds, no dead legs).

- [ ] Testing & Validation (FAT):

- Request a Factory Acceptance Test (FAT) using your specific bottles and liquid.

- Red Flag: Vendors who refuse to test with your specific samples.

- [ ] After-Sales Support:

- Verify the location of the spare parts depot. If the machine is imported (e.g., from Italy to the US), ensure the distributor stocks critical wear parts (seals, nozzles, pumps) domestically to prevent downtime.

Phase 4: Final Procurement Review

- [ ] Footprint Verification: Measure facility door width and ceiling height against machine dimensions (e.g., standard footprints like 61x64x161cm).

- [ ] Lead Time: Confirm lead times for fabrication vs. shipping. European imports to the USA can add 4–8 weeks for sea freight.

- [ ] Warranty Terms: Check if the warranty covers electronics and pneumatics, or solely the stainless steel frame.

Comprehensive Cost and Pricing Analysis for automatic bottle filling equipment Sourcing

Comprehensive Cost and Pricing Analysis for Automatic Bottle Filling Equipment Sourcing

Sourcing automatic bottle filling equipment requires a Total Cost of Ownership (TCO) approach. Buyers in the USA and Europe must evaluate not only the initial Capital Expenditure (CAPEX) but also the operational variables that drive long-term profitability.

Illustrative Image (Source: Google Search)

The following analysis breaks down cost structures based on material quality, labor implications, and logistical requirements.

1. Cost Breakdown Structure

A. Materials and Engineering (CAPEX)

The primary driver of equipment cost is the bill of materials (BOM) and the engineering precision required for specific viscosities.

- Chassis and Contact Parts:

- Standard: AISI 304 Stainless Steel is the industry standard for food and beverage (e.g., the Spagni systems).

- Corrosive/Pharma: Upgrading to AISI 316L or Hastelloy for pharmaceutical or acidic products increases material costs by 20–30%.

- Pneumatics and Pumps:

- Equipment utilizing simple gravity feeds or centrifugal pumps (like the Spagni 3-Nozzle Gravity Filler) represents the lower end of the cost spectrum.

- Cost Driver: Volumetric piston fillers or flow-meter-based systems (magnetic/mass) significantly increase precision but raise costs by 40–60% compared to gravity systems.

- Safety and Certification:

- Standard: NEMA 12 / IP54 (Dust/drip resistant).

- Explosion Proof (ATEX/Class 1 Div 1): Required for solvents or high-flash-point spirits. Note: Standard units, such as the Spagni Tall 3-Nozzle, are explicitly not explosion-proof. Requiring this certification for volatile liquids will double or triple the base machine price.

B. Labor and Operational Costs (OPEX)

Automation level directly correlates to labor dependency.

- Semi-Automatic/Benchtop:

- Low CAPEX / High Labor: As noted in Spagni specifications, output depends heavily on operator speed. A 1,200 L/hour rating is theoretical; actual throughput is dictated by the manual loading/unloading speed of the staff.

- Cost Implication: Lower upfront cost ($3k–$10k), but requires continuous human operator presence.

- Fully Automatic (Linear/Rotary):

- High CAPEX / Low Labor: Automated conveyors and indexing reduce operator requirements to monitoring only.

- Cost Implication: Higher upfront cost ($25k+), but ROI is achieved through reduced headcount and consistent throughput unaffected by human fatigue.

C. Logistics and Installation

For buyers in the US sourcing from Europe (e.g., Italian manufacturers like Spagni) or vice versa, logistics are a tangible line item.

Illustrative Image (Source: Google Search)

- Freight Dimensions: Compact units (e.g., 61x64x161cm footprint) optimize freight density, often fitting on standard pallets to reduce LTL (Less-Than-Truckload) rates.

- Power Configuration:

- USA: 110V/60Hz or 220V/3-Phase.

- Europe: 230V/50Hz or 400V/3-Phase.

- Cost Factor: Sourcing equipment incompatible with local voltage requires expensive transformers or rewiring. Ensure the unit (like the Spagni 110V/60hz model) is pre-configured for the destination grid.

2. Estimated Pricing Tiers (Market Averages)

| Tier | Equipment Type | Est. Price Range (USD/EUR) | Typical Application |

|---|---|---|---|

| Entry | Semi-Auto Gravity/Vacuum (e.g., Spagni 3-Nozzle) | $2,500 – $8,000 | Small batches, startups, viscous-free liquids. |

| Mid-Range | Automatic Linear (2-6 Heads) | $15,000 – $45,000 | SME production, conveyor-integrated. |

| High-End | Rotary Monoblock (Fill/Cap/Label) | $80,000 – $250,000+ | High-speed mass production (5,000+ BPH). |

3. Strategic Cost-Saving Tips

- Match Viscosity to Technology: Do not over-engineer. If filling water, wine, or thin spirits, a gravity filler is significantly cheaper than a piston or pump-driven filler. Only invest in positive displacement pumps if handling viscous products (oils, lotions).

- Avoid “Over-Spec” on Safety: If your product is non-flammable and water-based, ensure you are not purchasing Class 1 Div 1 (Explosion Proof) rated equipment. As indicated in manufacturer warnings, standard stainless fillers are cost-effective but strictly for non-volatile fluids.

- Modular Sourcing: For growing B2B operations, purchase machines with independent stations (filler separate from capper). While Monoblocks save space, modular components allow you to upgrade the filler speed later without replacing the entire line.

- Check “Plug-and-Play” Capability: Reduce installation costs by selecting single-phase equipment (110V/220V) that does not require hardwiring by a master electrician. Machines with simple footprints (under 1 square meter) often bypass complex rigging fees.

- Evaluate Throughput Realistically: Do not buy a 5,000 BPH (Bottles Per Hour) machine if your downstream packaging (labeling/boxing) can only handle 1,000 BPH. Bottle-necking wastes CAPEX. A 1,200 L/hour machine is sufficient for most SME operations.

Alternatives Analysis: Comparing automatic bottle filling equipment With Other Solutions

Alternatives Analysis: Comparing Automatic Bottle Filling Equipment With Other Solutions

When evaluating capital expenditure for production lines, facility managers must weigh the initial cost of automation against long-term operational efficiency. While automatic bottle filling equipment offers the highest throughput, it is essential to compare it against manual and semi-automatic alternatives to determine the correct fit for your current production volume.

The following analysis compares fully automatic systems against the two primary alternatives: Manual/Gravity Fillers and Semi-Automatic (Pneumatic) Machines.

Comparative Overview

| Feature | Manual / Gravity Fillers | Semi-Automatic Fillers | Automatic Bottle Filling Equipment |

|---|---|---|---|

| Primary Mechanism | Siphon/Gravity (Operator driven) | Pneumatic/Electric (Operator assisted) | PLC/Conveyor (Fully autonomous) |

| Throughput | Low (Dependent on operator speed) | Medium (approx. 400–800 BPH) | High (1,000+ BPH to industrial scale) |

| Labor Requirement | High (1 operator per unit constant) | Medium (1 operator for loading/unloading) | Low (1 operator monitors multiple lines) |

| Fill Precision | Low to Medium | High | Very High |

| Initial Investment | Low | Moderate | High |

| Scalability | Limited by physical labor | Limited by machine cycle time | Highly Scalable |

Alternative 1: Manual and Gravity Fillers

Manual systems, such as the Spagni Stainless Steel Gravity Fillers, represent the entry-level standard for bottling. These units rely on atmospheric pressure or simple pumps to move liquid from a bulk tank into bottles placed on a shelf.

- Operational Context: As noted in technical specifications for gravity fillers, output is directly correlated to the “speed of the operator.” The machine facilitates the fill, but the human element dictates the cycle time.

- Pros:

- Lowest CapEx: Minimal upfront investment required.

- Simplicity: Few moving parts and no complex electronics make maintenance simple.

- Flexibility: Ideal for micro-batches where setup time for an automatic line would be inefficient.

- Cons:

- Inconsistency: Fill levels can vary based on operator attention and fatigue.

- Labor Intensive: Requires constant human interaction; the operator cannot multitask.

- Throughput Ceiling: Even with a pump assist, production is physically capped (e.g., a 3-nozzle system may max out at ~1,200 liters/hour under perfect conditions, but rarely sustains this in practice).

Best For: Artisan producers, pilot batches, and startups where capital preservation is prioritized over speed.

Illustrative Image (Source: Google Search)

Alternative 2: Semi-Automatic (Pneumatic) Fillers

Semi-automatic fillers, often designed as pneumatic bench-top units, bridge the gap between manual labor and full automation. These systems require an operator to place the bottle under the nozzle and initiate the cycle (via foot pedal or button), but the machine controls the fill level and cutoff.

- Operational Context: These units often utilize pneumatic systems to ensure consistent pressure and fill levels, removing the “eyeball” variance associated with gravity fillers.

- Pros:

- Consistency: Delivers precise fill volumes regardless of operator skill.

- Versatility: Capable of handling a wider range of viscosities (from thin spirits to viscous oils) than standard gravity fillers.

- Moderate Throughput: Increases speed significantly over manual methods without the footprint of a conveyor system.

- Cons:

- Bottlenecks: The machine is still tethered to a human operator for loading and unloading.

- Scalability Limits: To double production, you typically must purchase a second machine and hire a second operator.

Best For: Small to Medium Businesses (SMBs) with established product lines that require professional consistency but lack the floor space or budget for a fully conveyed line.

Verdict: When to Choose Automatic Equipment

While manual and semi-automatic solutions like those from Spagni offer excellent entry points, they eventually become Operational Expenditure (OpEx) liabilities due to labor costs.

Automatic bottle filling equipment is the superior choice when:

1. Demand Exceeds Labor Capacity: You can no longer meet order volume without adding multiple shifts.

2. Precision is Critical: Your quality control standards require fill level variances lower than human operators can consistently achieve.

3. Integration is Required: You need to integrate filling with downstream automatic capping and labeling systems to create a continuous “hands-off” production line.

Illustrative Image (Source: Google Search)

Essential Technical Properties and Trade Terminology for automatic bottle filling equipment

Essential Technical Properties and Trade Terminology for Automatic Bottle Filling Equipment

When procuring automatic bottle filling equipment for US and European markets, procurement officers and production engineers must align technical capabilities with commercial requirements. The following section outlines critical technical specifications and trade terminology necessary for vetting suppliers and ensuring equipment compatibility.

Key Technical Properties

Understanding these properties ensures the machinery matches your specific product viscosity, container type, and production environment.

1. Viscosity and Fill Mechanism

The physical flow characteristics of your liquid dictate the machine type.

* Gravity Fillers: Best for free-flowing, low-viscosity liquids (water, wine, spirits). As noted in Spagni models, these rely on atmospheric pressure and are often time-based or volume-based.

* Piston/Pump Fillers: Required for viscous products (oils, lotions, sauces). The source equipment utilizes a pump assist to move supply from below tank level, bridging the gap between gravity and forced-flow systems.

* Volumetric vs. Level Fill: Volumetric ensures a specific liquid volume (e.g., 500ml), while level filling ensures a consistent cosmetic fill line, regardless of bottle irregularities.

2. Throughput and Nozzle Configuration

Production speed is calculated by the interaction of nozzle count, fill volume, and operator efficiency (for semi-automatic units).

* BPM / LPH: Bottles Per Minute or Liters Per Hour.

* Example: A 3-nozzle machine filling large PET bottles may achieve ~400 liters per nozzle/hour (1,200 L/hr total).

* Scalability: Modular systems allow for the addition of nozzles (e.g., expanding from 2 to 4 heads) to increase throughput without replacing the entire chassis.

Illustrative Image (Source: Google Search)

3. Material Compatibility and Hygiene

* Contact Parts: Must be Stainless Steel (typically grade 304 or 316) to prevent corrosion and ensure food/pharmaceutical safety.

* Chemical Resistance: Seals and gaskets (Viton, EPDM, PTFE) must be compatible with the product’s pH and solvency.

* CIP (Clean-in-Place): The ability to clean the machine without disassembly.

4. Power and Pneumatics

* Voltage/Phase:

* USA: Standard industrial is often 110V or 220V Single-Phase for smaller units, and 208V/480V 3-Phase for heavy industrial.

* Europe: Typically 230V Single-Phase or 400V 3-Phase.

* Note: Ensure the equipment frequency (50Hz for EU, 60Hz for USA) matches your facility to prevent motor damage.

* Pneumatic Requirements: Many fillers require compressed air for nozzle actuation. Verify PSI and CFM requirements.

5. Hazardous Location Ratings (Explosion Proof)

* Non-Explosion Proof: Standard machines (like the Spagni Tall 3-Nozzle) are not suitable for solvents or high-ethanol spirits with low flash points.

* ATEX (Europe) / NEC Class 1 Div 1 (USA): Required certifications for filling flammable liquids. Using non-rated equipment for volatile substances violates OSHA and EU safety directives.

Essential Trade Terminology

Navigating B2B contracts requires familiarity with the following commercial acronyms and terms standard in the packaging machinery industry.

| Term | Definition | Context for Buyers |

|---|---|---|

| MOQ | Minimum Order Quantity | While machinery usually has an MOQ of 1 unit, this term is critical when ordering custom change parts, replacement nozzles, or bottles. |

| OEM | Original Equipment Manufacturer | The factory that builds the machine. Sourcing directly from an OEM (or their authorized distributor) often ensures better technical support than buying from a generic reseller. |

| ODM | Original Design Manufacturer | A manufacturer that designs and builds a machine that is then rebranded by another company. Relevant if you are looking for “white label” machinery. |

| FAT | Factory Acceptance Test | A validation process performed at the manufacturer’s site before shipping. The buyer verifies the machine runs their specific bottles and liquid at the promised speed. |

| SAT | Site Acceptance Test | Validation performed after installation at the buyer’s facility to ensure the equipment was not damaged in transit and integrates with existing lines. |

| Lead Time | Production/Delivery Time | The period between the receipt of the deposit and the shipment of the machine. For semi-automatic units, this may be weeks; for custom lines, it can be months. |

| Change Parts | Format Parts | Custom components (star wheels, guide rails, nozzle tips) required to adapt the machine to a different bottle shape or neck size (e.g., switching from 16mm to 20mm nozzles). |

| Incoterms | International Commercial Terms | Standardized trade terms (e.g., EXW – Ex Works, FOB – Free on Board, CIF – Cost, Insurance, and Freight) that define where liability transfers from seller to buyer during shipping. |

Navigating Market Dynamics and Sourcing Trends in the automatic bottle filling equipment Sector

Navigating Market Dynamics and Sourcing Trends in the Automatic Bottle Filling Equipment Sector

The market for automatic and semi-automatic bottle filling equipment is undergoing a significant shift, driven by the rise of small-to-medium enterprises (SMEs) in the beverage, cosmetic, and chemical sectors. Buyers in the USA and Europe are increasingly prioritizing versatility, safety compliance, and equipment that bridges the gap between manual labor and full-scale industrial automation.

Current Market Dynamics: The Shift to Scalable Precision

The demand for bottling equipment is no longer limited to massive industrial facilities. There is a growing trend toward “prosumer” and professional-grade machinery designed for SMEs that require optimization without the footprint of a factory floor.

- Versatility Over Single-Use: Modern sourcing trends favor machines capable of handling a spectrum of viscosities—from thin spirits to viscous gels. Equipment that offers interchangeable nozzles or adjustable pressure settings, such as pneumatic bench-top units, is highly sought after.

- The “Italian Engineering” Standard: In the European and North American markets, machinery originating from established manufacturing hubs, particularly Italy (e.g., Spagni), retains a premium reputation for reliability and ease of use. Sourcing agents often look for this lineage as a proxy for build quality.

- Semi-Automatic as a Stepping Stone: There is a marked increase in the adoption of semi-automatic and gravity filling systems. These units allow businesses to scale output (e.g., up to 1,200 liters per hour) while maintaining operator control, offering a balance between capital investment and productivity.

Historical Context: From Manual Pouring to Pneumatic Precision

The evolution of bottle filling technology reflects a broader industrial move toward hygiene and standardization.

- Manual Era: Historically, bottling was a labor-intensive process relying on hand-pouring or basic siphons, resulting in high spillage rates and inconsistent fill levels.

- Gravity and Displacement: The introduction of gravity fillers marked a turning point, utilizing simple physics to ensure consistent fill levels. This technology remains a staple for non-viscous liquids due to its simplicity and low maintenance.

- Pneumatic and Electronic Integration: The current generation of machines integrates pneumatic pumps and electronic sensors. This evolution allows for the handling of larger containers (such as large PET bottles) and ensures that supply tanks can be situated below the filler, with pumps driving the liquid upward—a significant logistical improvement over gravity-only systems.

Sustainability and Efficiency Trends

Sustainability in bottling is now defined by waste reduction and energy efficiency.

- Minimizing Product Loss: Modern stainless steel gravity fillers with specialized nozzles (e.g., 16mm) utilize precise shut-off mechanisms. This reduces “drip” and product waste, a critical metric for high-value liquids like essential oils or premium spirits.

- Energy Consumption: Sourcing trends are favoring equipment that operates on standard voltage (110V/60Hz in the US) without requiring complex 3-phase power upgrades. Single-phase machines reduce the energy barrier to entry for smaller facilities.

- Durability and Material Lifecycle: The shift toward 100% stainless steel construction extends the lifecycle of the machinery, reducing the frequency of replacement and aligning with circular economy principles.

Sourcing Strategy: Key Technical Considerations

When sourcing automatic or semi-automatic filling equipment, buyers must evaluate technical specifications against safety protocols and production goals.

| Consideration | Sourcing Implication |

|---|---|

| Viscosity & Flow | Confirm if the machine utilizes gravity or pumps. Gravity is ideal for thin liquids; pumps are required for viscous products or when the supply tank is at floor level. |

| Safety & Volatility | Critical: Many standard fillers are not certified explosion-proof. Buyers handling high-flash-point solvents or flammable spirits must verify if the equipment requires specific ventilation or explosion-proof certification. |

| Material Compatibility | Ensure nozzle size (e.g., 16mm) and shelf design are compatible with the specific container material (Glass vs. PET) to prevent bottle deformation or breakage during the fill cycle. |

| Throughput Requirements | Calculate required liters per hour. A standard 3-nozzle machine may deliver ~400 liters per nozzle/hour. Sourcing decisions should be based on current volume + 20% projected growth. |

Conclusion

For buyers in the US and Europe, the focus is on acquiring equipment that offers the precision of industrial lines with the footprint and flexibility required by SMEs. Whether utilizing Spagni-engineered gravity fillers or pneumatic systems, the priority remains on stainless steel construction, safety compliance regarding volatile substances, and the ability to minimize product waste.

Frequently Asked Questions (FAQs) for B2B Buyers of automatic bottle filling equipment

Frequently Asked Questions (FAQs) for B2B Buyers

Q1: What factors most significantly influence the production output (bottles per hour) of automatic filling equipment?

Production speed is variable and dependent on three main factors:

1. Liquid Viscosity: Thinner liquids fill faster via gravity systems, while viscous products require pumps or pistons, which may have different cycle times.

2. Container Geometry: Large volume containers (e.g., large PET bottles) take longer to fill than standard units.

3. Operator Proficiency: For semi-automatic or bench-top systems, the speed at which an operator can load and unload bottles directly impacts throughput.

Example Benchmark: A 3-nozzle gravity filler with a pump can achieve approximately 1,200 liters per hour (400L per nozzle), assuming optimal flow conditions and continuous operation.

Q2: How do I determine if I need a gravity filler or a piston/pump filler?

The choice is dictated by the viscosity of your product:

* Gravity Fillers: Best suited for free-flowing, low-viscosity liquids (water, wine, thin spirits). These rely on atmospheric pressure or a header tank.

* Pump/Piston Fillers: Required for thicker, more viscous liquids (oils, syrups, heavy creams) or when the supply tank is located below the filler level.

* Note: Ensure your equipment specifications match your product’s flash point. Standard gravity fillers are often not explosion-proof and are unsuitable for highly volatile solvents.

Q3: What are the electrical and pneumatic requirements for standard filling machines in the US and European markets?

* Electricity: Many semi-automatic and bench-top units operate on single-phase power (110V/60Hz for the US; 220V/50Hz for Europe). Larger industrial automatic lines often require 3-phase power. Always verify if the machine requires a specific voltage transformer based on your facility’s location.

* Pneumatics: Pneumatic filling machines require a reliable compressed air source. You must ensure your facility’s air compressor can meet the CFM (Cubic Feet per Minute) and PSI requirements of the filler to ensure consistent actuation of nozzles.

Q4: Can a single machine handle both glass and PET bottles?

Generally, yes, provided the machine is equipped with adjustable bottle shelves and compatible nozzle diameters.

* Nozzle Size: You must match the nozzle diameter (e.g., 16mm) to the neck opening of your smallest bottle to prevent spillage or vacuum locking.

* Stability: Lightweight PET bottles may require neck-grabbers or specialized guides to prevent tipping during the high-speed fill process, whereas glass is more stable but requires careful handling to prevent breakage.

Q5: Are standard automatic bottle fillers certified for hazardous or flammable materials?

No. Standard stainless steel filling machines are typically designed for food-grade, non-hazardous beverages and liquids. They are not certified as explosion-proof.

If you are bottling solvents, spirits with high alcohol content (above certain proofs), or chemicals with low flash points, you must specify equipment that meets ATEX (Europe) or Class I, Div 1 (USA) explosion-proof standards. Using non-certified equipment for volatile liquids poses a severe safety risk.

Q6: How does the “semi-automatic” classification differ from fully automatic in a production line context?

* Semi-Automatic: Requires an operator to physically place the bottle under the nozzle and initiate the fill cycle (via foot pedal or button). These are ideal for small-to-medium businesses scaling up from manual filling.

* Fully Automatic: Bottles are fed via conveyor, detected by sensors, filled, and moved to capping without human intervention.

* Scalability: Many businesses start with semi-automatic bench-top fillers (e.g., 3-nozzle systems) and transition to fully automatic lines as demand exceeds the 1,000–1,500 liters/hour threshold.

Q7: What construction materials should I look for to ensure hygiene compliance?

For the food, beverage, and pharmaceutical sectors, AISI 304 or 316 Stainless Steel is the industry standard.

* Contact Parts: All parts coming into contact with the liquid (nozzles, tanks, tubing) must be food-grade and resistant to corrosion from acidic products (like fruit juices or vinegar).

* Sanitation: Look for designs that feature “tool-less” disassembly or CIP (Clean-In-Place) capabilities to minimize downtime during changeovers and cleaning cycles.

Q8: Can filling equipment accommodate supply tanks located at floor level?

Yes, but this requires a specific configuration.

* Gravity Fed: If the supply is above the filler, gravity does the work.

* Pump Assist: If your supply tank is on the floor (below the filler), the machine must be equipped with an integrated pump (e.g., a centrifugal or impeller pump) to draw the liquid up to the nozzles. Ensure the pump is rated for the specific lift height and viscosity of your product.

Strategic Sourcing Conclusion and Outlook for automatic bottle filling equipment

Strategic Sourcing Conclusion and Market Outlook

Investments in automatic and semi-automatic bottle filling equipment represent a critical pivot point for Small to Medium Enterprises (SMEs) aiming to professionalize their production lines. As demonstrated by the operational capabilities of systems like the Spagni 3-Nozzle Gravity Filler, the strategic value lies in balancing scalability with versatility. Moving beyond manual processes to precision-engineered stainless steel machinery ensures consistent fill accuracy, reduces product waste, and standardizes output for retail compliance.

For buyers in the USA and Europe, the sourcing outlook prioritizes equipment that offers high adaptability for varying viscosities—from thin spirits to viscous oils—without requiring massive facility footprints.

Key Strategic Takeaways

- Operational Agility: Prioritize machinery capable of handling diverse container materials (e.g., large PET, glass) and sizes to adapt to changing market SKUs.

- Efficiency Metrics: Look for benchmarks such as 1,200 liters/hour throughput to justify the capital expenditure (CapEx) against labor savings.

- Safety & Compliance: Ensure equipment meets regional safety standards, particularly regarding ventilation and non-flammable certification for specific solvents.

Outlook: The market is shifting toward compact, modular units that allow SMEs to increase volume without expanding facility real estate. Sourcing the right “bench-top” or semi-automatic solution today creates the infrastructure for the fully automated lines of tomorrow.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided is for informational purposes only. B2B buyers must conduct their own due diligence.