Best 1031 Exchange Calculator: Top 5 Tools Compared

Finding the Best 1031 Exchange Calculator: An Introduction

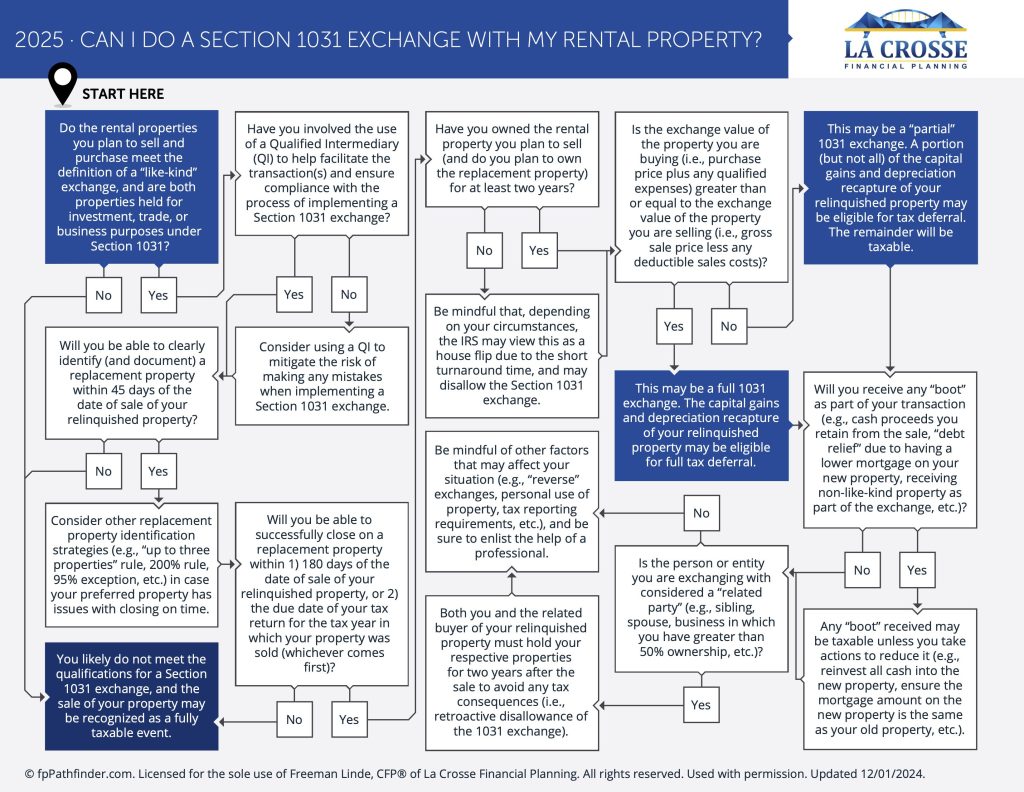

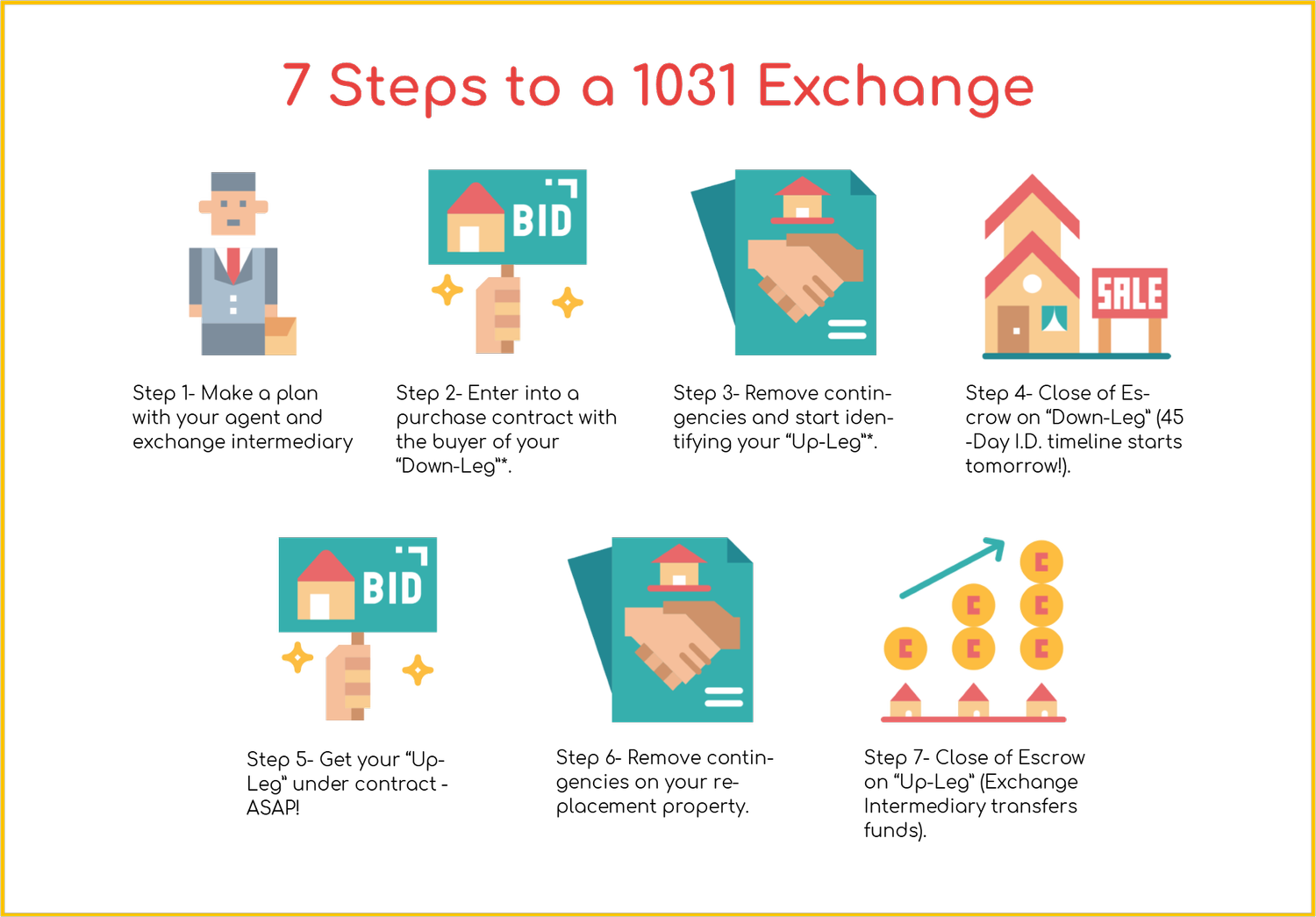

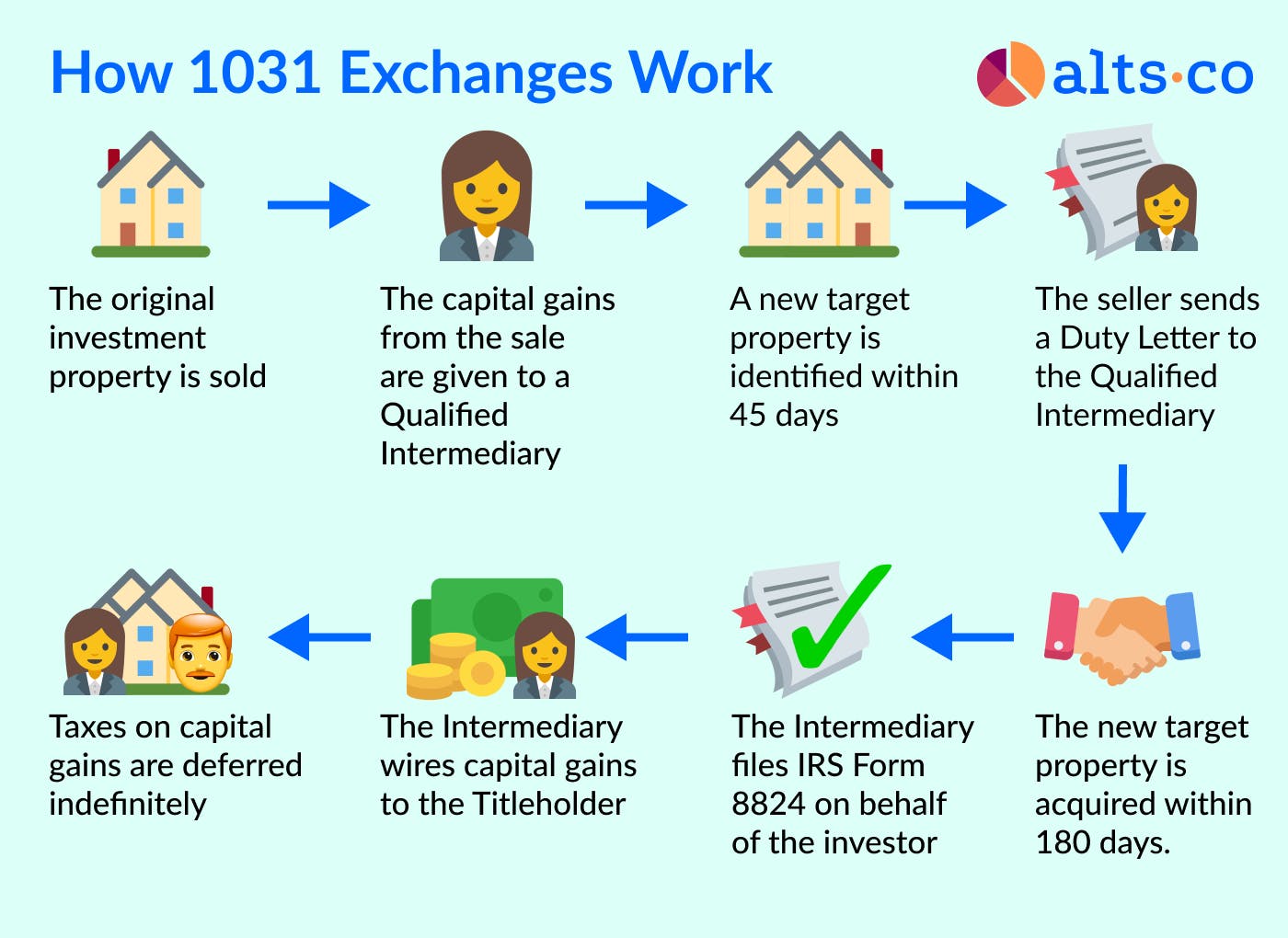

Finding a reliable and effective 1031 exchange calculator can be a daunting task for both seasoned investors and newcomers alike. With the complexities of real estate transactions and the potential tax implications involved, having access to a trustworthy tool is essential for making informed decisions. A 1031 exchange allows property owners to defer capital gains taxes by reinvesting the proceeds from a sold investment property into a new like-kind property. However, understanding the nuances of these transactions and accurately estimating potential tax savings can be challenging without the right resources.

This article aims to save you time and effort by reviewing and ranking the top 1031 exchange calculators available online. We have meticulously evaluated several calculators to determine which ones stand out based on various criteria. Key factors for our rankings include accuracy, ease of use, features, and overall user experience. A reliable calculator should not only provide precise estimates but also be user-friendly, allowing individuals to input their data with ease and understand the results quickly.

In the following sections, we will delve into our top picks, highlighting the strengths and weaknesses of each tool. Whether you’re looking to maximize your tax savings or simply seeking clarity on your real estate transactions, our comprehensive review will guide you to the best 1031 exchange calculator that fits your needs.

Our Criteria: How We Selected the Top Tools

Selection Criteria for 1031 Exchange Calculators

When selecting the top 1031 exchange calculators for our review, we considered several critical criteria to ensure that each tool provides valuable assistance to users looking to navigate the complexities of 1031 exchanges. Below are the key factors we evaluated:

-

Accuracy and Reliability

– The primary function of a 1031 exchange calculator is to provide accurate estimations of tax implications and potential savings. We assessed each tool’s methodology for calculations, including how they incorporate various tax rates and considerations related to capital gains and depreciation recapture. Tools that provide disclaimers about the need for professional consultation were favored, as they acknowledge the complexities involved. -

Ease of Use

– User experience is crucial when dealing with financial calculators. We evaluated the interface design, navigation, and overall usability of each calculator. Tools that offered intuitive layouts, clear instructions, and accessible support were prioritized. Additionally, we looked for calculators that allow users to input data easily and quickly view results without excessive clicks or navigation. -

Key Features

– A robust 1031 exchange calculator should include specific inputs to help users accurately assess their situation. We looked for calculators that:- Allow users to input original purchase price and capital improvements.

- Enable users to enter selling expenses and mortgage balances.

- Provide options for different capital gains tax rates (federal and state).

- Include fields for accumulated depreciation and net investment income tax considerations.

- Offer a comparison between 1031 exchanges and cash sales to highlight potential tax savings.

-

Cost (Free vs. Paid)

– We considered the cost structure of each calculator. Tools that are free to use, without hidden fees, were given preference, as they provide accessibility to a broader audience. While some calculators may offer premium features, we ensured that the basic functionalities necessary for performing a 1031 exchange were available at no cost. -

Additional Resources

– The availability of supplementary resources, such as guides, articles, or customer support, was an important factor. Tools that provided educational content about 1031 exchanges, tax implications, and investment strategies were considered more valuable, as they help users make informed decisions.

-

User Reviews and Reputation

– Finally, we looked at user reviews and the overall reputation of each calculator. Tools that had positive feedback regarding their accuracy, ease of use, and customer service were prioritized. We aimed to include calculators that are well-regarded within the real estate and investment communities.

By focusing on these criteria, we aimed to identify the most effective and user-friendly 1031 exchange calculators available online, ensuring that users can make informed decisions about their real estate investments.

The Best 1031 Exchange Calculators of 2025

1. 1031 Exchange Calculator

The 1031 Exchange Calculator from The 1031 Investor is a valuable tool designed to help users estimate the taxable implications of their proposed real estate transactions. By inputting sale and purchase details, users can assess how to execute a 1031 Exchange effectively to defer taxes. Its user-friendly interface and focus on tax implications make it an essential resource for investors looking to navigate the complexities of property exchanges.

- Website: the1031investor.com

- Established: Approx. 8 years (domain registered in 2017)

4. 1031 Exchange Calculator

The 1031 Exchange Calculator by CREFCOA is a valuable tool designed to help users estimate the tax deferment benefits of executing a 1031 tax exchange instead of opting for a taxable sale. By inputting relevant property details, users can quickly assess potential tax savings, making it an essential resource for real estate investors looking to maximize their financial advantages through strategic property transactions.

- Website: crefcoa.com

- Established: Approx. 12 years (domain registered in 2013)

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most critical steps to ensure accurate results from a 1031 exchange calculator is to double-check all your inputs. These calculators often require specific financial details, such as the original purchase price, selling price, accumulated depreciation, and any selling expenses. Inaccurate data can lead to misleading results. Before hitting the calculate button, review each figure for accuracy. It may also be beneficial to prepare your data in advance, using spreadsheets or notes, to avoid errors during input.

Understand the Underlying Assumptions

Each 1031 exchange calculator operates on a set of assumptions that influence the results. For example, many calculators assume you are selling an investment property, not a primary residence. They may also factor in specific tax rates based on current IRS guidelines. Familiarize yourself with these assumptions by reading the calculator’s description or disclaimers. Understanding these can help you interpret the results more effectively and decide if they apply to your unique situation.

Use Multiple Tools for Comparison

No single calculator can cover every aspect of your financial situation. To get a well-rounded view, consider using multiple 1031 exchange calculators. Each tool might present different features, assumptions, or methods for calculation, which can lead to variations in results. By comparing outputs from several calculators, you can identify any discrepancies and gain a more comprehensive understanding of potential tax implications.

Consult a Tax Professional

While online calculators can provide valuable estimates, they should not replace professional advice. Tax laws are complex and can change frequently, affecting your specific situation. Consulting with a qualified tax advisor or accountant can offer insights tailored to your circumstances. They can help clarify any nuances in the calculations, ensuring you understand how different factors, such as state taxes or depreciation recapture, may impact your overall tax liability.

Keep Current with Tax Laws

Tax regulations surrounding 1031 exchanges can change, and calculators may not always reflect the most up-to-date information. Stay informed about any recent changes in tax laws that could affect your calculations. Regularly check reliable sources, such as the IRS website or professional tax advisory services, for updates. This knowledge will help you use calculators more effectively and make informed decisions regarding your real estate investments.

Review the Results Critically

After receiving results from the calculator, take the time to review them critically. Look for key outputs like estimated capital gains taxes, potential tax savings, and reinvestment amounts. Consider how realistic these figures are in relation to your financial situation. If something seems off or too good to be true, it may warrant further investigation or a second opinion from a tax professional. This critical review can help you avoid potential pitfalls and make smarter investment choices.

Frequently Asked Questions (FAQs)

1. What is a 1031 exchange calculator, and how does it work?

A 1031 exchange calculator is an online tool designed to estimate the potential tax implications of selling an investment property and reinvesting the proceeds in another property, allowing for tax deferral under Section 1031 of the Internal Revenue Code. Users input details such as the original purchase price, selling price, and any capital improvements or depreciation taken on the property. The calculator then provides estimates of capital gains tax, depreciation recapture, and potential tax savings from utilizing a 1031 exchange.

2. Why should I use a 1031 exchange calculator?

Using a 1031 exchange calculator can help property owners better understand the financial benefits of deferring taxes when selling investment properties. It allows you to visualize how much you could save in taxes, which can inform your decision-making process regarding property sales and reinvestment strategies. Additionally, the calculator can provide insights into potential tax liabilities if you choose not to pursue a 1031 exchange.

3. Are the results from a 1031 exchange calculator accurate?

While 1031 exchange calculators provide valuable estimates, the results should be viewed as approximations rather than definitive calculations. Tax situations can vary significantly based on individual circumstances, including income level, state tax rates, and specific property details. For precise tax advice and to understand your specific situation, it’s recommended to consult with a qualified tax professional or financial advisor.

4. What factors do I need to input into a 1031 exchange calculator?

To use a 1031 exchange calculator effectively, you’ll typically need to input several key pieces of information, including:

– Original Purchase Price: The initial cost of the property.

– Selling Price: The expected sale price of the property.

– Capital Improvements: Any money spent on improvements that increase the property’s value.

– Accumulated Depreciation: The total depreciation claimed on the property during ownership.

– Selling Expenses: Costs associated with the sale, like real estate commissions and closing costs.

These inputs will help generate a more accurate estimate of potential tax implications.

5. Can I rely solely on a 1031 exchange calculator for my investment decisions?

No, while a 1031 exchange calculator is a useful tool for estimating tax implications and potential savings, it should not be the sole basis for your investment decisions. The calculator provides general estimates, and each individual’s tax situation can differ. It’s crucial to consult with a tax advisor or real estate professional who can provide personalized guidance and ensure that you fully understand the implications of a 1031 exchange versus a traditional sale.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.