Best 457B Calculator: Top 5 Tools Compared

Finding the Best 457B Calculator: An Introduction

Finding a reliable 457(b) calculator can be a daunting task for many individuals looking to plan their retirement savings effectively. With numerous options available online, the challenge lies not only in identifying tools that are accurate and user-friendly but also in understanding which features best suit your specific financial needs. A well-designed calculator can help you visualize how much you need to save, the impact of employer matching contributions, and how tax-deferred growth can enhance your retirement funds.

Purpose of This Article

The goal of this article is to simplify your search by reviewing and ranking the top 457(b) calculators available online. By consolidating our findings, we aim to save you time and effort in selecting the right tool for your retirement planning needs. Whether you are a novice or someone familiar with retirement accounts, having access to the best calculators can significantly aid in making informed decisions.

Ranking Criteria

In our evaluation process, we considered several critical criteria to ensure a comprehensive review:

- Accuracy: Each calculator’s ability to provide precise estimates based on user inputs is paramount. We prioritized tools that are grounded in sound financial principles and methodologies.

- Ease of Use: A user-friendly interface is essential for effective planning. We looked for calculators that are intuitive and require minimal effort to navigate.

- Features: Additional functionalities, such as the ability to factor in employer contributions, simulate different investment scenarios, and assess the impact of inflation, were also taken into account.

- Accessibility: Given the diverse audience, we favored calculators that are readily accessible across various devices and browsers, ensuring that users can plan their retirement conveniently.

Through this analysis, we hope to empower you with the knowledge and tools necessary to optimize your 457(b) savings strategy effectively.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting the Best 457b Calculators

When evaluating the top online tools for calculating 457b retirement contributions and potential growth, we considered several important criteria to ensure that users have access to the most effective and user-friendly calculators available. Below are the key factors that guided our selection process:

-

Accuracy and Reliability

– A good 457b calculator must provide accurate calculations based on user inputs. We assessed the underlying algorithms and methodology used in each tool to ensure they align with IRS guidelines and provide realistic projections. The reliability of the results is crucial for users making important financial decisions regarding their retirement savings. -

Ease of Use

– User experience is paramount when it comes to financial calculators. We looked for tools with intuitive interfaces that guide users through the input process without overwhelming them. Clear instructions, logical layouts, and accessibility across devices (desktop and mobile) were key factors in our evaluation. -

Key Features

– Effective calculators should offer a range of features that meet the specific needs of 457b plan participants. We focused on the following essential inputs and outputs:- Initial Contribution Amount: Users should be able to input their starting contribution.

- Employer Matching Contributions: Options to factor in any employer match percentages.

- Annual Contribution Increases: Ability to simulate increasing contributions over time.

- Projected Rate of Return: Users should be able to input expected annual growth rates to see potential future values.

- Withdrawal Scenarios: Tools that allow users to simulate retirement withdrawals and their impact on overall savings.

-

Cost (Free vs. Paid)

– We prioritized free calculators that provide robust features without hidden fees. While some paid tools may offer advanced functionality, our goal was to highlight accessible options that do not require a financial commitment. Transparency regarding costs was also a key factor in our selection process. -

Support and Resources

– Additional support such as FAQs, tutorials, or access to financial advisors can enhance the user experience. We evaluated whether the calculators provided supplementary resources to help users understand their results better and make informed financial decisions. -

Reputation and User Reviews

– We considered the reputation of the platforms offering these calculators. User feedback and reviews played a significant role in determining the reliability and effectiveness of the tools. Tools with positive testimonials from users were favored in our selection process.

By using these criteria, we ensured that the recommended 457b calculators not only meet the basic functional requirements but also provide a comprehensive, user-friendly experience to help individuals effectively plan for their retirement.

The Best 457B Calculators of 2025

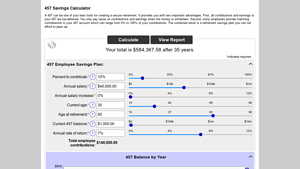

2. 457 Savings Calculator

The 457 Savings Calculator at mersofmich.com is designed to help users effectively plan for a secure retirement by leveraging the benefits of a 457 plan. This tool highlights two key advantages of 457 plans, which can enhance retirement savings strategies. With its user-friendly interface, the calculator enables individuals to estimate their potential savings and make informed decisions about their financial future.

- Website: mersofmich.com

- Established: Approx. 25 years (domain registered in 2000)

3. Future Value Calculator

The Future Value Calculator at nysdcp.com is a user-friendly tool designed to help individuals estimate the potential growth of their retirement investments over time. Users can input their expected average annual rate of return, with a recommended range between 2% and 9%, to visualize how their savings could evolve. This calculator is particularly useful for planning retirement finances and setting realistic investment goals.

- Website: nysdcp.com

- Established: Approx. 28 years (domain registered in 1997)

4. Calculators

MissionSquare Retirement offers a suite of calculators designed to help users create personalized retirement savings strategies. These tools enable individuals to assess the after-tax impact of different contribution levels on their net pay, facilitating informed financial planning. With an emphasis on tailoring retirement plans to specific needs, MissionSquare empowers users to make strategic decisions for a secure financial future.

- Website: missionsq.org

- Established: Approx. 4 years (domain registered in 2021)

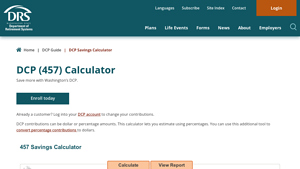

5. DCP Savings Calculator

The DCP Savings Calculator from the Department of Retirement Systems is a valuable tool designed to help users estimate their retirement savings based on percentage contributions. Key features include the ability to convert percentage-based contributions into dollar amounts, allowing users to better understand their potential savings. This calculator is particularly useful for individuals planning for retirement who want to visualize the impact of their contribution rates on their overall savings.

- Website: drs.wa.gov

- Established: Approx. 28 years (domain registered in 1997)

How to Get the Most Accurate Results

Double-Check Your Inputs

When using a 457(b) calculator, the accuracy of the results heavily relies on the data you provide. Before finalizing your inputs, take a moment to review them for accuracy. Common inputs include your current salary, contribution percentage, expected rate of return, and retirement age. Even a small error in these figures can lead to significantly different outcomes. Ensure that your inputs reflect your current financial situation and future goals. For best results, keep your financial documents handy to verify any numbers you may need.

Understand the Underlying Assumptions

Each calculator comes with its own set of assumptions that can impact your results. For example, many calculators assume a fixed rate of return or a specific inflation rate, which may not align with your personal circumstances or market conditions. Familiarize yourself with these assumptions by reading the calculator’s instructions or help sections. Understanding these parameters will enable you to interpret the results more accurately and make adjustments based on your unique financial situation.

Use Multiple Tools for Comparison

No single calculator can provide a complete picture of your retirement savings potential. To get a well-rounded view, use multiple calculators. Different tools may employ varying algorithms, assumptions, or input requirements, leading to diverse outcomes. By comparing results from several calculators, you can identify trends and gain a more comprehensive understanding of your savings strategy. This approach also helps you spot any outliers that might result from inaccurate input or flawed assumptions in a particular tool.

Keep Track of Your Progress

After obtaining your calculations, it’s essential to keep track of your progress over time. Use the results as benchmarks for your savings strategy and revisit them regularly—ideally annually or after significant financial changes. Adjust your inputs as your salary, expenses, and investment returns evolve. Regularly updating your calculations will help ensure that you stay on track to meet your retirement goals and can adjust your plan as necessary.

Consult a Financial Advisor

While online calculators are excellent tools for preliminary estimates, consulting a financial advisor can provide personalized insights that calculators cannot. A professional can help you navigate complex tax implications, investment strategies, and retirement planning nuances. They can also help you interpret the results from various calculators and align them with your overall financial goals.

Stay Informed

Finally, keep yourself updated on changes in tax laws, retirement plan rules, and market conditions that can affect your 457(b) savings. Knowledge about these factors will empower you to make informed decisions and adjust your retirement strategy accordingly. Regularly reviewing financial news and resources will help you remain proactive in your retirement planning.

Frequently Asked Questions (FAQs)

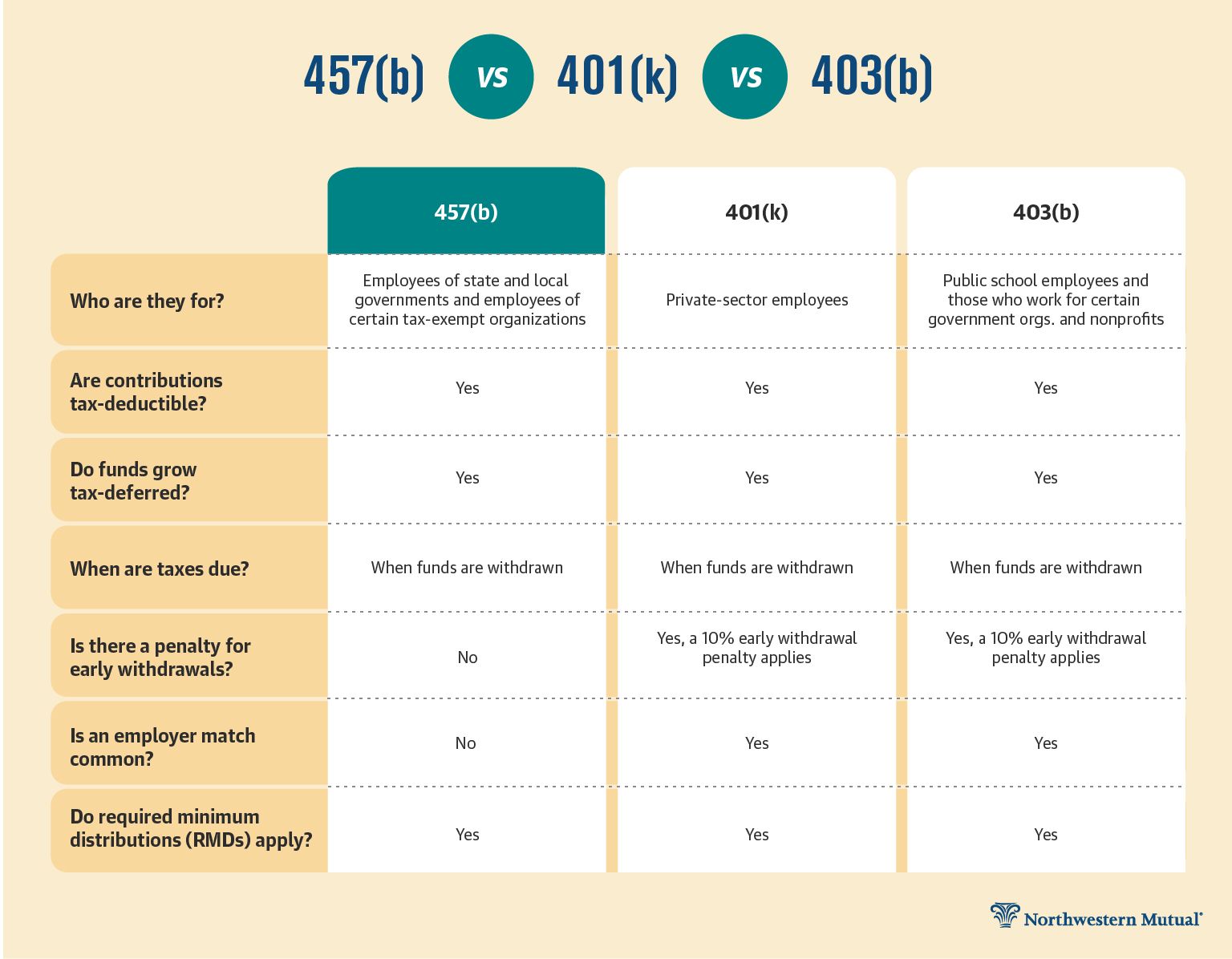

1. What is a 457(b) plan and how does it work?

A 457(b) plan is a type of retirement savings plan that allows employees of state and local governments, as well as certain non-profit organizations, to defer a portion of their income for retirement. Contributions to a 457(b) plan are made on a pre-tax basis, which means you won’t pay income tax on the money until you withdraw it during retirement. This plan often includes employer matching contributions, which can significantly enhance your savings potential.

2. How can a 457(b) calculator help me?

A 457(b) calculator is a valuable tool that helps you estimate how much you can save for retirement through your 457(b) plan. By inputting your current contributions, expected salary increases, and investment returns, the calculator can project your savings growth over time. This information can assist you in making informed decisions about your contributions and retirement planning strategies.

3. What factors should I input into a 457(b) calculator?

When using a 457(b) calculator, you should typically input the following information: your current salary, your current contribution rate (percentage of salary), expected salary increases, estimated annual rate of return on investments, and your desired retirement age. Some calculators may also allow you to input employer matching contributions and current savings balance for more accurate projections.

4. Are the results from a 457(b) calculator guaranteed?

No, the results from a 457(b) calculator are not guaranteed. These calculators provide estimates based on the information you input and certain assumptions about future salary increases and investment returns. Actual results may vary due to market conditions, changes in your income, or changes in contribution limits. It’s essential to use these calculators as a guide rather than a definitive projection.

5. Can I use a 457(b) calculator for other retirement plans?

While a 457(b) calculator is specifically designed for 457(b) plans, many online financial calculators can accommodate various retirement plans, including 401(k)s and IRAs. However, each type of retirement plan has unique features and rules, so it’s important to ensure that you are using the correct calculator for the specific plan you are evaluating.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.