Best 72T Calculator: Top 5 Tools Compared

Finding the Best 72T Calculator: An Introduction

Finding a reliable and effective 72T calculator can be a daunting task for individuals seeking to make early withdrawals from their retirement accounts without incurring penalties. With the complexities of the Internal Revenue Code (IRC) Section 72(t), which allows for “Substantially Equal Periodic Payments” (SEPP), it’s crucial to utilize a tool that not only provides accurate calculations but also simplifies the decision-making process. The stakes are high: a miscalculation could lead to unexpected penalties and financial strain, making it essential to choose the right calculator.

This article aims to review and rank the top online 72T calculators available, saving you time and effort in your search. We have meticulously evaluated various tools based on several key criteria to ensure that our recommendations are not only trustworthy but also user-friendly. The primary factors we considered include:

-

Accuracy: Each calculator’s ability to provide precise calculations based on the inputs you provide is paramount. We examined how well each tool adheres to IRS guidelines and whether it offers reliable outputs.

-

Ease of Use: Navigating a calculator should be straightforward, especially for those who may not be financially savvy. We assessed the user interface, clarity of instructions, and overall accessibility of each tool.

-

Features: Beyond basic calculations, we looked for additional functionalities such as the ability to choose different calculation methods, provide breakdowns of distributions, and offer educational resources about 72T distributions.

By focusing on these criteria, we aim to equip you with the best options for managing your early retirement withdrawals effectively. Whether you are planning for an early retirement or simply exploring your options, our findings will help guide you toward the right 72T calculator for your needs.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting the Best 72(t) Calculators

When evaluating the top online tools for calculating 72(t) distributions, we focused on several key criteria to ensure that users can find the most effective and reliable calculators. Here are the essential factors we considered:

-

Accuracy and Reliability

– The primary function of a 72(t) calculator is to provide precise distribution amounts based on IRS guidelines. We prioritized tools that utilize verified algorithms and formulas, ensuring that the results are consistent with IRS regulations. This is crucial as even minor miscalculations can lead to significant financial penalties. -

Ease of Use

– User-friendliness is vital for any online tool. We selected calculators that have intuitive interfaces, enabling users to navigate easily without requiring extensive financial knowledge. Clear instructions and straightforward input fields allow users to obtain results without frustration. -

Key Features

– A robust 72(t) calculator should offer various features to accommodate different user needs. Essential inputs may include:- Account Balance: The total amount in the retirement account.

- Client’s Age: Age of the individual seeking withdrawals, typically between 35 and 59.

- Beneficiary’s Age: Age of any beneficiaries, which can affect distribution calculations.

- Withdrawal Frequency: Options for annual, monthly, quarterly, or semi-annual distributions.

- Interest Rate Assumptions: Ability to input expected rates of return and reasonable distribution interest rates.

- Calculation Methods: Support for all three IRS-approved methods (annuitization, amortization, required minimum distribution).

-

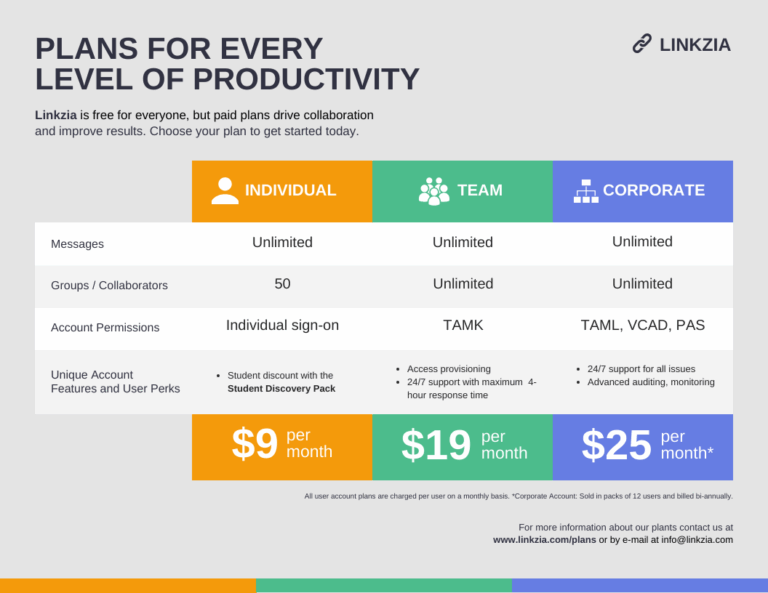

Cost (Free vs. Paid)

– We evaluated whether the calculators are free to use or require a subscription or one-time payment. Free tools that provide comprehensive features are preferable, as they ensure accessibility for all users. However, if a paid tool offers significant additional value, such as personalized advice or advanced analytics, we considered that in our assessment. -

Additional Resources

– We looked for calculators that offer supplementary resources, such as educational articles, FAQs, or customer support. These resources help users better understand the implications of their calculations and the 72(t) distribution rules, enhancing their overall experience. -

Updates and Maintenance

– Given that tax laws and IRS guidelines can change, we preferred calculators that are regularly updated to reflect the most current information. This ensures that users are making decisions based on the latest regulations. -

User Reviews and Reputation

– Finally, we considered user reviews and the overall reputation of the calculator providers. Tools that have received positive feedback for accuracy and customer service were given higher priority.

By adhering to these criteria, we aimed to identify the most effective 72(t) calculators available online, ensuring that users have the best resources at their disposal for making informed financial decisions.

The Best 72T Calculators of 2025

1. 72t Calculator

CalcXML’s 72(t) Early Distribution Calculator is a valuable tool designed to assist individuals in calculating IRA distributions before the age of 59½ without facing the IRS’s 10% penalty. This calculator allows users to explore various distribution options, providing insights into how to access retirement funds early while adhering to IRS guidelines. Its user-friendly interface makes it easy to navigate and understand potential withdrawal strategies.

- Website: calcxml.com

- Established: Approx. 19 years (domain registered in 2006)

3. Fidelity c72t Overview

The Fidelity c72t tool from ssnc.cloud is designed to assist users in calculating 72(t) payments, which allow for penalty-free early withdrawals from retirement accounts. This tool ensures compliance with IRS regulations by determining the appropriate interest rate, which must be at least 5% or up to 120% of the federal mid-term rate. Its user-friendly interface simplifies the complex calculations associated with early retirement distributions.

- Website: calculators.ssnc.cloud

- Established: Approx. 6 years (domain registered in 2019)

4. 72(t) Calculator

The 72(t) Calculator from MOAA is a valuable tool designed to help users calculate their allowable 72(t)/(q) distributions, which can be crucial for funding early retirement. By inputting relevant financial data, users can determine the specific amounts they can withdraw from their retirement accounts without incurring penalties. This calculator simplifies the complex rules surrounding early distributions, making it easier for individuals to plan their financial futures effectively.

- Website: moaa.org

- Established: Approx. 30 years (domain registered in 1995)

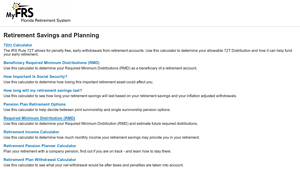

5. Financial Calculators

The Financial Calculators offered by MyFRS are designed to assist users in managing their retirement funds effectively. Key features include the ability to calculate allowable 72T distributions, which can provide crucial financial support for early retirement. Additionally, the tool helps users understand beneficiary required minimum distributions (RMD), ensuring they make informed decisions about their retirement savings and withdrawals.

- Website: myfrs.com

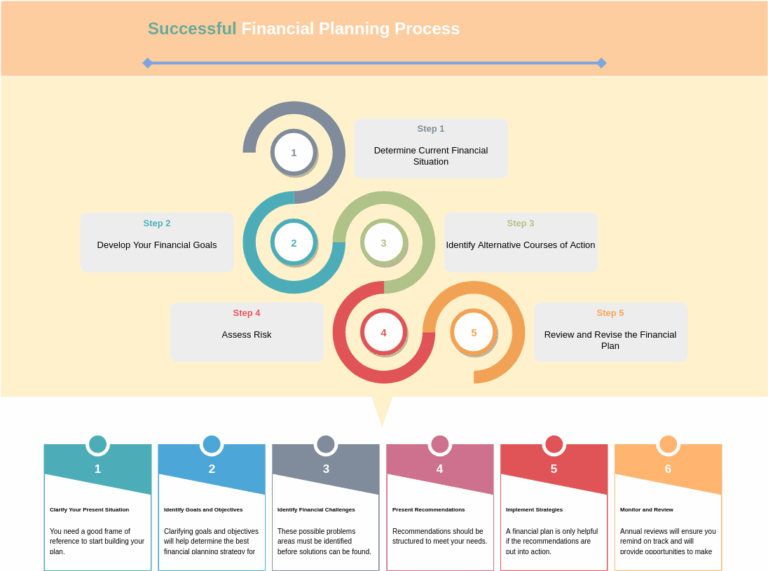

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most critical steps in obtaining accurate results from a 72t calculator is to ensure that all inputs are correct. Take your time to carefully enter your account balance, age, and any other relevant information. A simple typo can lead to significant discrepancies in the output. If the calculator allows for multiple entries (like beneficiary ages or interest rates), make sure each is accurate and reflects your current situation. Before hitting the “calculate” button, take a moment to review your entries to confirm their accuracy.

Understand the Underlying Assumptions

Every online calculator operates on specific assumptions that can significantly affect your results. For example, many calculators will use standard life expectancy tables, interest rates, and withdrawal methods defined by the IRS. Familiarize yourself with these assumptions to understand how they might impact your calculations. Look for any notes or disclaimers provided by the calculator, as these can offer insights into what factors are considered. Knowing these details can help you interpret the results more effectively and make informed decisions.

Use Multiple Tools for Comparison

To ensure the reliability of your results, consider using more than one 72t calculator. Different tools may employ varied methodologies or assumptions, leading to different outputs. By comparing results across multiple calculators, you can identify any inconsistencies and gain a more rounded understanding of your potential distributions. This practice can also help you spot any outliers that might indicate a need for further investigation or clarification.

Consult a Financial Advisor

While online calculators are excellent for preliminary estimates, they cannot replace professional advice tailored to your unique financial situation. After obtaining your results, consider discussing them with a financial advisor or tax professional. They can provide insights into the implications of your withdrawals and help you navigate any complexities associated with the 72(t) distribution rules. This step is especially crucial if you plan to make significant changes to your retirement strategy based on the calculator’s output.

Keep Records of Your Calculations

As you use different calculators and gather results, maintain a record of your calculations. Note the inputs you used, the results generated, and any observations about the assumptions underlying each tool. Keeping these records will not only help you track your financial planning journey but can also be beneficial if you decide to consult with a professional later. Having a clear history of your calculations will provide context and clarity during discussions about your retirement strategy.

Stay Updated on IRS Regulations

IRS rules and regulations can change, affecting how 72(t) distributions are calculated and applied. Stay informed about any updates that may impact your retirement planning. Regularly check the IRS website or reputable financial news sources for the latest information. Being aware of regulatory changes can help you make timely adjustments to your strategy, ensuring compliance and maximizing your benefits.

Frequently Asked Questions (FAQs)

1. What is a 72(t) calculator and how does it work?

A 72(t) calculator is an online tool designed to help individuals determine the allowable distributions from their retirement accounts under the Internal Revenue Code Section 72(t). This section permits penalty-free early withdrawals from retirement accounts, provided certain conditions are met. The calculator takes into account factors such as the account balance, the age of the account holder, and the method of calculation chosen (annuitization, amortization, or required minimum distribution) to calculate the annual distribution amount that can be withdrawn without incurring the IRS 10% early distribution penalty.

2. What methods can I use with a 72(t) calculator?

The 72(t) calculator typically allows users to select from three IRS-approved methods to calculate their distributions:

– Annuitization Method: This method uses an annuity factor to determine a fixed annual distribution amount based on life expectancy.

– Amortization Method: This method calculates a fixed distribution amount by amortizing the account balance over a specified life expectancy and a reasonable interest rate.

– Required Minimum Distribution (RMD) Method: This method calculates distributions based on the account balance divided by a life expectancy factor, resulting in varying annual amounts as the account value changes.

3. What information do I need to use a 72(t) calculator?

To effectively use a 72(t) calculator, you will typically need to provide:

– Account Balance: The total amount currently in your retirement account.

– Client Age: Your current age or the age at which you plan to start distributions.

– Beneficiary Information: Age and relationship of the beneficiary, if applicable.

– Interest Rate Assumptions: An estimated reasonable distribution interest rate, which can range from 0% to 12%.

– Withdrawal Frequency: Indicate whether you plan to take distributions annually, monthly, quarterly, or semi-annually.

4. Are there any risks associated with using a 72(t) calculator?

While using a 72(t) calculator can provide useful estimates for allowable distributions, it is important to understand that the results are based on assumptions and inputs provided by the user. If any of the assumptions change (such as account balance or interest rates), the calculated distributions may also change. Additionally, if distributions are modified before the required period ends (either five years or until age 59½), it could result in retroactive penalties. Therefore, it is recommended to consult a financial advisor or tax professional before making any withdrawals based on calculator results.

5. Can I change my distribution method once I start withdrawals?

Once you begin taking 72(t) distributions, you are generally required to stick with the chosen calculation method for the duration of the distribution period. The only exception is if you switch from the annuitization or amortization methods to the required minimum distribution method; this one-time change is permitted. Modifying the payment amounts or switching methods prematurely can lead to the imposition of the 10% early distribution penalty retroactively from the first year of distribution. Always seek guidance from a financial professional before making changes.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.