Best Auto Payoff Calculator: Top 5 Tools Compared

Finding the Best Auto Payoff Calculator: An Introduction

Finding the right auto payoff calculator can be a daunting task, especially with the multitude of options available online. Many people are eager to pay off their car loans faster, but determining the most effective strategy requires accurate calculations and a clear understanding of the implications of their choices. Whether you’re looking to experiment with different payment amounts, assess potential savings on interest, or simply track your remaining balance, having a reliable tool at your fingertips is crucial.

In this article, we aim to simplify your search by reviewing and ranking the top auto payoff calculators available online. Our goal is to save you time and effort by presenting tools that not only meet your needs but also provide accurate and user-friendly experiences.

Criteria for Ranking

To ensure that we offer you the best recommendations, we evaluated each calculator based on several key criteria:

-

Accuracy: We assessed how well each calculator performed in delivering precise results for various loan scenarios, including different interest rates and loan terms.

-

Ease of Use: We prioritized tools that are intuitive and straightforward, allowing users of all levels of financial expertise to navigate them easily.

-

Features: The ability to customize inputs, generate amortization schedules, and provide detailed reports were significant factors in our evaluation. We also looked for calculators that offered additional insights, such as potential interest savings from making extra payments.

By focusing on these criteria, we hope to guide you towards the best auto payoff calculators that can help you make informed financial decisions and expedite your journey to debt freedom.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting the Best Auto Payoff Calculators

When evaluating the best auto payoff calculators available online, we considered several critical factors to ensure that our recommendations meet the needs of users seeking to manage their auto loans effectively. Below are the key criteria we used to select the top tools:

-

Accuracy and Reliability

The primary function of an auto payoff calculator is to provide accurate calculations regarding loan payments, interest savings, and payoff timelines. We prioritized tools that are backed by reputable financial institutions or companies known for their reliability in providing financial services. Accuracy in calculations is vital, as users depend on these tools to make informed financial decisions. -

Ease of Use

An intuitive and user-friendly interface is essential for any online tool. We looked for calculators that allow users to easily input their data without confusion. A straightforward design with clear instructions ensures that even those unfamiliar with financial terminology can navigate the tool effectively. -

Key Features

The best auto payoff calculators offer a range of features that enhance their functionality. Important inputs include:

– Loan Amount: The total amount borrowed for the vehicle.

– Annual Interest Rate (APR): The yearly cost of borrowing expressed as a percentage.

– Loan Term: The duration of the loan, typically measured in months.

– Remaining Balance: The current amount left to pay on the loan.

– Additional Payment Options: The ability to experiment with different payment amounts to see how they affect the loan term and total interest paid.

– Prepayment Penalties: Information on any fees associated with paying off the loan early, which can influence a user’s decision-making. -

Cost (Free vs. Paid)

We evaluated whether the calculators were free to use or if they required a subscription or one-time payment. Free tools are generally preferred, as they provide accessible solutions for all users. However, if a paid tool offers significant advantages or unique features, we considered those as well.

-

Additional Resources and Guidance

A valuable calculator often comes with supplementary resources, such as articles or FAQs that provide further insights into managing auto loans. We favored tools that offer guidance on making extra payments, understanding loan amortization, and tips for paying off loans faster. -

Mobile Compatibility

With many users accessing tools via smartphones or tablets, we assessed whether the calculators were optimized for mobile use. A mobile-friendly design allows users to calculate their payoff options on the go, enhancing convenience.

By applying these criteria, we aimed to provide a comprehensive overview of the best auto payoff calculators that cater to the diverse needs of users looking to manage their vehicle loans effectively.

The Best Auto Payoff Calculators of 2025

2. Auto Loan Payoff Calculator

The Auto Loan Payoff Calculator from The Zebra is a user-friendly tool designed to help borrowers understand the impact of making extra payments on their auto loans. By inputting their loan details, users can discover how many months they can shorten their loan term and the potential interest savings. This calculator is an excellent resource for those looking to pay off their loans faster and save money in the process.

- Website: thezebra.com

- Established: Approx. 13 years (domain registered in 2012)

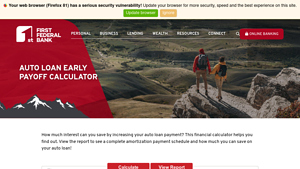

4. Auto Loan Early Payoff Calculator

The Auto Loan Early Payoff Calculator from First Federal Bank in Idaho is a valuable financial tool designed to help borrowers evaluate the potential savings from paying off their auto loans early. Users can generate a detailed amortization payment schedule, providing insights into their remaining payments and total interest savings. This calculator is particularly useful for those looking to manage their debt more effectively and optimize their financial planning.

- Website: bankfirstfed.com

- Established: Approx. 13 years (domain registered in 2012)

5. Auto Loan Calculator & Car Payment Tool at Bank of America

The Auto Loan Calculator and Car Payment Tool at Bank of America is designed to help users estimate their monthly payments and approximate interest rates for both new and used car loans. This user-friendly tool simplifies the car financing process, allowing potential borrowers to make informed decisions by providing clear financial insights tailored to their specific needs.

- Website: bankofamerica.com

- Established: Approx. 27 years (domain registered in 1998)

How to Get the Most Accurate Results

Double-Check Your Inputs

To achieve the most accurate results from an auto payoff calculator, it is crucial to ensure that all inputs are correct. Begin by carefully entering the following key details:

- Loan Amount: Make sure to input the exact amount borrowed for your vehicle.

- Annual Interest Rate (APR): Use the current interest rate on your auto loan, as this can significantly affect the calculations.

- Loan Term: Input the correct duration of your loan, typically expressed in months.

- Remaining Months: If you’re not starting from the beginning of your loan, be sure to enter how many months are left on your current loan.

- Extra Payment Amount: If considering an additional monthly payment, input this correctly to see its potential impact.

Mistakes in these values can lead to misleading results, so take a moment to verify that everything is accurate before hitting “calculate.”

Understand the Underlying Assumptions

Each auto loan payoff calculator may use different assumptions regarding amortization, interest calculations, and prepayment penalties. Familiarize yourself with how the calculator operates:

- Amortization Schedule: Understand that most calculators use a standard amortization schedule, where interest is higher at the beginning of the loan term.

- Prepayment Penalties: Some loans may impose fees for paying off the loan early. Ensure you know your loan’s terms and include any penalties if applicable.

- Interest Type: Determine if the interest is simple or compounded, as this can affect the overall cost of the loan.

By understanding these underlying assumptions, you can interpret the results more accurately and make informed decisions.

Use Multiple Tools for Comparison

Not all calculators are created equal. To gain a more comprehensive view of your auto loan payoff options, consider using multiple calculators from different sources. This can help you:

- Cross-Verify Results: Different calculators may provide slightly varying results due to their algorithms. By comparing outputs, you can identify any discrepancies and adjust your calculations accordingly.

- Explore Various Scenarios: Different tools may offer unique features, such as visual graphs or detailed amortization schedules, allowing you to explore different scenarios more thoroughly.

- Gain Insights: Some calculators may include additional tips or insights that could be beneficial, such as suggestions for refinancing or strategies to save on interest.

Review the Results Thoroughly

Once you have your results, take the time to review them in detail. Look for:

- Total Interest Savings: Understand how much you will save by making extra payments or shortening your loan term.

- New Loan Term: Check how much time you can shave off your repayment period with additional payments.

- Payment Schedule: If available, review the detailed payment schedule to see how your payments will change over time.

By thoroughly analyzing the output, you can develop a solid plan for paying off your auto loan in a way that best suits your financial situation.

Frequently Asked Questions (FAQs)

1. What is an auto payoff calculator?

An auto payoff calculator is an online tool that helps you determine how much you can save on your car loan by making extra payments or paying off your loan early. It calculates potential interest savings, shortens your loan term, and provides an amortization schedule based on the information you input, such as loan amount, interest rate, remaining balance, and desired extra payment.

2. How do I use an auto payoff calculator?

To use an auto payoff calculator, you typically need to input several key details about your loan: the total loan amount, the annual interest rate (APR), the loan term, the remaining months left on the loan, and any additional monthly payments you plan to make. Once you enter this information, the calculator will show you how much time you can shave off your loan and how much interest you might save.

3. Are there any fees associated with paying off my auto loan early?

Some lenders impose prepayment penalties for paying off a loan early. This fee is designed to compensate the lender for the interest they would have earned if the loan were paid according to the original schedule. It’s essential to review your loan agreement or consult with your lender to understand any potential penalties before making additional payments or paying off your loan early.

4. Can I save money by making extra payments on my auto loan?

Yes, making extra payments can significantly reduce the total interest you pay over the life of your loan. By applying additional payments towards your principal, you decrease the remaining balance faster, which reduces the amount of interest that accrues. Many auto payoff calculators will illustrate how much you can save by inputting different extra payment amounts.

5. What should I consider before using an auto payoff calculator?

Before using an auto payoff calculator, consider your overall financial situation, including your budget and other outstanding debts. Ensure that making extra payments won’t strain your finances or prevent you from meeting other financial obligations. Additionally, check whether your lender allows for changes to your payment structure and be aware of any prepayment penalties that may apply.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.