Best Blended Rate Calculator: Top 5 Tools Compared

Finding the Best Blended Rate Calculator: An Introduction

When managing multiple loans or credit accounts, calculating a blended interest rate can be a daunting task. A blended rate, which is the weighted average of various interest rates across different debts, provides a clearer picture of your overall financial situation. However, not all blended rate calculators are created equal. With numerous options available online, finding a reliable and efficient tool that meets your needs can be challenging.

This article aims to simplify your search by reviewing and ranking the top blended rate calculators available on the internet. Our goal is to save you time and effort by identifying tools that are not only user-friendly but also provide accurate calculations. Whether you’re considering refinancing, consolidating debt, or simply want to understand your financial landscape better, the right calculator can make all the difference.

Criteria for Ranking

To ensure a comprehensive evaluation, we have established several criteria for ranking these calculators:

-

Accuracy: The primary function of any calculator is to deliver precise results. We will assess how accurately each tool computes the blended rate based on the data inputted.

-

Ease of Use: A well-designed interface can significantly enhance user experience. We will consider how straightforward it is to enter data and obtain results.

-

Features: Additional functionalities, such as the ability to save results, compare rates, or provide financial insights, will be taken into account.

-

Accessibility: We will also evaluate how easy it is to access these calculators across different devices and platforms.

By the end of this article, you will have a clear understanding of which blended rate calculators stand out in terms of performance, making it easier for you to choose the best tool for your financial needs.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting the Best Blended Rate Calculators

When evaluating various blended rate calculators, we focused on several key criteria to ensure that users can find a reliable and effective tool for their financial needs. Here’s how we selected the top tools:

-

Accuracy and Reliability

– The primary function of a blended rate calculator is to provide an accurate representation of the average interest rate across multiple debts. We prioritized tools that have been tested for precision and offer transparent calculations, ensuring that users can trust the results they receive. -

Ease of Use

– A user-friendly interface is essential for any online tool. We looked for calculators that are intuitive, allowing users to input their data easily without confusion. Clear instructions and straightforward navigation were critical factors in our evaluation. -

Key Features

– The best calculators include specific inputs that cater to the needs of users. We sought tools that allow for:- Multiple loan entries, enabling users to input various debts with different balances and interest rates.

- Automatic calculations of the total balance and blended rate.

- Options to reset or modify entries easily.

- Additional features such as debt comparison tools or refinancing suggestions were also considered valuable.

-

Cost (Free vs. Paid)

– Most users prefer free tools, so we focused on calculators that do not require payment to access their features. However, if a paid tool offered significant advantages, such as advanced calculations or personalized advice, we included it in our review after careful consideration of its cost-benefit ratio. -

Mobile Compatibility

– Given the increasing use of smartphones and tablets for financial management, we ensured that the calculators we selected are mobile-friendly. This allows users to access their tools on the go, enhancing convenience.

-

Customer Support and Resources

– Tools that offer helpful resources, such as FAQs, user guides, and customer support options, were favored. This ensures that users can get assistance when needed and understand how to use the calculator effectively. -

Security and Privacy

– Since financial data is sensitive, we prioritized calculators that ensure user privacy and data security. Tools that do not store personal information after the session or that clearly outline their privacy policies were given preference. -

User Reviews and Reputation

– Finally, we considered user feedback and the reputation of the calculator providers. Tools with positive reviews and a history of satisfied users were more likely to be included in our top selections.

By applying these criteria, we aimed to provide a comprehensive overview of the best blended rate calculators available, helping users make informed financial decisions with confidence.

The Best Blended Rate Calculators of 2025

1. Blended rate calculator

The Blended Rate Calculator from drcalculator.com is a useful tool designed to help users determine the blended interest rate across multiple loans. It calculates the total balance and provides an effective rate, which is accurate only if all loans are paid off within the same timeframe. This calculator streamlines the process of understanding overall loan costs, making it easier for users to manage their finances effectively.

- Website: drcalculator.com

- Established: Approx. 21 years (domain registered in 2004)

2. Blended Rate Calculator

The Blended Rate Calculator from Churchill Mortgage is a practical tool designed to help users evaluate their overall borrowing costs. By inputting various debt balances and their corresponding interest rates, individuals can easily calculate their blended rate. This feature is particularly useful for those looking to consolidate debts or assess the impact of refinancing, enabling informed financial decisions based on accurate rate assessments.

- Website: churchillmortgage.com

- Established: Approx. 29 years (domain registered in 1996)

3. Blended Rate Calculator

The Blended Rate Calculator from F&M Bank is a valuable financial tool designed to help users determine their blended interest rates across various loans or investments. This calculator simplifies the process of calculating the average rate by considering multiple sources, making it easier for individuals and businesses to assess their overall borrowing costs or investment returns. With F&M Bank’s commitment to providing diverse financial resources, this tool enhances users’ financial decision-making capabilities.

- Website: fmbankva.com

- Established: Approx. 13 years (domain registered in 2012)

5. Blended Rate Calculator

The Blended Rate Calculator from Omni Calculator is a valuable tool designed to help users calculate the average blended interest rate across multiple financial obligations, such as mortgages, debts, and loans. This user-friendly calculator simplifies the process of assessing overall interest costs, making it easier for individuals to manage their finances effectively. With its straightforward interface and accurate computations, it serves as an essential resource for anyone looking to optimize their debt repayment strategy.

- Website: omnicalculator.com

- Established: Approx. 11 years (domain registered in 2014)

How to Get the Most Accurate Results

Double-Check Your Inputs

The accuracy of your blended rate calculation largely depends on the information you provide. Before hitting the “calculate” button, take a moment to double-check all your inputs. Ensure that the loan balances and interest rates you enter are accurate and reflect your current financial situation. Small errors, such as a misplaced decimal or incorrect interest rate, can significantly skew your results. It’s advisable to gather all relevant documents and data beforehand, including loan statements or credit reports, to ensure you have the most up-to-date information at your fingertips.

Understand the Underlying Assumptions

Every blended rate calculator operates based on certain assumptions that can affect the results. For example, most calculators assume that all loans will be paid off over the same time period, which may not reflect your actual repayment timeline. Additionally, some calculators may not account for fees, taxes, or insurance that could impact your overall costs. Understanding these assumptions will help you interpret the results more accurately and make informed financial decisions. Always read the FAQ or instructions provided by the calculator to grasp its limitations and underlying methodology.

Use Multiple Tools for Comparison

To ensure you’re getting the most accurate blended rate, consider using multiple calculators. Different tools may have varying algorithms or methods for calculating the blended rate, which can lead to slightly different results. By comparing outputs from various calculators, you can identify any discrepancies and gain a more comprehensive understanding of your financial situation. This practice will also help you spot any potential errors in your input data, as consistent results across tools can validate your information.

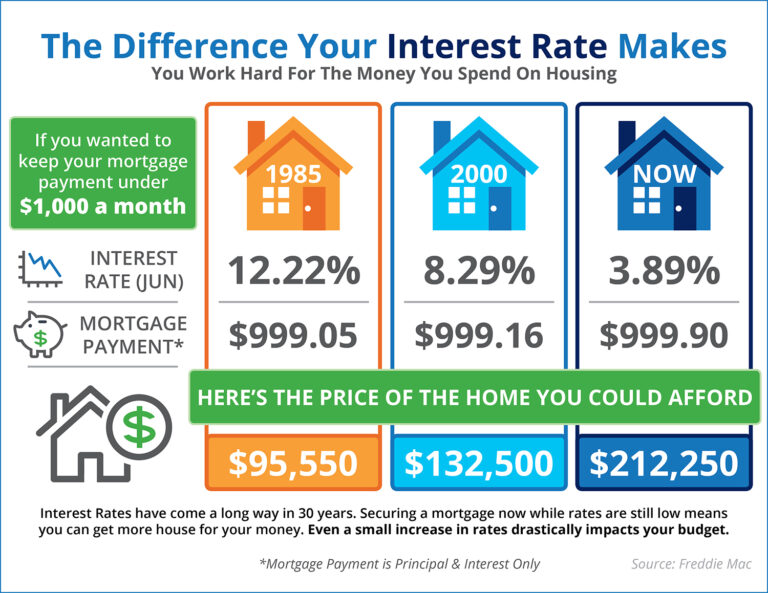

Review Current Market Rates

Once you have calculated your blended rate, compare it with current market interest rates. Understanding where your blended rate stands in relation to prevailing rates can help you determine if refinancing or consolidating your loans would be beneficial. If your blended rate is higher than current rates, it might be a good time to explore refinancing options. Conversely, if your blended rate is lower, you may want to focus on paying down your debts without additional changes.

Seek Professional Guidance

While online calculators are powerful tools, they cannot replace personalized advice from financial professionals. If you find the results complex or if your financial situation involves multiple variables, consider consulting with a financial advisor or mortgage specialist. They can provide tailored advice based on your unique circumstances and help you explore the best options available for managing your debts or refinancing your loans.

By following these tips, you can maximize the accuracy and usefulness of blended rate calculators, empowering you to make more informed financial decisions.

Frequently Asked Questions (FAQs)

1. What is a blended rate calculator?

A blended rate calculator is an online tool that helps users determine the average interest rate of multiple loans or debts. By inputting the balances and interest rates of each loan, the calculator computes a single blended rate, which represents the overall cost of borrowing across all loans combined. This can assist users in understanding their financial obligations and making informed decisions about refinancing or consolidating debts.

2. How do I calculate my blended rate using the calculator?

To calculate your blended rate using a blended rate calculator, you need to input the following information for each of your loans: the current balance and the corresponding interest rate. Once all data is entered, the calculator will automatically compute the total balance and the blended interest rate. This process eliminates the need for manual calculations and provides a clear overview of your average borrowing cost.

3. Why is it important to know my blended rate?

Knowing your blended rate is crucial because it gives you a clearer picture of your overall financial situation. If your blended rate is lower than current market rates, it may indicate that refinancing your loans could save you money on interest payments. Understanding your blended rate also helps you compare different financing options and make better decisions regarding debt management.

4. Can I use the blended rate calculator for any type of loan?

Yes, you can use a blended rate calculator for various types of loans, including mortgages, personal loans, auto loans, and credit card debts. The calculator is designed to handle multiple debts with different interest rates, allowing you to see how they combine into a single blended rate. However, ensure that the loans you input have similar payment terms for the most accurate results.

5. What factors can affect my blended rate?

Several factors can influence your blended rate, including the individual interest rates of each loan, the outstanding balances, and the total number of loans you have. Additionally, changes in market interest rates can affect your decision to refinance or consolidate your debts. It’s important to monitor these factors regularly to make informed financial decisions.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.