Best Calculate Diminishing Value: Top 5 Tools Compared

Finding the Best Calculate Diminishing Value: An Introduction

Finding the right online tool to calculate diminishing value depreciation can be a daunting task. With numerous options available, it’s crucial to ensure that the tool you choose is not only accurate but also user-friendly. Diminishing value depreciation is a method used to account for the decrease in value of an asset over time, which can be particularly complex for those unfamiliar with accounting principles. Inaccurate calculations can lead to financial discrepancies, which may affect your tax returns and overall business strategy.

This article aims to simplify your search by reviewing and ranking the top online tools specifically designed for calculating diminishing value depreciation. We understand that time is valuable, and our goal is to help you find a reliable solution without the hassle of sifting through numerous websites.

To determine the best tools, we evaluated several key criteria. Accuracy is paramount; we examined how closely the tools adhere to the standard calculations required for diminishing value depreciation. Ease of use also played a significant role, as a user-friendly interface can make the process smoother for both beginners and seasoned professionals. Additionally, we considered features such as customization options, reporting capabilities, and support resources, which can enhance the overall user experience.

By the end of this article, you will have a clear understanding of the top online tools available for calculating diminishing value depreciation, allowing you to make an informed decision that best fits your needs. Whether you are a small business owner, an accountant, or an individual looking to manage your assets more effectively, our insights will guide you toward the right choice.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting Top Diminishing Value Calculators

When evaluating the best online tools for calculating diminishing value depreciation, we considered several essential criteria to ensure that users can find a tool that meets their needs effectively. Below are the key factors that guided our selection process:

-

Accuracy and Reliability

– Precision in Calculations: The tool must provide accurate calculations based on the diminishing value formula. This includes correctly applying the original cost, residual value, and depreciation rate.

– Trustworthiness: The sources of the formulas and methodologies used should be reputable, ideally aligning with standard accounting practices and guidelines set forth by tax authorities. -

Ease of Use

– User-Friendly Interface: The calculator should have a simple, intuitive layout that allows users to input data without confusion.

– Clear Instructions: Each tool should provide clear instructions or tooltips that explain how to input information and interpret the results. -

Key Features

– Comprehensive Inputs: A good calculator should allow users to enter all necessary variables, including:- Original Cost: The initial purchase price of the asset.

- Residual Value: The estimated salvage value at the end of the asset’s useful life.

- Asset Lifespan: The expected duration for which the asset will be in use.

- Depreciation Rate: The percentage at which the asset depreciates annually.

- Step-by-Step Breakdown: The ability to see a detailed breakdown of the calculations year-by-year, which helps users understand how the diminishing value is applied over time.

-

Cost (Free vs. Paid)

– Accessibility: We evaluated whether the tools are available for free or require a subscription or one-time fee. Free tools are generally preferable for personal or small business use.

– Value for Money: For paid options, the tools should offer features that justify their cost, such as advanced reporting or additional financial insights. -

Additional Resources

– Educational Content: Tools that provide additional resources, such as articles or FAQs about diminishing value depreciation, can enhance user understanding and help users make informed decisions.

– Customer Support: Availability of support, whether through FAQs, live chat, or email, is crucial for users who may need assistance while using the calculator.

-

Compatibility

– Cross-Platform Functionality: The calculator should ideally work on various devices (desktop, tablet, mobile) to ensure accessibility for all users.

– Integration with Accounting Software: For users managing multiple assets, tools that integrate with popular accounting software can save time and improve efficiency.

By focusing on these criteria, we aimed to curate a selection of calculators that not only meet the technical requirements for calculating diminishing value but also provide a user-friendly and supportive experience for individuals and businesses alike.

The Best Calculate Diminishing Values of 2025

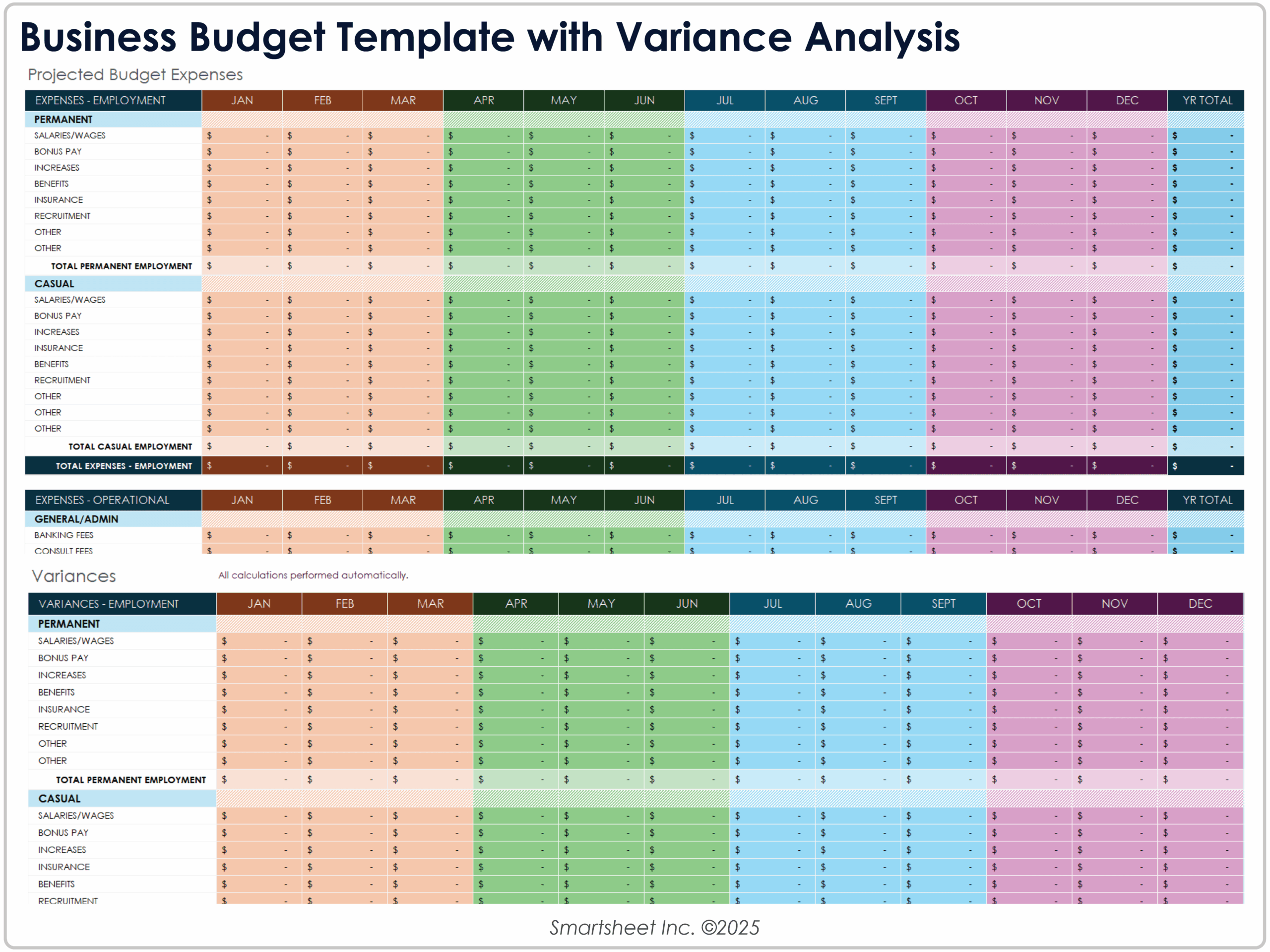

4. Calculate Diminishing Value vs Prime Cost Depreciation

The “Calculate Diminishing Value vs Prime Cost Depreciation” tool on asset.accountant is designed to help users assess two distinct depreciation methods for assets. The prime cost method offers a straightforward approach, delivering consistent depreciation throughout an asset’s effective life, making it easier for users to plan and manage their financial records. This tool aids in comparing the diminishing value method with the prime cost, allowing for informed decision-making regarding asset depreciation strategies.

- Website: asset.accountant

- Established: Approx. 6 years (domain registered in 2019)

How to Get the Most Accurate Results

Double-Check Your Inputs

Accuracy is paramount when using online calculators for diminishing value depreciation. The results generated by these tools are only as reliable as the data you input. Take the time to verify that all values are correct, including the initial asset cost, residual value, and expected lifespan. Small errors can lead to significant discrepancies in the depreciation calculations.

Before hitting ‘calculate,’ review your entries. Make sure you’re using consistent units (e.g., years for lifespan) and that the values reflect the correct context (e.g., after installation costs for asset value). This diligence can save you from potential financial miscalculations later on.

Understand the Underlying Assumptions

Every calculator operates based on certain assumptions and methodologies that may not be explicitly stated. Familiarize yourself with the calculator’s approach to depreciation. For instance, some calculators may assume a straight-line depreciation method rather than diminishing value, or they may use a specific rate of depreciation that doesn’t align with your asset’s characteristics.

Understanding these assumptions allows you to better interpret the results. If a calculator uses a fixed rate for depreciation that doesn’t match your asset’s actual usage pattern, the results may not be applicable to your situation. If you have doubts, consult the documentation or guidelines provided with the calculator.

Use Multiple Tools for Comparison

To enhance the accuracy of your results, consider using multiple online calculators. Different tools may employ varying algorithms or methodologies, leading to different depreciation figures. By comparing results from several calculators, you can gain a more comprehensive understanding of your asset’s depreciation.

When using multiple tools, look for patterns in the results. If one calculator consistently provides a significantly different figure, investigate why that might be the case. This practice not only helps validate your findings but also gives you a broader perspective on the potential depreciation values for your asset.

Keep Updated with Current Tax Laws

Tax laws and regulations regarding depreciation can change, affecting how you should calculate diminishing value. Ensure that the calculator you are using is updated with the latest tax guidelines and practices. This is particularly important if you are using the results for tax preparation purposes.

Refer to official resources or consult with a financial professional to confirm that the methods and rates used in your calculations comply with current laws. Staying informed will help you make more accurate financial decisions and avoid potential legal issues.

Document Your Calculations

Finally, maintain a clear record of all calculations and inputs used in the depreciation process. This documentation can be invaluable for future reference, especially during tax time or when you need to justify your depreciation claims. Having a detailed account of how you arrived at your figures can also help in discussions with accountants or financial advisors.

By following these guidelines, you can maximize the accuracy and reliability of your depreciation calculations, ensuring that your financial planning is based on solid data.

Frequently Asked Questions (FAQs)

1. What is diminishing value depreciation?

Diminishing value depreciation is a method used to calculate the declining value of an asset over time. This approach allows businesses to write off the cost of the asset in a way that reflects its reduced productivity and utility as it ages. Typically, this method is favored for assets that provide higher returns in their initial years, such as machinery or electronics, where the depreciation expense is higher at the beginning and decreases over time.

2. How do I calculate diminishing value depreciation?

To calculate diminishing value depreciation, you need three key pieces of information: the asset’s original cost, its residual value (the estimated value at the end of its useful life), and its useful lifespan. The formula is as follows:

-

Calculate the annual depreciation expense:

[

\text{Annual Depreciation Expense} = \frac{\text{Cost of Asset} – \text{Residual Value}}{\text{Asset Lifespan}}

] -

Determine the depreciation rate:

[

\text{Depreciation Rate} = \left( \frac{\text{Annual Depreciation Expense}}{\text{Cost of Asset}} \right) \times 100\%

] -

Calculate the depreciation charge for each year using:

[

\text{Depreciation Charge} = \text{Net Book Value} – \text{Residual Value} \times \text{Depreciation Factor}

]

3. What are the advantages of using a diminishing value method?

The primary advantage of the diminishing value method is that it allows businesses to maximize their tax deductions in the early years of an asset’s life, when the asset is typically most productive. This can improve cash flow and provide significant tax savings. Additionally, this method can more accurately reflect the asset’s decreasing utility and market value over time, making it a preferred choice for assets that experience rapid obsolescence.

4. How does diminishing value depreciation differ from straight-line depreciation?

Diminishing value depreciation differs from straight-line depreciation in the way the expense is recognized. Straight-line depreciation spreads the cost evenly across the asset’s useful life, resulting in equal annual deductions. In contrast, diminishing value depreciation starts with a higher deduction that decreases over time, reflecting the asset’s reduced value as it ages. This method is often more beneficial for assets that lose value quickly.

5. What types of assets are best suited for the diminishing value method?

The diminishing value method is particularly well-suited for assets that provide greater value when new, such as technology (computers, software) and machinery, which tend to depreciate faster initially. It’s also useful for vehicles and equipment that may become outdated or less effective as newer models are introduced. Conversely, assets with a longer useful life and stable value, such as buildings, may benefit more from straight-line depreciation.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.