Best Car Registration Fee Calculator Colorado: Top 5 Tools Compared

Finding the Best Car Registration Fee Calculator Colorado: An Introduction

Navigating the complexities of vehicle registration can be a daunting task, particularly in Colorado, where fees can vary significantly based on factors such as vehicle type, weight, and age. For many residents, understanding how to accurately calculate these fees is essential to avoid unexpected costs and ensure compliance with state regulations. With numerous online calculators available, finding a reliable and user-friendly car registration fee calculator can be a challenge.

This article aims to simplify that process by reviewing and ranking the best car registration fee calculators for Colorado. Our goal is to provide you with a comprehensive guide that saves you time and effort while helping you make informed decisions about your vehicle registration fees.

Criteria for Ranking

To ensure a fair and thorough evaluation, we have established a set of criteria for ranking these calculators. The primary factors considered include:

- Accuracy: The calculators must provide precise estimates based on the most current Colorado registration fee structures, including ownership taxes and other relevant fees.

- Ease of Use: User-friendly interfaces are crucial. We prioritize tools that allow users to quickly input necessary information and receive instant results.

- Features: Additional functionalities, such as the ability to compare fees for different vehicles or access historical fee data, enhance the overall user experience and utility of the calculator.

- Accessibility: We also consider whether the calculators are easily accessible on various devices, including smartphones and tablets.

By focusing on these criteria, we aim to present you with the most effective online tools to help you navigate Colorado’s vehicle registration process with confidence.

Our Criteria: How We Selected the Top Tools

When evaluating the top car registration fee calculators for Colorado, we considered several key criteria to ensure that the tools we recommend are effective, user-friendly, and reliable. Here’s how we selected the best options:

1. Accuracy and Reliability

The foremost criterion for a good car registration fee calculator is accuracy. The calculators must provide precise estimates based on the latest Colorado DMV regulations, which include various fees and taxes. We looked for tools that consistently yield correct results when tested with known vehicle values, weights, and ages. The accuracy of calculations is crucial, as users rely on these estimates for budgeting their vehicle registration costs.

2. Ease of Use

A user-friendly interface is essential for any online tool. We assessed the ease of navigation and clarity of instructions provided by each calculator. A good calculator should allow users to enter relevant data quickly without unnecessary steps or complications. Intuitive design and clear labeling of input fields enhance the user experience, making it accessible even for those who may not be tech-savvy.

3. Key Features

We evaluated the range of features offered by each calculator, focusing on the following specific inputs that are necessary for accurate fee calculations:

– Original Vehicle Value: The MSRP or sticker price of the vehicle.

– Vehicle Type: Options for different categories such as cars, trucks, and motorcycles.

– Vehicle Weight: A breakdown of fees based on weight classes, as registration fees vary significantly.

– Model Year: The year of manufacture, which affects ownership tax rates.

– Renewal vs. New Registration: Some calculators distinguish between the fees for renewing existing registrations and registering new vehicles.

4. Cost (Free vs. Paid)

Cost is a significant factor in selecting a car registration fee calculator. We prioritized tools that are available for free, ensuring that users can access essential information without incurring additional expenses. While some premium tools may offer advanced features or personalized services, our focus was on providing reliable free options that meet the basic needs of the majority of users.

5. Customer Support and Resources

We also considered the availability of customer support and additional resources. Good calculators often provide FAQs, contact information for support, and links to relevant DMV resources for further assistance. This added layer of support can be invaluable for users who have questions or need further clarification on their registration fees.

6. User Reviews and Feedback

Lastly, we analyzed user reviews and feedback to gauge overall satisfaction and performance. Insights from real users can highlight potential issues or advantages that may not be immediately apparent. Positive user experiences can indicate reliability and effectiveness, while consistent complaints may signal areas for improvement.

By weighing these criteria, we aimed to present a comprehensive list of the top car registration fee calculators for Colorado that cater to a wide range of user needs and preferences.

The Best Car Registration Fee Calculator Colorados of 2025

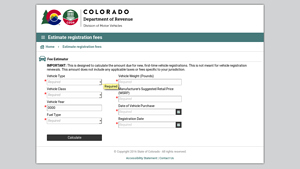

1. Estimate Registration Fee Calculator

The Estimate Registration Fee Calculator on myDMV Colorado is a user-friendly online tool designed to help residents estimate their vehicle registration fees. By inputting essential details such as vehicle type, age, and weight, users can quickly receive an approximate fee, making budgeting for registration more manageable. This calculator streamlines the process, providing clarity and efficiency for Colorado residents navigating vehicle registration requirements.

- Website: mydmv.colorado.gov

2. Colorado Registration Calculator and Plate Fee Chart

The Colorado Registration Calculator and Plate Fee Chart from F&I Tools is an invaluable resource for Colorado residents looking to streamline their vehicle registration process. This tool automatically calculates the costs associated with vehicle transfers and renewals by comparing the current year to the model year and original value of the vehicle. Its user-friendly interface simplifies the often complex fee structure, making it easier for users to budget for their registration expenses.

- Website: factorywarrantylist.com

- Established: Approx. 15 years (domain registered in 2010)

4. Taxes and Fees

The Taxes and Fees tool provided by the Colorado DMV is designed to help users calculate registration fees based on their vehicle’s empty weight and type, in accordance with Colorado Revised Statutes. This resource simplifies the fee assessment process by offering clear guidelines and potential additional fees, ensuring that vehicle owners can accurately determine their registration costs before proceeding with the DMV.

- Website: dmv.colorado.gov

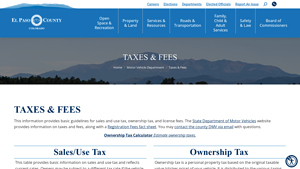

5. Taxes & Fees

The “Taxes & Fees” section of the El Paso County Clerk and Recorder’s website serves as a comprehensive resource for understanding the various taxes and fees associated with vehicle registration. It offers access to essential information and a Registration Fees fact sheet, ensuring residents can easily navigate their financial obligations. Additionally, users can contact the county DMV for personalized assistance, enhancing the overall utility of the tool.

- Website: clerkandrecorder.elpasoco.com

- Established: Approx. 25 years (domain registered in 2000)

How to Get the Most Accurate Results

Double-Check Your Inputs

When using a car registration fee calculator, the accuracy of your results heavily depends on the data you input. Ensure that you enter the correct information regarding your vehicle, including:

- Manufacturer’s Suggested Retail Price (MSRP): This is typically the original sticker price of the vehicle. Make sure you have the correct value, as this greatly influences ownership tax calculations.

- Vehicle Type: Different fees apply to passenger cars, trucks, and other vehicle types. Select the appropriate category to get precise results.

- Model Year: The age of your vehicle affects the tax rate. Ensure that you select the correct model year to reflect the correct depreciation in value.

Understand the Underlying Assumptions

Each calculator may operate on different assumptions based on local regulations and tax structures. Familiarize yourself with how the calculator derives its results:

- Tax Rates: Different regions within Colorado may have varying tax rates. For instance, the sales tax can differ based on the county or city. Knowing the specific rates that apply to your area can help you better understand the calculator’s output.

- Depreciation Models: Some calculators might use different formulas for assessing the depreciation of your vehicle’s value over time. Understanding how these models work can help you anticipate changes in fees as your vehicle ages.

Use Multiple Tools for Comparison

To ensure you are getting an accurate estimate, consider using multiple online calculators. Each tool may provide slightly different results due to variations in their underlying algorithms or data sources. By comparing results from different calculators, you can:

- Identify Outliers: If one calculator provides a significantly different estimate than others, it may indicate an error in input or an assumption that does not apply to your situation.

- Cross-Verify Information: Using multiple sources can help validate the accuracy of your registration fee estimates. If most calculators yield similar results, you can be more confident in the figures.

Keep Updated with Local Regulations

Registration fees can change due to new legislation or adjustments in local tax rates. Always check for the most current information:

- Official State Websites: Refer to the Colorado Department of Motor Vehicles and your local county clerk’s office for the latest fee schedules and tax rates.

- Community Resources: Local government websites often have updates on changes in vehicle registration laws or taxes. Staying informed will help you avoid surprises when you register your vehicle.

Be Mindful of Additional Fees

Remember that the registration fee is just one part of the overall cost. Additional fees may apply, such as:

- Late Fees: If you miss registration deadlines, late fees can accrue quickly. Familiarize yourself with the grace periods and penalties in your area.

- Specialty Plate Fees: If you choose a custom or specialty license plate, additional charges will apply.

By following these tips, you can enhance the accuracy of the car registration fee calculators and ensure a smoother registration process in Colorado.

Frequently Asked Questions (FAQs)

1. What is a car registration fee calculator for Colorado?

A car registration fee calculator for Colorado is an online tool that helps vehicle owners estimate the registration fees they need to pay when registering their car. The calculator typically takes into account factors such as the vehicle’s original MSRP (Manufacturer’s Suggested Retail Price), age, weight, and the specific county where the vehicle is registered. By inputting these details, users can receive an estimated fee breakdown that includes ownership tax, license fees, and any additional applicable charges.

2. How do I use the car registration fee calculator?

To use a car registration fee calculator, you generally need to provide specific information about your vehicle. This may include the original value (MSRP), model year, type of vehicle (car or truck), and its weight. Once you input this information, the calculator will process the data and display an estimated registration fee, often itemizing components such as ownership tax, license fees, and any additional charges based on your local jurisdiction.

3. What factors affect my car registration fees in Colorado?

Several factors influence car registration fees in Colorado, including:

– Vehicle Age: Registration fees decrease as the vehicle ages, with specific percentages applied to the MSRP for different years of service.

– Vehicle Weight: Heavier vehicles typically incur higher registration fees.

– County of Registration: Local tax rates can vary, affecting the total amount due.

– Sales and Use Tax: This is applicable at the time of purchase and varies by location.

– Plate Type: Specialty or personalized plates may incur additional fees.

4. Are the estimates provided by the calculator accurate?

While car registration fee calculators provide a helpful estimate, the final registration cost may vary due to several factors that the calculator might not account for, such as specific local taxes, additional fees for specialty plates, or late fees. Therefore, it is advisable to use the calculator as a guide and confirm the final amount with your local DMV or motor vehicle department for the most accurate and up-to-date information.

5. Can I use the calculator for any vehicle type?

Most car registration fee calculators in Colorado are designed to accommodate various vehicle types, including passenger cars, trucks, motorcycles, and more. However, the specific calculations may differ based on the vehicle type. For example, trucks may have different weight classifications and tax rates compared to passenger vehicles. Always ensure you are selecting the correct vehicle type when using the calculator to obtain the most accurate estimate.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.