Best Closing Cost Calculator Florida: Top 5 Tools Compared

Finding the Best Closing Cost Calculator Florida: An Introduction

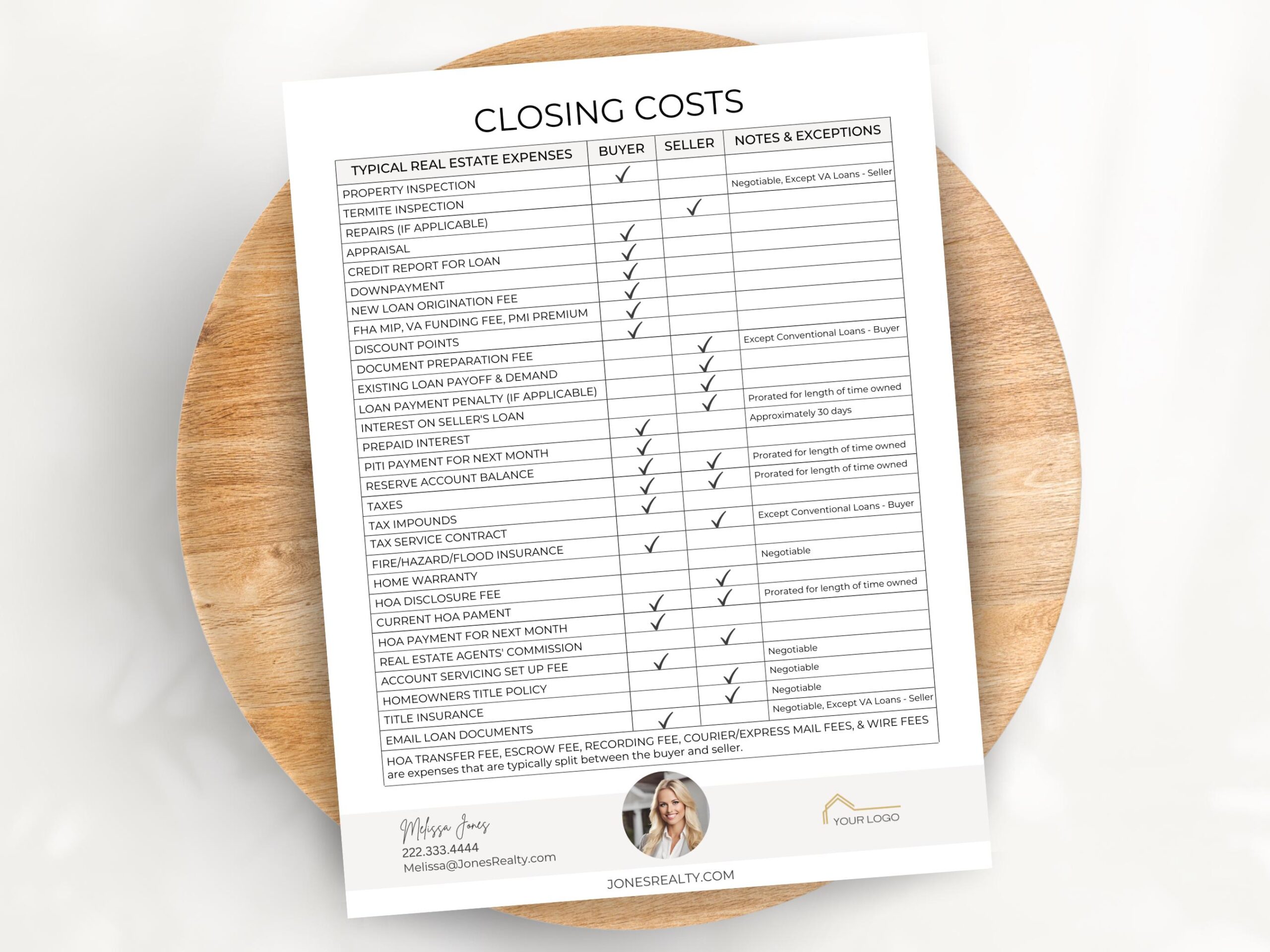

Navigating the complexities of home buying in Florida can be overwhelming, especially when it comes to understanding and estimating closing costs. With various fees such as underwriting, appraisal, and title insurance involved, it can be challenging for buyers to get a clear picture of the total expenses they will incur at closing. This is where a reliable closing cost calculator can make a significant difference. However, not all calculators are created equal, and finding one that is both accurate and user-friendly can be a daunting task.

This article aims to simplify your search by reviewing and ranking the top closing cost calculators available online specifically for Florida. Our goal is to save you time and provide you with the best tools to estimate your closing costs accurately. By utilizing these calculators, you can gain a better understanding of the financial obligations you’ll face, allowing you to plan more effectively for your home purchase.

To ensure a thorough evaluation, we have established criteria for ranking these calculators. Key factors include accuracy in estimating costs based on input data, ease of use and navigation, and the range of features offered. We will also consider user feedback and overall satisfaction to provide a comprehensive overview of each tool. Whether you are a first-time homebuyer or a seasoned investor, this guide will help you find the right closing cost calculator to suit your needs in Florida.

Our Criteria: How We Selected the Top Tools

Accuracy and Reliability

When selecting the top closing cost calculators for Florida, accuracy is paramount. A reliable calculator should provide estimates that closely align with actual closing costs. We evaluated each tool based on its ability to incorporate various local fees and taxes, ensuring that users receive a realistic picture of their financial obligations. Furthermore, calculators that utilize updated data and reflect current market conditions were favored.

Ease of Use

A user-friendly interface is essential for any online calculator. The tools we selected feature intuitive designs that allow users to input their information easily without any technical difficulties. We assessed the layout, navigation, and overall user experience to ensure that even those unfamiliar with real estate transactions could navigate the calculators with ease.

Key Features

The best closing cost calculators include a range of inputs to provide comprehensive estimates. We looked for tools that allow users to enter:

– Home Price: The total sale price of the property.

– Down Payment: Users should be able to specify the amount they plan to put down, as this significantly affects closing costs.

– Interest Rate: The ability to input an accurate interest rate helps tailor the estimate to the user’s financial situation.

– Mortgage Period: Options for different loan terms (e.g., 15 or 30 years) are crucial for calculating monthly payments and long-term costs.

– Property Taxes and Insurance: Calculators that allow users to input specific values for property taxes and homeowners insurance yield more accurate estimates.

– Additional Fees: Inclusion of optional inputs for HOA fees, PMI, and other relevant expenses enhances the calculator’s utility.

Cost (Free vs. Paid)

We prioritized tools that are available for free, as many users seek accessible resources without hidden fees. While some calculators may offer advanced features for a fee, we ensured that the primary functionalities necessary for estimating closing costs are available at no cost. This approach allows users to make informed financial decisions without incurring additional expenses upfront.

Customer Support and Resources

Lastly, we considered the availability of support and additional resources. Tools that offer educational materials, FAQs, or customer service options were rated higher, as they empower users to understand the closing cost process better. This support can be invaluable, particularly for first-time homebuyers who may have numerous questions about the closing process and associated costs.

By applying these criteria, we were able to curate a list of the best closing cost calculators for Florida, ensuring that users can find the tool that best meets their needs.

The Best Closing Cost Calculator Floridas of 2025

1. Florida Mortgage Closing Cost Calculator

The Florida Mortgage Closing Cost Calculator by RK Mortgage Group is a user-friendly tool designed to help homeowners estimate their closing expenses when securing a mortgage. This free calculator takes into account essential factors such as taxes, insurance, and private mortgage insurance (PMI), providing a comprehensive overview of potential costs. Its straightforward interface allows users to quickly assess their financial obligations, making it a valuable resource for prospective homebuyers in Florida.

- Website: rkmortgagegroup.com

- Established: Approx. 12 years (domain registered in 2013)

2. Closing Costs Calculator

The Closing Costs Calculator by Fannie Mae is a valuable tool designed to help homebuyers estimate and budget for their closing costs. Utilizing local data, it provides users with price ranges for common fees associated with the home-buying process. This calculator encourages users to shop around for the best terms, empowering them to make informed financial decisions and ultimately save money on their closing expenses.

- Website: yourhome.fanniemae.com

- Established: Approx. 30 years (domain registered in 1995)

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most critical steps in using a closing cost calculator is to ensure that all the information you input is accurate. Mistakes in data entry can lead to significant discrepancies in the results. Take a moment to review the following key inputs:

- Home Price: Ensure you have the correct sale price of the property.

- Down Payment: Enter the exact amount or percentage you plan to put down.

- Interest Rate: Use the most current interest rate from your lender or financial institution.

- Property Taxes and Insurance: If you have specific figures, input them instead of relying on averages, as these can vary greatly based on location.

By carefully reviewing each entry, you can avoid common pitfalls that lead to inaccurate estimates.

Understand the Underlying Assumptions

Every closing cost calculator operates on specific assumptions that can affect the accuracy of your results. Familiarize yourself with these factors:

- Calculation Methodology: Understand how the calculator derives its estimates. Some calculators might use state averages, while others may rely on national data.

- Fee Components: Closing costs can include various fees such as appraisal fees, title insurance, and escrow fees. Know which fees are included in the estimate and whether they match your situation.

- Loan Type: Different loan types (e.g., FHA, VA, conventional) may have different associated costs. Ensure that the calculator reflects your specific loan type to get a more accurate estimate.

By grasping these assumptions, you can better interpret the results and make informed decisions.

Use Multiple Tools for Comparison

To enhance the accuracy of your closing cost estimates, consider using several calculators. Different tools may yield varying results based on their underlying data and assumptions. By comparing estimates from multiple sources, you can identify discrepancies and arrive at a more reliable figure. Additionally, look for calculators that allow you to customize inputs based on your financial situation, as this can provide a more tailored estimate.

Consult with a Professional

While online calculators are valuable for quick estimates, they should not replace professional advice. Once you have a rough estimate of your closing costs, consult with a mortgage professional or real estate agent. They can provide insights into local market conditions, potential hidden fees, and personalized advice tailored to your specific circumstances. This collaboration can help you navigate the complexities of closing costs more effectively.

Keep an Eye on Additional Costs

Finally, remember that closing costs are just one part of the home-buying process. Be aware of additional costs such as moving expenses, home inspections, and ongoing maintenance. By considering the full scope of financial obligations, you can better prepare for homeownership and avoid unexpected financial strain.

By following these tips, you can maximize the accuracy of your results and make informed decisions as you navigate the home-buying process in Florida.

Frequently Asked Questions (FAQs)

1. What is a closing cost calculator for Florida?

A closing cost calculator for Florida is an online tool that helps homebuyers estimate the various fees and expenses associated with closing on a property. It typically requires inputs such as the home’s purchase price, down payment, mortgage terms, interest rate, and other relevant financial details. The calculator then provides an estimate of the total closing costs, which can include fees for underwriting, appraisal, title insurance, taxes, and more.

2. How do I use a closing cost calculator for Florida?

Using a closing cost calculator is straightforward. You generally need to enter specific information about your home purchase, including:

– Home Price: The total sale price of the property.

– Down Payment: The initial amount you plan to pay upfront.

– Interest Rate: The mortgage interest rate you expect to secure.

– Mortgage Term: The duration of the loan (usually 15 or 30 years).

– Property Taxes and Insurance: You can input these values or use the calculator’s averages for a more general estimate. After entering this information, the calculator will generate an estimate of your closing costs.

3. What factors influence closing costs in Florida?

Closing costs in Florida can be influenced by several factors, including:

– Property Location: Different counties may have varying fees and taxes.

– Loan Type: Conventional, FHA, VA, or other loan types can have different requirements and costs.

– Down Payment Amount: Higher down payments may reduce certain fees, like private mortgage insurance (PMI).

– Negotiated Fees: Some fees may be negotiable between buyers and sellers or lenders, impacting the total costs.

– Local Regulations: State-specific laws and regulations can also affect closing costs.

4. Are the estimates from a closing cost calculator accurate?

While closing cost calculators provide a good estimate, they should be viewed as a starting point rather than an exact figure. Actual closing costs can vary based on several factors, including specific lender fees, the final loan amount, and any additional costs that may arise during the closing process. It’s recommended to consult with your lender or real estate agent for a more precise breakdown of expected costs.

5. Can I find a closing cost calculator specifically for my county in Florida?

Yes, many closing cost calculators are designed to provide estimates based on specific counties in Florida. Some calculators allow you to select your county or input local tax rates and fees for a more tailored estimate. This feature can help you get a clearer understanding of the unique costs associated with your local real estate market.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.