Best Closing Cost Calculator For Seller: Top 5 Tools Compared

Finding the Best Closing Cost Calculator For Seller: An Introduction

When it comes to selling a home, understanding the financial implications can be daunting. One of the most significant aspects of this process is estimating the closing costs associated with the sale. Many sellers find themselves overwhelmed by the various fees, commissions, and taxes that can significantly impact their net proceeds. With numerous calculators available online, finding a reliable and effective closing cost calculator tailored for sellers can be quite a challenge.

This article aims to simplify that task by reviewing and ranking the best closing cost calculators for sellers. By providing an in-depth analysis of the top tools available online, we hope to save you time and help you make informed decisions about your home sale. Each calculator will be assessed based on several key criteria, including accuracy, ease of use, and features.

Accuracy is crucial when estimating closing costs, as even minor discrepancies can lead to substantial financial surprises at closing. Ease of use ensures that sellers can quickly navigate the calculators without unnecessary complications. Additionally, we will look at the features offered by each tool, such as the ability to account for specific local fees, the option to save and share results, and whether the calculator includes advanced options for more detailed estimates.

By the end of this review, you will have a clear understanding of the best closing cost calculators for sellers, allowing you to proceed with confidence in your home-selling journey.

Our Criteria: How We Selected the Top Tools

How We Selected the Top Closing Cost Calculators for Sellers

When evaluating the best closing cost calculators for sellers, we adhered to a set of criteria designed to ensure that the tools we recommend are not only effective but also user-friendly. Below are the key factors we considered during our selection process:

-

Accuracy and Reliability

– The calculators must provide accurate estimates of closing costs based on current market data and typical fees associated with selling a home. We looked for tools that reference up-to-date information and offer transparency regarding how calculations are made. -

Ease of Use

– A user-friendly interface is crucial for any online tool. The calculators we selected allow users to input their data with minimal hassle, featuring intuitive layouts and clear instructions. We prioritized tools that are accessible to individuals without a financial background, ensuring that the process of calculating closing costs is straightforward. -

Key Features

– We assessed the range of inputs that the calculators allow. Essential fields include:- Sales Price: The expected selling price of the home.

- Outstanding Mortgage Balance: Current mortgage debt that needs to be settled upon sale.

- Closing Date: The projected date for the transaction, which can affect certain fees.

- Local Taxes and Fees: Options to input specific local taxes and potential fees, as these can vary significantly by region.

- Additional Costs: The ability to include other relevant costs such as real estate agent commissions, repairs, and staging costs.

-

Cost (Free vs. Paid)

– We examined whether the calculators are free to use or require a subscription or one-time payment. Preference was given to free tools that offer comprehensive features without hidden costs. However, if a paid tool provides significant additional benefits or features, we considered those as well. -

Mobile Compatibility

– With the increasing use of smartphones and tablets, we evaluated whether the calculators are optimized for mobile devices. This ensures that users can access and utilize the tools on-the-go, making it more convenient for those who may be juggling multiple tasks during the selling process.

-

Customer Support and Resources

– We looked for calculators that provide access to additional resources, such as FAQs, customer support, or educational content. This support can be invaluable for users seeking to understand the various aspects of closing costs and the selling process. -

User Reviews and Reputation

– Finally, we considered user feedback and the overall reputation of each tool. Tools with positive reviews and a strong user base were prioritized, as this reflects their effectiveness and reliability in real-world applications.

By adhering to these criteria, we aimed to identify the top closing cost calculators for sellers that offer the best combination of accuracy, usability, and valuable features.

The Best Closing Cost Calculator For Sellers of 2025

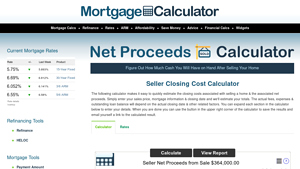

1. Calculate Your Net Closing Costs on Real Estate Sales

The “Calculate Your Net Closing Costs on Real Estate Sales” tool from MortgageCalculator.org is designed to help homeowners quickly estimate the closing costs incurred when selling a property. This user-friendly calculator not only provides an overview of potential expenses but also calculates the net proceeds from the sale, enabling users to make informed financial decisions during the selling process.

- Website: mortgagecalculator.org

- Established: Approx. 21 years (domain registered in 2004)

3. Seller Closing Costs Calculator

The Seller Closing Costs Calculator from Clever Real Estate is a valuable tool designed to help homeowners estimate the expenses associated with selling their property in the United States. By providing a detailed breakdown of potential costs, this calculator enables sellers to plan their finances more effectively, ensuring they are well-informed about the financial implications of their home sale. Its user-friendly interface simplifies the process, making it accessible for all sellers.

- Website: listwithclever.com

- Established: Approx. 8 years (domain registered in 2017)

5. Closing Costs Calculator

The Closing Costs Calculator from Fannie Mae is a valuable tool designed to help homebuyers estimate their closing expenses using localized data. By providing price ranges for common fees, it empowers users to budget effectively and encourages them to compare different offers to secure the best terms. This calculator simplifies the often complex process of understanding closing costs, making it easier for potential homeowners to plan their finances.

- Website: yourhome.fanniemae.com

- Established: Approx. 30 years (domain registered in 1995)

How to Get the Most Accurate Results

Double-Check Your Inputs

When using a closing cost calculator for sellers, accuracy is paramount. Begin by carefully entering all relevant information, including the sale price of your home, your current mortgage balance, and any other costs associated with the sale. A simple typo can lead to significant discrepancies in the estimated closing costs. After entering your data, take a moment to review it. Ensure that all figures are correct and that you’ve included all pertinent details, such as property taxes and agent commissions. By double-checking your inputs, you can avoid unnecessary confusion and receive a more precise estimate.

Understand the Underlying Assumptions

Each closing cost calculator operates based on specific assumptions about fees and expenses. For instance, some calculators might not account for local taxes or specific lender fees, while others may use average rates that do not reflect your unique situation. Familiarize yourself with the calculator’s methodology by reading any available documentation or FAQs. This understanding will help you interpret the results more accurately and identify any potential gaps in the calculations. If the tool provides a breakdown of the costs, review each component to see if it aligns with your expectations or experiences.

Use Multiple Tools for Comparison

To gain a more comprehensive view of your closing costs, consider using multiple calculators. Different tools may yield varying results due to their underlying assumptions and algorithms. By comparing estimates from several sources, you can identify a range of potential costs and make more informed decisions. Look for calculators that offer detailed breakdowns of fees, as this can help you understand where discrepancies arise. Additionally, using multiple tools allows you to cross-reference your findings and ensure that you’re not overlooking any essential expenses.

Stay Updated on Local Market Conditions

Closing costs can vary significantly based on location and current market conditions. Research local real estate trends, such as average closing costs in your area, to contextualize the results from your calculator. Knowing the typical range of costs for your location will help you gauge whether the estimates are reasonable. Additionally, consult with local real estate agents or professionals who can provide insights into recent changes in fees or regulations that may affect your closing costs.

Seek Professional Advice

While online calculators are valuable tools, they cannot replace the expertise of real estate professionals. If you’re uncertain about any figures or need clarification on specific costs, consider consulting a real estate agent or a financial advisor. They can provide personalized guidance and help you understand the nuances of your specific situation, ensuring that you are well-prepared for the closing process. By combining the insights from calculators with professional advice, you can achieve a more accurate understanding of your closing costs and net proceeds from the sale.

Frequently Asked Questions (FAQs)

1. What is a closing cost calculator for sellers?

A closing cost calculator for sellers is an online tool designed to help homeowners estimate the costs they will incur when selling their property. This calculator typically requires inputs such as the sales price of the home, outstanding mortgage balance, and potential closing date. Based on this information, it provides an estimate of net proceeds after deducting various closing costs, such as agent commissions, title fees, and other related expenses.

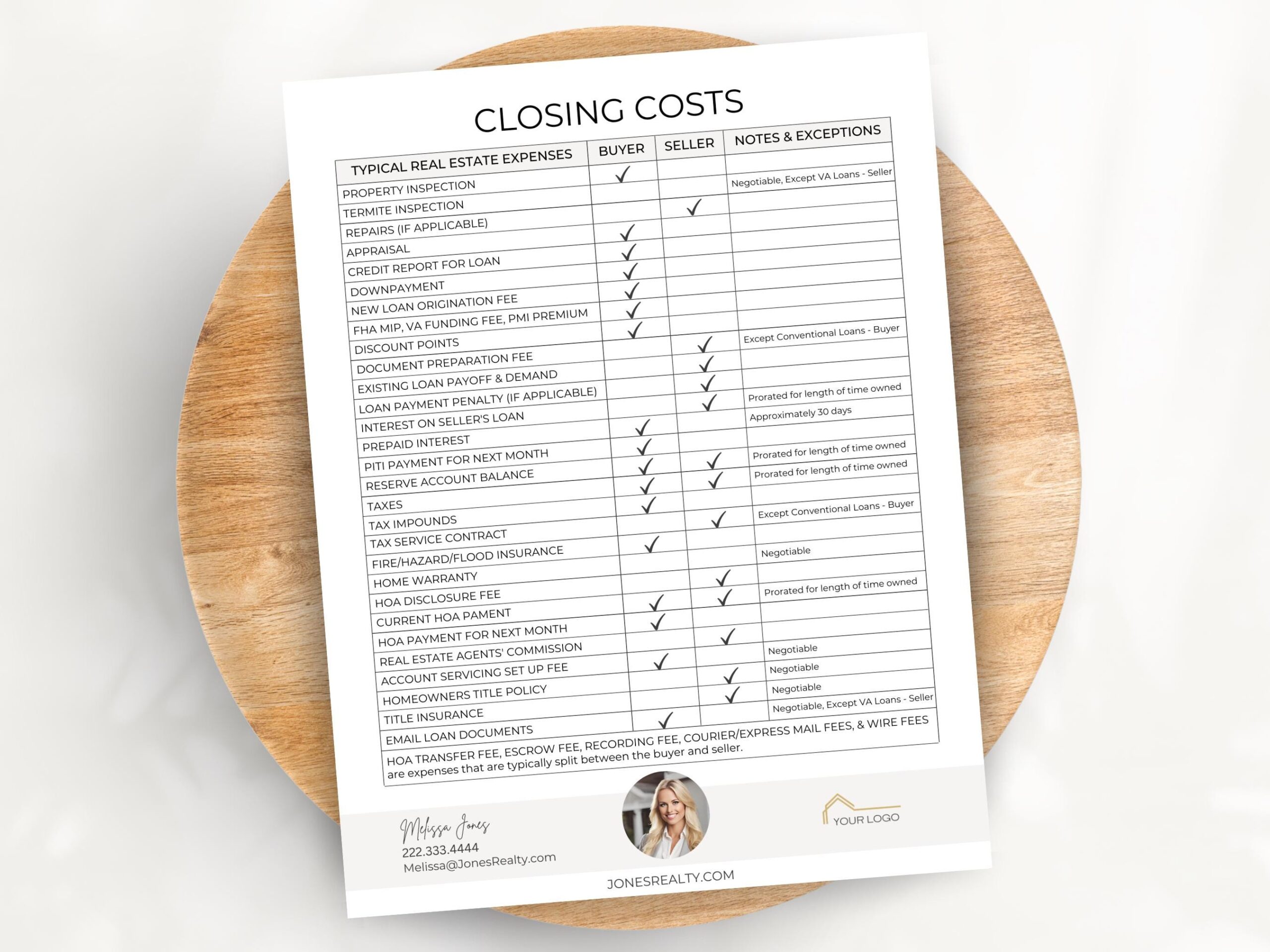

2. What types of closing costs can I expect when selling my home?

When selling a home, you may encounter several closing costs, including but not limited to:

– Real Estate Agent Commissions: Typically around 5% to 6% of the sale price.

– Title Insurance: Protects against claims on the property title.

– Transfer Taxes: Fees imposed by the state or local government when property ownership changes.

– Recording Fees: Charges for recording the sale with local authorities.

– Repairs or Concessions: Any agreed-upon repairs or concessions to the buyer.

– Outstanding Mortgage Balance: Any remaining mortgage balance that needs to be paid off at closing.

3. How accurate are the estimates provided by closing cost calculators?

While closing cost calculators can provide a good estimate of your potential expenses and net proceeds, the accuracy can vary. These tools rely on general assumptions and averages, so the actual costs may differ based on specific circumstances, local regulations, and negotiations with buyers or service providers. It’s advisable to consult with a real estate professional for more precise calculations tailored to your situation.

4. Can I save my calculations from the closing cost calculator?

Many closing cost calculators offer a feature that allows users to save their calculations. After entering the relevant details, you may find an option to email the results to yourself or generate a shareable link. This is useful for keeping track of different scenarios or discussing estimates with your real estate agent or financial advisor.

5. Is it necessary to use a closing cost calculator when selling my home?

While it is not mandatory to use a closing cost calculator, it is highly beneficial. Using this tool can help you understand your financial position before selling, prepare for potential expenses, and make informed decisions. Knowing your estimated net proceeds can also help you set realistic expectations for your sale price and subsequent home purchase.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.