Best Coastfire Calculator: Top 5 Tools Compared

Finding the Best Coastfire Calculator: An Introduction

Navigating the world of personal finance can be daunting, especially when it comes to planning for retirement. One of the more nuanced strategies gaining traction is Coast FIRE (Financial Independence, Retire Early), which allows individuals to stop making contributions to their retirement accounts while still ensuring they can retire comfortably. However, determining your Coast FIRE number—how much you need saved to retire without ongoing contributions—can be a complex calculation.

With numerous online tools available, finding a reliable Coast FIRE calculator can be overwhelming. Each calculator varies in functionality, accuracy, and user experience, making it challenging to identify the best option for your needs. This article aims to simplify that process by reviewing and ranking the top Coast FIRE calculators currently available online. By providing a comprehensive overview of each tool, we hope to save you time and effort in your quest for financial independence.

Criteria for Ranking

To determine the best Coast FIRE calculators, we evaluated each tool based on several key criteria:

- Accuracy: We assessed how well each calculator performs the necessary computations to arrive at a reliable Coast FIRE number.

- Ease of Use: The user interface and overall experience were considered to ensure that both beginners and seasoned investors can navigate the tools without frustration.

- Features: Additional functionalities, such as visualizations, customizable inputs, and detailed breakdowns of results, were taken into account to enhance the user experience.

By applying these criteria, we aim to present a well-rounded view of the most effective Coast FIRE calculators, helping you make informed decisions on your journey to financial independence.

Our Criteria: How We Selected the Top Tools

When selecting the best Coast FIRE calculators, we prioritized several key criteria to ensure that the tools we recommend are effective, user-friendly, and capable of providing accurate results. Here’s how we evaluated each calculator:

1. Accuracy and Reliability

The primary function of a Coast FIRE calculator is to provide precise calculations based on user inputs. We looked for tools that utilize well-established financial formulas and methodologies, ensuring that the results reflect realistic scenarios. This includes the ability to account for factors such as inflation, investment growth rates, and safe withdrawal rates, which are crucial for accurate retirement planning.

2. Ease of Use

A user-friendly interface is essential for any online tool, especially for those who may not be financially savvy. We assessed each calculator for its overall usability, including intuitive navigation, clear labeling of input fields, and straightforward instructions. A good calculator should allow users to quickly enter their information and receive results without confusion.

3. Key Features

We examined the specific inputs and features each calculator offers to determine its comprehensiveness. Important features for a Coast FIRE calculator include:

– Current Age and Retirement Age: Allows users to set the timeline for their financial planning.

– Annual Spending: Users should be able to estimate their expected expenses in retirement.

– Current Invested Assets: This input is vital for determining how much has already been saved.

– Monthly Contributions: Users can assess the impact of ongoing contributions on their financial independence.

– Investment Growth Rate: A realistic estimate of returns is crucial for long-term planning.

– Inflation Rate: To adjust future expenses and returns accordingly.

– Safe Withdrawal Rate: Users can understand how much they can withdraw from their savings without depleting their funds.

4. Cost (Free vs. Paid)

We considered the accessibility of each calculator, focusing on whether they are free to use or require a fee. While many effective calculators are available at no cost, we also noted any that offer premium features for a fee, ensuring users can make informed choices based on their needs and budget.

5. Visual Representation of Data

A good Coast FIRE calculator should not only provide numerical results but also visually represent the growth trajectory of investments over time. We prioritized tools that include graphs or charts to help users easily understand how their investments will grow and when they will reach their Coast FIRE milestone.

6. Additional Resources and Guidance

Finally, we looked for calculators that offer supplementary information, such as articles, guides, or FAQs that explain Coast FIRE concepts. This additional educational content helps users grasp the intricacies of financial independence planning and enhances their overall experience with the tool.

By applying these criteria, we aimed to present a curated list of the best Coast FIRE calculators that cater to a range of user needs, whether they are just starting their financial journey or are well on their way to achieving financial independence.

The Best Coastfire Calculators of 2025

1. Coast FIRE Calculator – Coasting to FI

The Coast FIRE Calculator from WalletBurst is an interactive tool designed to help users visualize and calculate the growth of their current investments on the path to financial independence. By inputting various parameters, users can effectively plan their financial journey, understanding how their investments can accumulate over time without the need for additional contributions. This user-friendly calculator simplifies the Coasting to Financial Independence strategy, making it accessible for anyone looking to achieve their financial goals.

- Website: walletburst.com

- Established: Approx. 7 years (domain registered in 2018)

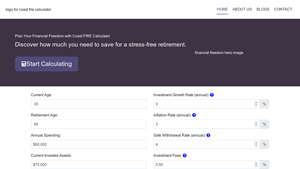

2. Coast FIRE Calculator

The Coast FIRE Calculator is a free online tool designed to assist users in planning their path to financial independence with a balanced retirement strategy. By leveraging its user-friendly interface, individuals can effectively evaluate their savings needs and investment strategies, allowing them to determine how much they need to save and invest to reach their financial goals without the pressure of aggressive saving.

- Website: coastfirecalc.com

- Established: Approx. 1 years (domain registered in 2024)

3. Need a Good Calculator : r/coastFIRE

The FundsForge wealth planning tool, highlighted in the r/coastFIRE Reddit discussion, is designed to assist users in effectively managing their finances and planning for early retirement. Its coast FIRE calculator specifically addresses various financial scenarios, making it a valuable resource for those aiming to achieve financial independence. With its comprehensive features, FundsForge stands out as a versatile tool for both detailed wealth planning and specific retirement calculations.

- Website: reddit.com

- Established: Approx. 20 years (domain registered in 2005)

4. Coast FIRE Calculator

The Coast FIRE Calculator from Marriage Kids and Money is a valuable tool designed to help individuals assess their progress toward achieving Coast Financial Independence, Retire Early (FIRE). This free online calculator allows users to evaluate their current savings and investment strategies, providing insights on how to secure a comfortable future without the need for aggressive saving. By using this tool, users can effectively plan their financial journey and work towards their ideal lifestyle.

- Website: marriagekidsandmoney.com

- Established: Approx. 9 years (domain registered in 2016)

5. Coast FIRE Calculator

The Coast FIRE Calculator by Clark Howard is a user-friendly tool designed to help individuals determine when they can achieve financial independence and “coast” into retirement. By inputting essential financial details, users can easily assess their savings trajectory and identify the point at which their investments will sustain them without additional contributions. This calculator is particularly beneficial for those looking to plan their retirement strategy effectively.

- Website: clark.com

- Established: Approx. 33 years (domain registered in 1992)

How to Get the Most Accurate Results

Double-Check Your Inputs

Accuracy in your calculations starts with the information you provide. Before hitting the calculate button, take a moment to review all your inputs. Ensure that your current age, desired retirement age, annual spending, and invested assets are all entered correctly. Even a small error, such as a misplaced decimal or an incorrect age, can lead to significantly different results. It’s advisable to keep a consistent format for numerical entries, especially with currency and percentages.

Understand the Underlying Assumptions

Each Coast FIRE calculator operates based on specific assumptions regarding investment returns, inflation rates, and safe withdrawal rates. Familiarize yourself with these assumptions, as they can greatly affect your results. For instance, if a calculator uses a default investment growth rate of 7% but you expect a different rate based on your investment strategy, adjust that figure accordingly. Understanding the rationale behind these assumptions can help you interpret your results more effectively and make informed adjustments.

Use Multiple Tools for Comparison

No single calculator can capture all variables relevant to your financial situation. To enhance accuracy and reliability, consider using multiple Coast FIRE calculators. By comparing results from different tools, you can identify discrepancies and better understand how varying inputs or assumptions can influence your Coast FIRE number. This cross-referencing can provide a more rounded perspective and help you pinpoint any potential errors in your calculations.

Keep Your Financial Goals in Mind

While calculators can provide valuable insights, they are just one piece of the puzzle. Always align your calculations with your broader financial goals and lifestyle aspirations. For instance, if the calculator suggests you can retire early based on your current savings, consider whether that aligns with your desired lifestyle. Are you prepared for potential healthcare costs? Will your planned retirement lifestyle be sustainable given your expected expenses?

Regularly Update Your Inputs

Your financial situation can change over time due to various factors such as salary increases, changes in expenses, or shifts in investment strategy. Regularly updating your inputs in the Coast FIRE calculator ensures that your projections remain relevant and accurate. Set a schedule—perhaps annually—to review your inputs and recalibrate your calculations based on your current financial landscape.

Seek Professional Advice

Lastly, while online calculators are helpful tools, they cannot replace personalized financial advice. If you have complex financial situations or uncertainties regarding your retirement strategy, consider consulting with a financial advisor. They can help you navigate the intricacies of Coast FIRE planning, ensuring that your calculations align with your overall financial strategy and personal goals.

By following these tips, you can maximize the effectiveness of Coast FIRE calculators and create a more accurate roadmap toward your financial independence.

Frequently Asked Questions (FAQs)

1. What is a Coast FIRE calculator and how does it work?

A Coast FIRE calculator is a financial tool designed to help individuals determine how much they need to have saved in order to “coast” to retirement without making further contributions to their retirement accounts. By inputting variables such as current age, retirement age, annual spending, current invested assets, and expected rates of return, the calculator estimates the amount required to reach financial independence by the desired retirement age. The calculator utilizes formulas that account for investment growth, inflation, and safe withdrawal rates, providing a visual representation of your financial journey.

2. Who should use a Coast FIRE calculator?

The Coast FIRE calculator is ideal for anyone considering early retirement or financial independence without the pressure of aggressive savings. It’s particularly useful for young professionals who have already begun investing early in their careers and want to assess whether their current savings will suffice for a comfortable retirement. Additionally, those looking to make career changes or reduce working hours while still feeling secure about their financial future may benefit from using this tool.

3. What key inputs do I need to provide for accurate calculations?

To get the most accurate results from a Coast FIRE calculator, you typically need to provide the following inputs:

– Current Age: Your present age.

– Retirement Age: The age at which you plan to retire.

– Annual Spending: Your expected yearly expenses during retirement.

– Current Invested Assets: Total amount of investments you currently have (excluding primary residence).

– Monthly Contributions: Any planned monthly contributions to your retirement savings (set to 0 if checking if you’ve reached Coast FIRE).

– Investment Growth Rate: The expected annual return rate of your investments.

– Inflation Rate: The anticipated annual rate of inflation.

– Safe Withdrawal Rate: The percentage of your savings you plan to withdraw annually during retirement.

4. How does a Coast FIRE calculator differ from traditional retirement calculators?

Unlike traditional retirement calculators that often require ongoing contributions and high savings rates, a Coast FIRE calculator focuses on the amount already saved and invested. It allows users to see if their current investments can grow enough to support their retirement goals without needing to continue saving aggressively. This approach offers more flexibility, enabling users to shift their focus from intense saving strategies to enjoying their current lifestyle while letting their investments grow through compound interest.

5. What are the potential limitations of using a Coast FIRE calculator?

While Coast FIRE calculators are valuable tools, they have limitations. They rely heavily on assumptions regarding future investment returns, inflation rates, and personal spending needs, which can change over time. Economic downturns or unexpected life events may affect your savings trajectory, making it essential to regularly reassess your financial plan. Additionally, the calculators typically do not account for potential taxes or changes in lifestyle, which could impact your overall retirement needs. Therefore, it’s advisable to use these calculators as a starting point and consult with a financial advisor for a more tailored approach.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.