Best Cobra Cost Calculator: Top 5 Tools Compared

Finding the Best Cobra Cost Calculator: An Introduction

Finding the right COBRA cost calculator can be a daunting task, especially when faced with the complexities surrounding healthcare coverage and the associated costs. With the rising expenses of health insurance and the full financial responsibility that comes with COBRA, individuals often find themselves overwhelmed when trying to estimate their premiums accurately. Many calculators available online vary significantly in terms of reliability, usability, and the information they provide, making it crucial to identify which tools are truly effective.

This article aims to review and rank the top COBRA cost calculators available online, helping you save time and effort in your search for an accurate estimation of your COBRA premiums. By consolidating the best options in one place, we hope to simplify your decision-making process and empower you with the right information to navigate your healthcare needs confidently.

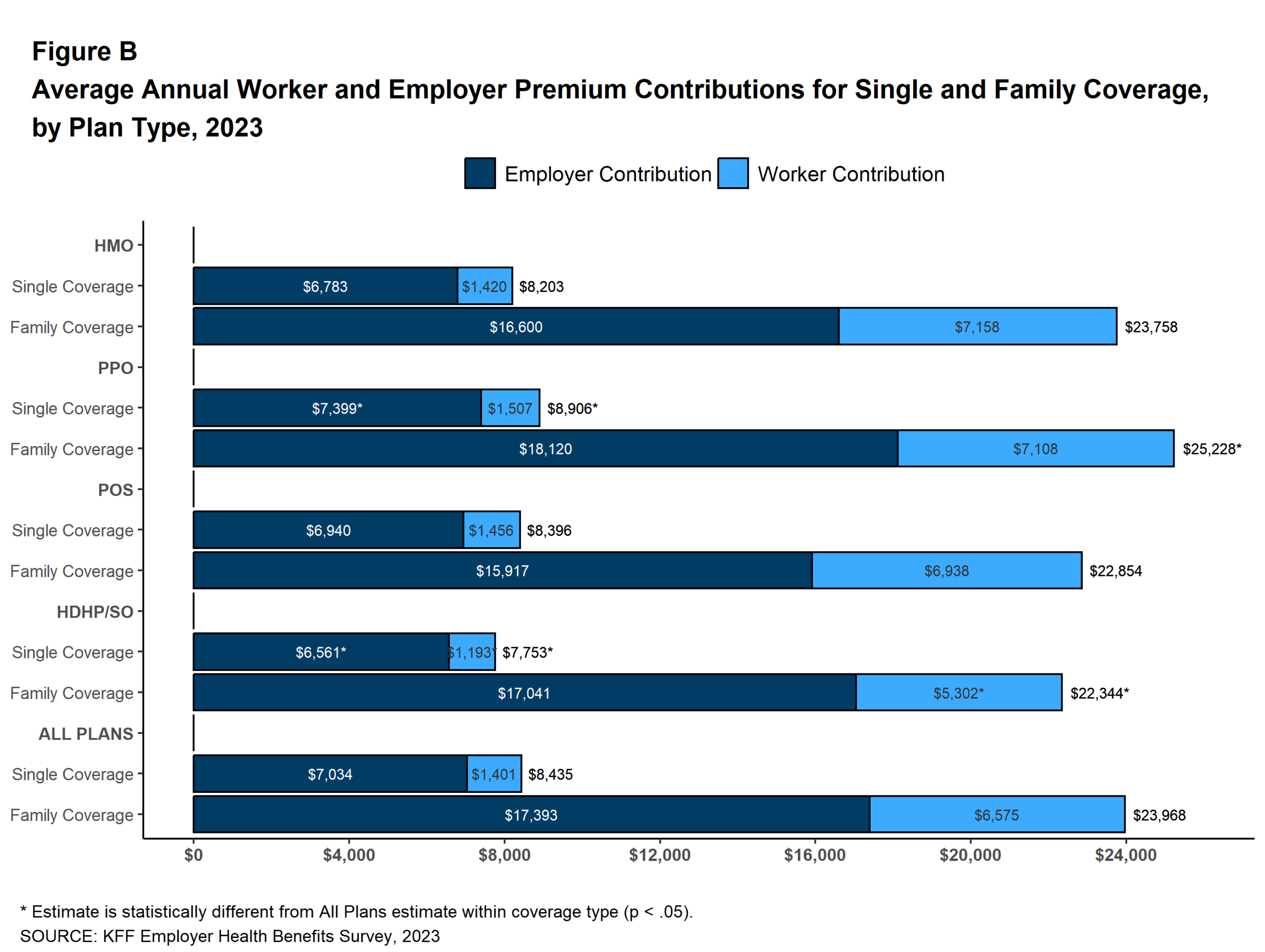

In evaluating these calculators, we considered several key criteria. Accuracy is paramount; we assessed how closely the calculators align with actual COBRA premium calculations, which include not just the individual’s previous contributions but also the employer’s share and any applicable administrative fees. Ease of use is another critical factor; we examined the user interface and overall accessibility of each tool, ensuring that even those with minimal technical skills can navigate them effortlessly. Finally, we looked at features offered by each calculator, such as the ability to input various data points and receive customized estimates, which can enhance the overall user experience.

Join us as we dive into the top COBRA cost calculators, providing you with the insights you need to make informed decisions about your health insurance coverage.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting the Best COBRA Cost Calculators

When it comes to estimating the costs associated with COBRA insurance, using the right calculator can significantly impact the accuracy of your financial planning. We evaluated several COBRA cost calculators based on the following key criteria:

-

Accuracy and Reliability

– Data Validation: The calculators must use reliable data sources to ensure that the estimated premiums reflect current market conditions and regulations.

– Consistency with Regulations: Tools should adhere to the guidelines set forth by the Consolidated Omnibus Budget Reconciliation Act (COBRA), ensuring that they incorporate all relevant fees, such as the allowable 2% administrative fee. -

Ease of Use

– User-Friendly Interface: The best calculators feature intuitive designs that guide users through the estimation process without overwhelming them with technical jargon.

– Clear Instructions: Tools should provide clear, step-by-step instructions for inputting necessary data, making it accessible for individuals who may not have extensive financial knowledge. -

Key Features

– Customizable Inputs: The calculators should allow users to input specific data points, such as:- Previous monthly insurance contribution (the amount deducted from the paycheck).

- Employer’s contribution to the health plan.

- Any applicable administrative fees.

- Output Details: Ideally, the calculator should break down the total estimated COBRA premium, highlighting the individual contributions and administrative fees separately. This transparency aids users in understanding their costs.

-

Cost (Free vs. Paid)

– Accessibility: We prioritized tools that offer free estimates, as they provide valuable information without financial commitment. However, if a paid tool offers significantly enhanced features, it was also considered.

– Value for Money: For paid calculators, we assessed whether the additional features justified the cost. This includes premium support or more detailed breakdowns of costs.

-

Additional Resources

– Educational Content: Tools that provide supplemental information, such as articles or FAQs about COBRA and alternatives, are more valuable. This content helps users make informed decisions about their healthcare coverage.

– Support Options: Availability of customer support, whether through chat, email, or phone, enhances the user experience by providing assistance when needed. -

Reviews and User Feedback

– Community Insights: We considered user reviews and feedback to gauge overall satisfaction with the calculators. High ratings and positive testimonials indicate reliability and user-friendly experiences.

By applying these criteria, we aimed to identify the best COBRA cost calculators that not only deliver accurate estimates but also enhance users’ understanding of their healthcare coverage options. This comprehensive approach ensures that users can make informed decisions regarding their COBRA health insurance.

The Best Cobra Cost Calculators of 2025

4. How Much Is COBRA Insurance? Cost, Implications, Alternatives

The article from Verywell Health provides a comprehensive overview of COBRA insurance, focusing on its costs, implications, and alternatives. It features a practical tool for calculating total monthly premiums, including a 2% service charge on the base amount. By illustrating a sample calculation, the article helps users understand their potential financial obligations under COBRA, making it a valuable resource for individuals navigating health insurance options after job loss.

- Website: verywellhealth.com

- Established: Approx. 19 years (domain registered in 2006)

5. How much does COBRA insurance cost?

The “How much does COBRA insurance cost?” tool on Insure.com provides users with a clear understanding of COBRA insurance expenses. It outlines that the cost generally amounts to 102% of the premium paid by the employer, encompassing both the employee’s and employer’s contributions, plus an additional 2% administrative fee. This resource is valuable for individuals navigating their health insurance options after leaving a job, offering transparency in potential costs.

- Website: insure.com

- Established: Approx. 31 years (domain registered in 1994)

How to Get the Most Accurate Results

Double-Check Your Inputs

When using a COBRA cost calculator, accuracy in your inputs is crucial for obtaining reliable estimates. Start by gathering all relevant documentation, such as your most recent W-2 form. Pay special attention to Box 12, Code DD, which shows the total annual cost of your employer-sponsored health coverage. This figure should include both your contributions and your employer’s contributions. Ensure that you accurately input this amount, as any errors will directly affect your estimated monthly premium. Additionally, if your employer charges an administrative fee (up to 2%), be sure to include this in your calculations.

Understand the Underlying Assumptions

Each calculator may operate on slightly different assumptions about health plan costs and contributions. For instance, some calculators might assume that the cost structure remains constant after you leave your job, which may not always be the case. Familiarize yourself with the methodology behind the calculator you’re using. This understanding can help you interpret the results more effectively and recognize any limitations in the estimate provided.

Use Multiple Tools for Comparison

To ensure you are getting the most accurate estimate, consider using multiple COBRA cost calculators. Different tools may utilize varying algorithms or data sources, which can lead to discrepancies in the estimated costs. By comparing results from different calculators, you can identify a range of potential costs and make a more informed decision about your COBRA options. This approach not only helps in cross-verifying estimates but also provides a broader perspective on your possible financial obligations.

Consult with Your COBRA Plan Administrator

While online calculators can give you a solid estimate, they cannot replace the guidance of a COBRA plan administrator. For the most accurate and personalized information, reach out directly to your plan administrator. They can provide specific details about your COBRA coverage options, including any unique fees or variations in costs that may apply to your situation. This step is especially important if you have any uncertainties about the inputs or assumptions used in the calculators.

Keep Up-to-Date with Policy Changes

COBRA regulations and health insurance costs can change frequently. Stay informed about any updates related to your employer’s health plan or federal regulations regarding COBRA coverage. Regularly checking for new information will ensure that your estimates remain relevant and accurate. Additionally, understanding your rights and responsibilities under COBRA can empower you to make better choices regarding your health coverage.

By following these tips, you can maximize the effectiveness of COBRA cost calculators and gain a clearer understanding of your potential health insurance expenses.

Frequently Asked Questions (FAQs)

1. What is a COBRA cost calculator?

A COBRA cost calculator is an online tool designed to help individuals estimate their monthly COBRA insurance premiums. It typically requires information such as the employee’s previous health insurance contributions, the employer’s contributions, and any applicable administrative fees. By inputting this data, users can get a clearer picture of what their COBRA coverage will cost.

2. How do I use a COBRA cost calculator?

To use a COBRA cost calculator, you usually need to provide details such as your previous monthly insurance deduction and your employer’s contribution to your health plan. Some calculators may also ask for your W-2 form information, specifically Box 12, Code DD, which reflects the total annual cost of your employer-sponsored health coverage. After entering this information, the calculator will provide an estimated monthly premium, including any potential administrative fees.

3. What information do I need to calculate my COBRA costs accurately?

To accurately estimate your COBRA costs, you will need:

– The amount previously deducted from your paycheck for health insurance.

– The employer’s contribution to your health insurance premium.

– Information from your W-2 form, particularly Box 12, Code DD, which indicates the total annual cost of your health coverage.

– Knowledge of any administrative fees that may apply, typically up to 2% of the total premium.

4. Why might my COBRA premium be higher than my previous insurance costs?

Your COBRA premium may be higher than what you previously paid for insurance because under COBRA, you are responsible for the entire premium amount, which includes both your previous contribution and your employer’s share. Additionally, an administrative fee of up to 2% is added to the total, which can further increase the cost. This shift from shared payment to full payment by the individual often results in a significant increase in monthly expenses.

5. Can I get an exact quote for my COBRA premium using a calculator?

While a COBRA cost calculator can provide a good estimate of your monthly premium, it may not give you an exact quote. This is because actual COBRA premiums can vary based on specific plan details and administrative fees set by your employer. For the most accurate information, it is recommended to contact your COBRA plan administrator or refer to your COBRA enrollment paperwork.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.