Best Commercial Real Estate Calculator: Top 5 Tools Compared

Finding the Best Commercial Real Estate Calculator: An Introduction

Finding a reliable commercial real estate calculator can be a daunting task for anyone involved in property investment or financing. With numerous tools available online, it can be challenging to determine which calculators provide accurate results and useful features. Whether you’re a seasoned investor or a newcomer to commercial real estate, the right calculator can make a significant difference in your financial planning and decision-making.

This article aims to review and rank the top commercial real estate calculators currently available online, allowing you to save time and effort. We understand that each user’s needs may vary, so our goal is to provide an unbiased assessment of the tools that can best serve your objectives, whether that involves calculating mortgage payments, estimating property appreciation, or analyzing investment returns.

To ensure a comprehensive evaluation, we have established several criteria for our rankings. Accuracy is paramount; calculators must provide reliable and precise results based on the latest financial data and formulas. Additionally, ease of use is essential; the best tools should feature intuitive interfaces that allow users to input data effortlessly and interpret results quickly. Finally, we consider the range of features offered by each calculator, including options for different loan types, customizable settings, and the ability to generate detailed reports or amortization schedules.

By the end of this article, you will have a clear understanding of the best commercial real estate calculators available, enabling you to make informed decisions with confidence.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting the Best Commercial Real Estate Calculators

When evaluating the top online calculators for commercial real estate, we focused on several key criteria to ensure that users can find the most effective and user-friendly tools. Here are the primary factors we considered:

-

Accuracy and Reliability

– The calculators must provide precise calculations based on the data inputted by users. Accuracy is crucial in commercial real estate financing, as even minor miscalculations can lead to significant financial discrepancies. We reviewed user feedback and conducted tests to verify the reliability of the results. -

Ease of Use

– A user-friendly interface is essential for any online tool. We assessed the navigability of each calculator, ensuring that users can easily input their data and understand the results. A clear layout with intuitive controls enhances the overall user experience, making it accessible for both novices and seasoned investors. -

Key Features

– Comprehensive calculators should include specific inputs relevant to commercial real estate, such as:- Property price

- Down payment

- Loan amount

- Annual interest rate

- Amortization period

- Balloon payment options

- Additionally, features like the ability to generate a printable amortization schedule and calculate various payment types (e.g., principal and interest, interest-only) add significant value.

-

Cost (Free vs. Paid)

– We evaluated whether the calculators are free to use or require a subscription or one-time payment. Many users prefer no-cost options, so we prioritized those tools that provide essential functionalities without a fee, while also noting any premium features available for paid services. -

Additional Resources and Support

– Good calculators often come with supplementary resources, such as guides or FAQs, that help users understand commercial real estate financing better. We looked for tools that offer educational content, calculators for different scenarios (e.g., refinancing, rent vs. buy), and customer support to assist users with any queries. -

Compatibility and Accessibility

– The calculators should be accessible on various devices, including desktops, tablets, and smartphones. We checked for mobile compatibility, ensuring that users can perform calculations on the go without sacrificing functionality. -

User Reviews and Reputation

– We considered user reviews and ratings to gauge the overall satisfaction with each tool. Feedback from real users provides valuable insights into the effectiveness and practicality of the calculators.

By applying these criteria, we have compiled a list of the most effective and reliable commercial real estate calculators available online, ensuring that users can make informed financial decisions with confidence.

The Best Commercial Real Estate Calculators of 2025

1. Commercial Mortgage Calculator

The Commercial Mortgage Calculator from mortgagecalculator.org is designed to help users calculate payments for commercial properties. It offers versatility by providing options for Principal and Interest (P&I), Interest-Only, and Balloon repayment structures. Users can easily determine their monthly payment amounts, making it a valuable tool for investors and property owners looking to assess financing options for commercial real estate.

- Website: mortgagecalculator.org

- Established: Approx. 21 years (domain registered in 2004)

2. Commercial Mortgage Calculator

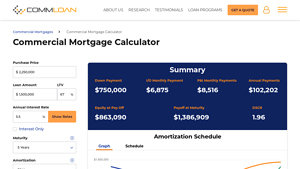

The Commercial Mortgage Calculator by CommLoan is a user-friendly, free tool designed to help users swiftly calculate the specifics of commercial real estate loans. With its straightforward interface, it allows users to input various parameters to obtain essential mortgage details, making it an efficient resource for property investors and real estate professionals looking to assess financing options for commercial properties.

- Website: commloan.com

- Established: Approx. 21 years (domain registered in 2004)

3. The Internet’s 9 Best Commercial Loan Calculators

In the review article, we explore the top commercial loan calculators tailored for small business owners, highlighting tools such as the SBA7a.loans Calculator and the Commercial Real Estate Loans’ Commercial Loan Calculator. These calculators are designed to simplify the loan assessment process, offering features like customizable loan terms, interest rate calculations, and amortization schedules, helping users make informed financial decisions for their businesses.

- Website: sba7a.loans

4. Commercial Mortgage Calculator with Latest Interest Rates

The Commercial Mortgage Calculator at commercialrealestate.loans is designed to help users accurately calculate their monthly loan payments and any potential balloon payments associated with commercial mortgages. By incorporating the latest interest rates, this tool provides a reliable and straightforward way for borrowers to assess their financing options, ensuring they can make informed decisions regarding their commercial real estate investments.

- Website: commercialrealestate.loans

5. Best Investment Calculator Ever? : r/realestateinvesting

PropertyCast.io, formerly known as BRRRRbot, has garnered significant praise in the real estate investing community for its robust investment analysis capabilities. This tool is designed to help users evaluate potential property investments, offering features such as cash flow analysis, ROI calculations, and the ability to model various financing scenarios. Its user-friendly interface and comprehensive data presentation make it a go-to resource for both novice and experienced investors looking to optimize their investment strategies.

- Website: reddit.com

- Established: Approx. 20 years (domain registered in 2005)

How to Get the Most Accurate Results

Double-Check Your Inputs

The accuracy of any commercial real estate calculator heavily relies on the data you input. Before hitting the calculate button, take a moment to review all your entries. Ensure that the property price, down payment, interest rate, and loan term are correct. Mistakes in these figures can lead to significant discrepancies in the results. For example, entering an incorrect interest rate or miscalculating the down payment can alter monthly payment estimates and the total cost of the loan. Always cross-reference your figures with reliable sources or documentation to ensure accuracy.

Understand the Underlying Assumptions

Each calculator comes with its own set of assumptions regarding loan terms, payment structures, and other financial variables. Familiarize yourself with these assumptions, as they can greatly influence the results. For instance, some calculators may assume a fixed interest rate, while others might factor in variable rates or include additional costs such as property taxes and insurance. Understanding these assumptions will help you interpret the results more accurately and allow you to adjust your expectations based on your specific financial situation.

Use Multiple Tools for Comparison

No single calculator can provide a complete picture of your financing options. To get a more comprehensive understanding of your potential costs, use multiple calculators from different sources. This will not only help you verify the accuracy of the results but also expose you to various calculation methodologies. Each tool may offer unique features, such as different payment structures (e.g., interest-only vs. amortizing payments), which can provide insights into how different scenarios affect your financial outcomes. By comparing results, you can better gauge the range of possible payments and costs associated with your commercial real estate investment.

Consider Additional Costs

When evaluating commercial real estate financing, it’s essential to account for costs beyond the mortgage payment. Many calculators focus solely on loan payments but may overlook other significant expenses such as property taxes, insurance, maintenance, and potential homeowners association (HOA) fees. Be sure to factor in these additional costs when assessing the total financial commitment. This holistic approach will give you a more accurate picture of your investment and help you plan your budget effectively.

Consult with Professionals

While online calculators are valuable tools, they should not replace professional financial advice. After obtaining estimates from calculators, consider discussing your findings with a financial advisor or a commercial mortgage broker. These professionals can provide insights tailored to your specific circumstances, help clarify any confusing aspects of the calculations, and offer advice on securing the best financing options available in the market. Their expertise can be invaluable in making informed decisions and optimizing your investment strategy.

Frequently Asked Questions (FAQs)

1. What is a commercial real estate calculator?

A commercial real estate calculator is an online tool designed to help users estimate various financial metrics related to commercial property investments. These calculators can compute mortgage payments, loan amounts, interest rates, amortization schedules, and potential returns on investment. They simplify complex calculations, allowing investors, property owners, and real estate professionals to make informed financial decisions.

2. How do I use a commercial real estate calculator?

Using a commercial real estate calculator typically involves entering specific details about the property and the financing terms. You may need to input the property price, down payment amount, interest rate, loan term, and any additional fees. Once you enter this information, the calculator will generate outputs such as monthly payments, total interest paid, and potential balloon payments. Most calculators are user-friendly and provide step-by-step guidance to help users navigate the input process.

3. What types of calculations can I perform with a commercial real estate calculator?

Commercial real estate calculators can perform various calculations, including:

– Mortgage Payment Calculation: Determines your monthly payments based on loan amount, interest rate, and loan term.

– Amortization Schedule Generation: Shows how much of each payment goes toward principal and interest over the life of the loan.

– Balloon Payment Calculation: Calculates the lump sum payment due at the end of a balloon loan term.

– Investment Analysis: Estimates potential returns, cash flow, and property appreciation based on input assumptions.

– Loan Comparison: Allows you to compare different loan scenarios or terms side by side.

4. Are commercial real estate calculators accurate?

The accuracy of commercial real estate calculators largely depends on the quality of the inputs provided. If you enter accurate and up-to-date information regarding interest rates, property values, and loan terms, the outputs will be reliable for estimating your financial obligations and potential returns. However, it is important to remember that these calculators provide estimates and should not replace professional financial advice. Factors such as market fluctuations and individual lender terms can affect actual outcomes.

5. Can I use a commercial real estate calculator for refinancing?

Yes, many commercial real estate calculators can assist with refinancing calculations. You can input your existing loan details along with potential new loan terms to see how refinancing might impact your monthly payments, total interest costs, and overall financial strategy. This can help you determine whether refinancing is a beneficial option based on current interest rates and your financial goals.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.