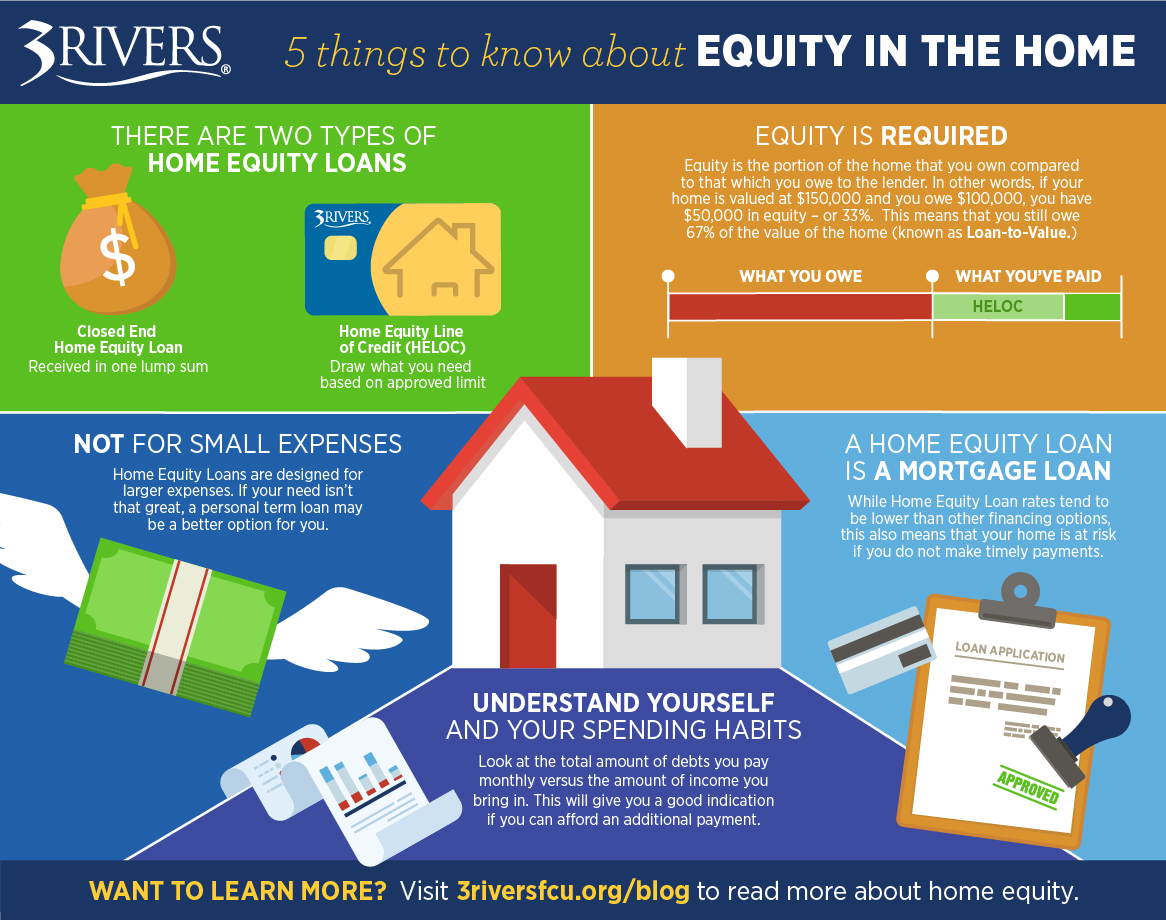

Best Equity Line Calculator: Top 5 Tools Compared

Finding the Best Equity Line Calculator: An Introduction

Finding a reliable equity line calculator can be a daunting task for many homeowners. With the growing popularity of home equity lines of credit (HELOCs), more individuals are looking to leverage the equity in their homes for various financial needs. However, the sheer number of online calculators available can make it challenging to determine which tools are trustworthy, user-friendly, and accurate. Many calculators promise quick estimates but may lack the necessary depth and functionality, leading to confusion or miscalculated figures.

The goal of this article is to streamline your search by reviewing and ranking the top equity line calculators available online. We aim to save you time and effort by providing comprehensive evaluations of these tools, allowing you to make informed decisions based on your specific financial situation.

Criteria for Ranking

In our analysis, we have established key criteria to ensure that the calculators we recommend meet high standards of quality. These criteria include:

-

Accuracy: We assess how reliably each calculator provides estimates based on user input, ensuring that the results reflect realistic scenarios.

-

Ease of Use: A user-friendly interface is crucial for a positive experience. We examine the design and navigation of each calculator to ensure it is intuitive and accessible to all users, regardless of their technical expertise.

-

Features: We consider the range of features offered by each calculator, such as the ability to factor in various loan terms, interest rates, and draw periods. Additional functionalities, like the option to save results or compare different scenarios, are also taken into account.

By focusing on these criteria, we hope to guide you to the most effective tools that will help you navigate your home equity options with confidence.

Our Criteria: How We Selected the Top Tools

Selection Criteria for Equity Line Calculators

When evaluating the best equity line calculators available online, we considered several key criteria to ensure that our recommendations meet the needs of a general audience. Below are the primary factors that guided our selection process:

-

Accuracy and Reliability

– The most critical aspect of any financial calculator is its accuracy. We assessed each tool’s ability to provide precise estimates based on the inputs provided. This included checking for up-to-date interest rates, accurate calculations of monthly payments, and reliable outputs based on varying loan amounts and terms. -

Ease of Use

– A user-friendly interface is essential for any online tool. We looked for calculators that are intuitive and easy to navigate, allowing users to input their information without confusion. Clear instructions and a straightforward layout contribute to a positive user experience, especially for those who may not be financially savvy. -

Key Features

– The functionality of the calculators was a significant consideration. We prioritized tools that offered a range of features, including:- Input Flexibility: The ability to enter various parameters such as estimated property value, outstanding mortgage balance, desired line of credit, and initial withdrawal amount.

- Output Clarity: Clear results displaying monthly payments, interest rates, and repayment terms, enabling users to make informed decisions.

- Additional Options: Features like fixed-rate options, variable interest rates, and the ability to simulate different scenarios to see how changes in inputs affect outcomes.

-

Cost (Free vs. Paid)

– We evaluated whether the calculators are free to use or require payment. Our focus was on free tools that provide comprehensive functionality without hidden fees. Many users prefer no-cost solutions, especially for preliminary calculations, so we made sure to include tools that offer valuable insights without financial commitment. -

Additional Resources and Support

– The availability of supplementary resources, such as FAQs, articles on home equity options, and customer support, was also a factor in our selection. Tools that offer educational content help users understand their options better and make more informed decisions. -

Reputation and User Feedback

– We considered the reputation of the platforms hosting these calculators. User reviews and testimonials can provide insight into the effectiveness and reliability of the tool. We prioritized calculators from established financial institutions or reputable mortgage and finance websites.

By applying these criteria, we aimed to curate a list of equity line calculators that are not only effective in providing estimates but also enhance the overall user experience, making it easier for individuals to navigate their home equity options.

The Best Equity Line Calculators of 2025

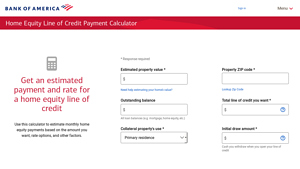

1. Home Equity Line of Credit Payment Calculator

The Home Equity Line of Credit Payment Calculator from Bank of America is a user-friendly tool designed to help homeowners estimate their monthly payments on a home equity line of credit. Users can input various parameters, including the desired loan amount and interest rate options, to receive tailored payment estimates. This calculator simplifies financial planning by allowing users to visualize potential costs associated with borrowing against their home equity.

- Website: bankofamerica.com

- Established: Approx. 27 years (domain registered in 1998)

2. HELOC Qualification Calculator

The HELOC Qualification Calculator from MortgageCalculator.org is designed to help users estimate the amount they may qualify for in a home equity line of credit (HELOC). By calculating based on a percentage of the home’s value, this tool offers a straightforward way to assess potential borrowing limits, making it an essential resource for homeowners considering leveraging their equity for financial needs.

- Website: mortgagecalculator.org

- Established: Approx. 21 years (domain registered in 2004)

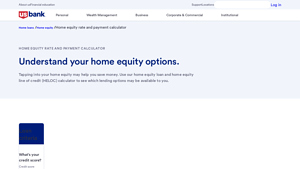

3. Home equity loan rates & HELOC calculator

The Home Equity Loan Rates & HELOC Calculator from U.S. Bank is a valuable tool designed to help users estimate payments for home equity loans and lines of credit. This calculator allows homeowners to input various loan amounts and terms, providing instant insights into potential rates and payments. With its user-friendly interface, it simplifies the decision-making process for those considering leveraging their home equity.

- Website: usbank.com

- Established: Approx. 30 years (domain registered in 1995)

5. Calculate a Home Equity Loan Payment

The Home Equity Loan Payment Calculator from Dollar Bank is a user-friendly tool designed to help homeowners estimate their monthly payments on home equity loans. It takes into account essential factors such as the loan amount, interest rate, loan term, and amortization schedule, enabling users to make informed financial decisions. This calculator is particularly useful for those considering leveraging their home equity for additional funds.

- Website: dollar.bank

- Established: Approx. 10 years (domain registered in 2015)

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most crucial steps in obtaining accurate results from an equity line calculator is to ensure that all your inputs are accurate. Take the time to carefully enter your home’s estimated value, outstanding mortgage balances, and the total line of credit you wish to obtain. Avoid rounding off numbers or using non-numeric characters, as these can lead to erroneous calculations. Consider gathering relevant documents, such as your mortgage statements and recent property appraisals, to provide precise figures. A small error in your inputs can significantly affect the results, potentially leading to unrealistic expectations regarding your borrowing capacity.

Understand the Underlying Assumptions

Every online calculator operates based on certain assumptions, which can vary from one tool to another. For example, some calculators might assume a fixed interest rate while others may use a variable rate based on current market conditions. It’s essential to read the fine print and understand these assumptions, as they can influence your estimated monthly payments and total interest costs. Familiarizing yourself with terms such as Loan-to-Value (LTV) ratio, draw period, and repayment period can also help you grasp how these factors affect your equity line calculations.

Use Multiple Tools for Comparison

Different calculators might yield varying results based on their algorithms and the parameters they use. To get a comprehensive view of your options, it is advisable to use multiple equity line calculators. This will not only provide you with a range of estimates but also give you insights into how different factors might influence your potential borrowing capacity. By comparing results from various tools, you can identify any discrepancies and gain a more nuanced understanding of what to expect.

Stay Updated on Market Rates

Interest rates can fluctuate, impacting the cost of borrowing. When using an equity line calculator, check to see if the tool offers current market rates or if it allows you to input your expected interest rate. Staying informed about prevailing interest rates and trends will help you make more accurate predictions about your potential payments. Many financial websites and banks publish daily or weekly updates on mortgage and home equity line rates, which can be useful when filling out your calculator.

Consider Future Changes

When estimating your equity line needs, think about potential changes in your financial situation or housing market. For instance, if you anticipate a rise in interest rates or a decrease in your home’s value, factor these possibilities into your calculations. Additionally, consider how your financial needs might evolve over time—will you need to access more funds for home improvements, education, or other expenses? Planning for the future can provide a more realistic picture of what an equity line can offer you.

By following these tips, you can maximize the accuracy and usefulness of the results generated by equity line calculators, ensuring that you make informed financial decisions.

Frequently Asked Questions (FAQs)

1. What is an equity line calculator and how does it work?

An equity line calculator is an online tool that helps homeowners estimate the amount they can borrow through a home equity line of credit (HELOC). It typically requires inputs such as the current value of the home, outstanding mortgage balances, and the desired line of credit amount. The calculator uses these details to provide estimates on potential monthly payments, interest rates, and borrowing limits based on the homeowner’s equity.

2. How accurate are the results from an equity line calculator?

While equity line calculators provide useful estimates, the results are not guaranteed and should be viewed as illustrative rather than definitive. Actual borrowing limits and terms may vary based on lender criteria, individual financial situations, and market conditions. It’s advisable to consult with a lending specialist for precise information tailored to your circumstances.

3. What factors should I consider when using an equity line calculator?

When using an equity line calculator, consider the following factors:

– Current Home Value: Input the most accurate estimate of your home’s market value.

– Outstanding Mortgages: Include all existing loans secured by your home.

– Desired Line of Credit Amount: Be realistic about how much you want to borrow based on your financial needs and equity.

– Interest Rates: Keep in mind that rates can fluctuate, affecting your monthly payments.

– Repayment Terms: Understand the difference between draw periods and repayment periods, as these will influence payment amounts.

4. Can I use an equity line calculator to compare different lenders?

Yes, you can use an equity line calculator to compare potential borrowing amounts and monthly payments across different lenders by adjusting the interest rates and terms based on the offers available. However, keep in mind that each lender may have unique criteria and fees, so it’s essential to gather detailed information from each lender before making a final decision.

5. Is there a cost associated with using an equity line calculator?

Most equity line calculators available online are free to use. However, while the calculator itself does not incur any costs, obtaining a HELOC may involve fees such as application fees, closing costs, and annual fees, depending on the lender. It’s important to review all associated costs when considering a home equity line of credit.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.