Best Estate Tax Calculator: Top 5 Tools Compared

Finding the Best Estate Tax Calculator: An Introduction

Finding the right estate tax calculator can be a daunting task for many individuals and families. With various tools available online, it’s essential to choose one that is not only accurate but also user-friendly and comprehensive. Estate taxes can be complex, and the implications of miscalculating can be significant. As such, relying on a trustworthy calculator is crucial for effectively estimating federal estate tax liabilities and planning accordingly.

This article aims to simplify the process by reviewing and ranking the best estate tax calculators currently available online. Our goal is to save you time and effort by providing a curated list of tools that meet high standards of reliability and functionality. Whether you are a novice looking to understand your estate’s potential tax obligations or someone with more experience seeking to optimize your calculations, this guide will help you identify the most suitable options.

Criteria for Ranking

To ensure a fair and thorough evaluation, we considered several key criteria in our rankings:

- Accuracy: Each calculator’s ability to deliver precise estimates based on the latest tax laws and exemptions.

- Ease of Use: User experience is critical; we assessed how intuitive the interfaces are and how straightforward the input processes are.

- Features: Additional functionalities, such as the ability to account for state-specific taxes, deductions, and various asset types, were also taken into account.

- Support and Resources: Availability of guides, FAQs, or customer support that can assist users in understanding their calculations.

By focusing on these criteria, we aim to present a balanced view that can help you navigate the complexities of estate tax planning with confidence.

Our Criteria: How We Selected the Top Tools

When selecting the best estate tax calculators, we considered several key criteria to ensure that the tools we recommend are both effective and user-friendly. Here are the primary factors that guided our evaluation process:

1. Accuracy and Reliability

The most critical aspect of any tax calculator is its ability to provide accurate estimates. We prioritized tools that are based on the latest tax laws and regulations. Calculators that incorporate current federal and state estate tax rates and exemptions were favored, as they can offer users reliable estimates of their potential tax liabilities.

2. Ease of Use

A user-friendly interface is essential for individuals who may not have extensive financial knowledge. We looked for calculators that feature intuitive designs, clear instructions, and straightforward input fields. Tools that allow users to easily navigate through the process without overwhelming jargon or complex terminology were given preference.

3. Key Features

Effective estate tax calculators should allow users to input a variety of asset types and liabilities to provide a comprehensive view of their estate’s value. We evaluated calculators based on the following specific inputs:

– Asset Types: Real estate, stocks, bonds, retirement accounts, cash, vehicles, and life insurance.

– Liabilities: Mortgages, loans, credit card debts, and funeral expenses.

– Deductions: Charitable contributions and any lifetime gifts made.

– Marital Status: Options for users to indicate if they are married, which can significantly affect tax calculations due to marital deductions.

4. Cost (Free vs. Paid)

The cost of using a calculator can influence accessibility for users. We considered both free and paid options, evaluating the functionality of free calculators against those requiring a fee. Tools that offer a robust set of features without charging were highlighted, while also noting the advantages of paid calculators that may provide more detailed analyses or additional resources.

5. Customer Support and Resources

We assessed the availability of customer support and educational resources accompanying the calculators. Tools that offer FAQs, guides, or direct assistance can enhance user experience, especially for those unfamiliar with estate tax concepts. Resources that explain how the calculator works or provide insights into estate planning were also valued.

6. User Reviews and Ratings

Finally, we considered feedback from actual users to gauge satisfaction levels with the calculators. Tools that received positive reviews for their accuracy, ease of use, and helpfulness in planning were prioritized in our recommendations. User testimonials can provide valuable insights into the real-world effectiveness of these tools.

By focusing on these criteria, we aimed to present a well-rounded selection of estate tax calculators that cater to a variety of needs and expertise levels, empowering users to navigate their estate planning with confidence.

The Best Estate Tax Calculators of 2025

1. Estate Tax Calculator

The Estate Tax Calculator from Calculator.net is a free tool designed to help users estimate the federal estate tax owed in the U.S. This user-friendly calculator not only provides quick estimates but also offers comprehensive information about estate tax regulations and the latest tax rates. It serves as a valuable resource for individuals seeking to understand their potential tax liabilities and stay informed about current estate tax laws.

- Website: calculator.net

- Established: Approx. 27 years (domain registered in 1998)

2. Estate Tax Planning Calculator

The Estate Tax Planning Calculator from Corebridge Financial is a valuable tool designed to help users estimate the future value of their estate and the corresponding estate tax liabilities over the next decade. By inputting various financial details, users can gain insights into potential tax implications, enabling more informed estate planning decisions. This calculator is particularly useful for individuals looking to optimize their estate strategy and minimize tax burdens.

- Website: corebridgefinancial.com

- Established: Approx. 5 years (domain registered in 2020)

3. Estate Tax Calculator

The Estate Tax Calculator from Jackson Hewitt is a user-friendly tool designed to provide quick and complimentary estimates of estate tax liabilities. It has been updated to reflect the changes introduced by the Tax Cuts and Jobs Act (TCJA), ensuring that users receive accurate and relevant calculations. This tool is ideal for individuals looking to understand their potential estate tax obligations efficiently.

- Website: jacksonhewitt.com

- Established: Approx. 28 years (domain registered in 1997)

4. Estate Tax Calculator

The Estate Tax Calculator by Merrill Edge is a valuable tool designed to assist users in understanding the implications of federal estate tax rates and exclusions on their estate planning. By inputting relevant financial data, users can easily calculate potential estate tax liabilities, enabling them to make informed decisions about their estate strategy and optimize their financial legacy. This user-friendly calculator simplifies a complex process, making estate planning more accessible.

- Website: merrilledge.com

- Established: Approx. 15 years (domain registered in 2010)

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most crucial steps to obtaining accurate results from an estate tax calculator is to ensure that all your inputs are correct. Take the time to review each piece of information you enter, including the values of your assets and liabilities. Miscalculations or typos can lead to significant discrepancies in the estimated tax liability. For example, if you accidentally omit a valuable asset like real estate or miscalculate your debts, the final output could be misleading. Consider keeping a detailed list of your assets and liabilities handy, so you can input accurate figures without missing anything.

Understand the Underlying Assumptions

Every estate tax calculator operates based on specific assumptions, such as the current tax laws, exemption limits, and rates. Familiarize yourself with these parameters to understand how they influence the calculator’s output. For instance, some calculators may only provide estimates based on federal estate tax laws, while others might consider state-specific regulations. If you live in a state with its own estate tax, ensure that the tool you are using accounts for this. Reading the tool’s documentation or help sections can provide insights into its methodology, helping you interpret the results more accurately.

Use Multiple Tools for Comparison

To get a more comprehensive understanding of your potential estate tax liability, consider using multiple estate tax calculators. Different tools may use varying methodologies or data inputs, leading to different results. By comparing outputs from several calculators, you can identify patterns or discrepancies and arrive at a more balanced understanding of your estate tax situation. This approach can also help you spot any unusual results that may warrant further investigation.

Stay Updated on Tax Laws

Tax laws can change frequently, which can significantly affect estate tax calculations. Make sure you are using an estate tax calculator that is updated to reflect the most current tax laws and exemption amounts. If you’re unsure, consult the calculator’s website for updates or verify the information against official IRS publications. Being aware of any legislative changes will help ensure that your estimates are as accurate as possible.

Consult a Professional for Complex Situations

While online calculators can provide valuable estimates, they may not capture all the nuances of your financial situation, especially if your estate involves complex assets or liabilities. If you have a high-value estate or unique circumstances, consider consulting with an estate planning professional. They can provide personalized advice and help you navigate the complexities of estate tax laws, ensuring that you make informed decisions regarding your estate planning.

By following these guidelines, you can maximize the accuracy and usefulness of estate tax calculators, empowering you to make informed decisions about your financial future.

Frequently Asked Questions (FAQs)

1. What is an estate tax calculator?

An estate tax calculator is an online tool designed to estimate the federal estate tax that may be owed upon a person’s death. It takes into account various assets and liabilities to provide an approximation of the taxable value of an estate. Users typically input information about their real estate, investments, debts, and any charitable contributions to receive a clearer picture of their potential tax obligations.

2. How do I use an estate tax calculator?

To use an estate tax calculator, you generally need to follow these steps:

1. Input Asset Information: Enter details about your assets, such as real estate, stocks, bonds, cash, vehicles, and life insurance benefits.

2. List Liabilities: Include any debts, like mortgages and loans, as well as estimated funeral and administration expenses.

3. Provide Other Relevant Data: You may need to input information about gifts made during your lifetime, charitable contributions, and any applicable state estate taxes.

4. Calculate: After entering the required information, click on the calculate button. The tool will process the data and present an estimated estate tax amount based on the current federal tax rates and exemptions.

3. Why is it important to know my estate tax liability?

Understanding your estate tax liability is crucial for several reasons:

– Financial Planning: It helps you plan your finances and make informed decisions about asset distribution.

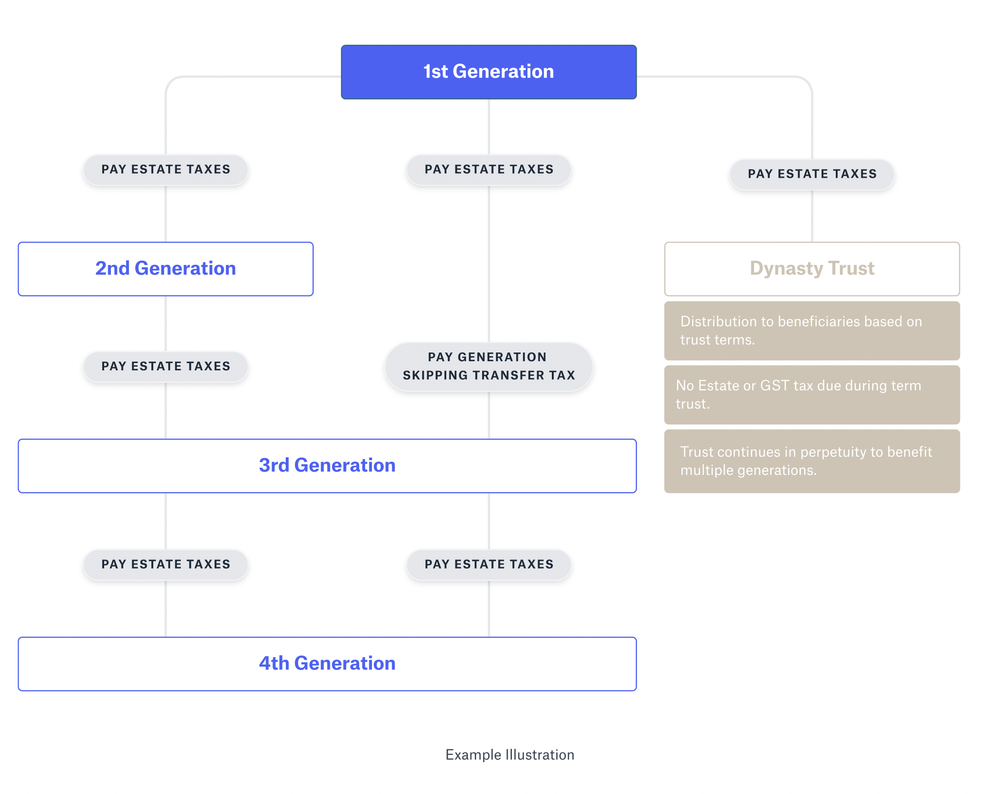

– Estate Planning: Knowing potential tax obligations allows you to explore strategies to minimize taxes, such as charitable donations or setting up trusts.

– Beneficiary Awareness: It prepares your beneficiaries for what to expect, ensuring they are not surprised by tax liabilities after your death.

– Legal Compliance: Being aware of your estate tax situation can help ensure you comply with federal and state laws, avoiding penalties or complications for your heirs.

4. Are estate tax calculators accurate?

While estate tax calculators can provide a helpful estimate, they should not be considered definitive. The accuracy of the results depends on the information entered and the current tax laws. Additionally, these calculators typically focus on federal estate taxes and may not account for state-specific taxes, which can vary significantly. For precise calculations and personalized advice, consulting with a tax professional or estate planner is recommended.

5. What should I do if my estate is over the exemption limit?

If your estate exceeds the federal exemption limit, there are several strategies you can consider to potentially reduce your estate tax liability:

– Gifting: Use the annual gift tax exclusion to gift assets to family members or charities, effectively reducing the size of your estate.

– Establish Trusts: Setting up irrevocable trusts can help shield assets from estate taxes, as they remove those assets from your taxable estate.

– Charitable Contributions: Donations to qualified charities can reduce your taxable estate and provide a tax deduction.

– Estate Planning: Consult with an estate planner to explore other strategies tailored to your situation, ensuring you comply with legal requirements while minimizing tax liabilities.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.