Best Fico Loan Savings Calculator: Top 5 Tools Compared

Finding the Best Fico Loan Savings Calculator: An Introduction

Finding the right FICO loan savings calculator can be a daunting task. With numerous options available online, it can be challenging to determine which tools provide the most accurate insights and valuable features. Many users are looking for calculators that not only help estimate potential savings based on different credit scores but also offer a user-friendly experience and reliable results. As the importance of a good credit score continues to grow, so does the need for effective tools that can help borrowers understand how their FICO scores impact loan costs.

The goal of this article is to streamline the search process by reviewing and ranking the top FICO loan savings calculators available online. By examining various tools, we aim to save you time and effort in finding the best option tailored to your needs. Our comprehensive evaluation will focus on key criteria, including accuracy, ease of use, and the range of features offered by each calculator.

In our analysis, we will explore how each tool calculates potential savings, the types of loans it covers, and the user interface design. Additionally, we will consider whether the calculators provide educational resources or tips for improving one’s credit score. By the end of this article, you will have a clear understanding of the best FICO loan savings calculators available, empowering you to make informed financial decisions and potentially save thousands on your loans.

Our Criteria: How We Selected the Top Tools

How We Selected the Top Tools

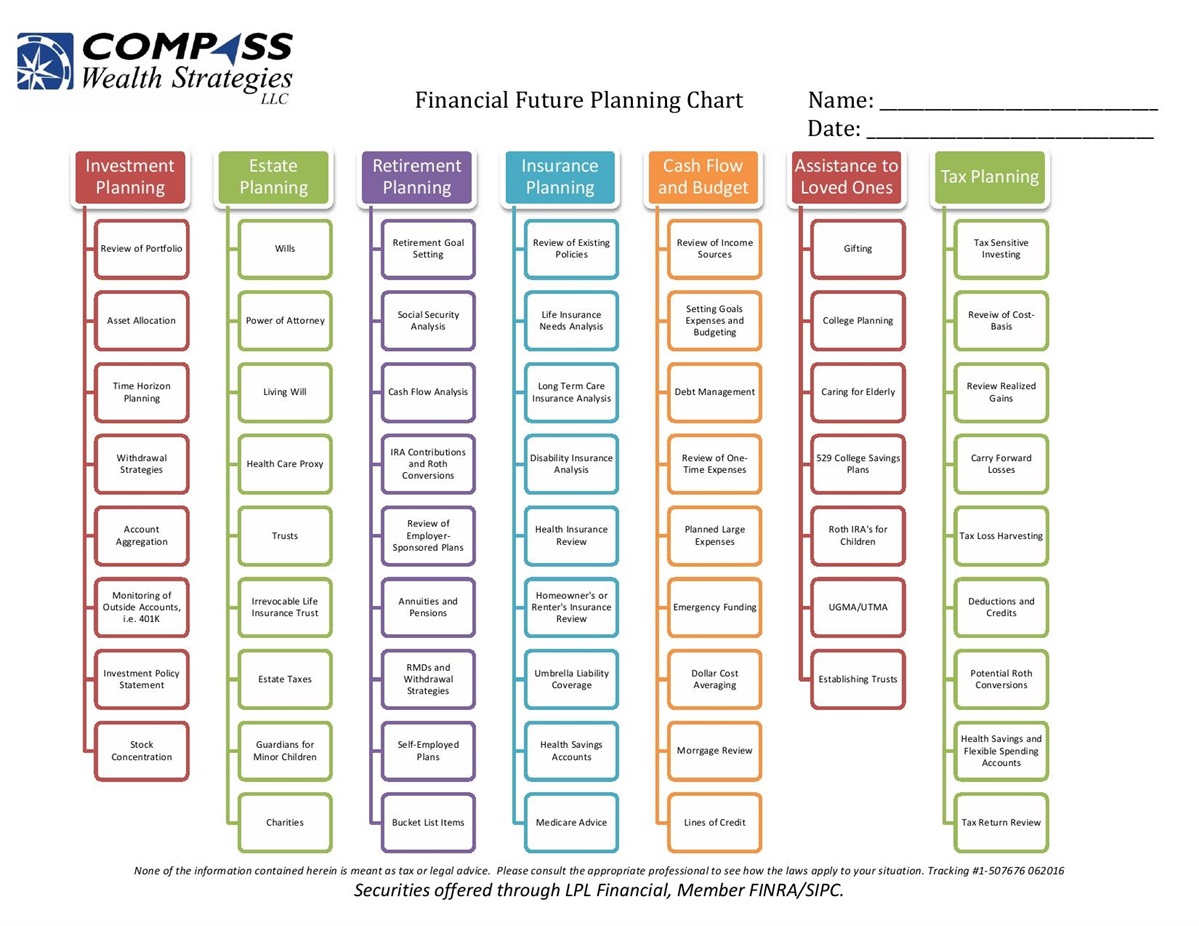

When reviewing the best FICO loan savings calculators, we established a set of criteria to ensure that our selections meet the needs of users looking to optimize their loan options. Here are the key factors we considered:

-

Accuracy and Reliability

– The calculators must provide accurate estimates based on industry-standard calculations. We looked for tools that utilize up-to-date interest rate data and reliable algorithms to reflect the impact of FICO scores on loan costs. Accuracy in outputs is essential for users to make informed financial decisions. -

Ease of Use

– User-friendly interfaces were a priority. The calculators should be intuitive, allowing users to navigate through the input fields easily without confusion. We assessed the design and layout to ensure that even those with minimal financial knowledge could utilize the tools effectively. -

Key Features

– We evaluated the specific inputs required by the calculators to deliver comprehensive outputs. Essential features include:- Loan Type Selection: Options for various loans (mortgage, auto, personal).

- FICO Score Input: Users should be able to enter their current FICO score or select from predefined ranges.

- Loan Amount and Term: Users need to specify the amount they intend to borrow and the duration of the loan.

- Interest Rate: The ability to input or select prevailing interest rates based on creditworthiness.

- Monthly Payment Estimates: Outputs that provide estimated monthly payments and total interest paid over the life of the loan.

-

Cost (Free vs. Paid)

– We prioritized tools that offer free access to their calculators, as cost is a significant factor for many users. While some paid tools may offer advanced features, our focus was on those that deliver valuable insights without any associated fees. -

Educational Resources

– Additional educational content accompanying the calculators was considered. Tools that provide explanations about how FICO scores affect loan costs and tips for improving credit scores were favored, as they offer users a better understanding of their financial health. -

Customer Support and Accessibility

– We looked for calculators that offer customer support or FAQs to assist users in case they encounter issues or have questions. Accessibility features, such as mobile-friendliness and compatibility with various devices, were also taken into account.

-

User Reviews and Feedback

– Finally, we considered user reviews and feedback to gauge real-world effectiveness and satisfaction. Tools that consistently received positive remarks from users regarding their performance and reliability were prioritized in our selections.

By applying these criteria, we aimed to provide a well-rounded list of the best FICO loan savings calculators that can help users make informed decisions and potentially save money on their loans.

The Best Fico Loan Savings Calculators of 2025

1. Loan Savings Calculator

The Loan Savings Calculator from myFICO is a valuable tool designed to help users understand how their FICO Scores influence loan interest rates. By selecting the loan type and entering specific loan details, users can estimate potential savings based on their credit scores. This calculator empowers borrowers to make informed financial decisions by illustrating the direct correlation between credit health and loan costs.

- Website: myfico.com

- Established: Approx. 25 years (domain registered in 2000)

2. Credit Score Loan Cost Calculator

The Credit Score Loan Cost Calculator from Consolidated Credit is a valuable tool designed to help users understand how their credit score influences the monthly and total costs associated with borrowing. It evaluates eight common loan types, enabling borrowers to make informed decisions about the timing of their loans based on their credit standing. This calculator is essential for anyone looking to optimize their borrowing strategy and manage their finances effectively.

- Website: consolidatedcredit.org

- Established: Approx. 26 years (domain registered in 1999)

4. Loan Savings Calculator

The Loan Savings Calculator from Northern Credit Union is a user-friendly tool designed to help individuals estimate potential savings by transferring their loans, mortgages, or credit cards to the credit union. By inputting relevant financial information, users can quickly visualize the benefits of switching, making it easier to make informed decisions about their financial future. This calculator serves as a valuable resource for those seeking to optimize their loan arrangements.

- Website: mynorthern.com

- Established: Approx. 17 years (domain registered in 2008)

How to Get the Most Accurate Results

Double-Check Your Inputs

To achieve the most accurate results from a FICO loan savings calculator, it’s crucial to ensure that all the information you input is correct. This includes loan amounts, interest rates, loan terms, and your FICO score. Errors in these inputs can lead to misleading outcomes. For instance, a small mistake in the interest rate can significantly alter your estimated monthly payments and total interest paid over the life of the loan. Take a moment to review each field before you hit calculate. Additionally, consider using a calculator that allows you to save your inputs, so you can come back and verify them later.

Understand the Underlying Assumptions

Every calculator operates based on specific assumptions, which can affect the accuracy of your results. For example, many calculators use average interest rates or standard loan terms based on your credit score. Familiarize yourself with these assumptions to better interpret the results. If a calculator assumes a fixed interest rate but you’re considering an adjustable-rate mortgage, the results may not accurately reflect your situation. Read the instructions or FAQs provided by the calculator to understand these nuances fully.

Use Multiple Tools for Comparison

No single calculator can provide a complete picture of your financial scenario. Different calculators may use varied algorithms and assumptions, leading to different outputs. For a more rounded understanding, consider using multiple FICO loan savings calculators. Compare the results to identify trends and discrepancies. This approach can help you make more informed decisions and provide a clearer view of potential savings or costs associated with different loan options.

Stay Updated on Interest Rates

Interest rates fluctuate regularly based on market conditions. Before using a loan savings calculator, check the current rates from reliable financial news sources or lender websites. Inputting outdated rates can skew your results, leading you to underestimate or overestimate your potential savings. If possible, use calculators that automatically pull in current rates to ensure your calculations are as accurate as possible.

Consult Financial Experts

While calculators are a great starting point for estimating loan costs, they shouldn’t be your only resource. Consider consulting with a financial advisor or loan officer to gain personalized insights tailored to your financial situation. They can help you understand the implications of your credit score, the specific loan terms available to you, and how changes in your financial status may affect your borrowing costs. Their expertise can complement the data you gather from online tools, providing a more comprehensive understanding of your loan options.

Review and Adjust Regularly

As your financial situation changes—whether through improved credit scores, changes in income, or shifts in interest rates—revisit your calculations. Regularly using loan savings calculators can help you stay informed about the best loan options available to you and guide your financial decisions over time. This continuous assessment will ensure that you’re always making the most financially sound choices.

Frequently Asked Questions (FAQs)

1. What is a FICO loan savings calculator?

A FICO loan savings calculator is an online tool that estimates how your FICO® Score impacts the interest rates and overall cost of a loan. By entering specific loan details—such as loan type, amount, and your credit score—you can see potential savings associated with different FICO Score ranges. This helps users understand how improving their credit score could result in lower monthly payments and reduced total interest over the life of the loan.

2. How do I use a FICO loan savings calculator?

To use a FICO loan savings calculator, you typically need to follow these steps:

1. Select Loan Type: Choose the type of loan you are interested in (e.g., mortgage, auto loan).

2. Input Loan Amount: Enter the amount of money you plan to borrow.

3. Enter Your FICO Score: Provide your current FICO Score or an estimated range.

4. Specify the Interest Rate: If applicable, enter the annual percentage rate (APR) you expect based on your credit score.

5. View Results: The calculator will display your estimated monthly payments, total interest paid, and potential savings based on different FICO Score scenarios.

3. Why is my FICO Score important for loan savings?

Your FICO Score is crucial because it is a key factor that lenders use to determine your creditworthiness. A higher FICO Score generally leads to lower interest rates, which can save you significant amounts of money over the life of the loan. For example, even a small difference in interest rates can translate into thousands of dollars in savings, making it vital to understand how your score affects your borrowing costs.

4. Can I use a FICO loan savings calculator for any type of loan?

Yes, most FICO loan savings calculators can be used for various types of loans, including mortgages, auto loans, and personal loans. However, the specific features and details required may vary depending on the type of loan. Make sure to choose a calculator that accommodates the loan type you are interested in to get the most accurate estimates.

5. Are there any fees associated with using a FICO loan savings calculator?

No, using a FICO loan savings calculator is typically free of charge. These tools are designed to provide users with valuable insights into potential savings without any cost. However, always ensure you are using a reputable website to avoid any hidden fees or misleading information.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.