Best Futures Calculator: Top 5 Tools Compared

Finding the Best Futures Calculator: An Introduction

In the fast-paced world of futures trading, having the right tools at your disposal can make a significant difference in your trading success. However, navigating the multitude of options available can be overwhelming. With numerous online futures calculators to choose from, finding a reliable and effective tool that meets your specific needs can be quite a challenge. A good futures calculator should not only provide accurate calculations but also be user-friendly and feature-rich, allowing traders to quickly assess potential profits, losses, and risk management strategies.

The goal of this article is to simplify your search by reviewing and ranking the top futures calculators currently available online. We understand that your time is valuable, and our aim is to save you the hassle of sifting through countless tools. In our rankings, we will focus on several key criteria that are essential for any effective futures calculator:

Accuracy

First and foremost, the accuracy of the calculations provided by the tool is paramount. A calculator that delivers precise figures is critical for informed decision-making in trading.

Ease of Use

A user-friendly interface is vital, especially for those who may not be as tech-savvy. We will assess how intuitive each calculator is and whether it provides clear instructions for use.

Features

We will also examine the range of features offered by each calculator, such as the ability to calculate profit/loss, manage risk, and customize settings for different futures markets.

By considering these criteria, our review will help you identify the best futures calculator that aligns with your trading strategy and enhances your overall trading experience.

Our Criteria: How We Selected the Top Tools

Key Criteria for Selecting the Best Futures Calculators

When evaluating various futures calculators, we established a set of criteria to ensure that the tools we recommend are effective, user-friendly, and suitable for a range of trading needs. Below are the key factors that guided our selection process:

-

Accuracy and Reliability

– The primary function of a futures calculator is to provide accurate profit and loss estimates, risk assessments, and other essential calculations. We prioritized tools that demonstrate a high degree of precision in their calculations. This includes the ability to handle different contract sizes, tick values, and margin requirements accurately. -

Ease of Use

– A user-friendly interface is crucial for traders who may not be technically inclined. We looked for calculators that allow users to easily input data and obtain results without confusion. Features such as intuitive design, clear instructions, and straightforward navigation were essential in our assessment. -

Key Features

– Effective futures calculators should offer a range of inputs that cater to different trading scenarios. The following features were considered important:- Market Selection: The ability to choose from various futures markets (e.g., commodities, indices, currencies).

- Position Type: Options to specify whether the user is entering a long or short position.

- Entry Price, Take Profit, and Stop Loss: Inputs for critical price levels to calculate potential profits and losses.

- Number of Contracts: Flexibility in selecting the number of contracts to be traded.

- Account Size and Risk Management: Options to input account size and set risk parameters to tailor calculations based on the trader’s profile.

-

Cost (Free vs. Paid)

– We considered both free and paid tools, analyzing the value offered by each. While some free calculators provide essential functions, others may require payment for advanced features. We looked for tools that offer a good balance of functionality and affordability, ensuring that users can access quality calculators without breaking the bank. -

Additional Resources and Support

– Comprehensive tools often come with educational resources such as tutorials, FAQs, and customer support. We favored calculators that offer additional guidance to help users understand how to make the most of the tool, as well as how to interpret the results effectively.

-

Customization Options

– The ability to customize inputs and settings based on individual trading strategies can enhance the user experience. We sought calculators that allow traders to adjust parameters according to their specific needs, thereby making the tool more versatile and applicable to various trading styles. -

Integration with Other Tools

– Many traders use multiple platforms for analysis and trading. We looked for calculators that could integrate well with other trading tools or platforms, allowing for a seamless trading experience.

By focusing on these criteria, we aimed to identify futures calculators that not only meet the basic requirements of accuracy and usability but also enhance the overall trading experience for users of all skill levels.

The Best Futures Calculators of 2025

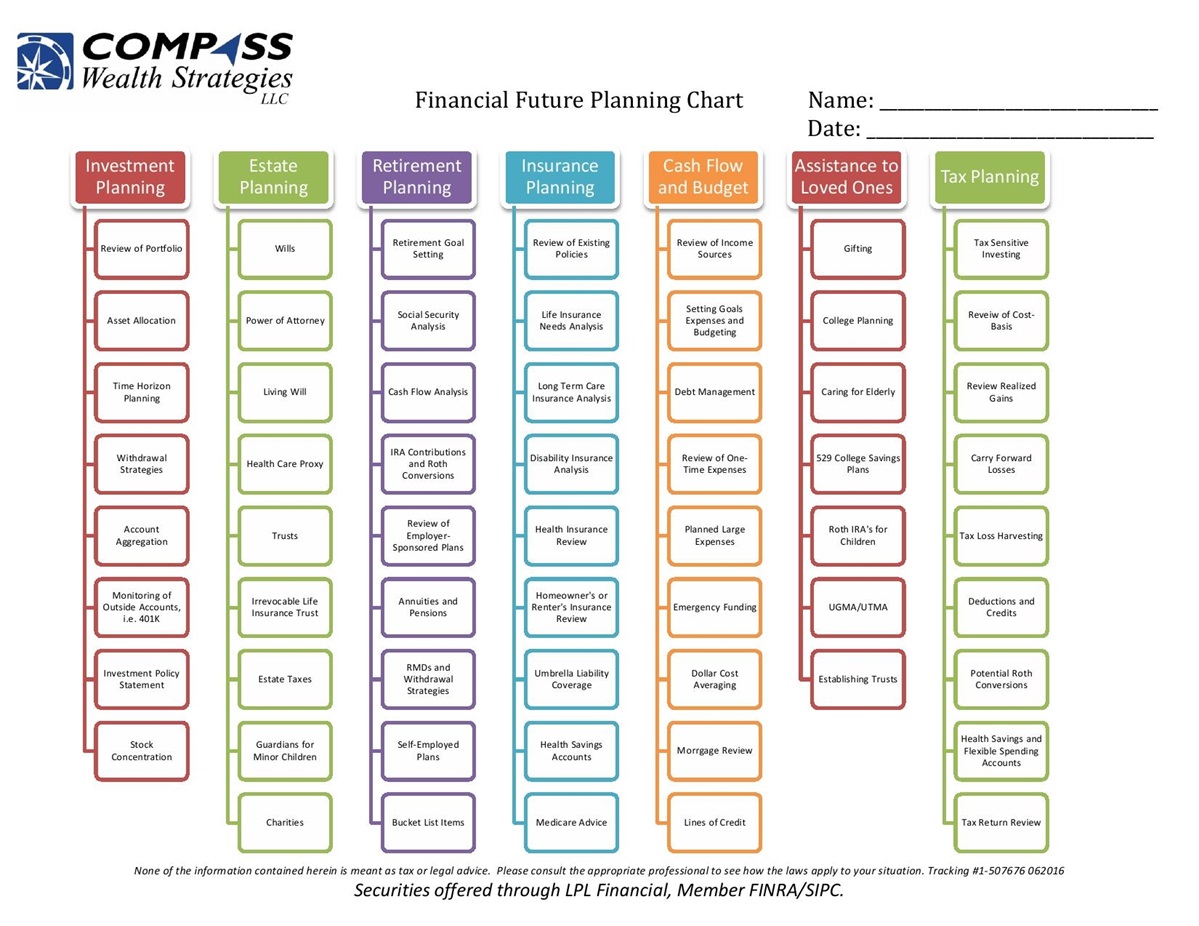

1. Futures Calculator

The Futures Calculator from Insider-Week.com is a valuable tool designed for traders in the US futures markets, enabling them to accurately calculate potential profits, losses, and associated risks. With its user-friendly interface, the calculator offers essential insights that help users make informed trading decisions, allowing them to unlock critical details for their next investment strategy. This tool is ideal for both novice and experienced traders looking to optimize their market approaches.

- Website: insider-week.com

- Established: Approx. 9 years (domain registered in 2016)

2. Futures Calculator

The Futures Calculator at futures.stonex.com is a valuable tool designed for traders looking to assess potential profits or losses from commodity futures trades. By allowing users to select a specific futures market and input their entry and exit prices, this calculator provides a straightforward way to evaluate hypothetical trading scenarios. Its user-friendly interface makes it accessible for both novice and experienced traders aiming to enhance their decision-making processes in the futures market.

- Website: futures.stonex.com

- Established: Approx. 22 years (domain registered in 2003)

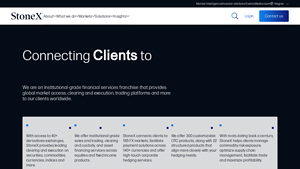

3. Futures Pnl Calculator

The Futures PnL Calculator by Trademetria is a user-friendly tool that enables traders to quickly assess potential profits or losses on their futures trades. Designed for ease of use, it streamlines the calculation process, allowing users to make informed trading decisions efficiently. This calculator is particularly beneficial for both novice and experienced traders looking to optimize their futures trading strategies.

- Website: trademetria.com

- Established: Approx. 10 years (domain registered in 2015)

4. Best Calculator for Futures Trading : r/FuturesTrading

In the Reddit discussion titled “Best Calculator for Futures Trading,” users seek a tool that simplifies the complexities of futures trading by automating calculations. The ideal calculator should efficiently process inputs such as entry and exit prices, along with commission fees, to provide clear outputs that help traders make informed decisions. This tool aims to eliminate the tedious manual calculations often associated with trading, enhancing overall efficiency and accuracy.

- Website: reddit.com

- Established: Approx. 20 years (domain registered in 2005)

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most critical steps in achieving accurate results with a futures calculator is to ensure that all your inputs are correct. This includes your entry price, take profit, stop loss, and the number of contracts you intend to trade. A small error in any of these fields can lead to significant discrepancies in your profit and loss calculations. Take a moment to review each input before hitting the ‘Calculate’ button. If possible, use a checklist to confirm that you’ve filled in all necessary fields correctly.

Understand the Underlying Assumptions

Futures calculators often operate under specific assumptions regarding market behavior and trading conditions. For example, they may assume constant volatility, fixed transaction costs, or standard margin requirements. Familiarizing yourself with these assumptions can help you interpret the results more effectively. If you understand what factors the calculator does and does not account for, you can make more informed decisions based on its output.

Use Multiple Tools for Comparison

No single calculator can account for every variable in the complex world of futures trading. Therefore, it can be beneficial to use multiple futures calculators to compare results. Different tools might employ various methodologies or assumptions, which can lead to variations in calculated profits and losses. By cross-referencing multiple calculators, you can identify any discrepancies and better gauge the accuracy of your results.

Keep Market Conditions in Mind

Market conditions can change rapidly, affecting the potential outcomes of your trades. While calculators provide theoretical profits and losses, they do not account for real-time market fluctuations or sudden price movements. Always consider the current market environment when interpreting your results. This includes monitoring news events, market sentiment, and other external factors that could impact your trades.

Regularly Update Your Knowledge

The world of futures trading is dynamic, with new tools, strategies, and regulations constantly emerging. Staying informed through educational resources, webinars, and trading forums can enhance your understanding of how to use calculators effectively. Regularly updating your knowledge will also help you adapt to changing market conditions and improve your overall trading strategy.

Document Your Trades and Results

Finally, keeping a detailed record of your trades and the results generated by the calculator can help you identify patterns and refine your trading strategy over time. By analyzing past trades, you can gain insights into what works and what doesn’t, allowing you to make more informed decisions in the future. Consider using a trading journal to document your inputs, the calculator’s outputs, and the actual outcomes of your trades.

By following these tips, you can maximize the effectiveness of futures calculators and enhance your trading performance.

Frequently Asked Questions (FAQs)

1. What is a futures calculator and how does it work?

A futures calculator is an online tool designed to help traders estimate potential profits, losses, and risks associated with futures trading. Users input details such as entry price, take profit, stop loss, and the number of contracts they wish to trade. The calculator then processes this information to provide outputs, including potential profit or loss in monetary terms and risk/reward ratios. This aids traders in making informed decisions based on their trading strategies.

2. What parameters do I need to enter in a futures calculator?

When using a futures calculator, you’ll typically need to enter several key parameters:

– Market Type: Choose the specific futures market (e.g., commodities, indexes, currencies).

– Position Type: Indicate whether you are taking a long or short position.

– Entry Price: The price at which you plan to enter the trade.

– Take Profit: The target price at which you will close the trade to secure a profit.

– Stop Loss: The price level where you will exit the trade to minimize losses.

– Number of Contracts: The quantity of futures contracts you intend to trade.

– Account Size: Optional, but useful for assessing risk based on your total trading capital.

3. Can a futures calculator help with risk management?

Yes, a futures calculator is an excellent tool for risk management. By allowing you to input your account size and desired risk percentage, the calculator can determine the appropriate number of contracts to trade. It also calculates potential profits and losses, enabling you to assess your risk/reward ratio. This helps traders make more strategic decisions to protect their capital while maximizing potential gains.

4. Are there different types of futures calculators available?

Yes, there are various types of futures calculators, each tailored for specific trading needs. Some common types include:

– Profit and Loss Calculators: Focus on estimating potential gains or losses from trades.

– Margin Calculators: Help traders understand the margin requirements for different futures contracts.

– Risk/Reward Ratio Calculators: Specifically designed to assess the risk versus potential reward of a given trade.

– Lot Size Calculators: Assist in determining the appropriate contract size based on account size and risk tolerance.

These calculators can be used individually or in combination for comprehensive trade analysis.

5. Is it necessary to register to use a futures calculator?

While some futures calculators are available for immediate use without registration, others may require you to create a free account or log in to access all features. Registration often allows users to save their calculations, access advanced features, and receive personalized insights. Always check the specific requirements of the calculator you are using to ensure you can utilize it to its full potential.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.