Best Heloc Payment Calculator: Top 5 Tools Compared

Finding the Best Heloc Payment Calculator: An Introduction

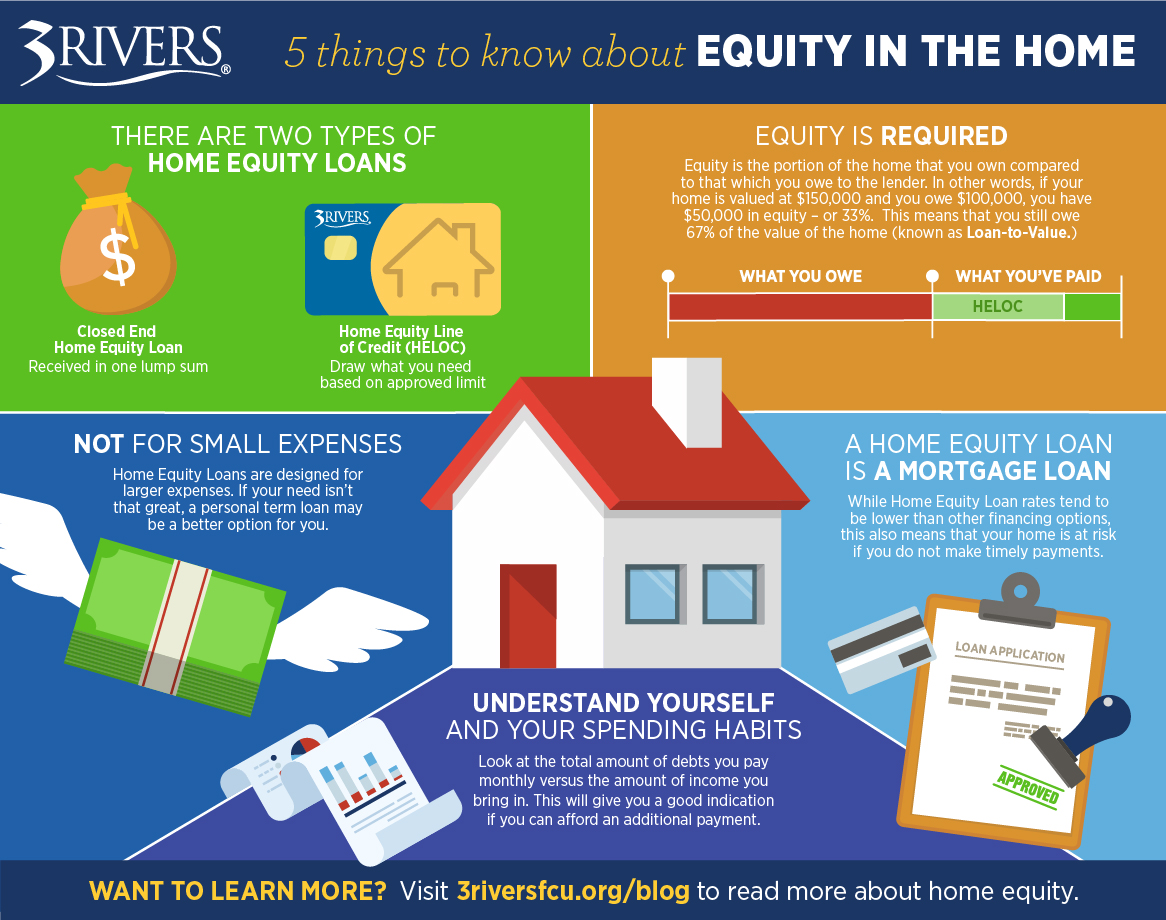

When it comes to managing finances, particularly home equity lines of credit (HELOC), having the right tools at your disposal can make all the difference. However, with a myriad of HELOC payment calculators available online, finding a reliable and effective one can be a daunting task. Many calculators vary significantly in terms of features, accuracy, and user experience, leaving homeowners unsure about which tool will best meet their needs.

This article aims to simplify your search by reviewing and ranking the top HELOC payment calculators available on the internet. By consolidating our findings, we hope to save you valuable time and effort, allowing you to make informed financial decisions regarding your home equity.

Criteria for Ranking

To ensure a comprehensive evaluation, we have established several criteria for ranking these tools. Accuracy is paramount; a calculator that provides precise estimates can help you better understand your financial obligations. Ease of use is also crucial—an intuitive interface can significantly enhance your experience, especially for users who may not be financially savvy. Additionally, we considered the features offered by each calculator, such as the ability to handle different loan scenarios, interest rates, and payment structures.

By focusing on these key aspects, we aim to present a curated list of the best HELOC payment calculators, empowering you to navigate your financial journey with confidence. Whether you’re looking to estimate monthly payments or explore various loan scenarios, our guide will help you find the right tool to suit your needs.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting the Best HELOC Payment Calculators

When it comes to choosing the most effective Home Equity Line of Credit (HELOC) payment calculators, several key factors were considered to ensure users receive the best tools available. Here’s a breakdown of the criteria we used in our selection process:

-

Accuracy and Reliability

– The calculators must provide precise calculations based on the inputs provided. This includes accurate estimations of monthly payments, interest rates, and total repayment amounts. We looked for tools that have been tested and validated against standard mortgage calculations to ensure reliability. -

Ease of Use

– A user-friendly interface is crucial for any online tool. The best calculators should have a straightforward layout, allowing users to navigate easily without unnecessary complications. We prioritized calculators that minimize the number of steps required to obtain results and that provide clear instructions for first-time users. -

Key Features

– Effective HELOC calculators should include various inputs that reflect real-world scenarios. Key features we looked for include:- Property Value Input: Users should be able to enter the estimated value of their home.

- Outstanding Mortgage Balance: This allows the calculator to determine the available equity.

- Desired Line of Credit Amount: Users should input how much they wish to borrow.

- Interest Rate Options: Calculators should allow users to enter different potential interest rates to see how they affect payments.

- Loan Terms: The ability to select or adjust the term of the loan (e.g., 10 years draw period followed by 20 years repayment) is essential for accurate projections.

-

Cost (Free vs. Paid)

– We evaluated whether the calculators are offered for free or if there are associated costs. Free tools are generally preferred, but if a paid option provides significant additional features or benefits, it was considered. Transparency about any costs or fees is essential for user trust. -

Additional Resources and Support

– The best calculators often come with supplementary resources, such as educational articles, FAQs, or support options. We favored tools that provide users with more context about HELOCs, helping them make informed decisions. Access to customer support for technical issues or inquiries about calculations also adds value. -

Mobile Compatibility

– With more users accessing tools from their smartphones, we ensured that the calculators are mobile-friendly. This includes responsive design and easy usability on various devices. -

Privacy and Security

– Given that users may input sensitive financial information, we prioritized calculators that ensure data privacy and have secure protocols in place to protect user information.

By adhering to these criteria, we aimed to provide a comprehensive list of HELOC payment calculators that meet the needs of a diverse audience, from first-time homebuyers to seasoned homeowners looking to leverage their equity effectively.

The Best Heloc Payment Calculators of 2025

1. Monthly Home Equity Loan Repayment Calculator

The Monthly Home Equity Loan Repayment Calculator from mortgagecalculator.org is a valuable tool for homeowners looking to manage their equity loans effectively. It allows users to calculate their interest-only payments while also assessing the financial implications of making additional principal payments. This dual functionality helps borrowers understand their repayment options and make informed decisions about their home equity loans.

- Website: mortgagecalculator.org

- Established: Approx. 21 years (domain registered in 2004)

2. Home Equity Line of Credit Payment Calculator

The Home Equity Line of Credit Payment Calculator from Bank of America is a user-friendly tool designed to help homeowners estimate their monthly payments for a home equity line of credit. By inputting the desired loan amount, selecting rate options, and considering other relevant factors, users can gain valuable insights into their potential financial commitments, making it easier to plan their borrowing strategy.

- Website: bankofamerica.com

- Established: Approx. 27 years (domain registered in 1998)

4. Home Equity Line of Credit (HELOC) Payment Calculator

The Home Equity Line of Credit (HELOC) Payment Calculator from Flagstar simplifies the process of estimating monthly payments and interest rates for homeowners. This user-friendly tool allows individuals to effectively plan their mortgage payments by providing accurate calculations, making it an essential resource for those looking to manage their home equity financing efficiently. With its straightforward interface, it caters to both seasoned borrowers and first-time users alike.

- Website: flagstar.com

- Established: Approx. 30 years (domain registered in 1995)

5. Home Equity Loan Amount and Payment Calculators

Navy Federal’s Home Equity Loan Amount and Payment Calculators are designed to help users estimate the potential size of their equity line of credit or loan. These tools provide a straightforward way to assess how much equity can be accessed and calculate estimated monthly payments, making it easier for homeowners to plan their finances effectively. With user-friendly interfaces, they cater to those looking to leverage their home equity for various needs.

- Website: navyfederal.org

- Established: Approx. 28 years (domain registered in 1997)

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most critical steps in using a HELOC payment calculator is to ensure that all inputs are accurate. Small mistakes in entering figures can lead to significant discrepancies in the results. Take the time to carefully input the following information:

- Estimated Property Value: Make sure you enter the most current and realistic value of your home. You can use recent appraisals or sales of comparable homes in your area as a reference.

- Outstanding Balances: Include all existing loans tied to your property, such as mortgages or other home equity loans. This will help in calculating your available equity accurately.

- Total Line of Credit Desired: Specify the amount you wish to borrow carefully, as this affects the monthly payment calculations directly.

Always review your entries before hitting the calculate button to ensure everything is correct.

Understand the Underlying Assumptions

HELOC calculators often operate under specific assumptions that can impact the accuracy of the results. Familiarize yourself with these assumptions, which may include:

- Interest Rate Type: Determine whether the calculator assumes a fixed or variable interest rate. Many HELOCs have variable rates, which can change over time based on market conditions.

- Repayment Structure: Understand how the calculator treats the draw period and repayment period. Some calculators may not accurately reflect the transition from interest-only payments to principal and interest payments.

- Loan Term: Know the assumed loan term, as this will affect the calculation of your monthly payments. Most calculators will default to common terms like 30 years, but verify if that aligns with your needs.

Use Multiple Tools for Comparison

To ensure that you are getting the most accurate and reliable estimates, consider using multiple HELOC payment calculators. Different calculators may have varying algorithms, rates, and assumptions, leading to different results. By comparing outputs from different tools, you can:

- Identify Trends: Look for consistent results across multiple calculators to confirm your estimates.

- Spot Outliers: If one calculator provides a significantly different payment estimate, it may indicate an issue with your inputs or the calculator’s assumptions.

- Enhance Decision-Making: Gaining a broader perspective can empower you to make more informed financial decisions regarding your home equity line of credit.

Stay Updated on Rates and Terms

Finally, keep in mind that interest rates and loan terms can fluctuate. Always check for the latest rates from lenders and compare them against the calculator’s inputs. Some calculators may also provide real-time rates, which can help you adjust your calculations accordingly. Staying informed will not only improve the accuracy of your estimates but also enhance your overall understanding of the current market conditions affecting HELOCs.

By following these tips, you can maximize the accuracy of your HELOC payment calculations and make more informed financial decisions.

Frequently Asked Questions (FAQs)

1. What is a HELOC payment calculator?

A HELOC payment calculator is an online tool designed to help homeowners estimate their monthly payments for a Home Equity Line of Credit (HELOC). By inputting information such as the loan amount, interest rate, and draw period, users can see potential monthly payments based on various scenarios, including interest-only payments and principal repayments.

2. How do I use a HELOC payment calculator?

To use a HELOC payment calculator, you typically need to provide several key pieces of information: the estimated value of your property, the outstanding balance on your existing mortgage, the total line of credit you want, and the interest rate. Once you enter this data, the calculator will generate an estimated monthly payment based on the parameters you’ve set.

3. What factors affect my HELOC payments?

Several factors can influence your HELOC payments, including the amount borrowed, the interest rate (which can be variable), the length of the draw period, and whether you choose to make interest-only payments or include principal repayments. Additionally, the loan-to-value ratio and any applicable fees from your lender can also affect your overall payment structure.

4. Can I calculate different payment scenarios with a HELOC calculator?

Yes, most HELOC payment calculators allow users to explore different payment scenarios. You can adjust variables like the loan amount, interest rate, and repayment terms to see how these changes affect your monthly payment. This feature is particularly useful for planning your finances based on various borrowing amounts or interest rates.

5. Are HELOC calculators accurate?

While HELOC calculators provide a good estimate of potential monthly payments, they may not always reflect the exact amounts you will pay. The results depend on the accuracy of the information you input and current market conditions. For precise figures, it’s advisable to consult with a financial advisor or your lender, who can provide detailed quotes based on your specific situation.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.