Best How Do You Calculate Margin: Top 5 Tools Compared

Finding the Best How Do You Calculate Margin: An Introduction

Calculating profit margin can often feel overwhelming, especially for those new to financial metrics. With various formulas and methods available, it can be a challenge to determine which approach is best suited for your needs. Whether you’re a small business owner, a student, or just someone looking to grasp the basics of financial health, finding a reliable and easy-to-use tool for margin calculation is essential.

The goal of this article is to review and rank the top online tools available for calculating margin, providing you with the information needed to make an informed choice. By examining several calculators, we aim to save you time and effort, allowing you to focus on what really matters—your business or project.

Criteria for Ranking

To ensure a comprehensive review, we utilized several key criteria in our evaluation of margin calculators:

- Accuracy: The primary function of any calculator is to provide precise results. We assessed how well each tool adheres to standard margin calculation formulas.

- Ease of Use: User-friendliness is critical, especially for those unfamiliar with financial concepts. We considered how intuitive the interface is and the clarity of instructions provided.

- Features: Some calculators offer additional functionalities such as the ability to calculate different types of margins (gross, operating, net), compare margins, and even export results. We looked at how these features enhance the overall utility of each tool.

- Accessibility: We also took into account whether the tools are available on multiple platforms and devices, making them easier to access whenever needed.

With this structured approach, we hope to guide you in selecting the best margin calculator that aligns with your specific requirements.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting the Best Margin Calculation Tools

When evaluating the best online tools for calculating margin, we focused on several key criteria that reflect the needs of our audience. These criteria ensure that users can find reliable, easy-to-use calculators that provide accurate results. Below are the primary factors we considered:

-

Accuracy and Reliability

The most critical aspect of any margin calculator is its accuracy. We selected tools that consistently provide precise calculations based on universally accepted formulas for gross profit margin, operating profit margin, and net profit margin. Each tool must demonstrate reliability in its outputs, ensuring that users can trust the results for financial decision-making. -

Ease of Use

User-friendliness is paramount for online calculators. We prioritized tools with intuitive interfaces that guide users through the calculation process. A good calculator should minimize the number of steps required to obtain results, allowing users to input data quickly without confusion. Clear labeling and a straightforward layout contribute significantly to a positive user experience. -

Key Features

Each selected tool must include essential features that cater to various user needs. Important inputs typically include:

– Cost of Goods Sold (COGS): The direct costs attributable to the production of goods sold.

– Revenue: The total income generated from sales before any expenses are deducted.

– Profit Margin Percentage: The desired percentage that indicates how much profit is made relative to revenue.

Additionally, tools that offer multiple calculation options (such as gross margin, net margin, and markup calculations) were given preference. -

Cost (Free vs. Paid)

We examined whether the calculators are free to use or if they require a paid subscription. Tools that are completely free or offer a robust free version with optional paid features were prioritized. This accessibility is essential for small business owners and individuals who may not have the budget for premium tools. -

Educational Resources

We also considered tools that provide additional educational content, such as tutorials or articles explaining how margin calculations work. This aspect helps users understand the underlying principles of margin calculations, making the tool more valuable and enhancing financial literacy.

-

Mobile Compatibility

With many users accessing tools via mobile devices, we assessed whether the calculators are optimized for mobile use. A responsive design that works seamlessly on smartphones and tablets enhances accessibility and convenience for users on the go. -

User Feedback and Reviews

Finally, we reviewed user ratings and testimonials to gauge overall satisfaction with each tool. Tools that consistently receive positive feedback for their performance, ease of use, and customer support were favored in our selection process.

By focusing on these criteria, we aimed to provide our audience with a well-rounded selection of the best margin calculation tools available online, ensuring that they can confidently make informed financial decisions.

The Best How Do You Calculate Margins of 2025

1. Margin Calculator

The Margin Calculator from Omni Calculator is a user-friendly tool designed to help users quickly determine profit margins for products. It simplifies the calculation process by guiding users through converting percentages into decimal form and applying straightforward arithmetic to derive the necessary values. With its clear instructions, the calculator is ideal for business owners and individuals looking to assess pricing strategies and ensure profitability.

- Website: omnicalculator.com

- Established: Approx. 11 years (domain registered in 2014)

4. Margin Calculator

The Margin Calculator from Logiwa is a user-friendly tool designed to help businesses assess their profitability by calculating gross margin percentages. By dividing gross profit by revenue and multiplying the result by 100, users can easily determine their margin percentage. This calculator is essential for businesses looking to optimize pricing strategies and improve financial performance, making it a valuable addition to any warehouse management system.

- Website: logiwa.com

- Established: Approx. 9 years (domain registered in 2016)

How to Get the Most Accurate Results

Double-Check Your Inputs

When using online margin calculators, the accuracy of your results heavily relies on the data you input. Always double-check your entries for errors. For example, ensure that the cost of goods sold (COGS) and revenue figures are accurate and reflect the specific items or services you are analyzing. A simple typo or incorrect number can lead to significant discrepancies in your calculated profit margin. Take your time to review each value before hitting the calculate button.

Understand the Underlying Assumptions

Each calculator may operate under slightly different assumptions regarding the definitions of terms like “cost,” “revenue,” and “profit.” Familiarize yourself with these definitions to ensure you’re using the calculator correctly. For instance, some calculators may consider only direct costs in COGS, while others might include indirect costs as well. Understanding these nuances helps you to interpret the results more effectively and ensures that you’re applying the right method for your specific business context.

Use Multiple Tools for Comparison

While one calculator may provide a good estimate, using multiple margin calculators can help you validate your results. Different calculators might have varied algorithms or assumptions that could affect the output. By comparing results from several tools, you can identify any significant discrepancies and gain a more comprehensive understanding of your profit margins. This can also highlight any potential errors in your data entry or assumptions.

Familiarize Yourself with Different Margin Types

There are various types of profit margins—gross, operating, and net—each serving a unique purpose in financial analysis. Before using a calculator, understand which margin type you are calculating and why it matters for your business. Knowing the differences will help you choose the right tool and interpret the results correctly. For instance, gross profit margin focuses solely on production costs, while net profit margin includes all expenses, providing a broader view of your business’s profitability.

Review Industry Standards

To assess the accuracy and relevance of your calculated margins, compare them against industry benchmarks. Understanding the average profit margins in your sector can provide context for your results. If your margins are significantly lower than the industry average, it may indicate a need for operational improvements. Conversely, higher margins may suggest effective pricing strategies or cost management.

Keep Learning and Adapting

Profit margin calculations are just one part of a larger financial picture. As you use these online tools, continue to educate yourself about financial metrics and their implications for your business. Regularly revisiting your calculations and strategies can help you adapt to changing market conditions and improve your overall profitability. Consider consulting additional resources, such as articles or financial advisors, for deeper insights into managing your margins effectively.

By following these tips, you can maximize the accuracy and utility of online margin calculators, enabling better decision-making for your business’s financial health.

Frequently Asked Questions (FAQs)

1. What is the formula for calculating profit margin?

To calculate profit margin, you can use the following formula:

[ \text{Profit Margin} = \left( \frac{\text{Profit}}{\text{Revenue}} \right) \times 100 ]

Where profit is the difference between revenue and costs (cost of goods sold). This formula expresses profit margin as a percentage of revenue, allowing you to understand how much of each dollar earned is retained as profit.

2. How do I calculate a desired profit margin for a product?

To calculate a selling price that achieves a desired profit margin, you can follow these steps:

1. Convert the desired profit margin percentage into a decimal (e.g., for a 20% margin, use 0.20).

2. Subtract this decimal from 1 (1 – 0.20 = 0.80).

3. Divide the cost of the product by the result (Cost / 0.80).

The resulting figure is the selling price needed to achieve your desired profit margin.

3. What’s the difference between gross margin and net margin?

Gross margin refers to the percentage of revenue that exceeds the cost of goods sold (COGS). It does not account for operating expenses, taxes, or interest. Conversely, net margin includes all expenses, providing a more comprehensive picture of a company’s profitability. While gross margin indicates the efficiency of production, net margin reflects overall financial health.

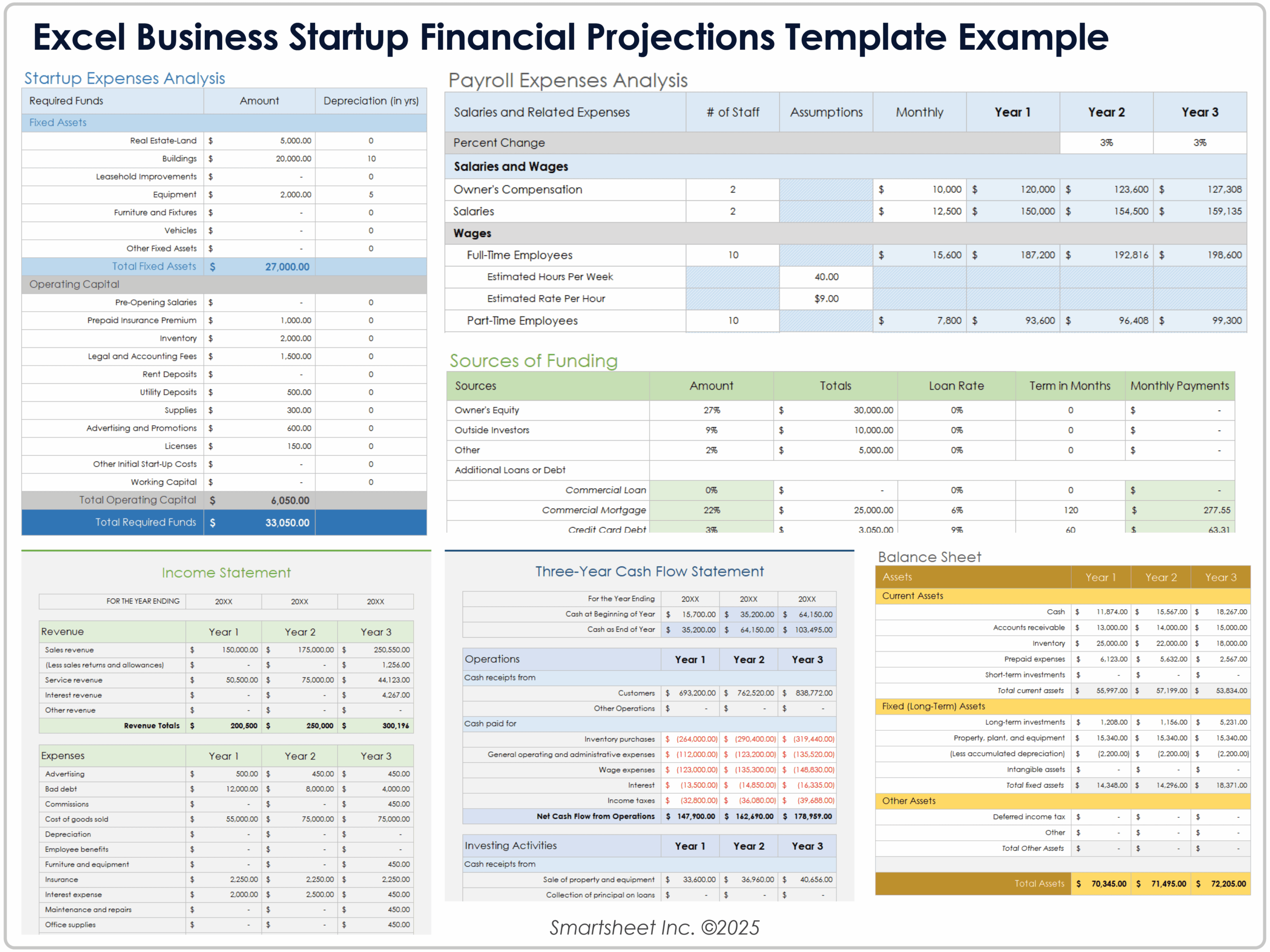

4. Can I calculate profit margin using Excel?

Yes, you can easily calculate profit margin in Excel. Here’s how:

1. Input the cost of goods sold in one cell (e.g., A1) and the revenue in another cell (e.g., B1).

2. In a new cell, calculate profit by subtracting the cost from revenue (e.g., in C1, input =B1-A1).

3. Finally, calculate the profit margin in another cell (e.g., in D1, input =(C1/B1)*100). Format this cell as a percentage to view your profit margin.

5. What is considered a good profit margin?

A good profit margin can vary significantly by industry. Generally, a profit margin of 10% is considered average, while 20% is often viewed as good. However, some sectors may have higher or lower benchmarks. It’s essential to compare your profit margins against industry standards to gauge your business’s performance effectively.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.