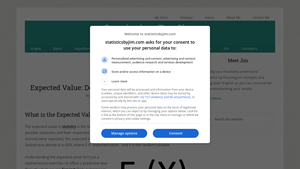

Best How To Calculate The Expected Value: Top 5 Tools Compared

Finding the Best How To Calculate The Expected Value: An Introduction

Calculating the expected value (EV) is an essential skill for anyone involved in decision-making under uncertainty, whether in finance, gaming, or statistics. However, with numerous online resources claiming to simplify this complex concept, it can be challenging to find a good, reliable tool that meets your needs. Many users may find themselves overwhelmed by the variety of options available, leading to confusion rather than clarity.

This article aims to save you time and effort by reviewing and ranking the top online tools for calculating expected value. Our goal is to provide you with a concise overview of the most effective calculators, helping you choose the one that best suits your requirements. We understand that accuracy, ease of use, and features are critical factors in selecting the right tool. Therefore, we meticulously evaluated each option based on these criteria.

Accuracy

We prioritized tools that deliver precise results, as even small errors in EV calculations can lead to significant consequences in decision-making processes.

Ease of Use

User-friendly interfaces and straightforward instructions are vital for a smooth experience. We assessed how intuitive each tool is for users of varying skill levels, ensuring that even beginners can navigate them without frustration.

Features

Beyond basic calculations, we considered additional features such as the ability to handle complex scenarios, save calculations for future reference, and provide explanatory insights on the results.

By the end of this article, you will have a clear understanding of the best tools available to calculate expected value, empowering you to make informed decisions with confidence.

Our Criteria: How We Selected the Top Tools

How We Selected the Top Tools for Calculating Expected Value

When choosing the best online tools for calculating expected value, we considered several key factors that would ensure users have access to reliable and efficient calculators. Below are the criteria that guided our selection process:

-

Accuracy and Reliability

The foremost requirement for any expected value calculator is its ability to deliver accurate results. We evaluated each tool’s underlying algorithms and methodologies to ensure they correctly apply the expected value formula, which involves multiplying each possible outcome by its probability and summing the results. Tools that demonstrated consistent reliability in their calculations were prioritized. -

Ease of Use

A user-friendly interface is essential for any online tool. We looked for calculators that are intuitive and accessible, allowing users of all skill levels to navigate effortlessly. This includes clear labeling of input fields, straightforward instructions, and a clean layout that minimizes confusion. -

Key Features

The best calculators should offer essential features that enhance functionality. We focused on tools that allow users to input:

– Multiple outcomes and their associated probabilities

– Options for different types of distributions (discrete vs. continuous)

– Examples or templates for common scenarios (like games of chance or investment calculations)

– Visual aids, such as graphs or tables, to help illustrate the expected value computation. -

Cost (Free vs. Paid)

Cost can be a significant factor for many users. We evaluated whether the tools were free to use or if they required payment. While many high-quality calculators are available at no charge, we also considered the value offered by paid tools, such as advanced features, additional resources, or enhanced customer support. -

Educational Resources

We sought tools that not only provide calculators but also offer educational content. This includes tutorials, articles, or FAQs explaining the concept of expected value, its applications, and how to interpret the results. Resources that help users understand the methodology behind the calculations were deemed valuable.

-

Customer Support

Access to reliable customer support can greatly enhance the user experience, especially for those encountering issues or needing clarification. We considered tools that offer support options such as live chat, email assistance, or comprehensive help sections. -

Reviews and User Feedback

We analyzed user reviews and testimonials to gauge satisfaction levels and identify any recurring issues with the calculators. Positive feedback from a diverse range of users can indicate a tool’s overall effectiveness and reliability.

By applying these criteria, we aimed to curate a list of the top online tools for calculating expected value that cater to a broad audience, from casual users to professionals in finance and statistics. Each tool featured in our review has been assessed against these standards to ensure it meets the needs of our readers.

The Best How To Calculate The Expected Values of 2025

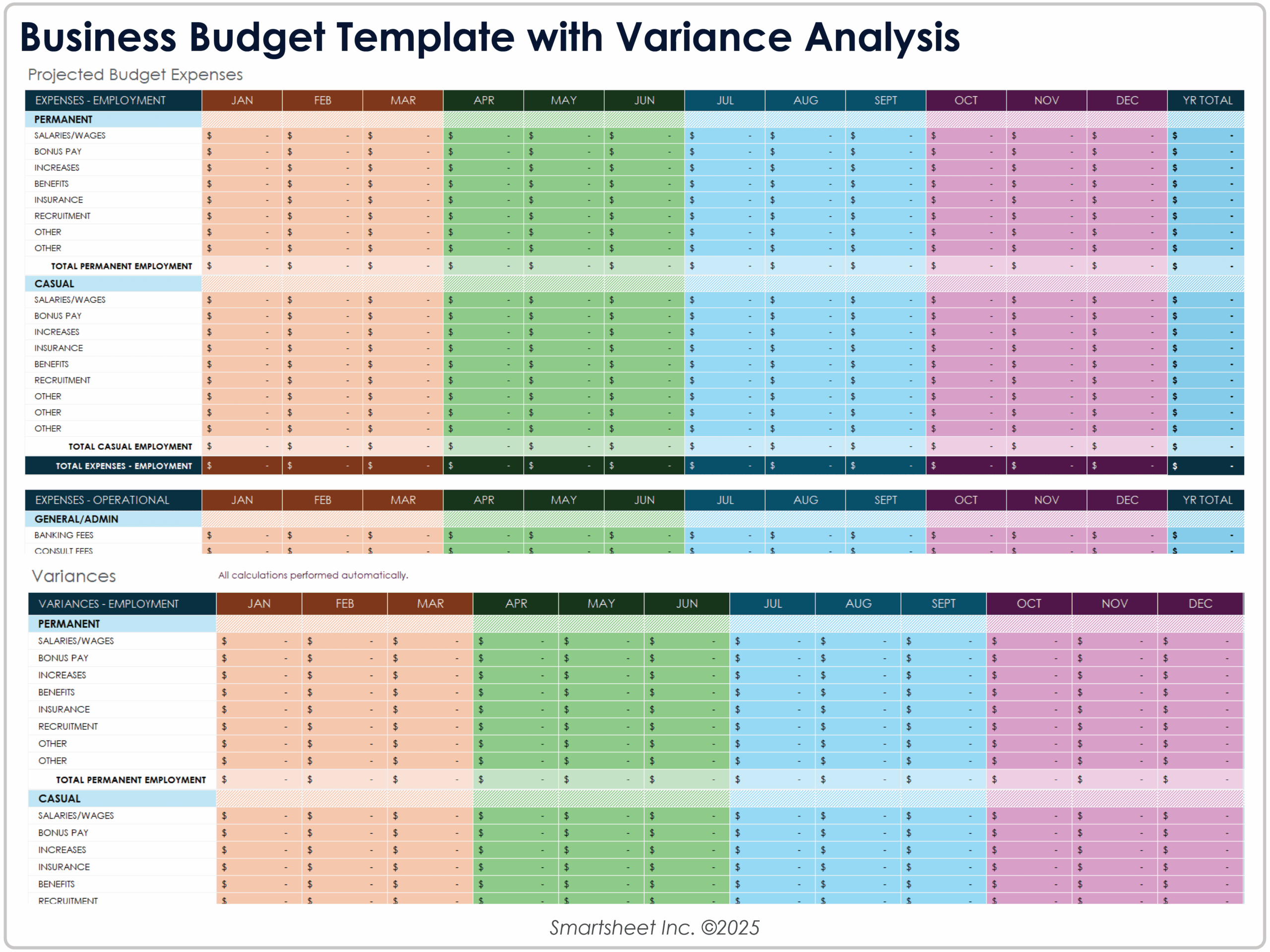

1. 4.2 Mean or Expected Value and Standard Deviation

The “4.2 Mean or Expected Value and Standard Deviation” tool from OpenStax is designed to assist users in calculating the expected value, also known as the long-term average, in statistical analysis. It features a straightforward table where users can input values and their corresponding probabilities, ultimately allowing for the computation of the expected value through the multiplication of each value by its probability. This tool is particularly useful for students and educators looking to enhance their understanding of fundamental statistical concepts.

- Website: openstax.org

- Established: Approx. 14 years (domain registered in 2011)

2. Help understanding Expected value : r/learnmath

The Reddit thread “Help understanding Expected value” provides a valuable discussion for those seeking clarity on the concept of expected value in probability and statistics. Users explain that the expected value is calculated by weighting potential outcomes—both wins and losses—by their respective probabilities. This community-driven resource offers insights and examples, making it a helpful tool for learners looking to grasp the fundamentals of expected value in various contexts.

- Website: reddit.com

- Established: Approx. 20 years (domain registered in 2005)

3. Expected Value: Definition, Formula & Finding

The article “Expected Value: Definition, Formula & Finding” on Statistics By Jim provides a comprehensive guide to understanding and calculating expected value in statistics. It outlines the key formula for finding expected value by multiplying each possible value of a discrete variable by its corresponding probability and summing the results. This resource is valuable for students and professionals seeking to grasp the concept of expected value and its practical applications in statistical analysis.

- Website: statisticsbyjim.com

- Established: Approx. 8 years (domain registered in 2017)

4. Expected Value: Why Probabilities Can Help Us Make Better Career …

The article “Expected Value: Why Probabilities Can Help Us Make Better Career Decisions” from probablygood.org delves into the concept of expected value as a decision-making tool. It emphasizes the importance of evaluating potential outcomes by quantifying their value and likelihood, enabling individuals to make informed career choices. Key features include a clear methodology for calculating expected value and practical applications that illustrate how this approach can lead to more strategic career planning.

- Website: probablygood.org

- Established: Approx. 5 years (domain registered in 2020)

5. How to Calculate (and Forecast) Expected Value

The Workday Blog’s article on calculating and forecasting Expected Value (EV) serves as a comprehensive guide for understanding this essential statistical concept. It explains the formula for EV, detailing how to multiply each value of a random variable by its corresponding probability and sum the results. The article also provides practical examples, making it easier for readers to grasp the application of Expected Value in various scenarios, enhancing decision-making processes.

- Website: blog.workday.com

- Established: Approx. 24 years (domain registered in 2001)

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most critical steps to ensure accurate results when using online expected value calculators is to double-check your inputs. Before you hit the calculate button, take a moment to review the values you’ve entered. Make sure that the probabilities and outcomes are accurate and properly formatted. A small mistake in entering a probability (e.g., entering 0.5 instead of 0.05) can lead to significantly different results. If the tool allows, consider using the provided examples or templates as a guide to ensure you’re inputting the data correctly.

Understand the Underlying Assumptions

Every online calculator operates based on specific mathematical assumptions and models. Familiarize yourself with the underlying principles of expected value calculations. For instance, some tools may assume that the probabilities must add up to one, while others might allow for more complex scenarios, such as continuous variables. Understanding these assumptions will help you interpret the results more accurately and determine whether the calculator is appropriate for your specific situation. If you’re unsure about how the calculator works, many tools provide explanations or guides that can enhance your understanding.

Use Multiple Tools for Comparison

To gain a more comprehensive view of your expected value calculations, consider using multiple online calculators. Different tools may employ various algorithms or methods, leading to slightly different results. By comparing outputs from several calculators, you can identify inconsistencies and validate your findings. This approach can also help you understand how different tools handle specific scenarios, enhancing your overall grasp of expected value calculations.

Review the Output Thoroughly

Once you receive your results, take the time to review them carefully. Look for not just the final expected value but also any additional metrics or insights the calculator may provide, such as standard deviation or risk assessment. Understanding these additional metrics can offer deeper insights into your investment or decision-making process. If the calculator provides graphs or tables, utilize them to visualize the expected value in relation to different outcomes and probabilities.

Seek Additional Resources

If you’re new to the concept of expected value or find yourself struggling to interpret the results from the calculators, consider seeking additional resources. Numerous educational websites, such as Investopedia or OpenStax, offer detailed explanations of expected value, its applications, and examples. These resources can provide the context you need to better understand the calculations and their implications for your decisions.

Stay Updated on Tool Features

Lastly, online calculators are frequently updated with new features or enhancements. Make sure to stay informed about any changes to the tools you frequently use. New functionalities might offer improved accuracy or additional analysis options that can further enhance your decision-making process. Regularly checking the tool’s website or user reviews can keep you informed about the best practices for using the calculator effectively.

Frequently Asked Questions (FAQs)

1. What is expected value and why is it important?

Expected value (EV) is a statistical concept that represents the anticipated average outcome of a random variable based on its possible values and their probabilities. It is calculated by multiplying each possible outcome by its probability and summing these products. Understanding EV is crucial for decision-making in various fields, including finance and insurance, as it helps assess the potential returns of investments and the risks associated with them.

2. How do I calculate expected value manually?

To calculate expected value manually, follow these steps:

1. Identify possible outcomes: List all the possible outcomes of the random variable.

2. Determine probabilities: Assign a probability to each outcome, ensuring that the total probability sums to 1.

3. Multiply and sum: Multiply each outcome by its corresponding probability and sum all these products.

The formula is:

[ EV = \sum (P(X_i) \times X_i) ]

where ( P(X_i) ) is the probability of outcome ( X_i ).

3. Are there online tools to help calculate expected value?

Yes, there are several online calculators and tools designed to simplify the process of calculating expected value. Many of these tools allow users to input their outcomes and probabilities, automatically computing the expected value. Some popular options include statistical software like R and Python libraries, as well as dedicated online calculators found on educational websites.

4. What are some practical applications of expected value?

Expected value has numerous practical applications across various fields. In finance, it helps investors evaluate potential returns on investments by comparing the EV of different assets. In gambling, players use EV to assess the profitability of bets and strategies. It is also used in insurance to determine premiums based on the likelihood of claims. Overall, EV serves as a critical tool for making informed decisions under uncertainty.

5. Can expected value be negative?

Yes, expected value can be negative. This occurs when the potential losses outweigh the potential gains, meaning that, on average, you would expect to lose money over time. A negative EV suggests that a particular investment or gamble may not be favorable and should be approached with caution. Understanding the implications of a negative expected value is essential for risk management and informed decision-making.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.