Best Idaho Paycheck Calculator: Top 5 Tools Compared

Finding the Best Idaho Paycheck Calculator: An Introduction

Finding a reliable Idaho paycheck calculator can be a daunting task, especially with the myriad of options available online. For residents of Idaho, understanding the intricacies of state taxes, federal withholdings, and other deductions is crucial to accurately estimating take-home pay. With varying tax rates and potential deductions, it’s essential to choose a calculator that not only provides accurate results but also simplifies the process for users.

This article aims to review and rank the top Idaho paycheck calculators available online, helping you save time and effort in your search. Our goal is to provide you with a clear overview of the best tools that can help you calculate your earnings efficiently. Whether you are an hourly worker or a salaried employee, the right calculator can make a significant difference in understanding your financial situation.

Criteria for Ranking

To ensure a comprehensive evaluation, we have considered several criteria in our rankings:

-

Accuracy: The primary function of any paycheck calculator is to provide precise estimates of net pay. We examined each tool’s ability to factor in federal, state, and local taxes accurately.

-

Ease of Use: A user-friendly interface is essential for a seamless experience. We looked at how intuitive each calculator is, including the simplicity of inputting personal information and understanding the results.

-

Features: The best calculators offer additional features, such as options for different pay frequencies, deductions, and exemptions. We considered tools that provide a more in-depth breakdown of where your money goes.

-

Reputation: The reliability of the source behind the calculator plays a crucial role in its trustworthiness. We reviewed calculators from reputable companies known for their expertise in payroll and tax services.

By focusing on these criteria, we aim to guide you in selecting the best Idaho paycheck calculator that suits your needs.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting the Best Idaho Paycheck Calculators

When it comes to choosing the best paycheck calculators for Idaho, we focused on several essential criteria to ensure that users find tools that are accurate, user-friendly, and comprehensive. Here’s how we evaluated each tool:

-

Accuracy and Reliability

– The foremost criterion for any paycheck calculator is its accuracy. We assessed tools based on their ability to provide precise calculations of net pay after accounting for federal and state taxes, FICA contributions, and any other applicable deductions. Reliable tools will consistently reflect current tax rates and regulations specific to Idaho. -

Ease of Use

– A good paycheck calculator should be intuitive and easy to navigate. We examined the user interface and overall design of each tool, looking for features that facilitate straightforward input of personal and financial information. Clear instructions and a streamlined process enhance the user experience, making it accessible even for those who may not be tech-savvy. -

Key Features

– Effective calculators should offer a range of input options to cater to various employment situations. We specifically looked for tools that allow users to input:- Gross Pay: Options for both hourly and salaried employees.

- Tax Withholdings: Flexibility to input federal and state tax allowances, additional withholdings, and exemptions.

- Deductions: Ability to factor in pre-tax deductions (like retirement contributions or health insurance) and post-tax deductions.

- Pay Frequency: Options for different pay periods, such as weekly, bi-weekly, or monthly.

- The presence of features that provide a breakdown of deductions and taxes can also significantly enhance the usefulness of the calculator.

-

Cost (Free vs. Paid)

– We prioritized tools that offer free access, as many users are seeking straightforward calculations without incurring additional costs. While some calculators may provide premium features for a fee, we focused on those that deliver essential functionality at no charge, ensuring accessibility for all users. -

User Reviews and Feedback

– We considered user feedback and reviews to gauge the overall satisfaction with each calculator. Tools that consistently received positive ratings for their performance and user experience were favored in our selection process. -

Additional Resources

– Some calculators offer supplementary resources, such as tax tips, financial advice, or links to relevant tax forms. Tools that provide educational content or guidance can help users make informed decisions about their finances, further enhancing their value.

By adhering to these criteria, we aimed to present a well-rounded selection of Idaho paycheck calculators that meet the diverse needs of users, ensuring they can accurately assess their take-home pay with confidence.

The Best Idaho Paycheck Calculators of 2025

Could not retrieve enough information to build a top list for idaho paycheck calculator.

How to Get the Most Accurate Results

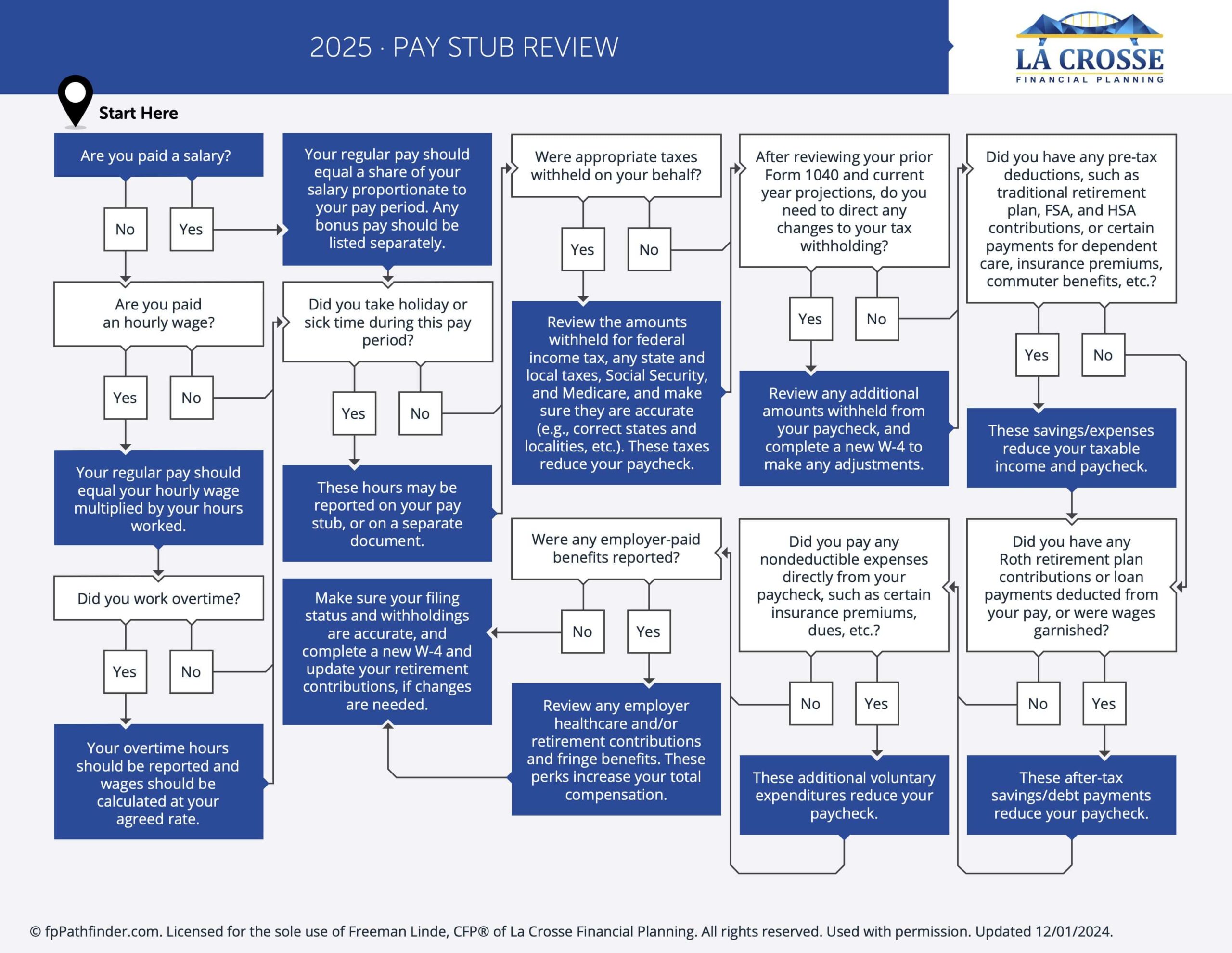

Double-Check Your Inputs

Accuracy in any paycheck calculator begins with the information you provide. When entering your details, ensure that all inputs are correct and reflect your current financial situation. This includes your gross pay, filing status, number of dependents, and any pre-tax deductions. A small error in any of these fields can significantly alter your estimated take-home pay. Take a moment to review each entry before hitting the calculate button. If you have recently changed jobs or your financial situation has altered, make sure to update your information accordingly.

Understand the Underlying Assumptions

Different paycheck calculators may operate based on various assumptions regarding tax rates, deductions, and local laws. Familiarize yourself with the assumptions used by the calculator you are using. For instance, some calculators may not account for specific state tax credits or might assume a standard deduction that doesn’t apply to your situation. Reading the documentation or help sections of these tools can provide insight into how they calculate estimates and what factors they consider. This understanding will help you interpret the results more accurately.

Use Multiple Tools for Comparison

No single paycheck calculator can provide a definitive answer, as variations in algorithms and assumptions can lead to different results. To gain a more comprehensive understanding of your potential take-home pay, use multiple calculators and compare the results. Look for calculators from reputable sources, such as SmartAsset, ADP, and Gusto, as they often have reliable data and updated tax information. By cross-referencing these results, you can identify any discrepancies and arrive at a more balanced estimate of your net income.

Keep Current with Tax Changes

Tax laws and rates can change frequently, impacting your paycheck significantly. Make sure you are using a calculator that reflects the most recent tax information for Idaho, including federal, state, and FICA taxes. Many calculators will update automatically, but it’s a good idea to check for any recent changes or updates in tax legislation that could affect your calculations. Staying informed will help ensure that your estimates are as accurate as possible.

Consider Additional Factors

While paycheck calculators are useful for estimating take-home pay, they may not account for all variables that can affect your financial situation. Factors such as bonuses, overtime pay, and additional income sources should be considered when using these tools. If you have specific financial situations like student loan repayments or health insurance premiums, factor these into your calculations separately to get a fuller picture of your financial standing.

By following these tips, you can maximize the accuracy of the results from Idaho paycheck calculators, ensuring you have a better understanding of your financial situation.

Frequently Asked Questions (FAQs)

1. What is an Idaho paycheck calculator?

An Idaho paycheck calculator is an online tool designed to help employees estimate their take-home pay after taxes and deductions. By inputting details such as salary or hourly wage, marital status, tax withholdings, and any deductions, users can see an estimated breakdown of their earnings, including federal and state taxes, Social Security, Medicare, and other withholdings.

2. How accurate are Idaho paycheck calculators?

While Idaho paycheck calculators can provide a good estimate of your take-home pay, they should not be relied upon for precise calculations. These tools use standard tax rates and assumptions based on the information you provide. For exact figures, especially for tax planning or financial decisions, it’s advisable to consult a tax professional or accountant.

3. What information do I need to use an Idaho paycheck calculator?

To use an Idaho paycheck calculator effectively, you typically need to provide the following information:

– Gross pay (hourly wage or annual salary)

– Marital status

– Number of dependents

– Pay frequency (weekly, bi-weekly, monthly, etc.)

– State and federal tax withholding allowances

– Any additional deductions (e.g., retirement contributions, health insurance premiums)

4. Are Idaho paycheck calculators free to use?

Most Idaho paycheck calculators are free to use. Popular options, such as those from SmartAsset, ADP, and Gusto, allow users to calculate their take-home pay without any cost. However, some platforms may offer additional services or features for a fee, particularly for business payroll management.

5. Can I use an Idaho paycheck calculator for any job type?

Yes, Idaho paycheck calculators can be used for both salaried and hourly positions. The tools accommodate various pay structures and can provide estimates for different employment scenarios. Whether you are a full-time employee, part-time worker, or freelancer, you can input your specific earnings and deductions to receive a tailored estimate of your take-home pay.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.