Best Interest Only Heloc Calculator: Top 5 Tools Compared

Finding the Best Interest Only Heloc Calculator: An Introduction

Navigating the financial landscape of home equity lines of credit (HELOCs) can be daunting, particularly when it comes to understanding the implications of interest-only payment options. With various calculators available online, finding a reliable and user-friendly interest-only HELOC calculator can be a challenge. Many tools promise to simplify your financial calculations, yet not all deliver the accuracy and features needed to make informed decisions.

This article aims to streamline your search by reviewing and ranking the top interest-only HELOC calculators currently available online. Our goal is to save you time and effort by highlighting the best tools that can help you estimate your monthly payments accurately during the draw period and understand how your costs will change once you enter the repayment phase.

Criteria for Ranking

In selecting the best calculators, we considered several key factors:

-

Accuracy: The primary function of a calculator is to provide precise estimates. We evaluated how well each tool calculates interest payments based on varying draw amounts and interest rates.

-

Ease of Use: A good calculator should be intuitive and straightforward. We assessed the user interface and overall experience to ensure that you can easily input your data and interpret the results.

-

Features: Beyond basic calculations, we looked for additional features such as the ability to adjust for variable interest rates, repayment scenarios, and clear explanations of the results.

By focusing on these criteria, we aim to provide you with a comprehensive guide that empowers you to make informed financial decisions regarding your HELOC options. Whether you are a first-time borrower or looking to refine your existing financial strategies, our top list will help you find the perfect calculator to suit your needs.

Our Criteria: How We Selected the Top Tools

Selection Criteria for Interest Only HELOC Calculators

When evaluating the best interest-only HELOC calculators, we focused on several key criteria that ensure users receive a reliable and user-friendly experience. Here’s a breakdown of the factors we considered:

-

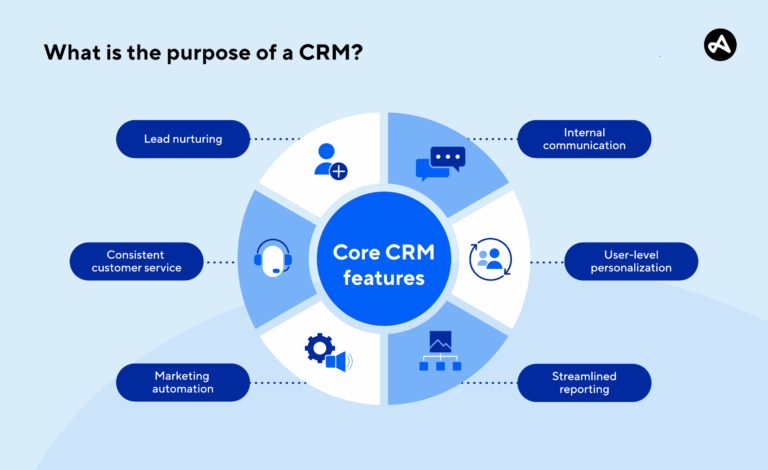

Accuracy and Reliability

– It is crucial for a calculator to deliver accurate results based on the inputs provided. We prioritized tools that are straightforward in their calculations, using clear formulas that reflect real-world scenarios. This ensures that users can trust the output when planning their finances. -

Ease of Use

– A user-friendly interface is essential for any online tool. We looked for calculators that are intuitive and require minimal effort to navigate. This includes clear labeling of input fields, straightforward instructions, and a clean layout that enhances the user experience. -

Key Features

– Effective calculators should offer essential features that allow users to customize their calculations. Important inputs include:- Draw Amount: Users should be able to enter the specific amount they intend to borrow, as interest payments are only calculated on the drawn amount.

- Interest Rate: The ability to adjust the interest rate is vital, as many HELOCs have variable rates. Users should see how changes in the rate affect their payments.

- Draw and Repayment Periods: Calculators that allow users to specify the length of the draw and repayment phases provide a more accurate picture of future payment obligations.

- Payment Breakdown: A good calculator should offer insights into both the interest-only payments during the draw period and the total payments during the repayment period.

-

Cost (Free vs. Paid)

– We favored calculators that are free to use, as this accessibility allows a broader audience to benefit from these financial tools. While some calculators may offer premium features, the core functions should remain available without charge. -

Additional Resources and Support

– Tools that provide educational resources or links to further information about HELOCs and their implications were prioritized. This includes guidance on how to interpret the results and tips for responsible borrowing. -

Mobile Compatibility

– Given the increasing use of smartphones for online services, calculators that are optimized for mobile use were favored. This ensures users can conveniently access and utilize these tools on the go. -

User Reviews and Feedback

– We considered user reviews and ratings to gauge overall satisfaction and effectiveness of each calculator. Tools that have positive feedback from real users were given preference, as this indicates a proven track record.

By focusing on these criteria, we ensured that the selected interest-only HELOC calculators not only meet users’ needs but also enhance their understanding of their financial options.

The Best Interest Only Heloc Calculators of 2025

5. Home equity line of credit (HELOC) payment calculator

The Home Equity Line of Credit (HELOC) Payment Calculator from UNFCU is a user-friendly tool designed to help homeowners estimate their monthly payments for both traditional and interest-only HELOC options. With its straightforward interface, users can easily input their loan details to receive accurate payment estimates. Additionally, UNFCU offers a free online application process for those ready to leverage their home equity, making it a convenient choice for potential borrowers.

- Website: unfcu.org

- Established: Approx. 29 years (domain registered in 1996)

How to Get the Most Accurate Results

Double-Check Your Inputs

When using an interest-only HELOC calculator, accuracy starts with the data you provide. Ensure that you enter the correct draw amount, interest rate, and any other relevant figures. Small errors in these inputs can lead to significant discrepancies in your results. For instance, if you mistakenly enter a higher interest rate, your estimated monthly payments may appear inflated, which could mislead your budgeting process. Take a moment to verify each figure before running the calculation to ensure you are getting the most accurate assessment of your potential payments.

Understand the Underlying Assumptions

Most calculators have built-in assumptions that can affect the accuracy of your results. For example, some calculators may assume a fixed interest rate over the loan term, while others might consider variable rates that can change over time. Additionally, calculators might standardize the draw and repayment periods, which may not align with your specific situation. Familiarize yourself with these assumptions by reviewing the calculator’s instructions or FAQs. Understanding how these factors influence the output will help you interpret the results more effectively.

Use Multiple Tools for Comparison

No single calculator can capture every nuance of your financial situation. To achieve a well-rounded view of your potential HELOC payments, consider using multiple online calculators. Different tools may offer unique features, such as varying assumptions about interest rates or repayment periods. By cross-referencing the results from various calculators, you can identify trends and anomalies, giving you a clearer picture of what to expect. This approach also helps you become more informed about your options and may uncover potential costs you hadn’t previously considered.

Review Additional Costs and Fees

While calculators focus on monthly payments, it’s essential to factor in additional costs associated with a HELOC, such as annual fees, closing costs, or draw fees. These expenses can impact your overall financial picture and the true cost of borrowing. Before making any decisions based solely on calculator outputs, research these potential fees and integrate them into your financial planning. This comprehensive approach will ensure you are fully prepared for the financial commitment of a HELOC.

Consult with a Financial Professional

Finally, while online calculators are valuable tools, they should not replace professional financial advice. If you’re unsure about your calculations or how a HELOC fits into your financial strategy, consider consulting with a financial advisor. They can provide personalized insights and help you navigate the complexities of home equity financing. This step can be crucial in ensuring that you make informed, well-rounded decisions that align with your long-term financial goals.

Frequently Asked Questions (FAQs)

1. What is an interest-only HELOC calculator?

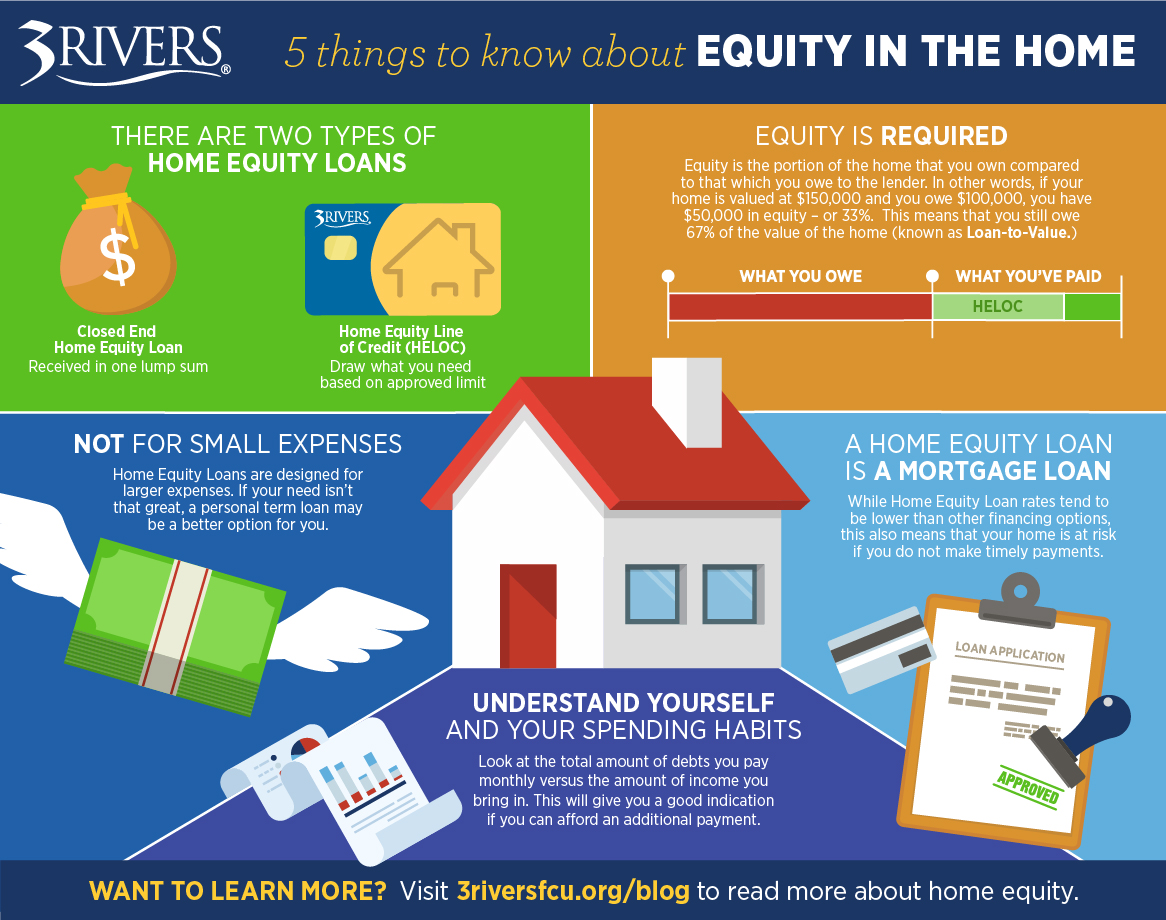

An interest-only HELOC calculator is an online tool that helps homeowners estimate their monthly payments during the interest-only draw period of a Home Equity Line of Credit (HELOC). It calculates how much you would owe monthly based on the amount you draw and the interest rate, allowing you to see the financial implications of borrowing against your home equity.

2. How do I use an interest-only HELOC calculator?

To use an interest-only HELOC calculator, you typically need to input the following information:

– Draw Amount: The amount you plan to borrow from your HELOC.

– Interest Rate: The annual percentage rate (APR) associated with your HELOC.

Once you’ve entered these details, the calculator will compute your estimated monthly payment for the interest-only period and show how payments will change when the repayment period begins.

3. What are the advantages of using an interest-only HELOC?

Using an interest-only HELOC can offer several advantages:

– Lower Initial Payments: During the draw period, your payments are limited to interest, which can significantly reduce your monthly financial burden.

– Flexibility: You can borrow as needed, making it a suitable option for ongoing expenses like home improvements or education.

– Potential Tax Benefits: Interest payments on HELOCs may be tax-deductible, depending on your financial situation and tax laws.

4. Are there any risks associated with an interest-only HELOC?

Yes, there are risks involved in using an interest-only HELOC:

– Payment Increases: Once the interest-only period ends, your payments will increase significantly, as you’ll need to start paying down the principal.

– Variable Interest Rates: Many HELOCs have variable interest rates, which means your payments can fluctuate based on market conditions.

– Risk of Foreclosure: Since HELOCs are secured by your home, failing to make payments could result in foreclosure, putting your property at risk.

5. Can I use an interest-only HELOC calculator for different scenarios?

Absolutely! Most interest-only HELOC calculators allow you to adjust various inputs, such as the draw amount and interest rate. This flexibility enables you to simulate different borrowing scenarios, helping you understand how changes in these factors can affect your monthly payments and overall financial strategy.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.