Best Mileage Reimbursement Calculator: Top 5 Tools Compared

Finding the Best Mileage Reimbursement Calculator: An Introduction

Finding a reliable mileage reimbursement calculator can be a daunting task for both employees and employers. As businesses increasingly rely on personal vehicles for work-related travel, the need for accurate and efficient reimbursement tools has become paramount. The challenge lies in the variety of calculators available online, each claiming to provide the best solution. With differing features, user interfaces, and levels of compliance with IRS regulations, selecting the right tool can often lead to confusion and frustration.

The goal of this article is to simplify that process by reviewing and ranking the top mileage reimbursement calculators currently available online. By exploring the best options, we aim to save you time and ensure you find a tool that meets your specific needs. Whether you are an employee looking to claim your mileage or an employer tasked with managing reimbursements, having access to the right calculator can make all the difference.

Criteria for Ranking

In our evaluation, we considered several key criteria to ensure a comprehensive assessment of each tool:

- Accuracy: The calculator must provide precise reimbursement amounts based on the latest IRS mileage rates and any relevant state-specific rates.

- Ease of Use: A user-friendly interface is crucial for quick calculations. We looked for tools that require minimal input while delivering clear results.

- Features: Additional functionalities such as the ability to store historical data, generate reports, and track mileage automatically were also taken into account.

- Compliance: We ensured that the calculators adhered to IRS guidelines to guarantee that users could confidently submit their claims.

By focusing on these criteria, we hope to guide you toward the best mileage reimbursement calculator to meet your needs efficiently and effectively.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting the Top Mileage Reimbursement Calculators

When reviewing and selecting the best mileage reimbursement calculators, we considered several essential criteria to ensure that users find a tool that meets their needs effectively and efficiently. Here are the key factors we evaluated:

-

Accuracy and Reliability

– It is crucial that the calculators provide accurate estimates based on the most current IRS mileage rates and other relevant local rates. We ensured that each tool’s calculations are based on verified data to prevent discrepancies and ensure users receive the correct reimbursement amounts. -

Ease of Use

– A user-friendly interface is essential for any online tool. We assessed how intuitive the navigation is, how quickly users can input their data, and whether the tool provides clear instructions. The best calculators allow users to calculate their reimbursements quickly without extensive training or technical knowledge. -

Key Features

– We looked for calculators that offer essential functionalities, including:- Input Flexibility: The ability to enter multiple types of mileage (business, medical, charitable) and various mileage rates.

- Historical Data Access: Options to view past rates and calculate reimbursements for previous years.

- Mileage Tracking Integration: Some tools offer features for tracking mileage automatically or uploading logs, enhancing compliance with IRS requirements.

- Custom Rate Options: The ability to enter custom reimbursement rates if the user’s organization offers a higher rate than the standard.

-

Cost (Free vs. Paid)

– We compared the pricing models of the calculators. While many tools are free, some offer premium features at a cost. We evaluated whether the free versions provided sufficient functionality for typical users or if the paid features justified their cost. Transparency in pricing is vital for user trust. -

Compliance with IRS Guidelines

– The calculators must align with IRS regulations regarding mileage reimbursement to ensure that users can claim deductions without issues. We prioritized tools that provide guidance on maintaining compliant mileage logs and offer up-to-date information on IRS mileage rates. -

Customer Support and Resources

– Access to customer support and additional resources, such as guides or FAQs, can significantly enhance user experience. We looked for calculators that offer robust support systems, ensuring that users can get help if they encounter any issues. -

User Reviews and Reputation

– Finally, we considered user feedback and expert reviews of each tool. Tools that have a strong reputation for reliability and customer satisfaction ranked higher on our list.

By applying these criteria, we aimed to provide a comprehensive overview of the best mileage reimbursement calculators available, helping users make informed choices that suit their specific needs.

The Best Mileage Reimbursement Calculators of 2025

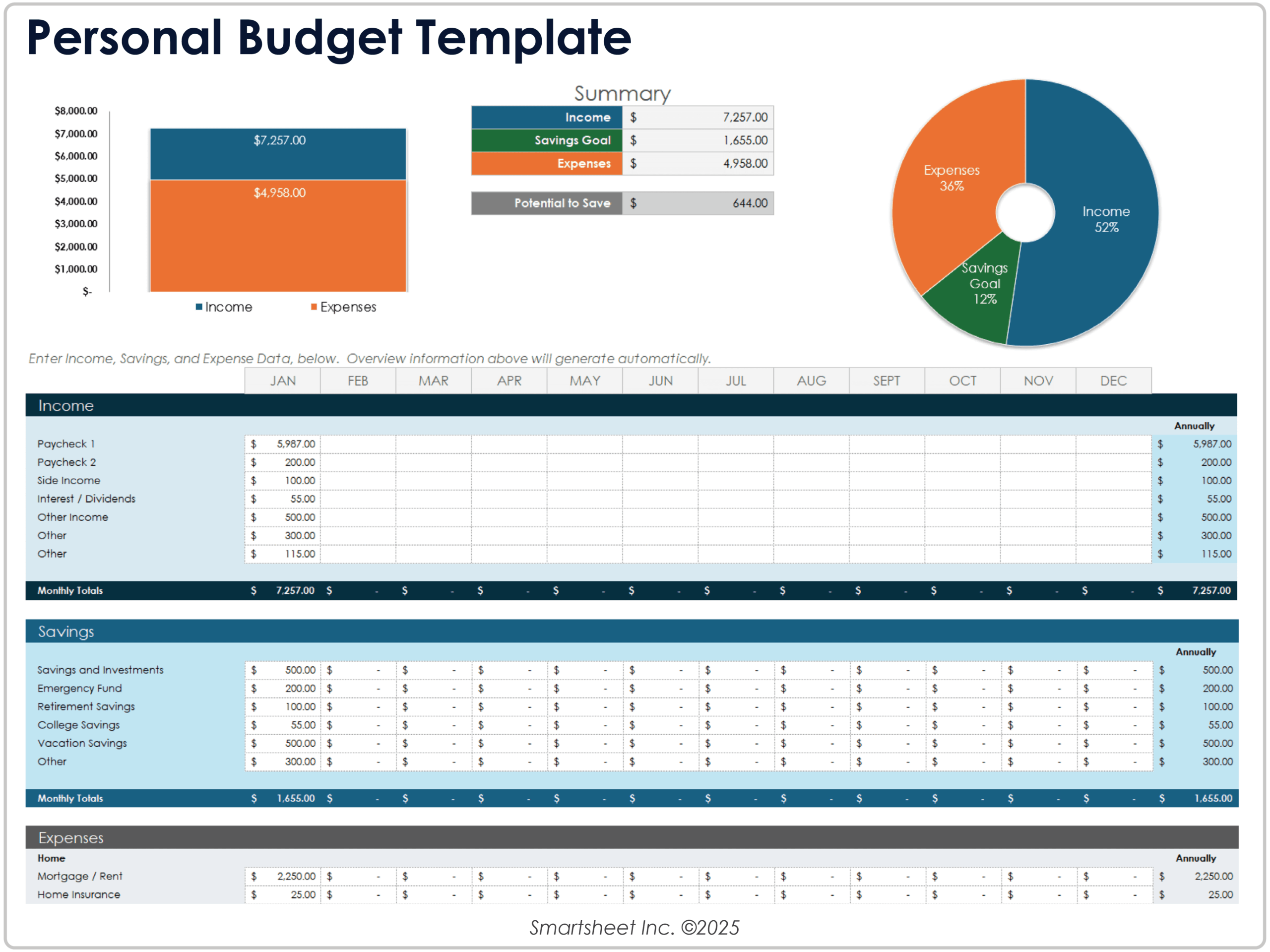

1. Mileage Reimbursement Calculator

The Mileage Reimbursement Calculator from TravelPerk is designed to simplify the process of calculating reimbursements for employee travel expenses. This user-friendly tool allows businesses to quickly determine the amount employees can claim for mileage, ensuring accurate and efficient reimbursement. By streamlining the calculations, TravelPerk’s calculator helps organizations manage travel costs effectively while providing transparency and ease for their employees.

- Website: travelperk.com

- Established: Approx. 20 years (domain registered in 2005)

2. Free IRS mileage calculator 2024 and 2025

The Free IRS Mileage Calculator from Driversnote is designed to help users estimate their potential reimbursement or tax deduction for business-related driving. Tailored for the 2024 and 2025 tax years, this user-friendly tool simplifies the process of calculating mileage expenses, ensuring drivers can accurately assess their entitlements based on the latest IRS mileage rates.

- Website: driversnote.com

- Established: Approx. 11 years (domain registered in 2014)

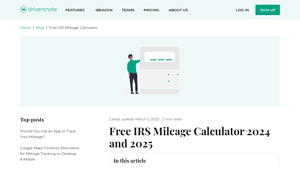

4. Rental Vehicle vs. Mileage Reimbursement Calculator

The Rental Vehicle vs. Mileage Reimbursement Calculator from FMX is a practical tool designed to help users assess the most cost-effective option for transportation expenses. By inputting relevant data, the calculator evaluates and compares the costs associated with renting a vehicle against claiming mileage for using a personal vehicle. This feature enables individuals and organizations to make informed financial decisions regarding travel options.

- Website: fmx.cpa.texas.gov

- Established: Approx. 28 years (domain registered in 1997)

5. 2025 Mileage Reimbursement Rates & Calculator For All States

The “2025 Mileage Reimbursement Rates & Calculator” by Brex is a user-friendly tool designed to help individuals and businesses accurately calculate mileage reimbursement for the year 2025 and previous years. By simply entering the number of miles driven, users can instantly determine the amount owed based on current IRS reimbursement rates. This calculator streamlines the reimbursement process, ensuring users receive accurate compensation for their travel expenses.

- Website: brex.com

- Established: Approx. 27 years (domain registered in 1998)

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most critical steps in obtaining accurate results from a mileage reimbursement calculator is to ensure that you input the correct data. Carefully review the mileage you have driven for business purposes, as well as any other relevant details such as the type of trip (business, medical, or charitable). Small errors in your input can lead to significant discrepancies in the reimbursement amounts calculated. For example, if you mistakenly enter 1,000 miles instead of 100, your reimbursement will be inflated by tenfold. Always cross-reference your mileage logs and ensure that the numbers you provide align with documented trips.

Understand the Underlying Assumptions

Each mileage reimbursement calculator may operate under different assumptions regarding rates and eligibility. Familiarize yourself with the standard mileage rates set by the IRS or your local tax authority, as these can vary year to year and by state. Additionally, some calculators may only apply the business mileage rate, while others might allow you to calculate rates for medical or charitable driving. Make sure you understand how the calculator you’re using derives its figures, and ensure it aligns with your specific needs and circumstances.

Use Multiple Tools for Comparison

To enhance accuracy and reliability, consider using multiple mileage reimbursement calculators. Different calculators may yield varying results due to differences in algorithms, assumptions, or updates to mileage rates. By comparing results from several tools, you can identify any significant discrepancies and make a more informed decision regarding your reimbursement claim. This approach not only provides a safety net against errors but also helps you become more familiar with the tools available for calculating mileage.

Keep Detailed Records

Maintaining meticulous records of your mileage is essential for accurate reimbursement calculations. Use a mileage log to document every trip, including the date, purpose, starting and ending locations, and total miles driven. Many online calculators will require this information to give you a precise estimate. Furthermore, having a detailed log can support your claims in case of audits or inquiries from your employer or tax authority. Digital tools or mobile apps that automate mileage tracking can simplify this process, ensuring you don’t miss any trips.

Stay Informed About Rate Changes

Mileage reimbursement rates are subject to change, typically on an annual basis, and can vary based on the type of trip or location. Regularly check for updates from authoritative sources such as the IRS or your local tax office. Being aware of current rates ensures that you are using the most accurate figures in your calculations, which can have a significant impact on your reimbursement amount. Some calculators even offer automatic updates to reflect these changes, so look for tools that keep you informed.

Familiarize Yourself with Tax Implications

Understanding the tax implications of mileage reimbursement is crucial. Depending on your situation, reimbursements may be tax-deductible, or they could count as taxable income. Familiarize yourself with IRS guidelines and consult with a tax professional if necessary. This knowledge can not only help you maximize your reimbursement but also ensure compliance with tax regulations, preventing potential issues down the line.

Frequently Asked Questions (FAQs)

1. What is a mileage reimbursement calculator?

A mileage reimbursement calculator is an online tool designed to help individuals or businesses calculate the amount of reimbursement an employee or contractor is entitled to for using their personal vehicle for business purposes. By inputting the total number of business miles driven and the applicable reimbursement rate, users can quickly determine the total amount owed.

2. How do I use a mileage reimbursement calculator?

To use a mileage reimbursement calculator, follow these simple steps:

1. Select the tax year: Choose the relevant tax year as reimbursement rates can vary annually.

2. Input miles driven: Enter the total number of miles driven for business purposes.

3. Calculate: Click the calculate button to see your total reimbursement amount based on the current standard mileage rate.

3. Who sets the mileage reimbursement rates?

Mileage reimbursement rates are typically set by the Internal Revenue Service (IRS) in the United States. The IRS updates these rates annually to reflect changes in vehicle operating costs. However, businesses can also set their own reimbursement rates, which can be higher than the IRS standard if they choose.

4. Are mileage reimbursement calculators accurate?

Mileage reimbursement calculators can provide a good estimate of what you may be owed, but the accuracy depends on the information entered. It’s essential to ensure that you use the correct mileage rate and accurately log all business miles. Additionally, some calculators may not account for specific circumstances, such as different rates for medical or charitable driving, so it’s good to verify with your company’s policy or consult a tax professional for precise calculations.

5. Can I use a mileage reimbursement calculator for personal travel?

Mileage reimbursement calculators are specifically designed for business-related travel and typically do not account for personal trips. If you need to calculate reimbursements for business use, you should only input the miles driven for business purposes. However, some calculators may allow you to categorize different types of trips, so check the tool’s features for any flexibility in tracking personal versus business miles.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.