Best Millionaire Calculator: Top 5 Tools Compared

Finding the Best Millionaire Calculator: An Introduction

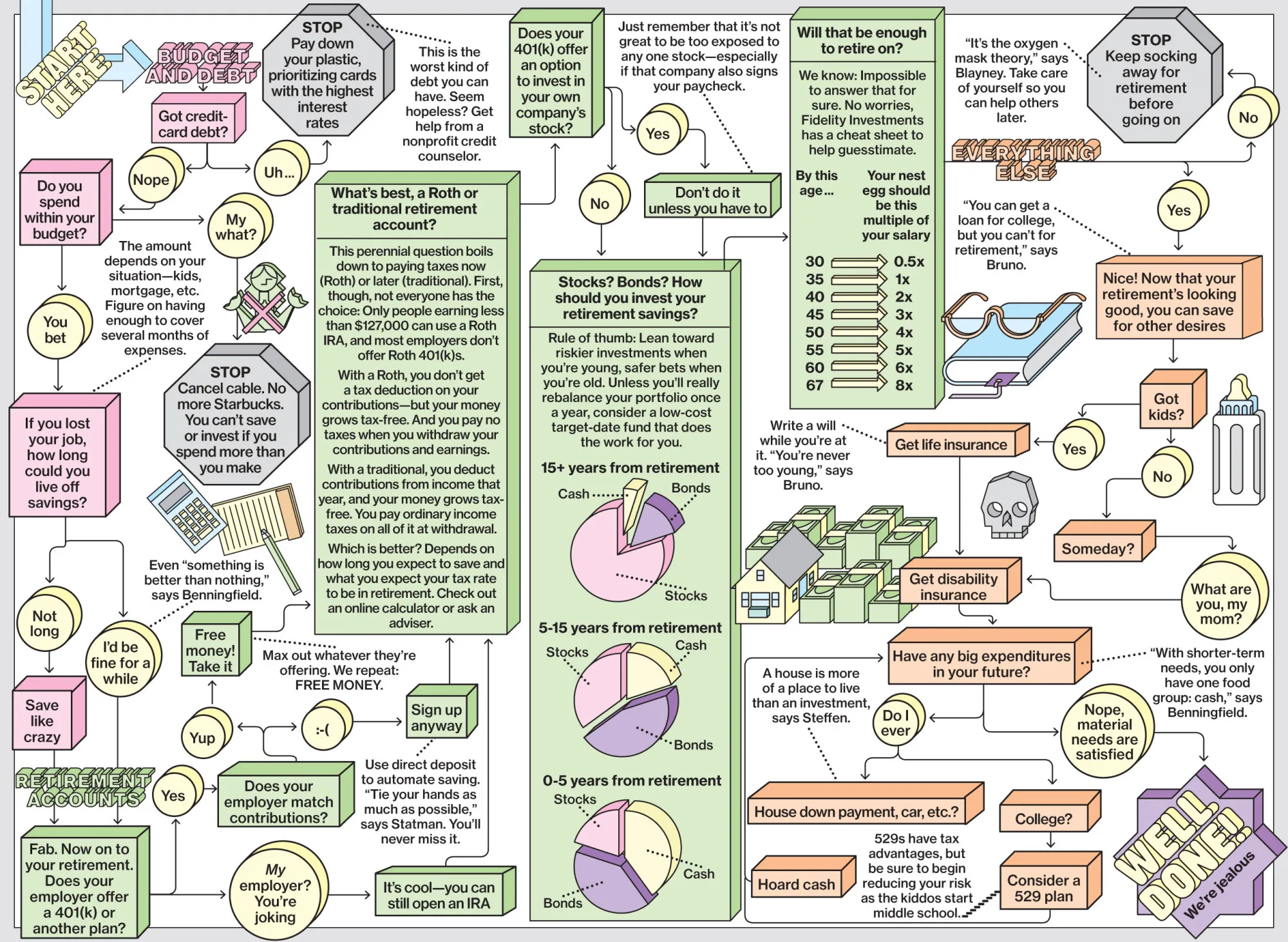

Finding a reliable millionaire calculator can be a daunting task, especially with the multitude of options available online. Whether you’re looking to set a savings goal, determine how much to invest, or simply understand the steps needed to reach millionaire status, the right calculator can make all the difference. With varying features, levels of complexity, and user interfaces, it’s essential to find a tool that not only meets your needs but also provides accurate and actionable insights.

This article aims to streamline your search by reviewing and ranking the top millionaire calculators available online. Our goal is to save you time and help you make informed decisions about your financial future. We understand that each individual’s financial situation is unique, and the calculators we evaluate will reflect a range of functionalities to cater to diverse needs.

Criteria for Ranking

In our review, we focused on several key criteria to ensure that each calculator meets high standards:

-

Accuracy: We assessed how well each calculator estimates the time and effort needed to achieve millionaire status based on user inputs like current savings, monthly contributions, and expected returns.

-

Ease of Use: The user interface and overall experience were evaluated to ensure that even those with minimal financial knowledge can navigate the tools effectively.

-

Features: We considered additional functionalities that enhance the user experience, such as graphical representations of financial growth, inflation adjustments, and personalized reports.

-

Reliability: The credibility of the source and any disclaimers regarding the use of the calculators were also taken into account to ensure users receive trustworthy information.

By the end of this article, you will have a clear understanding of the best millionaire calculators available, enabling you to take the next steps toward achieving your financial goals.

Our Criteria: How We Selected the Top Tools

Selection Criteria for Millionaire Calculators

When curating the best millionaire calculators available online, we focused on several key criteria to ensure that our recommendations meet the diverse needs of users aiming to achieve their financial goals. Here’s how we evaluated each tool:

-

Accuracy and Reliability

The primary goal of any financial calculator is to provide accurate projections based on the inputs provided. We examined each tool’s methodology to ensure that the calculations consider important factors like expected rates of return, inflation, and time horizon. Tools that offer clear explanations of their formulas and assumptions were prioritized. -

Ease of Use

A user-friendly interface is crucial for a positive experience, especially for individuals who may not be financially savvy. We assessed each calculator for intuitive design, straightforward navigation, and minimal jargon. Tools that guide users through the input process and provide clear results were favored. -

Key Features

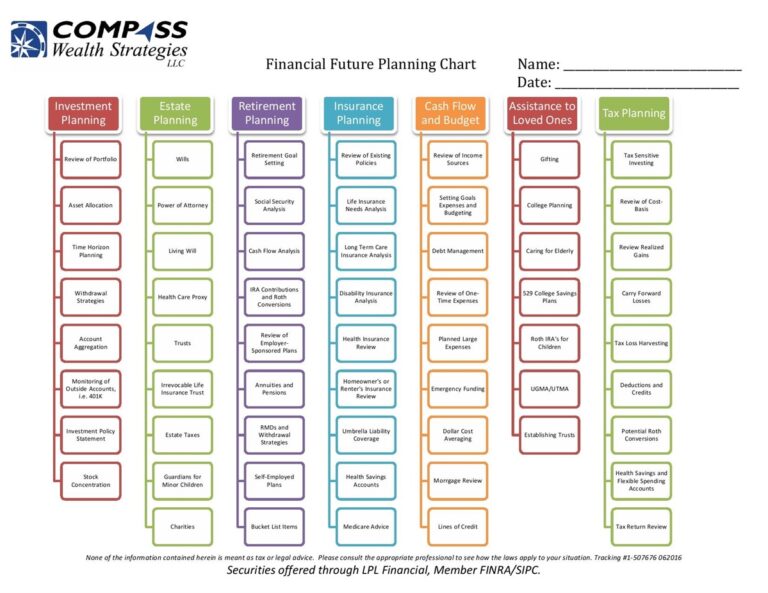

Effective millionaire calculators should allow users to input a variety of factors that influence their savings journey. We looked for features that include:

– Current Age and Target Age: To determine the time frame for reaching millionaire status.

– Existing Savings: Users can input their current savings or investments.

– Monthly Contributions: The ability to specify how much users plan to save each month.

– Expected Rate of Return: Users should be able to enter their anticipated investment growth rate.

– Inflation Rate: A feature that accounts for inflation’s impact on future wealth. -

Cost (Free vs. Paid)

We considered the accessibility of each tool, focusing primarily on free calculators that provide comprehensive features without hidden fees. While some paid tools may offer advanced features, we prioritized those that deliver significant value without requiring payment, ensuring that users can access essential financial planning tools without barriers. -

Additional Resources and Support

We evaluated whether the calculators offer supplementary resources, such as educational articles, budgeting tools, or links to financial advisors. Tools that provide users with additional context about their results or how to improve their savings strategy were given preference. -

Visual Output and Reporting

A good calculator should not only provide numerical results but also offer visual representations, such as graphs or charts, to help users understand their financial trajectory. We looked for tools that present data in an engaging and comprehensible way, allowing users to visualize their path to becoming a millionaire.

By applying these criteria, we aimed to highlight the most effective millionaire calculators that empower users to take actionable steps toward their financial aspirations. Each tool included in our list has been thoroughly vetted to ensure it meets these standards, providing a reliable resource for anyone looking to achieve millionaire status.

The Best Millionaire Calculators of 2025

1. Millionaire Calculator

The Millionaire Calculator from Banner Bank is a user-friendly tool designed to help individuals assess their financial goals and plan for wealth accumulation. By inputting factors such as current age, target age for becoming a millionaire, and current investment amounts, users can gain insights into the necessary savings and investment strategies needed to achieve their millionaire status. This calculator serves as a valuable resource for anyone looking to map out their financial future.

- Website: bannerbank.com

- Established: Approx. 28 years (domain registered in 1997)

5. Investment Calculator

The Investment Calculator by Ramsey Solutions is designed to help users estimate their potential earnings from investments. By inputting specific financial data, users can gain insights into how their investments may grow over time. This tool is user-friendly and serves as a practical resource for individuals looking to make informed decisions about their financial future, ultimately aiding in effective investment planning.

- Website: ramseysolutions.com

- Established: Approx. 13 years (domain registered in 2012)

How to Get the Most Accurate Results

Double-Check Your Inputs

Accuracy begins with the data you provide. Before hitting the calculate button, take a moment to review all the information you’ve entered. Common inputs include your current savings, monthly contributions, expected rate of return, and target age for reaching millionaire status. Ensure that these figures are realistic and reflect your financial situation. Even small errors can lead to significantly skewed results, so it’s essential to verify each value.

Understand the Underlying Assumptions

Every millionaire calculator operates on a set of assumptions regarding investment growth rates, inflation, and other economic variables. Familiarize yourself with these assumptions as they can greatly influence the outcome. For instance, if a calculator assumes a 7% annual return on investments, but your portfolio has historically returned only 5%, your projections may be overly optimistic. Read the calculator’s documentation or help section to understand how these factors are integrated into the calculations.

Use Multiple Tools for Comparison

No single calculator can account for every variable in your financial life. To get a more comprehensive view, use multiple millionaire calculators from different sources. This will allow you to compare results and identify any discrepancies. Each calculator might use different methodologies or assumptions, which can lead to variations in outcomes. By cross-referencing results, you can arrive at a more nuanced understanding of what it might take to achieve your millionaire goal.

Adjust for Inflation

Inflation plays a crucial role in long-term financial planning. Ensure that the calculator you are using factors in inflation when projecting future values. If it doesn’t, consider adjusting your final target (e.g., $1 million today may not hold the same purchasing power in 20 years). You can manually adjust for expected inflation rates based on historical data or use an inflation calculator to estimate future values.

Consult a Financial Professional

While online calculators are excellent tools for initial estimates, they are not substitutes for personalized financial advice. After using a calculator, consider discussing your results with a financial advisor. A professional can provide tailored advice based on your unique financial situation, helping you create a more effective strategy for reaching your millionaire goal.

Stay Informed on Market Trends

The financial landscape is always changing. Keeping abreast of economic news, changes in investment strategies, and shifts in interest rates can help you make more informed decisions. Regularly revisiting and updating your inputs in the calculator can help ensure your projections remain relevant in a dynamic environment.

By following these tips, you can maximize the accuracy of your millionaire calculator results and gain valuable insights into your financial future.

Frequently Asked Questions (FAQs)

1. What is a millionaire calculator and how does it work?

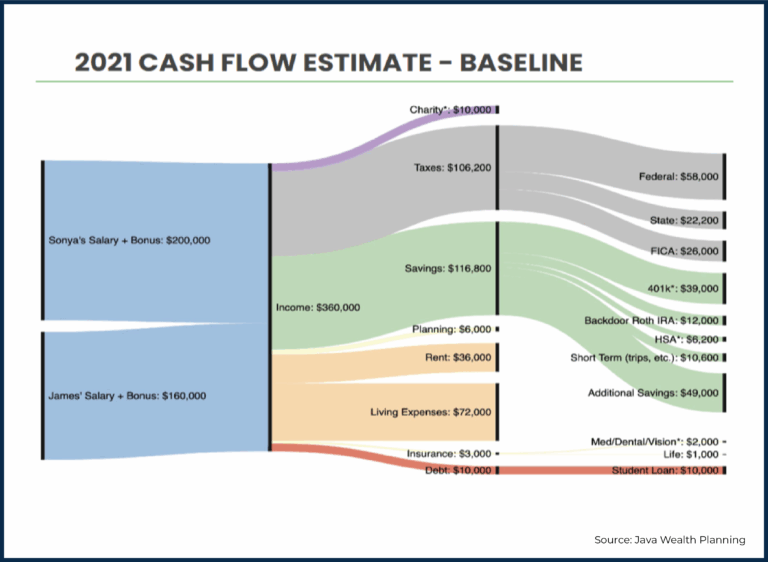

A millionaire calculator is an online financial tool designed to help users estimate how much they need to save and invest to reach a net worth of one million dollars. Users input variables such as their current age, existing savings, monthly contributions, expected rate of return on investments, and target age for becoming a millionaire. The calculator then provides projections and visualizations of how these factors will influence their journey toward reaching the million-dollar mark.

2. What factors do I need to input into a millionaire calculator?

To use a millionaire calculator effectively, you typically need to provide the following information:

– Current Age: Your age when starting the savings plan.

– Target Age: The age by which you aim to reach one million dollars.

– Current Savings: The total amount of money you have already saved or invested.

– Monthly Contribution: How much you plan to save each month.

– Expected Rate of Return: The annual return you anticipate from your investments (e.g., stocks, bonds).

– Inflation Rate: An estimate of inflation, which affects the future purchasing power of your money.

3. Can a millionaire calculator account for inflation?

Yes, many millionaire calculators include an option to factor in inflation. This is important because inflation can erode the purchasing power of your savings over time. By inputting an expected inflation rate, the calculator can provide a more realistic projection of how much money you’ll need to save to maintain your desired lifestyle in the future. This feature helps users understand the true value of one million dollars at their target age.

4. Are the results from a millionaire calculator accurate?

The results generated by a millionaire calculator are based on the assumptions and inputs provided by the user. While these calculators can give a good estimate of potential outcomes, they cannot guarantee accuracy due to the inherent uncertainties in investment returns, inflation rates, and personal financial situations. It’s advisable to use the results as a guideline and consult with a financial advisor for personalized advice tailored to your specific circumstances.

5. How can I use the results from a millionaire calculator to improve my savings strategy?

The results from a millionaire calculator can help you identify how much you need to save each month and what rate of return you should aim for to reach your financial goal. If the calculations indicate that you need to save a significant amount each month to reach your target, you can consider adjusting your budget, reducing expenses, or finding additional income sources. Additionally, understanding the impact of different investment strategies and rates of return can help you make informed decisions about where to allocate your savings to maximize growth.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.