Best Mortgage Points Calculator: Top 5 Tools Compared

Finding the Best Mortgage Points Calculator: An Introduction

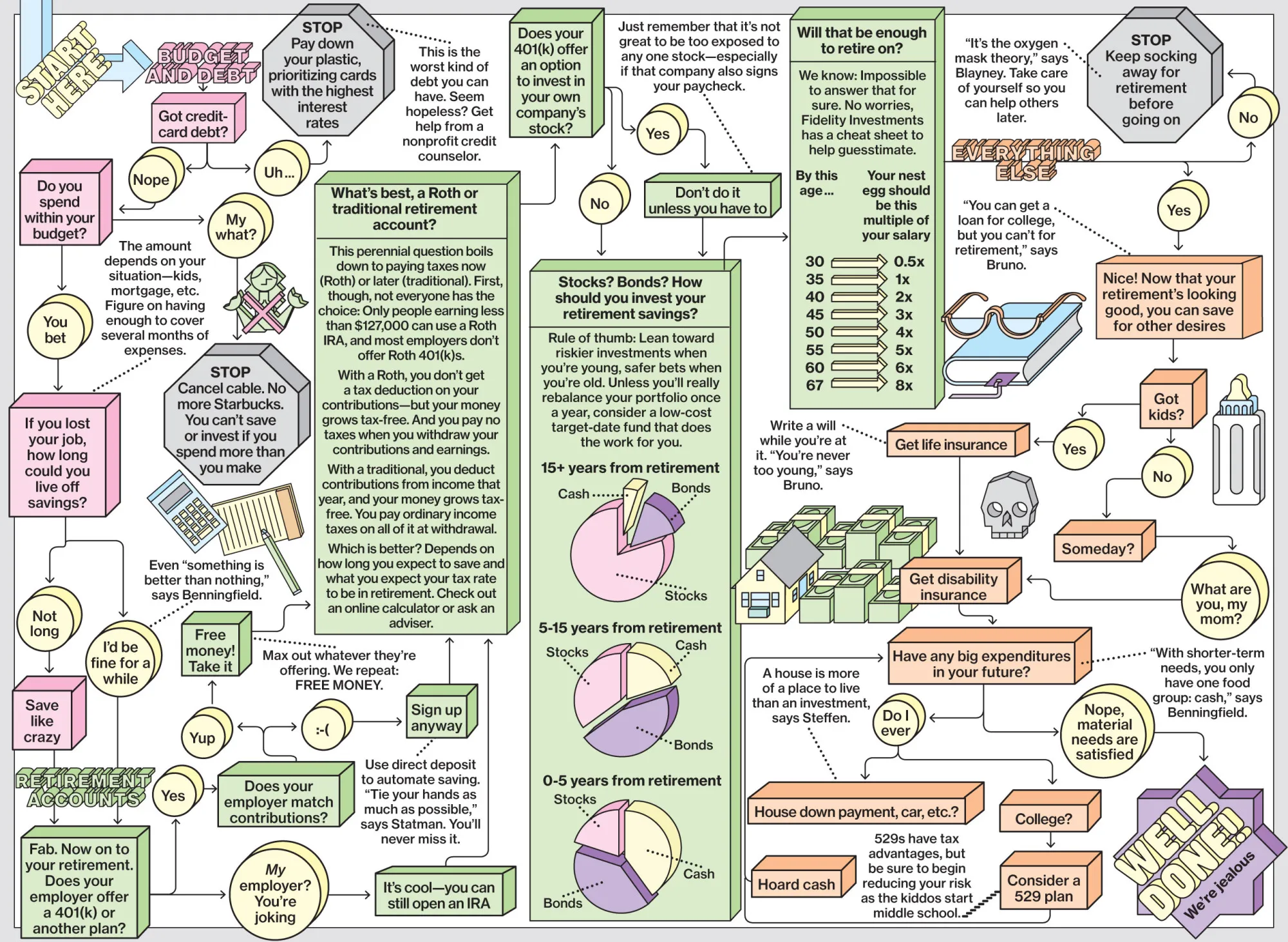

When navigating the complex world of mortgages, understanding mortgage points can significantly impact your financial decisions. Mortgage points, which are upfront fees paid to lower the interest rate on a loan, can be a valuable tool for homebuyers looking to save money over the life of their mortgage. However, calculating whether purchasing points is worth it can be a daunting task, especially with so many calculators available online.

Finding a reliable mortgage points calculator is crucial, but the sheer volume of options can overwhelm even the most seasoned buyers. Many calculators vary in terms of accuracy, features, and user-friendliness, making it challenging to determine which tool will provide the best insights for your unique situation. This article aims to simplify your search by reviewing and ranking the top mortgage points calculators available online.

Goal of This Article

Our goal is to save you time and effort by identifying the most effective tools for calculating mortgage points. We have meticulously evaluated each calculator based on several key criteria:

- Accuracy: The calculator’s ability to provide precise and reliable results.

- Ease of Use: User-friendly interfaces that make it simple to input data and interpret results.

- Features: Additional functionalities, such as comparisons of different loan scenarios and the ability to factor in local mortgage rates.

By considering these factors, we hope to guide you toward the best mortgage points calculator that meets your needs, empowering you to make informed decisions as you embark on your home-buying journey.

Our Criteria: How We Selected the Top Tools

Key Criteria for Selecting the Best Mortgage Points Calculators

When evaluating the top mortgage points calculators, we focused on several essential criteria that ensure users can make informed decisions about their mortgage options. Here’s how we selected the tools featured in our review:

-

Accuracy and Reliability

The foremost criterion for any financial calculator is its accuracy. We assessed each tool’s ability to provide precise calculations based on user inputs. A reliable calculator should use up-to-date mortgage rates and provide clear methodologies for how it arrives at its results, including factors like monthly payments, total interest savings, and break-even points. -

Ease of Use

User experience is critical for any online tool. We prioritized calculators that are intuitive and user-friendly, allowing users to navigate through the input fields effortlessly. A well-designed interface with clear instructions enhances user confidence in the tool’s functionality and encourages repeated use. -

Key Features

A robust mortgage points calculator should offer a range of features that cater to various user needs. Essential inputs we looked for include:

– Loan Amount: The total amount being borrowed.

– Loan Term: The duration of the loan, typically in years.

– Interest Rate Without Points: The initial rate offered without purchasing points.

– Discount Points: The number of points the user is considering buying.

– Monthly Payment Calculations: The ability to display monthly payments with and without points.

– Break-Even Analysis: A feature that calculates how long it will take for the cost of points to be offset by the monthly savings. -

Cost (Free vs. Paid)

We evaluated whether the tools are free to use or if they require payment. Free tools allow users to explore options without financial commitment, while paid calculators may offer more advanced features or additional financial advice. We highlighted tools that provide good value for their cost and ensure users understand any potential fees involved.

-

Comprehensive Information

In addition to calculations, we looked for calculators that provide educational resources. This includes explanations of mortgage points, how they work, and their potential benefits and drawbacks. A tool that educates users can enhance their decision-making process. -

Customer Support and Resources

Effective customer support can significantly enhance user experience. We considered whether the tools offered help through FAQs, chat support, or contact information for assistance. Resources such as articles or guides on mortgage-related topics were also taken into account, as they can help users gain a better understanding of their options.

By applying these criteria, we ensured that the mortgage points calculators we recommend are not only functional but also supportive of users’ financial decision-making processes. Each tool has been evaluated to help you find the best fit for your mortgage planning needs.

The Best Mortgage Points Calculators of 2025

1. Mortgage Discount Points Calculator

The Mortgage Discount Points Calculator at mortgagecalculator.org is a user-friendly tool designed to help home buyers assess the financial impact of purchasing discount points to reduce their mortgage interest rates. By inputting relevant loan details, users can quickly determine whether buying points is a cost-effective strategy, ultimately aiding in making informed decisions that could lead to significant long-term savings.

- Website: mortgagecalculator.org

- Established: Approx. 21 years (domain registered in 2004)

2. Mortgage points calculator

The Mortgage Points Calculator from U.S. Bank is designed to help users understand the concept of mortgage points and their potential to reduce interest rates on loans. This user-friendly tool provides insights into how purchasing points can affect overall mortgage costs, enabling borrowers to make informed decisions about their financing options. By illustrating the trade-offs between upfront costs and long-term savings, it serves as a valuable resource for prospective homeowners.

- Website: usbank.com

- Established: Approx. 30 years (domain registered in 1995)

3. Mortgage Points Calculator

The Mortgage Points Calculator by Freedom First is a valuable tool designed to help users understand the financial impact of purchasing mortgage points. By inputting various loan parameters, users can see how buying points can effectively lower their interest rates, leading to reduced monthly payments. This calculator is particularly useful for homebuyers looking to evaluate the cost-benefit of paying upfront for lower long-term mortgage expenses.

- Website: freedomfirst.com

- Established: Approx. 25 years (domain registered in 2000)

4. Mortgage Points Calculator

The Mortgage Points Calculator from NerdWallet is a valuable tool designed to help users evaluate the financial impact of purchasing mortgage points to lower their interest rates. By calculating the break-even point, it allows homeowners to assess when the savings from reduced monthly payments will offset the upfront costs of buying points, enabling informed decisions about mortgage financing options.

- Website: nerdwallet.com

- Established: Approx. 16 years (domain registered in 2009)

5. Mortgage points calculator

The Mortgage Points Calculator from Chase is a valuable tool designed to help homeowners evaluate the financial implications of purchasing mortgage points. Users can input two different scenarios to compare how these points affect the overall cost of their loan. This feature enables borrowers to make informed decisions about whether buying points is a beneficial strategy for their specific mortgage situation.

- Website: chase.com

- Established: Approx. 30 years (domain registered in 1995)

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most critical steps to ensure accurate results from a mortgage points calculator is to double-check all your inputs. When entering data such as the loan amount, interest rate, loan term, and number of points, make sure they are accurate and reflect your specific situation. Even a small error in your input can lead to significant discrepancies in your calculations. Take the time to review each field before running the calculation to ensure that the figures you are using are correct.

Understand the Underlying Assumptions

Every mortgage points calculator operates under certain assumptions that may affect the results. Familiarize yourself with these assumptions, such as the method used to calculate the break-even point or the impact of financing points versus paying them upfront. For instance, some calculators might assume you will keep the mortgage for a specific duration, while others may not account for changes in interest rates over time. Understanding these assumptions helps you interpret the results more accurately and apply them to your own financial situation.

Use Multiple Tools for Comparison

Not all mortgage points calculators are created equal. Each tool may offer different features, assumptions, and outputs. To get a comprehensive view of your options, use multiple calculators to compare results. This approach can provide a range of potential outcomes, helping you identify trends and making it easier to spot any inconsistencies. By analyzing data from several sources, you can gain a more nuanced understanding of how purchasing points may impact your overall mortgage costs.

Review Current Market Conditions

Mortgage rates and market conditions can fluctuate significantly. When using a mortgage points calculator, it’s essential to input current mortgage rates to ensure your calculations are relevant. Check various sources for the latest rates, including local lenders and financial news websites, to get the most accurate snapshot of the market. Additionally, consider how economic factors, such as inflation or changes in the Federal Reserve’s interest rate policy, might affect future rates.

Consult with a Financial Advisor

While online calculators are a great starting point, consulting with a financial advisor can provide personalized insights tailored to your unique financial situation. A professional can help clarify the implications of buying points versus other mortgage options and provide guidance on whether purchasing points is a sound financial decision based on your long-term goals. They can also assist in understanding the nuances of your specific mortgage agreement and how it fits into your overall financial strategy.

By following these tips, you can enhance the accuracy of your results when using mortgage points calculators and make more informed decisions regarding your mortgage options.

Frequently Asked Questions (FAQs)

1. What are mortgage points, and how do they work?

Mortgage points, often referred to as discount points, are fees paid upfront to lower the interest rate on your mortgage. Each point typically costs 1% of the loan amount and can reduce your interest rate by about 0.125% to 0.25% for fixed-rate mortgages. By purchasing points, you can lower your monthly payments, but it requires a larger upfront investment.

2. How can a mortgage points calculator help me?

A mortgage points calculator helps you determine whether buying points makes financial sense based on your specific loan details. It calculates the break-even point—the number of months it will take for the savings from the lower monthly payments to offset the cost of the points purchased. This allows you to make informed decisions based on how long you plan to stay in the home.

3. What factors should I consider when deciding to buy points?

When deciding whether to buy points, consider your financial situation, how long you plan to stay in the home, and your current and expected future interest rates. If you plan to stay in your home long-term, purchasing points may be beneficial. However, if you anticipate moving or refinancing in a few years, the upfront cost may not be justified.

4. Are mortgage points tax-deductible?

Yes, mortgage points can be tax-deductible. The IRS allows you to deduct the points you pay on your mortgage in the year you pay them, provided certain criteria are met. These criteria include using the loan to buy or build your main home and the points being a standard business practice in your area.

5. Can I finance the cost of mortgage points?

Yes, you can finance the cost of mortgage points by rolling them into your loan. However, this increases your loan balance and can extend the break-even point, making it take longer to recoup the costs through monthly savings. It’s generally advisable to pay for points upfront if possible to maximize your savings over the life of the loan.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.