Best Nebraska Paycheck Calculator: Top 5 Tools Compared

Finding the Best Nebraska Paycheck Calculator: An Introduction

Navigating the complexities of payroll calculations can be a daunting task, especially for residents of Nebraska. With various state-specific tax regulations, including a progressive income tax system and no local income taxes, accurately estimating your take-home pay requires a reliable tool. The challenge lies in finding a trustworthy Nebraska paycheck calculator that not only simplifies this process but also delivers precise results.

In this article, we aim to alleviate that burden by reviewing and ranking the top Nebraska paycheck calculators available online. Our goal is to save you time and ensure you have access to the best tools to calculate your earnings accurately. Whether you are an hourly worker, a salaried employee, or a business owner, having a dependable calculator at your fingertips is essential for effective financial planning.

Criteria for Ranking

To determine the best Nebraska paycheck calculators, we evaluated several key factors:

- Accuracy: Each tool’s ability to provide precise calculations based on the latest tax laws and regulations.

- Ease of Use: User-friendly interfaces that allow for quick and straightforward data input without unnecessary complications.

- Features: The availability of additional functionalities, such as options for pre-tax deductions, various pay frequencies, and the ability to accommodate different filing statuses.

- Reliability: The reputation of the platform and the trustworthiness of the data provided.

By considering these criteria, we have compiled a list of the most effective Nebraska paycheck calculators to help you make informed financial decisions with confidence.

Our Criteria: How We Selected the Top Tools

When evaluating the best Nebraska paycheck calculators, we carefully considered a variety of criteria to ensure that our recommendations are both practical and effective for users. Here are the key factors we used in our selection process:

1. Accuracy and Reliability

- Tax Calculations: The calculators must accurately compute federal, state, and local tax deductions, including FICA, Medicare, and Nebraska’s progressive income tax rates.

- Updates: Tools should be regularly updated to reflect any changes in tax laws and regulations, ensuring users receive the most current information.

2. Ease of Use

- User-Friendly Interface: The calculators should have a simple and intuitive design that allows users to input their information without confusion.

- Guidance and Support: Clear instructions or tooltips should be available to assist users in entering their details correctly.

3. Key Features

- Comprehensive Input Options: The best calculators allow users to input a variety of parameters, including:

- Income Type: Options for both hourly and salaried positions.

- Pay Frequency: Choices for daily, weekly, bi-weekly, semi-monthly, monthly, and annual pay periods.

- Deductions: Ability to enter pre-tax and post-tax deductions such as retirement contributions, health insurance, and other benefits.

- Allowances and Exemptions: Options to specify federal and state tax allowances, as well as any exemptions that may apply.

4. Cost (Free vs. Paid)

- Accessibility: We prioritized tools that are free to use, ensuring that users can access these calculators without incurring any costs.

- Transparency: If a tool offers paid features, it should clearly outline what additional benefits or services come with the cost.

5. Additional Resources

- Educational Content: The best tools provide supplemental information about Nebraska tax laws, deductions, and tips for optimizing take-home pay.

- Integration with Other Financial Tools: Some calculators offer features that link to budgeting tools or financial planning resources, enhancing their overall utility.

6. User Reviews and Feedback

- Reputation: We considered user reviews and ratings to gauge the overall satisfaction and effectiveness of the calculators.

- Community Support: Tools that foster a supportive community or forum for users to discuss their experiences and share tips were given preference.

7. Mobile Compatibility

- Responsive Design: The calculators should be accessible on various devices, including smartphones and tablets, allowing users to calculate their pay on-the-go.

By focusing on these criteria, we aimed to identify the most effective Nebraska paycheck calculators available online, ensuring that our recommendations meet the diverse needs of users looking to understand their earnings better.

The Best Nebraska Paycheck Calculators of 2025

2. Nebraska Paycheck Calculator

The Nebraska Paycheck Calculator by ADP is a user-friendly tool designed to help employees estimate their net or “take home” pay, whether they are hourly or salaried. By simply entering their wages and tax withholdings, users can quickly calculate their expected earnings after deductions. This calculator is particularly useful for budgeting and financial planning, providing clear insights into take-home pay in Nebraska.

- Website: adp.com

- Established: Approx. 34 years (domain registered in 1991)

3. 2025 Nebraska Hourly Paycheck Calculator

The 2025 Nebraska Hourly Paycheck Calculator from PaycheckCity is a comprehensive tool designed to help users accurately calculate their take-home pay based on hourly wages. Key features include various calculators for tax withholding and payroll information, making it easy for residents to understand their earnings and deductions. This user-friendly platform is ideal for employees and employers seeking clarity on payroll calculations in Nebraska.

- Website: paycheckcity.com

- Established: Approx. 26 years (domain registered in 1999)

4. Nebraska Salary Paycheck Calculator

Gusto’s Nebraska Salary Paycheck Calculator is a valuable tool designed to help employers accurately calculate take-home pay for their hourly employees. It simplifies the process by determining necessary withholdings, ensuring compliance with state regulations. With its user-friendly interface, Gusto’s calculator enables quick and precise payroll calculations, making it an essential resource for businesses operating in Nebraska.

- Website: gusto.com

- Established: Approx. 30 years (domain registered in 1995)

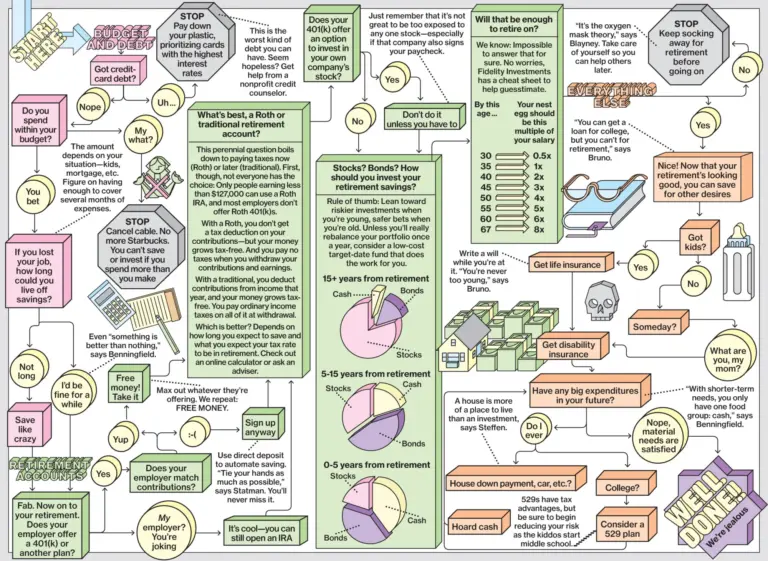

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most critical steps to ensure accurate results when using a Nebraska paycheck calculator is to double-check all the inputs you provide. This includes your gross salary, pay frequency, marital status, and any additional deductions or withholdings. A single typo or incorrect figure can lead to significant discrepancies in your estimated take-home pay. Take the time to verify each entry before hitting the calculate button. If possible, cross-reference your inputs with your latest pay stub or tax documents for accuracy.

Understand the Underlying Assumptions

Each paycheck calculator operates based on certain assumptions regarding tax rates, deductions, and other financial factors. Familiarize yourself with these assumptions, as they can vary between calculators. For example, some tools may not account for specific local taxes or unique deductions related to your employment or personal situation. Understanding these assumptions will help you interpret the results better and adjust your expectations accordingly.

Use Multiple Tools for Comparison

To get a well-rounded view of your potential take-home pay, consider using multiple Nebraska paycheck calculators. Different tools may utilize varying methodologies or data sources, which can lead to different results. By comparing outputs from several calculators, you can identify a range of possible take-home pays, which can be particularly useful if you are in a unique financial situation or have multiple income sources. This practice will help you form a more comprehensive understanding of your financial standing.

Keep Updated on Tax Laws

Tax laws and rates can change, impacting your paycheck significantly. Make sure the calculator you use is updated to reflect the current tax rates and regulations in Nebraska. Regularly check for updates on state income tax brackets, FICA contributions, and other relevant deductions. If you notice discrepancies between your calculated take-home pay and actual amounts, it might be worth reviewing recent changes in tax laws or consulting a tax professional.

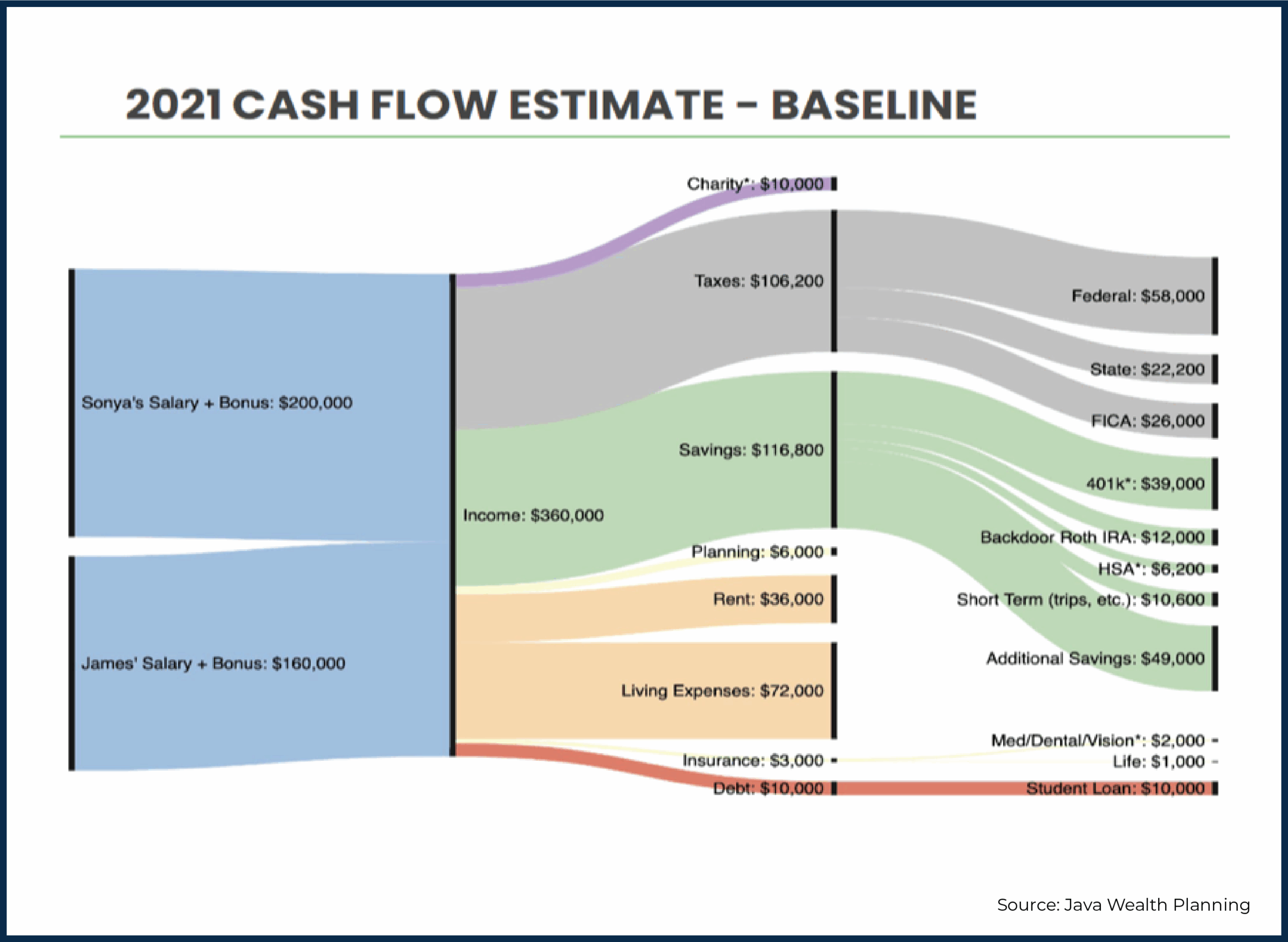

Include All Relevant Deductions

When calculating your take-home pay, ensure that you include all relevant pre-tax and post-tax deductions. Common deductions include contributions to retirement accounts (like 401(k) plans), health insurance premiums, and flexible spending accounts (FSAs). Omitting these deductions can lead to an inflated estimate of your take-home pay. If you have any unique deductions or benefits provided by your employer, make sure to factor those in as well.

Consult a Financial Advisor if Needed

If you find the calculations overwhelming or if your financial situation is complex (for instance, multiple income sources, freelance work, or significant deductions), consider consulting a financial advisor. A professional can provide personalized insights and help you navigate the intricacies of your paycheck, ensuring that you are making the most informed financial decisions possible. They can also offer advice on optimizing your withholdings to improve your cash flow throughout the year.

Frequently Asked Questions (FAQs)

1. What is a Nebraska paycheck calculator?

A Nebraska paycheck calculator is an online tool that helps users estimate their take-home pay after accounting for federal, state, and local taxes, as well as other deductions. By inputting details such as salary, hourly wage, marital status, and any additional withholdings, users can get a clear picture of their net earnings.

2. How do I use a Nebraska paycheck calculator?

To use a Nebraska paycheck calculator, you typically need to enter several key pieces of information: your gross income (hourly wage or salary), pay frequency (weekly, bi-weekly, etc.), marital status, and any pre-tax or post-tax deductions. After entering this information, the calculator will provide an estimate of your take-home pay by applying the relevant tax rates and deductions.

3. Are Nebraska paycheck calculators accurate?

While Nebraska paycheck calculators can provide a useful estimate of your take-home pay, they should not be considered 100% accurate. These tools use general tax rates and assumptions that may not account for your specific financial situation, such as unique deductions or credits. For precise tax calculations, consulting a tax professional is recommended.

4. What factors can affect my take-home pay in Nebraska?

Several factors can influence your take-home pay in Nebraska, including your income level, filing status (single, married, etc.), number of dependents, and any pre-tax deductions (like retirement contributions or health insurance premiums). Additionally, changes in federal or state tax laws can also impact your net earnings.

5. Can I find Nebraska paycheck calculators online for free?

Yes, there are several free Nebraska paycheck calculators available online. Websites like SmartAsset and ADP offer user-friendly calculators that allow you to input your financial information and receive an estimate of your take-home pay without any cost. These tools are accessible and can be beneficial for budgeting and financial planning.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.