Best Ohio Pay Calculator: Top 5 Tools Compared

Finding the Best Ohio Pay Calculator: An Introduction

When navigating the complexities of personal finance, one of the most daunting tasks for Ohio residents is calculating their take-home pay accurately. With multiple layers of taxation—including federal, state, and local taxes—understanding how much money you actually receive can be a challenge. This complexity is compounded by Ohio’s progressive income tax system and the existence of local income taxes in many municipalities, which can vary significantly. As a result, finding a reliable Ohio pay calculator becomes essential for both employees and employers alike.

The Goal of This Article

In this article, our aim is to review and rank the best Ohio pay calculators available online, allowing you to save time and effort in your search. We understand that not all calculators are created equal; some may provide a quick estimate while others offer in-depth breakdowns of deductions and withholdings. By highlighting the most effective tools, we hope to empower you with the knowledge needed to make informed financial decisions.

Criteria for Ranking

To ensure a comprehensive evaluation, we will use several key criteria in our ranking process. Accuracy is paramount; a calculator that produces erroneous results can lead to significant financial miscalculations. Ease of use is also critical; a user-friendly interface allows individuals to input their information quickly without confusion. Additionally, we will consider the features offered by each calculator, such as support for various pay frequencies, tax exemptions, and the ability to include pre-tax deductions. By focusing on these aspects, we aim to present a curated list of the best Ohio pay calculators that meet the diverse needs of users.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting the Best Ohio Pay Calculators

When selecting the top Ohio pay calculators, we evaluated several critical factors to ensure that users have access to reliable and efficient tools. Here’s a breakdown of the key criteria that guided our selection process:

-

Accuracy and Reliability

– It is essential that the calculators provide accurate estimates of take-home pay, accounting for federal, state, and local taxes. We assessed each tool’s methodology and cross-referenced their outputs with known tax rates and regulations in Ohio to ensure reliability. -

Ease of Use

– A user-friendly interface is crucial for any online calculator. We looked for tools that are straightforward to navigate, with clear instructions and minimal input requirements. The ability to quickly input information and receive results without unnecessary complexity is vital for a positive user experience. -

Key Features

– Effective calculators should offer a range of input options to cater to various employment situations. Important features we considered include:- Income Type: Options for both salaried and hourly wages.

- Tax Withholdings: Ability to input federal, state, and local tax rates.

- Deductions: Options to enter pre-tax and post-tax deductions, such as health insurance premiums and retirement contributions.

- Pay Frequency: Flexibility to calculate based on different pay periods (weekly, bi-weekly, monthly, etc.).

- Dependents and Allowances: Ability to enter personal information like marital status and number of dependents, which can affect tax withholding.

-

Cost (Free vs. Paid)

– We prioritized free tools that provide comprehensive functionality without hidden fees. While some paid services may offer more advanced features, our focus was on ensuring that users can access essential paycheck calculations without incurring costs. -

Mobile Compatibility

– In today’s digital age, many users access tools via mobile devices. We evaluated whether the calculators are optimized for mobile use, ensuring that users can calculate their pay on the go without sacrificing usability. -

Customer Support and Resources

– Good calculators should be backed by reliable customer support or additional resources. We looked for tools that offer FAQs, tutorials, or live assistance to help users navigate any uncertainties they might encounter while using the calculator. -

Reviews and User Feedback

– We considered user reviews and ratings to gauge overall satisfaction. Feedback from real users helped us identify which tools consistently meet expectations and provide accurate results.

By employing these criteria, we aimed to identify the best Ohio pay calculators that meet the diverse needs of users, from those seeking quick estimates to individuals needing detailed breakdowns of their paychecks.

The Best Ohio Pay Calculators of 2025

2. Ohio Paycheck Calculator

The Ohio Paycheck Calculator by ADP is a user-friendly tool designed to help both hourly and salaried employees estimate their net or “take home” pay. By simply inputting wages, tax withholdings, and other relevant factors, users can quickly gain insights into their earnings after deductions. This calculator is ideal for individuals looking to understand their paychecks better and plan their finances effectively.

- Website: adp.com

- Established: Approx. 34 years (domain registered in 1991)

3. Ohio Salary Paycheck Calculator

Gusto’s Ohio Salary Paycheck Calculator is a valuable tool designed to assist employers in accurately calculating employee paychecks. It enables users to determine withholdings and compute the take-home pay for hourly employees in Ohio. With its user-friendly interface, the calculator simplifies the payroll process, ensuring that businesses can efficiently manage payroll calculations while adhering to state regulations.

- Website: gusto.com

- Established: Approx. 30 years (domain registered in 1995)

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most critical steps to ensure accurate results when using an Ohio pay calculator is to meticulously double-check all the information you input. Pay attention to details such as your gross pay, pay frequency (hourly, weekly, bi-weekly, etc.), and any deductions. Even a small error, such as a misplaced decimal point or an incorrect pay frequency, can significantly affect your take-home pay calculation. It’s beneficial to have your most recent pay stub on hand to verify your figures, including any additional withholdings for things like retirement contributions or health insurance.

Understand the Underlying Assumptions

Each pay calculator operates based on specific tax laws and assumptions. Familiarize yourself with the tax brackets and rates applicable to Ohio, which may vary by income level and municipality. For instance, Ohio has a progressive income tax system with multiple brackets, and many cities impose their own local taxes. Understanding these nuances will help you interpret the results more accurately. Additionally, some calculators may not account for all possible deductions or credits, so consider this when assessing your results.

Use Multiple Tools for Comparison

To increase the reliability of your calculations, it’s wise to use multiple pay calculators. Different tools may utilize varying algorithms or tax parameters, which can lead to discrepancies in results. By comparing outputs from different calculators, you can identify a reasonable range for your take-home pay. This practice is particularly useful if you are considering a job change or need to budget for upcoming expenses. Remember to input the same data across all calculators to ensure consistency in your comparisons.

Stay Informed About Changes in Tax Laws

Tax laws and rates can change frequently, impacting your paycheck calculations. Regularly check for updates on Ohio’s tax rates, local taxes, and any changes to federal tax legislation that could affect your withholdings. Many calculators have an update schedule, but it’s a good habit to stay informed through reliable financial news sources or the Ohio Department of Taxation’s website.

Factor in Additional Income and Deductions

If you have other sources of income—such as bonuses, commissions, or freelance work—make sure to include these when calculating your total earnings. Additionally, consider any other deductions that may not be standard, such as student loan payments or charitable contributions. Including these factors can provide a more realistic picture of your financial situation.

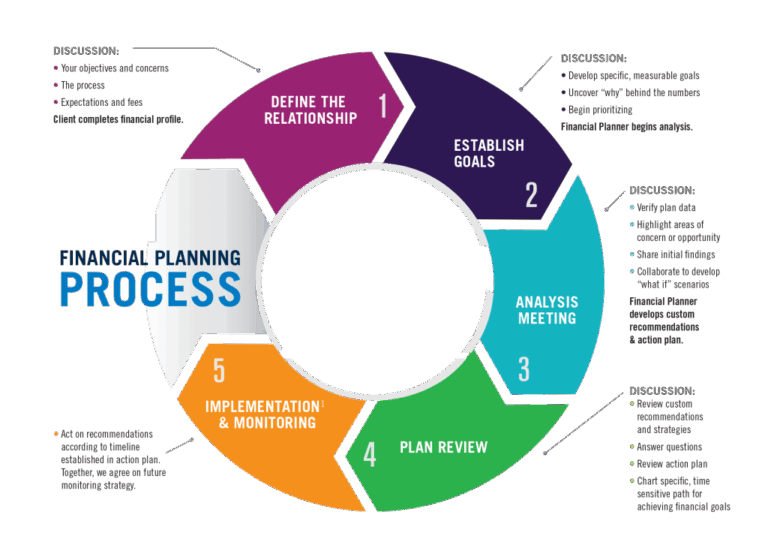

Consult a Professional if Needed

While online calculators are incredibly useful tools, they may not cover every unique situation or provide personalized advice. If you find yourself confused about your results or if your financial situation is complex, consider consulting with a financial advisor or tax professional. They can help clarify your specific circumstances and ensure that you are optimizing your tax withholdings and deductions effectively.

By following these guidelines, you can maximize the accuracy of your results when using Ohio pay calculators, leading to better financial planning and decision-making.

Frequently Asked Questions (FAQs)

1. What is an Ohio pay calculator?

An Ohio pay calculator is an online tool designed to help individuals estimate their take-home pay after accounting for various deductions such as federal, state, and local taxes. Users input details like their salary or hourly wage, tax withholdings, marital status, and any pre-tax deductions to receive an estimate of their net income per paycheck.

2. How do I use an Ohio pay calculator?

To use an Ohio pay calculator, follow these steps:

1. Navigate to a reliable paycheck calculator website, such as SmartAsset or ADP.

2. Enter your gross pay (salary or hourly wage).

3. Input your filing status (single, married, etc.) and any applicable deductions.

4. Specify your location, as local taxes can vary significantly.

5. Click on the “Calculate” button to see your estimated take-home pay along with a breakdown of deductions.

3. Are Ohio pay calculators accurate?

Ohio pay calculators provide estimates based on current tax rates and user inputs. While they are generally reliable for giving a rough idea of take-home pay, they may not account for every individual’s unique tax situation, such as specific deductions or credits. It is advisable to consult a tax professional for precise calculations or for complex financial situations.

4. What factors can affect my take-home pay in Ohio?

Several factors can influence your take-home pay, including:

– Gross Income: Higher salaries or wages lead to higher take-home pay, though they may also increase tax liabilities.

– Tax Withholdings: The amount withheld for federal, state, and local taxes will directly impact your net pay.

– Pre-Tax Deductions: Contributions to retirement accounts (like a 401(k)), health insurance premiums, and flexible spending accounts can lower your taxable income, thus increasing your take-home pay.

– Local Taxes: Many cities in Ohio impose their own income taxes, which can vary widely and affect your overall earnings.

5. Can I trust the results from an Ohio pay calculator?

While Ohio pay calculators are generally trustworthy for providing estimates, it is essential to remember that they are tools meant for guidance rather than definitive calculations. The accuracy of the results depends on the information you enter. Always verify your inputs and consider consulting a financial advisor or tax professional for personalized advice, especially if you have complicated tax situations or significant changes in income.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.