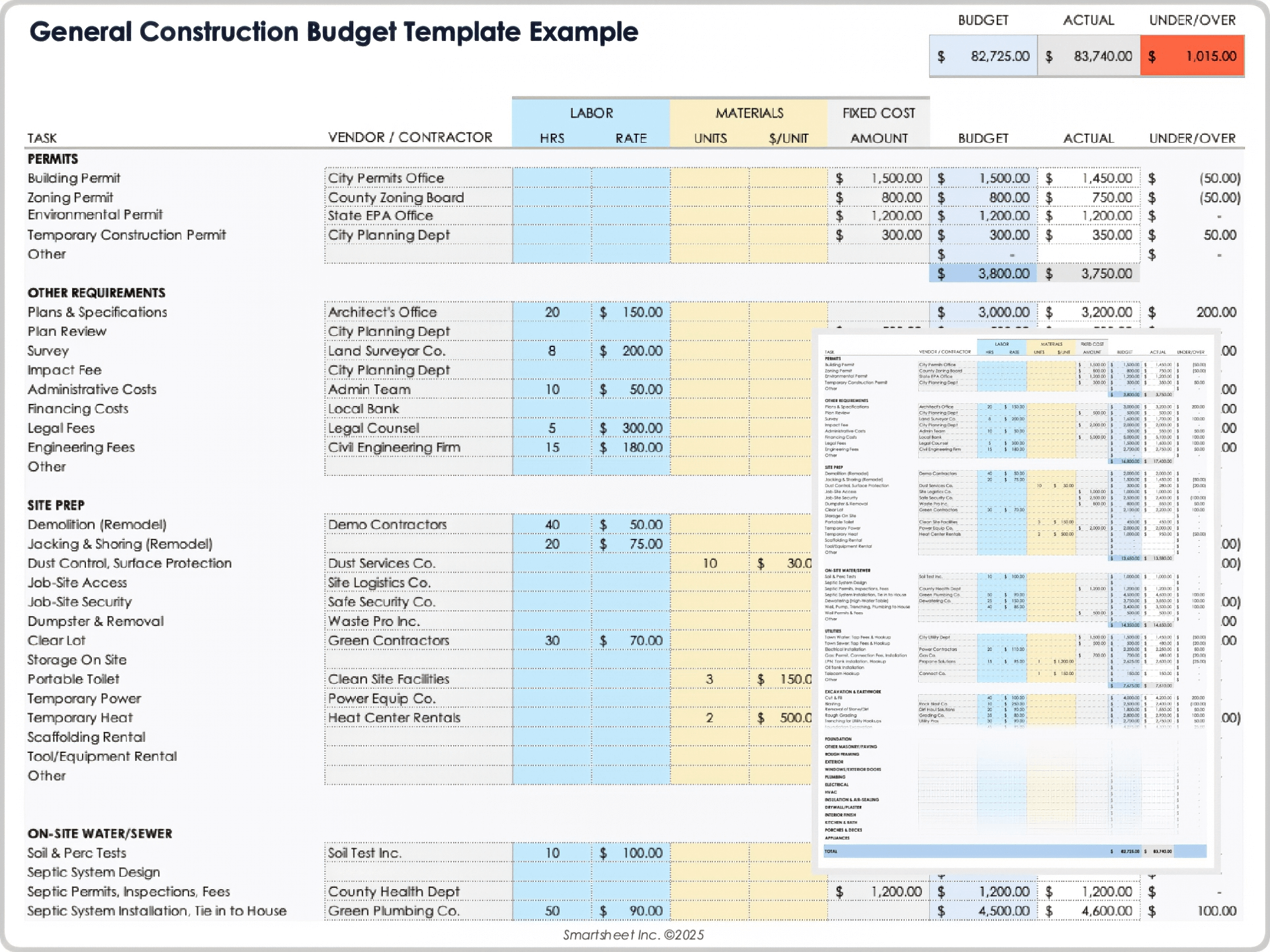

Best Pool Loan Calculator: Top 5 Tools Compared

Finding the Best Pool Loan Calculator: An Introduction

Finding a reliable pool loan calculator can be a daunting task for homeowners looking to finance their dream swimming pool. With countless options available online, many tools promise to simplify the loan calculation process, but not all deliver on their promises. A good pool loan calculator should provide accurate estimates, be user-friendly, and offer features that cater to various financing needs. However, many calculators fall short, either due to complex interfaces or a lack of essential functionalities, leading to confusion and frustration for users.

The goal of this article is to streamline your search by reviewing and ranking the top pool loan calculators available online. By compiling this list, we aim to save you time and effort, allowing you to focus on what truly matters—creating your ideal backyard oasis. Our rankings are based on several key criteria to ensure you have the best tools at your disposal.

Criteria for Ranking

-

Accuracy: We evaluate how precise the calculators are in estimating monthly payments based on varying loan amounts, interest rates, and terms.

-

Ease of Use: User experience is crucial; we assess how intuitive and straightforward each calculator is to navigate.

-

Features: We consider additional functionalities, such as the ability to compare different loan scenarios, access to financial resources, and customer support options.

-

Trustworthiness: We look for calculators provided by reputable lenders or financial institutions to ensure you’re getting reliable information.

By the end of this article, you’ll have a clear understanding of which pool loan calculators can best meet your financing needs, helping you make informed decisions on your investment in a swimming pool.

Our Criteria: How We Selected the Top Tools

When selecting the top pool loan calculators for our review, we considered several important criteria to ensure that users find reliable, user-friendly, and feature-rich tools. Below, we outline the key factors that guided our selection process.

1. Accuracy and Reliability

The primary function of a loan calculator is to provide accurate estimates of monthly payments based on user inputs. We evaluated each tool for its ability to deliver precise calculations, ensuring that users can trust the figures presented. This includes checking for realistic interest rates, loan terms, and repayment amounts that reflect current market conditions.

2. Ease of Use

User experience is crucial when it comes to online tools. We assessed how intuitive each calculator is for first-time users and those unfamiliar with loan calculations. The best calculators feature straightforward interfaces, allowing users to quickly input necessary data without confusion. Additionally, we looked for tools that provide clear instructions and tooltips to guide users through the calculation process.

3. Key Features

A comprehensive pool loan calculator should offer a variety of input options to accommodate different financing needs. We prioritized calculators that allow users to input:

– Loan Amount: The total amount of money needed for the pool project.

– Interest Rate: The annual percentage rate (APR) that will apply to the loan.

– Loan Term: The duration over which the loan will be repaid, typically ranging from a few years to several decades.

– Monthly Payment Estimation: The calculator should provide an immediate estimate of monthly payments based on the inputs.

– Additional Options: Some calculators also offer features such as tax implications, maintenance costs, and the ability to compare different loan scenarios.

4. Cost (Free vs. Paid)

While many calculators are offered for free, some tools may charge fees for additional features or personalized services. We examined the pricing structure of each calculator, ensuring that users can access essential functionalities without incurring unnecessary costs. Free tools with no hidden fees are particularly beneficial for users looking to explore their financing options without financial commitment.

5. Additional Resources

Beyond just the calculator functionality, we looked for tools that provide educational resources. This includes articles, FAQs, and guides on pool financing, which can help users make informed decisions. Access to such resources enhances the overall value of the calculator and supports users in understanding the broader context of their financing needs.

6. Customer Support

Lastly, we assessed the availability of customer support for each tool. Having access to help through chat, email, or phone can significantly enhance the user experience, especially for those who may have questions or need assistance while using the calculator.

By applying these criteria, we aimed to identify the best pool loan calculators that cater to a variety of user needs, ensuring that anyone looking to finance a pool can do so with confidence and ease.

The Best Pool Loan Calculators of 2025

1. Swimming Pool Loan Calculator

The Swimming Pool Loan Calculator by Lyon Financial offers a quick and straightforward way to estimate monthly payments for financing a swimming pool. With a user-friendly interface, this tool allows users to calculate payments in seconds, while providing access to low interest rates and flexible loan terms of up to 30 years. Established in 1979, Lyon Financial is a trusted resource for homeowners looking to enhance their outdoor spaces.

- Website: lyonfinancial.net

- Established: Approx. 26 years (domain registered in 1999)

2. Pool Loan Calculator

The Pool Loan Calculator from mypoolloan.com is a user-friendly tool designed to assist homeowners in estimating their financing options for pool installations. By allowing users to adjust variables such as loan amount, interest rate, and loan term, this calculator provides a clear breakdown of potential monthly payments. Its straightforward interface makes it easy to navigate, helping users make informed decisions about their pool loan options.

- Website: mypoolloan.com

- Established: Approx. 17 years (domain registered in 2008)

3. Pool Loan Calculator: See Your Monthly Pool Payments

The Pool Loan Calculator from NerdWallet is a practical tool designed to help users estimate their monthly payments and total interest costs for pool financing. By inputting the loan amount, interest rate, and repayment term, users can quickly assess the financial implications of their pool purchase. This calculator simplifies the budgeting process, making it easier for homeowners to plan their investments in a backyard oasis.

- Website: nerdwallet.com

- Established: Approx. 16 years (domain registered in 2009)

4. Pool Financing Loans

Credit Union West offers a user-friendly Amortizing Loan Calculator designed to assist individuals in determining their pool financing options. Users can input their desired monthly payment to calculate the corresponding loan amount or vice versa, making it a versatile tool for budgeting. This calculator simplifies the loan process, allowing potential borrowers to explore various financing scenarios effectively while planning for their new pool investment.

- Website: cuwest.org

- Established: Approx. 26 years (domain registered in 1999)

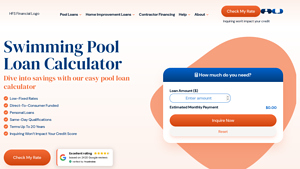

5. Swimming Pool Loan Calculator

The Swimming Pool Loan Calculator from HFS Financial is a user-friendly tool designed to assist potential pool owners in estimating their monthly payments and comparing various loan amounts. By providing clear insights into financing options, this calculator empowers users to make informed decisions about their pool investments, ensuring they choose a loan that best fits their financial situation and goals.

- Website: hfsfinancial.net

- Established: Approx. 14 years (domain registered in 2011)

How to Get the Most Accurate Results

Double-Check Your Inputs

When using a pool loan calculator, the accuracy of your results hinges on the inputs you provide. Start by ensuring that you enter the correct loan amount, interest rate, and loan term. Even a small error in any of these figures can significantly skew your estimated monthly payments. Take the time to review each input before hitting the calculate button. If you are unsure about the interest rate, consider checking current rates from various lenders to get a realistic figure.

Understand the Underlying Assumptions

Each calculator may operate based on specific assumptions, such as fixed interest rates or standard loan terms. Familiarize yourself with these assumptions as they can affect your calculations. For example, some calculators may not account for additional fees like closing costs or insurance, which can influence your overall financial commitment. Reading the calculator’s instructions or FAQs can provide insight into how the tool functions and what limitations it may have.

Use Multiple Tools for Comparison

To ensure that you are making the best financial decision, it’s wise to use more than one pool loan calculator. Different tools may offer varied features, inputs, and outputs. By comparing results from multiple calculators, you can gain a broader perspective on potential loan options and terms. This approach will help you identify any discrepancies and provide a more comprehensive view of what to expect in terms of monthly payments and total costs.

Experiment with Different Scenarios

Many calculators allow you to adjust parameters like loan amount, interest rate, and term length. Use this feature to run various scenarios. For instance, try calculating the monthly payment for different loan amounts or interest rates to see how these changes impact your payment. This exercise can help you find the most affordable option that fits your budget while also illustrating how longer loan terms may reduce monthly payments but increase total interest paid over time.

Factor in Additional Costs

While the calculator gives you a good estimate of monthly payments, remember to factor in ongoing costs associated with pool ownership. Maintenance, insurance, and utilities can add up quickly and should be considered in your overall budget. Some calculators may offer additional tools to estimate these costs, so take advantage of them for a more holistic view of your financial commitment.

Consult with Financial Experts

If you are still uncertain after using the calculators, consider reaching out to a financial advisor or loan consultant. They can help clarify your options and provide personalized advice based on your financial situation. This step can be invaluable, especially if you’re looking to secure a loan for a significant investment like a swimming pool.

Frequently Asked Questions (FAQs)

1. What is a pool loan calculator?

A pool loan calculator is an online tool designed to help users estimate their monthly payments for financing a swimming pool. By entering the loan amount, interest rate, and loan term, you can quickly see how these factors affect your monthly payment. This tool is particularly useful for budgeting and planning your pool installation or renovation project.

2. How do I use a pool loan calculator?

To use a pool loan calculator, simply input the following details:

– Loan Amount: The total amount you plan to borrow for your pool project.

– Interest Rate: The percentage rate of interest that will be applied to your loan.

– Loan Term: The duration over which you plan to repay the loan, typically measured in years.

After entering these values, the calculator will provide you with an estimated monthly payment, helping you understand what you can afford.

3. What factors should I consider when using a pool loan calculator?

When using a pool loan calculator, consider the following factors:

– Interest Rates: These can vary based on your credit score and market conditions, which will directly impact your monthly payment.

– Loan Terms: Shorter loan terms usually have higher monthly payments but lower total interest costs, while longer terms have lower payments but may result in paying more interest over time.

– Additional Costs: Remember to factor in ongoing costs associated with pool maintenance, insurance, and potential increases in utility bills when budgeting for your pool.

4. Can I get pre-approved for a pool loan using the calculator?

While a pool loan calculator itself does not provide pre-approval, many lenders allow you to check your eligibility and get pre-qualified after using the calculator. Pre-approval generally involves a more detailed review of your financial situation, including your credit history, income, and existing debts. It’s a good idea to consult with lenders after estimating your payments to explore your financing options further.

5. Is my personal information safe when using a pool loan calculator?

Most reputable pool loan calculators prioritize user privacy and security. They typically use encryption and secure connections to protect your data. However, it’s essential to read the privacy policy of the website to understand how your information will be used and whether it will be shared with third parties. Always ensure that you are using a trusted and secure platform when entering personal information.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.