Best Real Estate Capital Gains Tax Calculator: Top 5 Tools Compared

Finding the Best Real Estate Capital Gains Tax Calculator: An Introduction

Navigating the complexities of real estate capital gains tax can be a daunting task for property owners and investors alike. The intricacies of tax laws, varying rates based on the length of ownership, and the impact of additional deductions can create confusion. With numerous calculators available online, finding a reliable and user-friendly real estate capital gains tax calculator becomes essential. However, not all tools are created equal, and selecting the right one can significantly affect your financial planning.

This article aims to simplify your search by reviewing and ranking the top online real estate capital gains tax calculators. Our goal is to save you time and effort by providing a curated list of the best tools available. Each calculator will be evaluated based on several key criteria, ensuring that you have access to the most effective resources.

Criteria for Ranking

- Accuracy: The calculator must provide reliable estimates based on current tax laws, ensuring that users can trust the results.

- Ease of Use: A user-friendly interface is crucial. The ideal calculator should be straightforward, allowing users to input their data with minimal hassle.

- Features: Additional functionalities, such as the ability to account for local taxes, different ownership lengths, and investment scenarios, can enhance the utility of the calculator.

- Accessibility: The tool should be easily accessible on various devices, ensuring users can calculate their potential tax liabilities whenever needed.

By the end of this article, you will be equipped with the knowledge to choose the best real estate capital gains tax calculator that suits your needs, enabling you to make informed decisions regarding your property investments.

Our Criteria: How We Selected the Top Tools

Accuracy and Reliability

One of the most critical factors in selecting a real estate capital gains tax calculator is its accuracy and reliability. The tool must provide precise calculations based on the latest tax laws and rates, ensuring that users can trust the results. We prioritized calculators that are regularly updated to reflect current tax regulations, as well as those that use reliable data sources to compute potential tax liabilities.

Ease of Use

A user-friendly interface is essential for any online tool, especially for those who may not have a strong background in finance or tax law. We assessed each calculator for its intuitive design, straightforward navigation, and clear instructions. Tools that require minimal input from users while still delivering accurate outputs scored higher in our evaluation.

Key Features

The best calculators offer a range of features that cater to various user needs. We looked for tools that allow users to input essential variables, such as:

– Initial Purchase Price: The price at which the property was acquired.

– Sale Price: The anticipated selling price of the property.

– Length of Ownership: Options for both short-term and long-term ownership.

– Location: Tax implications can vary significantly by state or locality, so calculators that factor in state-specific tax rates were favored.

– Filing Status and Income Level: These parameters can influence the tax rate applied, making it important for calculators to accommodate them.

Cost (Free vs. Paid)

We considered the cost of using each tool, evaluating both free and paid options. Free calculators are often sufficient for basic calculations, while paid tools may offer advanced features such as comprehensive tax planning and personalized advice. We aimed to include a variety of tools, ensuring that users can find an option that fits their budget without sacrificing functionality.

Customer Support and Resources

A good calculator should not only provide calculations but also offer additional resources for users seeking more information on capital gains tax. We prioritized tools that include educational materials, FAQs, and customer support options, enabling users to make informed decisions regarding their real estate transactions.

User Reviews and Reputation

Finally, we analyzed user reviews and the overall reputation of each calculator. Tools that have received positive feedback from users and have established credibility in the financial community were given precedence. User testimonials can provide insight into the effectiveness and reliability of the calculators, enhancing our selection process.

By evaluating these criteria, we aimed to present a list of the most effective and trustworthy real estate capital gains tax calculators available online, catering to the needs of our diverse audience.

The Best Real Estate Capital Gains Tax Calculators of 2025

2. Capital Gain Tax Calculator

The Capital Gain Tax Calculator by Asset Preservation, Inc. is designed to help users accurately calculate their taxable gains while strategically leveraging IRC Section 1031 to potentially defer taxes. This tool simplifies the process of determining capital gains, making it easier for investors to navigate tax implications associated with asset sales. Its user-friendly interface and focus on tax optimization make it a valuable resource for anyone looking to preserve their investment profits.

- Website: apiexchange.com

- Established: Approx. 27 years (domain registered in 1998)

3. Real Estate Capital Gains Calculator

The Real Estate Capital Gains Calculator by Bangerter Financial Strategies is an interactive tool designed to help users estimate their potential returns on real estate investments. By inputting relevant data, users can quickly assess the impact of various investment scenarios on their capital gains, enabling informed financial decisions. This user-friendly calculator is ideal for both novice and experienced investors looking to maximize their investment strategies.

- Website: bangerterfinancial.com

- Established: Approx. 14 years (domain registered in 2011)

4. Capital Gains Tax Calculator (2025)

NerdWallet’s Capital Gains Tax Calculator for 2025 is a user-friendly tool designed to help investors estimate their tax liabilities on profitable investment sales. By inputting relevant details about their transactions, users can quickly calculate potential capital gains taxes, enabling better financial planning and informed decision-making. This calculator is particularly useful for those looking to understand their tax obligations ahead of time, ensuring they are prepared for future financial outcomes.

- Website: nerdwallet.com

- Established: Approx. 16 years (domain registered in 2009)

5. Capital Gains Tax Calculator

The Capital Gains Tax Calculator from 1031 Crowdfunding is a valuable tool designed for real estate investors seeking to calculate potential tax liabilities. It provides accurate estimates based on various scenarios, including short-term and long-term capital gains, as well as 1031 exchange implications. This user-friendly calculator simplifies the often complex process of tax planning, helping users make informed financial decisions regarding their real estate investments.

- Website: 1031crowdfunding.com

- Established: Approx. 11 years (domain registered in 2014)

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most crucial steps to obtaining accurate results from a real estate capital gains tax calculator is to ensure that all your inputs are correct. Before you hit “calculate,” take a moment to review the data you’ve entered, including your purchase price, sale price, length of ownership, and any relevant deductions or exemptions. Small errors in these figures can lead to significant discrepancies in your estimated tax liability. Consider using a spreadsheet to organize your financial details, which can help you visualize the numbers and confirm their accuracy.

Understand the Underlying Assumptions

Each calculator may operate under specific assumptions regarding tax rates, exemptions, and your filing status. Familiarize yourself with these assumptions to better interpret the results. For example, some calculators may not account for state-specific tax rates or may use outdated federal tax brackets. Understanding these limitations will allow you to make informed decisions based on the calculator’s output. Additionally, consult the calculator’s help section or FAQs to clarify any uncertainties about how it computes taxes.

Use Multiple Tools for Comparison

To ensure the reliability of your results, consider using more than one real estate capital gains tax calculator. Different tools may provide varied estimates based on their algorithms and data inputs. By comparing results from multiple calculators, you can identify any outliers or discrepancies and gain a more rounded perspective on your potential tax liability. This approach can also help you cross-verify your inputs and assumptions, leading to a more accurate overall picture.

Keep Updated on Tax Laws

Tax laws can change frequently, and calculators may not always reflect the latest regulations. Stay informed about any recent changes to capital gains tax rates, deductions, or exemptions by consulting official IRS resources or financial news outlets. When using a calculator, ensure that it is updated to reflect the current tax year and any relevant legal changes. This diligence will help you avoid unpleasant surprises during tax season.

Consult a Tax Professional

While online calculators can be incredibly useful, they cannot replace personalized financial advice. If you find yourself in a complex tax situation—such as owning multiple properties or dealing with significant capital gains—consider consulting a tax professional. They can provide tailored guidance based on your unique financial situation and help you strategize ways to minimize your tax liability effectively.

Document Your Findings

Finally, keep a record of the calculations and assumptions you used in your estimations. This documentation can be invaluable when preparing your tax return or if you need to explain your calculations to a tax advisor or the IRS. By maintaining clear records, you not only strengthen your understanding of your tax situation but also create a reference for future transactions.

Frequently Asked Questions (FAQs)

1. What is a real estate capital gains tax calculator?

A real estate capital gains tax calculator is an online tool that helps property owners estimate the taxes they may owe when selling their real estate. By inputting specific information such as the purchase price, sale price, length of ownership, and applicable tax rates, users can determine their potential capital gains tax liability. This tool is particularly useful for planning and understanding the financial implications of selling real estate investments.

2. How do I use a real estate capital gains tax calculator?

To use a real estate capital gains tax calculator, follow these general steps:

1. Input Purchase and Sale Prices: Enter the original purchase price of the property and the expected sale price.

2. Specify Length of Ownership: Indicate how long you have owned the property, as this affects whether the gain is classified as short-term or long-term.

3. Provide Tax Information: Enter your income level and filing status to determine applicable federal and state tax rates.

4. Calculate: Click the calculate button to receive an estimate of your capital gains tax liability based on the data provided.

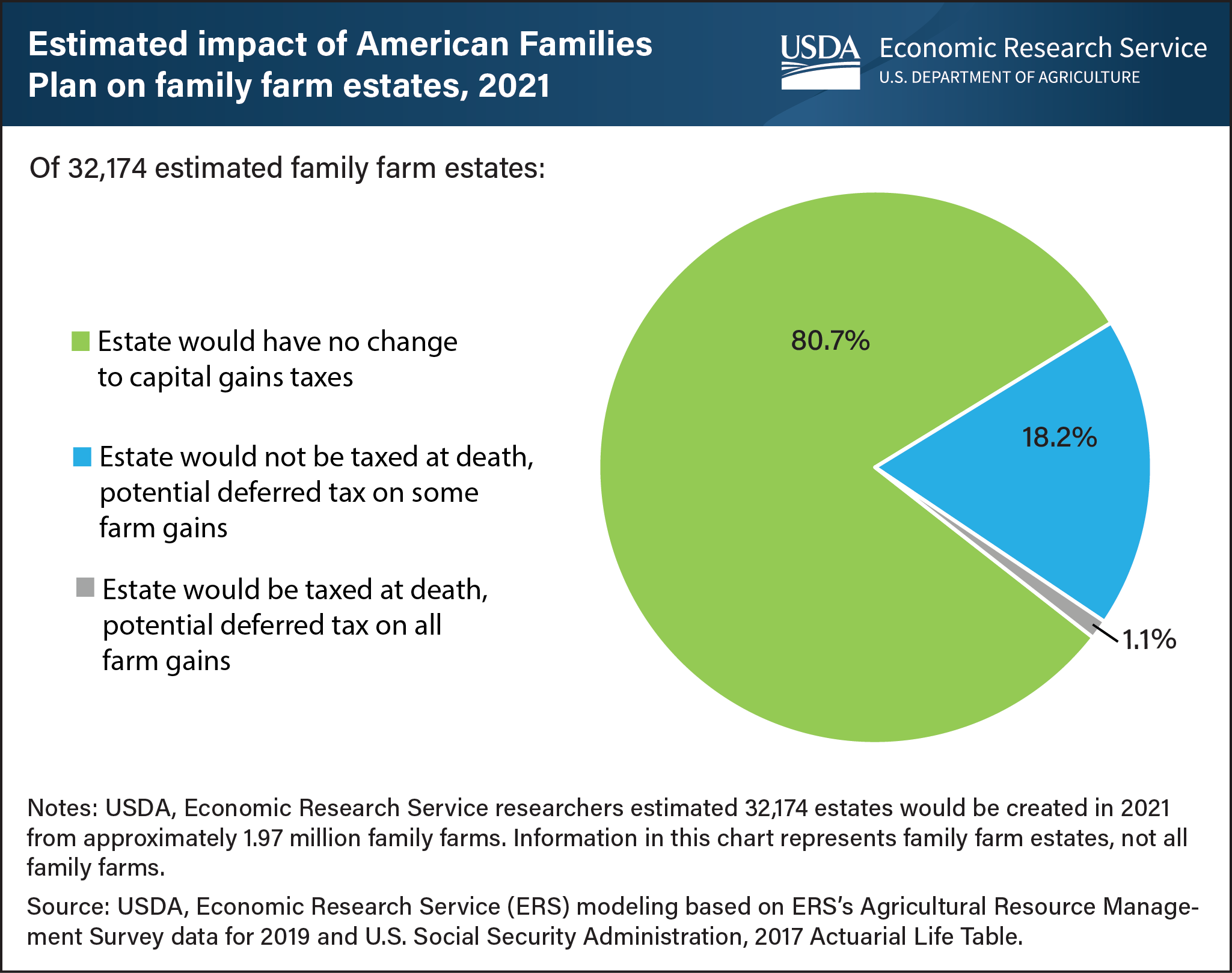

3. Why is it important to calculate capital gains tax before selling real estate?

Calculating capital gains tax before selling real estate is important for several reasons:

– Financial Planning: Understanding potential tax liabilities allows sellers to better plan their finances and investment strategies.

– Budgeting for Expenses: Knowing the tax implications can help sellers budget for the costs associated with the sale, ensuring they are not caught off guard by unexpected tax bills.

– Investment Decisions: The calculator can help assess whether it is more beneficial to hold the property longer to qualify for lower long-term capital gains rates, which can significantly reduce tax liabilities.

4. What factors can affect my capital gains tax liability when selling real estate?

Several factors can influence your capital gains tax liability, including:

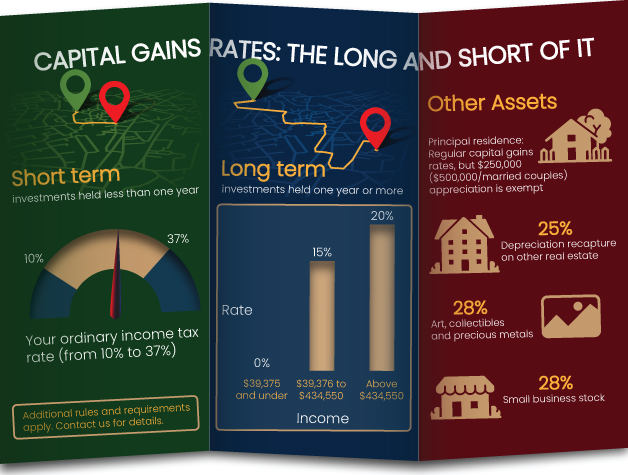

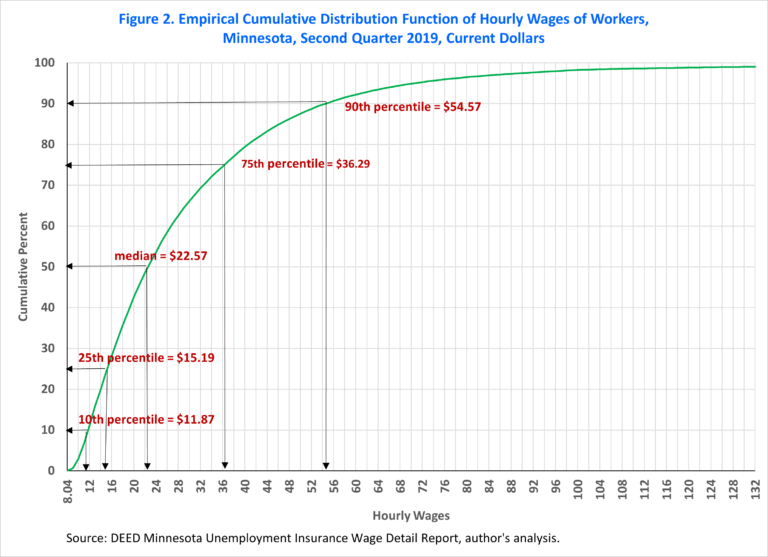

– Length of Ownership: Properties held for more than one year qualify for lower long-term capital gains rates, while those held for less than a year are taxed at higher short-term rates.

– Purchase Price and Sale Price: The difference between what you paid for the property and what you sell it for directly impacts your capital gains.

– Tax Bracket: Your overall income determines your tax bracket, which affects the rate at which your capital gains are taxed.

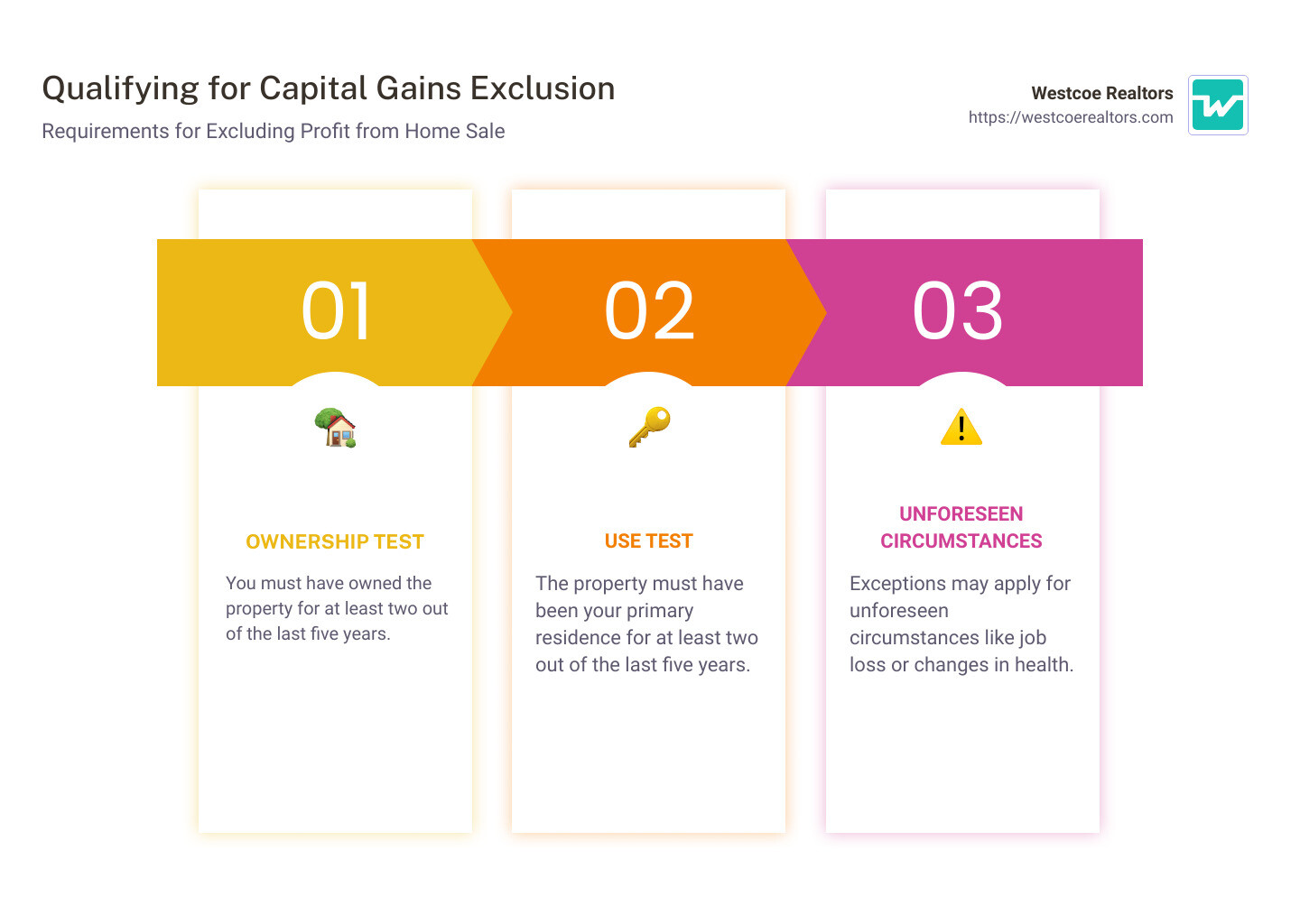

– Deductions and Exemptions: Certain deductions, such as selling costs or home improvements, can reduce your taxable gain. Additionally, primary residence exclusions may apply if you meet specific criteria.

5. Can I lower my capital gains tax using a calculator?

While a real estate capital gains tax calculator itself does not lower your tax liability, it can provide valuable insights that help you make informed decisions to potentially reduce your taxes. For example, by analyzing the results, you might decide to:

– Hold the Property Longer: If the calculator indicates that waiting to sell could lower your tax rate, you may choose to delay the sale.

– Offset Gains with Losses: You can use the calculator to evaluate if selling other investments at a loss could offset your capital gains.

– Utilize Tax-Advantaged Accounts: The calculator can help you understand if your investments could be better placed in tax-advantaged accounts like IRAs, which may defer taxes on gains.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.