Best S Corp Tax Calculator: Top 5 Tools Compared

Finding the Best S Corp Tax Calculator: An Introduction

When it comes to managing the finances of an S Corporation, understanding the potential tax implications can be a daunting task for business owners. The complexity of tax laws, coupled with the specific requirements for S Corps, makes finding a reliable S Corp tax calculator essential yet challenging. With numerous online tools available, it can be overwhelming to determine which calculator will provide accurate estimates and meaningful insights tailored to your unique financial situation.

This article aims to simplify that process by reviewing and ranking the top S Corp tax calculators available online. Our goal is to save you time and help you make informed decisions regarding your business’s tax strategy. Whether you are considering converting to an S Corp or simply want to explore potential tax savings, having the right calculator at your fingertips can make all the difference.

To ensure a thorough evaluation, we have established specific criteria for ranking these tools. We will assess their accuracy in calculations, ease of use, and the features they offer. Accuracy is paramount; the calculators must provide reliable estimates that reflect current tax laws. Ease of use refers to the user interface and how intuitively users can navigate the tool without requiring extensive tax knowledge. Lastly, we will look at the features offered, such as the ability to input various scenarios, detailed breakdowns of tax savings, and additional resources that can further assist users in understanding their S Corp tax obligations.

By the end of this article, you will have a clear understanding of which S Corp tax calculators stand out from the rest, allowing you to choose the best tool for your needs.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting the Best S Corp Tax Calculators

When reviewing online S Corp tax calculators, we focused on several key criteria to ensure that our recommendations would provide the most value to users. Here’s how we evaluated each tool:

-

Accuracy and Reliability

– Precision of Calculations: We examined whether the calculators provided accurate estimates of potential tax savings based on user inputs. This is crucial, as incorrect calculations can lead to misguided financial decisions.

– Up-to-Date Information: The tools must reflect the latest tax laws and regulations pertaining to S Corporations. We prioritized calculators that were updated regularly to align with current IRS guidelines. -

Ease of Use

– User Interface: A straightforward, intuitive interface is essential for users who may not have a strong background in tax matters. We looked for calculators that allow users to navigate easily without overwhelming them with jargon.

– Guidance and Instructions: Tools that offer clear instructions or tips on how to use the calculator effectively were favored. This includes tooltips or FAQs that explain terms and processes related to S Corp taxation. -

Key Features

– Essential Inputs: We assessed the range of inputs required by each calculator. A good S Corp tax calculator should allow users to enter:- Estimated yearly net income

- Reasonable salary to be paid to the owner

- Business expenses

- Current self-employment tax liabilities

- Output Breakdown: The calculators should not only provide a total savings estimate but also offer a detailed breakdown of how the savings were calculated, including potential payroll tax savings and the impact of business expenses.

-

Cost (Free vs. Paid)

– Accessibility: We considered whether the calculator is free to use or if there are costs associated with it. Tools that provide significant functionality without requiring payment were prioritized, but we also evaluated the value of paid options where they offer additional features or professional support.

– Transparency of Fees: For paid tools, we examined how clearly they communicate any fees or costs associated with their services, including any hidden charges for using advanced features. -

Additional Support Resources

– Educational Content: We favored calculators that provide supplementary information, such as articles, guides, or links to professional tax advisors. This additional content helps users understand the implications of their calculations and make informed decisions about their S Corp status.

By applying these criteria, we aimed to identify the top S Corp tax calculators that not only deliver accurate financial insights but also enhance user experience, making tax planning more manageable for business owners.

The Best S Corp Tax Calculators of 2025

1. S Corp Tax Savings Calculator – How Much Could Your …

The S Corp Tax Savings Calculator from Gusto is a valuable tool for entrepreneurs considering the S corporation structure for their business. It helps users assess potential payroll tax savings by comparing their current business entity with the S corp option. This calculator provides a straightforward way to evaluate whether forming an S corp aligns with their financial goals, making it easier to make informed decisions about business structure.

- Website: gusto.com

- Established: Approx. 30 years (domain registered in 1995)

3. S Corp Tax Calculator

The S Corp Tax Calculator from Student Loan Planner is a valuable tool designed for business owners evaluating the tax advantages of electing S Corporation status versus remaining a sole proprietor. It provides estimates that help users determine potential tax savings, making it easier to make informed financial decisions. This calculator is particularly beneficial for entrepreneurs looking to optimize their tax strategies and maximize their earnings.

- Website: studentloanplanner.com

- Established: Approx. 9 years (domain registered in 2016)

4. S Corporation Tax Calculator: Estimate Your Tax Savings

The S Corporation Tax Calculator by Bizee is a valuable tool designed to help business owners estimate their potential tax savings from forming an S Corporation. By inputting relevant financial data, users can understand how this business structure can effectively reduce their tax liabilities and enhance overall profitability. With its user-friendly interface, the calculator simplifies the process of financial planning for entrepreneurs considering the S Corp option.

- Website: bizee.com

- Established: Approx. 24 years (domain registered in 2001)

5. Self Employed S Corp Tax Calculator

The Self Employed S Corp Tax Calculator from Huddleston Tax CPAs is designed to help users evaluate potential tax savings by transitioning from a sole proprietorship to an S corporation. This intuitive tool allows individuals to input their financial data and quickly assess the impact of this change on their self-employment tax obligations, making it a valuable resource for self-employed professionals seeking to optimize their tax strategy.

- Website: huddlestontaxcpas.com

- Established: Approx. 16 years (domain registered in 2009)

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most critical steps in obtaining accurate results from an S Corp tax calculator is ensuring that all input values are correct. Take the time to review and confirm your yearly net income, reasonable salary, business expenses, and any other relevant figures. Small errors in data entry can lead to significant discrepancies in your tax calculations. Additionally, ensure that you’re using the correct definitions for terms like “reasonable salary,” as this can vary based on your industry and role.

Understand the Underlying Assumptions

Each S Corp tax calculator may operate under different assumptions regarding tax rates, business expenses, and filing requirements. Familiarize yourself with these assumptions, as they can significantly impact the outcome. For instance, some calculators may not factor in certain deductions or may apply average tax rates rather than your specific situation. By understanding these assumptions, you can better interpret the results and make more informed decisions.

Use Multiple Tools for Comparison

To ensure you’re getting the most accurate and comprehensive understanding of your potential tax savings, consider using multiple S Corp tax calculators. Different tools may employ varying methodologies or algorithms, leading to slightly different results. By comparing outputs from several calculators, you can identify trends and gain a more holistic view of your potential tax benefits. This approach also helps you pinpoint any outliers that may indicate an error in your data or a miscalculation in one of the tools.

Consult with a Tax Professional

While online calculators are excellent for providing preliminary insights, they are not a substitute for professional advice. Tax laws can be complex and subject to change, and a certified public accountant (CPA) or tax advisor can help you navigate these nuances. They can also assist you in ensuring that you are compliant with IRS regulations regarding reasonable salary and other S Corp requirements. By consulting with a professional, you can validate your calculator results and receive personalized guidance tailored to your unique financial situation.

Keep Up with Tax Law Changes

Tax laws, especially those concerning S Corporations, can change frequently. Staying informed about recent developments in tax legislation will help you understand the context of your calculator results. Subscribe to relevant tax news outlets, follow IRS updates, or engage in forums and communities where tax professionals discuss changes. Being aware of these updates allows you to adjust your inputs and expectations accordingly, ensuring that your calculations remain relevant and accurate.

Review Your Results Regularly

Finally, tax situations can change over time due to various factors like changes in income, business expenses, or even shifts in tax law. Make it a habit to revisit your S Corp tax calculator results periodically, especially before tax season. By keeping your calculations up to date, you can make more informed decisions about your business structure and tax strategy, optimizing your potential savings year after year.

Frequently Asked Questions (FAQs)

1. What is an S Corp tax calculator, and how does it work?

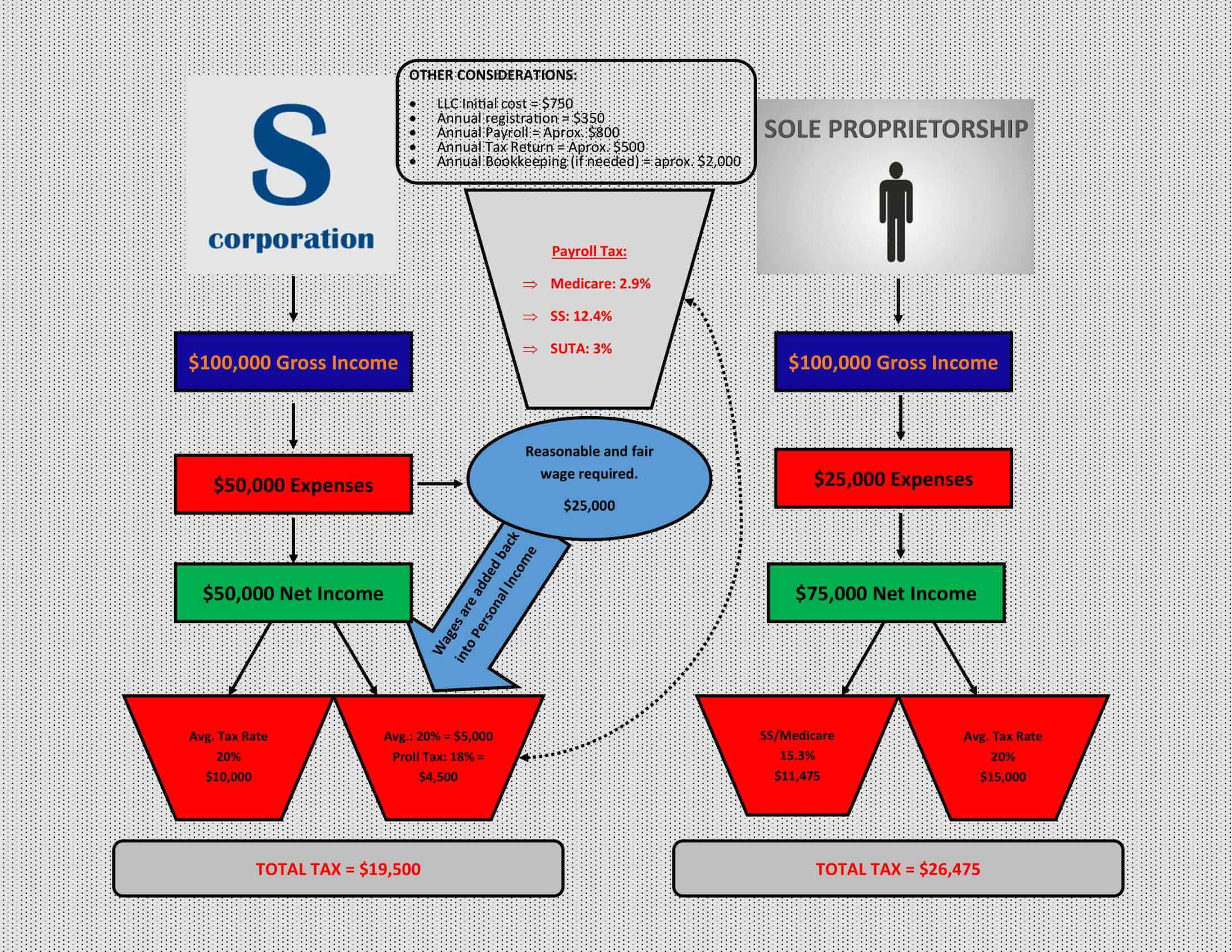

An S Corp tax calculator is an online tool designed to help business owners estimate their potential tax savings by electing S Corporation status. Users typically input their annual revenue, business expenses, and a reasonable salary they would pay themselves. The calculator then compares the estimated self-employment taxes of a sole proprietor with those of an S Corp, providing insights into potential tax savings and overall financial benefits.

2. Who should consider using an S Corp tax calculator?

Business owners, particularly those operating as sole proprietors or single-member LLCs, should consider using an S Corp tax calculator if they are exploring the benefits of converting their business to an S Corporation. It’s especially useful for those with annual net profits of at least $40,000, as the tax benefits become more pronounced at this income level. Additionally, anyone wanting to understand the impact of their salary decisions on overall tax liability can benefit from this tool.

3. What factors are considered in the calculations?

The primary factors considered in an S Corp tax calculator include:

– Annual Net Income: This is the revenue generated minus business expenses.

– Reasonable Salary: The amount the business owner plans to pay themselves, which affects payroll taxes.

– Self-Employment Tax Rates: The calculator takes into account current self-employment tax rates to determine the tax burden for both sole proprietorships and S Corps.

– Additional Costs: It may also factor in costs associated with maintaining an S Corp, such as payroll processing fees and state incorporation fees.

4. Are there any drawbacks to using an S Corp tax calculator?

While an S Corp tax calculator can provide valuable insights, it has limitations. The results are based on the information provided and may not account for all individual circumstances or tax nuances. Additionally, the calculator does not replace professional advice from tax advisors or accountants. It’s important for users to consult with a tax professional to discuss their specific situation and ensure they understand the implications of electing S Corp status.

5. How accurate are the results from an S Corp tax calculator?

The accuracy of results from an S Corp tax calculator largely depends on the quality of the tool and the accuracy of the inputs provided by the user. Most calculators are designed to give a general estimate based on standard tax rules and rates. However, since tax laws can vary by state and individual circumstances, users should treat the results as estimates and seek professional advice for precise tax planning and decision-making.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.