Best Tariff Calculator: Top 5 Tools Compared

Finding the Best Tariff Calculator: An Introduction

Finding a reliable tariff calculator can be a daunting task, especially for small business owners and importers navigating the complexities of international trade. With constantly changing tariffs and trade policies, having access to an accurate and user-friendly tool is essential for making informed decisions. Whether you’re looking to calculate duties on imported goods, assess potential costs, or determine how tariffs impact your profit margins, the right calculator can save you both time and money.

This article aims to review and rank the top tariff calculators available online, providing you with a comprehensive overview of the best tools to streamline your tariff management process. Our goal is to equip you with the information you need to choose a calculator that suits your specific requirements, allowing you to focus on growing your business rather than getting bogged down by calculations.

Criteria for Ranking

In selecting the top tariff calculators, we evaluated several key criteria to ensure that our recommendations are both practical and effective:

-

Accuracy: The reliability of the tariff rates and calculations provided by the tool is paramount. We considered how frequently the calculators are updated to reflect the latest changes in tariffs and trade policies.

-

Ease of Use: A user-friendly interface is crucial for quickly obtaining results. We assessed how intuitive each tool is, including the clarity of instructions and the simplicity of the input process.

-

Features: We looked at the additional functionalities offered by each calculator, such as the ability to compare costs across different countries, calculate total landed costs, and provide insights into profit margins.

By focusing on these criteria, we aim to help you find a tariff calculator that not only meets your needs but also enhances your overall importing experience. Let’s dive into our rankings of the best tariff calculators available today.

Our Criteria: How We Selected the Top Tools

Key Criteria for Selecting the Best Tariff Calculators

When evaluating the top tariff calculators available online, we established a set of criteria to ensure that the selected tools meet the diverse needs of users, from small business owners to trade compliance professionals. Here are the key factors we considered:

-

Accuracy and Reliability

– The primary function of a tariff calculator is to provide accurate duty rates and tariff calculations. We focused on tools that pull data from official sources, such as the Harmonized Tariff Schedule (HTSUS) and government announcements, ensuring that users receive up-to-date and precise information. -

Ease of Use

– A user-friendly interface is essential for any online tool. We prioritized calculators that are intuitive and easy to navigate, allowing users to input their data without confusion. A clear layout and straightforward instructions contribute significantly to the overall user experience. -

Key Features

– The best tariff calculators should offer essential functionalities that cater to various user needs. Key features we looked for include:- Input Options: Ability to enter purchase costs, shipping fees, quantities, and specific tariff rates.

- Comparison Tools: Options to compare tariffs across different countries or scenarios to help users make informed sourcing decisions.

- Detailed Cost Breakdown: A clear summary of total landed costs, including product costs, duties, and additional fees, to provide a comprehensive financial overview.

- Historical Data and Updates: Access to historical tariff data and timely updates on changes in tariffs or trade policies.

-

Cost (Free vs. Paid)

– We assessed the pricing models of each tool, favoring those that offer free access while still delivering robust features. While some advanced tools may charge a fee, we ensured that free options provide sufficient functionality for most users, especially small businesses navigating tariff impacts. -

Customization and Flexibility

– A good tariff calculator should allow users to customize inputs based on their specific situations. We looked for tools that enable users to apply different tariff rates, shipping methods, and product categories to see how these variables affect overall costs.

-

Support and Resources

– Comprehensive support resources, such as FAQs, guides, and customer service options, enhance the usability of a tariff calculator. We considered tools that provide educational materials to help users understand tariffs better and navigate any complexities that arise during the calculation process. -

Reputation and User Feedback

– Finally, we reviewed user testimonials and expert evaluations to gauge the reliability and effectiveness of each tool. Tools with positive feedback from a broad user base were prioritized, ensuring that our recommendations are grounded in real-world performance.

By adhering to these criteria, we aimed to identify the most effective and user-friendly tariff calculators available online, empowering users to navigate the complexities of international trade with confidence.

The Best Tariff Calculators of 2025

1. Tariff Simulator

Flexport’s Tariff Simulator is a free tool designed to help users accurately estimate U.S. Customs charges for various commodities. This user-friendly app provides detailed insights into import duties and tariffs, allowing businesses and individuals to calculate costs associated with importing goods. With its comprehensive database, the simulator ensures that users can navigate the complexities of customs fees efficiently, making it an invaluable resource for importers.

- Website: tariffs.flexport.com

- Established: Approx. 12 years (domain registered in 2013)

2. U.S. Tariff Calculator 2025

The U.S. Tariff Calculator 2025 from NerdWallet is a valuable online tool designed to help users assess the financial implications of tariffs on imported goods. By inputting specific product details, users can calculate how tariffs affect their overall costs, profit margins, and sales prices. This intuitive calculator is essential for businesses and individuals looking to navigate the complexities of international trade and pricing strategies effectively.

- Website: nerdwallet.com

- Established: Approx. 16 years (domain registered in 2009)

3. 2025 US Tariff Calculator

The 2025 US Tariff Calculator from TimeTrex is a user-friendly tool designed to help users easily estimate import tariffs on goods. By selecting the country of origin and entering the price of the items, users can quickly calculate the associated tariff costs. This efficient calculator simplifies the process of understanding import expenses, making it a valuable resource for businesses and individuals involved in international trade.

- Website: timetrex.com

- Established: Approx. 21 years (domain registered in 2004)

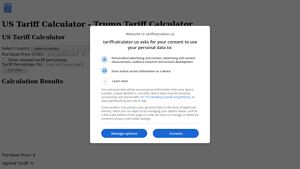

5. US Tariff Calculator

The US Tariff Calculator, also known as the Trump Tariff Calculator, is a user-friendly online tool designed to help businesses and individuals estimate tariffs on imported goods from various countries. It provides a comprehensive list of tariff rates, with notable examples including a 125% tariff on imports from China, Hong Kong, and Macau. This tool is essential for anyone looking to navigate the complexities of U.S. trade tariffs effectively.

- Website: tariffcalculator.us

- Established: Approx. 0 years (domain registered in 2025)

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most critical steps to ensure accurate results when using tariff calculators is to double-check your inputs. Before hitting the calculate button, take a moment to review all the details you’ve entered, including product costs, shipping expenses, quantities, and tariff rates. Even minor errors in data entry can lead to significant discrepancies in the output. For instance, mistakenly entering an incorrect tariff percentage can drastically alter your expected costs. Make sure to use official documentation to gather accurate figures, such as the Harmonized Tariff Schedule for your product’s HTS code.

Understand the Underlying Assumptions

Each tariff calculator operates based on specific assumptions and methodologies. Familiarize yourself with how the tool calculates tariffs, including which costs are included in the customs value. Many calculators consider the product cost, shipping fees, and additional costs like insurance. Understanding these assumptions can help you gauge the accuracy of the results. Additionally, some calculators may not account for certain fees or charges, such as the Merchandise Processing Fee or the Harbor Maintenance Fee. Knowing these nuances allows you to better interpret the results and make informed decisions.

Use Multiple Tools for Comparison

No single tariff calculator is infallible. To get a more comprehensive view of your potential costs, consider using multiple tools. Different calculators may have varying algorithms or data sources, which can yield different results. By comparing outputs from several calculators, you can identify any significant discrepancies and gain a clearer understanding of your potential tariff obligations. This approach also helps you uncover any additional costs or considerations that one tool may not have accounted for.

Stay Updated on Tariff Changes

Tariff rates can frequently change due to evolving trade policies and regulations. To ensure that you are working with the most current information, regularly check for updates from reliable sources such as government websites or trade organizations. Many calculators are updated periodically, but it’s your responsibility to verify that you are using the latest rates. If you find that your calculator hasn’t been updated recently, cross-reference with the Harmonized Tariff Schedule or consult a customs broker for the most accurate rates.

Consider the Broader Context

When evaluating the output from a tariff calculator, it’s essential to consider the broader context of your import strategy. Tariffs are just one piece of the puzzle; factors such as market demand, competition, and supplier relationships can also significantly impact your business. Use the insights gained from the calculator to inform not just pricing strategies but also sourcing decisions, negotiation tactics, and overall business planning. This holistic view will help you make more informed choices that extend beyond mere calculations.

Frequently Asked Questions (FAQs)

1. What is a tariff calculator and how does it work?

A tariff calculator is an online tool designed to help users estimate the import duties and taxes applicable to goods brought into a country. It typically requires inputs such as product cost, shipping expenses, the country of origin, and the applicable tariff rate. Once this information is entered, the calculator provides an estimate of the total tariffs owed, breaking down costs per unit and overall landed costs, which include product costs, shipping, and duties.

2. How do I find the correct tariff rate for my product?

To find the correct tariff rate, you can refer to the Harmonized Tariff Schedule (HTS) of the United States or your country’s equivalent. This schedule categorizes products and lists the applicable tariff rates based on their classification codes. Many tariff calculators also offer features that allow users to input their product’s HTS code to automatically retrieve the relevant tariff rate.

3. Can a tariff calculator help me assess the financial impact of tariffs on my business?

Yes, a tariff calculator can be an invaluable tool for assessing the financial impact of tariffs on your business. By inputting various parameters such as product cost, shipping fees, and desired profit margins, you can see how tariffs will affect your overall costs and pricing strategy. Many calculators will provide insights on whether you need to adjust your pricing or sourcing strategy to maintain profitability.

4. Are there any additional fees I should consider when calculating landed costs?

Yes, in addition to tariffs, there are other fees that may apply to your imports. These can include the Merchandise Processing Fee (MPF), which is a percentage of the customs value, and the Harbor Maintenance Fee (HMF) for sea shipments. It’s important to factor these additional costs into your calculations for a comprehensive understanding of your total landed costs.

5. Is using a tariff calculator free, and do I need to create an account to use it?

Most tariff calculators are free to use and do not require users to create an account. This accessibility allows users to quickly estimate tariffs without the need for sign-up or subscription fees. However, some advanced calculators may offer premium features or require registration for more detailed analyses or historical data. Always check the specific terms of use for the calculator you are using.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.