Best Wells Mortgage Calculator: Top 5 Tools Compared

Finding the Best Wells Mortgage Calculator: An Introduction

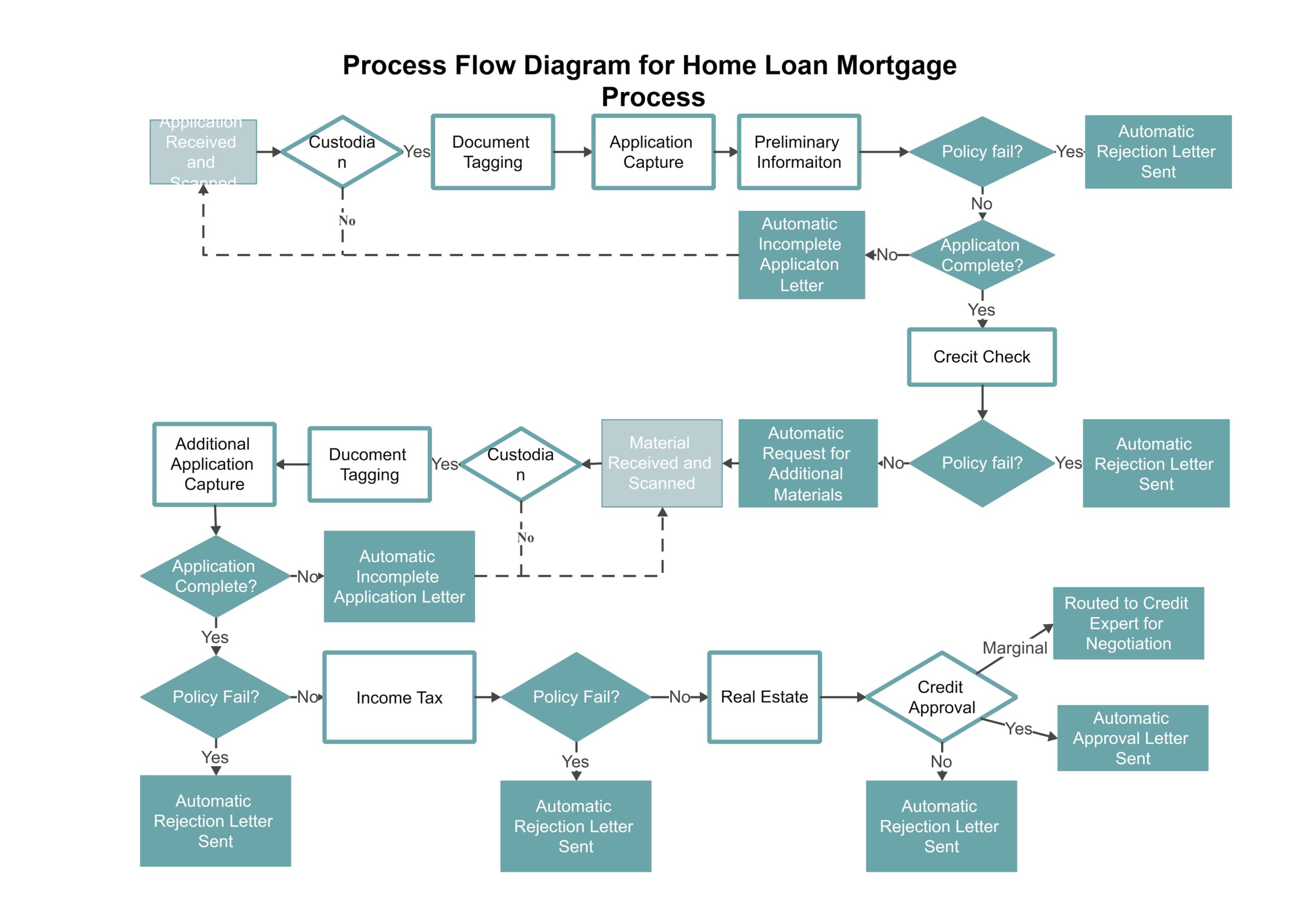

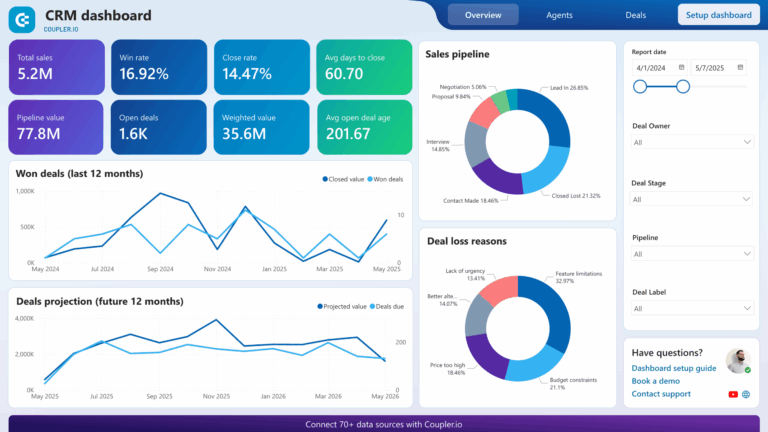

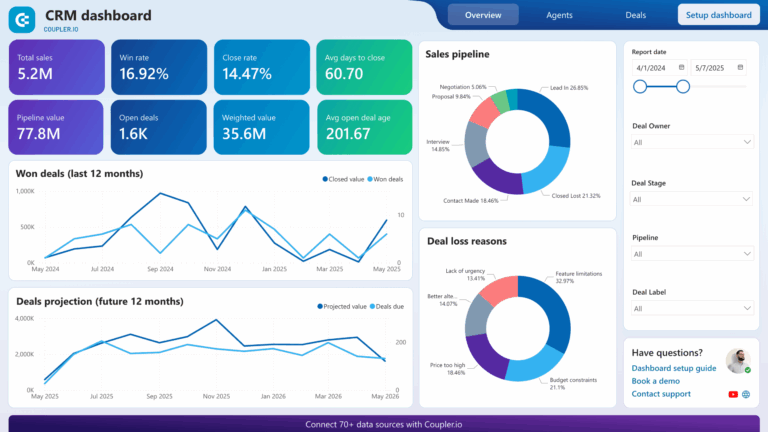

When navigating the complex world of home financing, finding a reliable mortgage calculator can be a daunting task. With countless options available online, it can be challenging to determine which tools provide accurate estimates and user-friendly experiences. A good Wells mortgage calculator should not only help you understand your potential monthly payments but also factor in various elements like down payments, interest rates, and your unique financial situation. This is crucial for making informed decisions as you embark on your home-buying journey.

The goal of this article is to streamline your search by reviewing and ranking the top Wells mortgage calculators currently available online. By focusing on the best tools, we aim to save you time and effort while ensuring you have access to the most effective resources for your mortgage planning needs.

To create our rankings, we evaluated several key criteria that are essential for a top-notch mortgage calculator. Accuracy is paramount; the tools must provide reliable estimates based on the most current interest rates and mortgage guidelines. Ease of use is also crucial, as the best calculators should be intuitive and require minimal input for maximum output. Additionally, we considered the features offered by each calculator, such as the ability to compare different loan scenarios, calculate refinancing options, and access additional resources for homebuyers.

In the sections that follow, we will delve into the specifics of each recommended Wells mortgage calculator, providing you with the insights needed to choose the tool that best meets your financial needs.

Our Criteria: How We Selected the Top Tools

Key Criteria for Selecting the Best Wells Mortgage Calculators

When evaluating the top online mortgage calculators specifically for Wells Fargo, we considered several important criteria to ensure that users can find tools that meet their needs effectively. Below are the key factors that guided our selection process:

-

Accuracy and Reliability

The primary function of a mortgage calculator is to provide accurate estimates of monthly payments, borrowing capacity, and other financial metrics. We prioritized tools that are backed by reliable data and algorithms, ensuring that users can trust the results they obtain. Calculators that utilize up-to-date interest rates and current market conditions were favored. -

Ease of Use

A user-friendly interface is crucial for any online tool. We selected calculators that are intuitive and straightforward, allowing users to input their information quickly without confusion. Features such as clear instructions, accessible design, and a logical flow of information contribute to a better user experience. -

Key Features

The most effective mortgage calculators offer a range of features that cater to diverse user needs. We looked for tools that include:

– Borrowing Power Calculator: Helps users determine how much they can borrow based on their income, debt, and credit history.

– Home Affordability Calculator: Estimates the price range of homes users can afford based on their financial situation.

– Refinance Savings Calculator: Assists users in evaluating potential savings from refinancing their existing mortgage.

– Cash-Out Refinance Calculator: Provides insights into how much equity users can access through a cash-out refinance. -

Cost (Free vs. Paid)

We focused on identifying calculators that are free to use, as this is a significant advantage for most homebuyers. While some premium tools may offer advanced features, the best calculators in our selection are those that provide essential functions without any cost, making them accessible to a broader audience.

-

Educational Resources

The best tools also provide educational content that enhances users’ understanding of the mortgage process. We considered calculators that are accompanied by helpful articles, guides, and FAQs that clarify mortgage-related concepts, enabling users to make informed decisions. -

Mobile Compatibility

In today’s digital age, many users access tools via smartphones and tablets. We selected calculators that are mobile-friendly, ensuring users can easily calculate their mortgage estimates on the go. -

Customer Support

Availability of customer support can enhance the overall experience. We preferred calculators from platforms that offer robust customer service options, including FAQs, live chat, or contact information for additional assistance.

By adhering to these criteria, we aimed to curate a list of the best Wells Fargo mortgage calculators that will assist users in navigating their home financing options effectively.

The Best Wells Mortgage Calculators of 2025

1. Mortgage Calculators

Wells Fargo’s Mortgage Calculators are designed to help potential homebuyers estimate their home purchase budget and monthly mortgage payments. By inputting key financial details such as income, monthly debt, down payment, and location, users can gain insights into what they can afford. This tool simplifies the mortgage planning process, enabling informed financial decisions and a clearer understanding of homeownership costs.

- Website: wellsfargo.com

- Established: Approx. 32 years (domain registered in 1993)

3. Wells Fargo Mortgage Calculator of August 2025

The Wells Fargo Mortgage Calculator from Finanso is a user-friendly tool designed to help users estimate their mortgage payments as of August 2025. It allows individuals to calculate essential figures such as monthly payments, loan amounts, and interest rates, enabling prospective homeowners to make informed financial decisions. With its straightforward interface, the calculator simplifies the mortgage planning process, making it accessible for anyone looking to navigate their financing options.

- Website: finanso.com

- Established: Approx. 18 years (domain registered in 2007)

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most critical steps to obtaining accurate results from a Wells mortgage calculator is to ensure that all your inputs are correct. Carefully enter your financial information, including your income, monthly debts, down payment amount, and the estimated price of the home. A small error in any of these figures can lead to significant discrepancies in the results. Take the time to review each entry before hitting the calculate button to avoid unnecessary confusion later.

Understand the Underlying Assumptions

Each mortgage calculator operates based on certain assumptions, such as interest rates, loan terms, and the types of costs included in your monthly payments. Familiarize yourself with these assumptions to better interpret the results. For example, some calculators may not include property taxes or insurance in their estimates, while others do. Understanding what is and isn’t included can help you gauge the accuracy of the results and plan your budget more effectively.

Use Multiple Tools for Comparison

While Wells mortgage calculators can provide valuable insights, it’s wise to use multiple calculators from different platforms. This allows you to compare results and see how varying inputs can influence your mortgage estimates. Different calculators may employ slightly different algorithms or assumptions, which can lead to different outcomes. By cross-referencing results, you can gain a more comprehensive view of your potential mortgage costs and make more informed decisions.

Consider Current Market Conditions

Mortgage rates can fluctuate based on market conditions, so it’s essential to use the most up-to-date information when calculating your potential mortgage. Check current interest rates and economic indicators before using the calculator. Many calculators, including those from Wells Fargo, allow you to adjust the interest rate based on your credit score and market trends. Being aware of the latest rates can help you get a more realistic estimate of your monthly payments.

Take Advantage of Prequalification

For a more precise estimate, consider taking advantage of prequalification options offered by Wells Fargo. This process involves a soft credit inquiry, which provides a more accurate assessment of what you can afford based on your credit history and financial situation. Prequalification not only gives you a clearer picture of your borrowing power but also helps streamline your home search, ensuring you focus on properties within your budget.

Review Additional Costs

Finally, remember that your mortgage payment may include more than just principal and interest. Other costs such as property taxes, homeowner’s insurance, and possibly private mortgage insurance (PMI) can significantly impact your monthly payment. Use the calculator to estimate these additional expenses, and be sure to account for them in your overall budget. Understanding the full scope of your financial obligations will lead to more accurate results and better financial planning.

Frequently Asked Questions (FAQs)

1. What types of calculations can I perform with the Wells mortgage calculator?

You can perform various calculations with the Wells mortgage calculator, including estimating how much you can borrow, determining your home affordability, calculating potential monthly payments, and evaluating refinance savings. Each calculator is designed to help you understand different aspects of your mortgage options and financial situation.

2. Do I need to create an account to use the Wells mortgage calculator?

No, you do not need to create an account to use the Wells mortgage calculator. The calculators are accessible online and can be used without any registration. Simply visit the Wells Fargo mortgage calculator page, input your information, and get instant results.

3. Will using the Wells mortgage calculator affect my credit score?

No, using the Wells mortgage calculator will not affect your credit score. The calculators perform soft inquiries, which do not impact your credit rating. This allows you to explore your mortgage options without any financial repercussions.

4. How accurate are the estimates provided by the Wells mortgage calculator?

The estimates provided by the Wells mortgage calculator are based on the information you input, such as income, debts, and down payment. While the calculations are designed to give you a good approximation of your mortgage options, the actual figures may vary based on your complete financial profile and current market conditions. For more accurate results, consider getting prequalified through Wells Fargo.

5. Can I use the Wells mortgage calculator for refinancing options?

Yes, the Wells mortgage calculator includes specific tools for evaluating refinancing options. You can compare your current mortgage payments with potential new payments to see how much you could save by refinancing at today’s rates. This feature helps you make informed decisions about whether refinancing is a suitable option for your financial situation.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.