Free Arm Mortgage Calculators: Our Top 5 Picks for 2025

Finding the Best Arm Mortgage Calculator: An Introduction

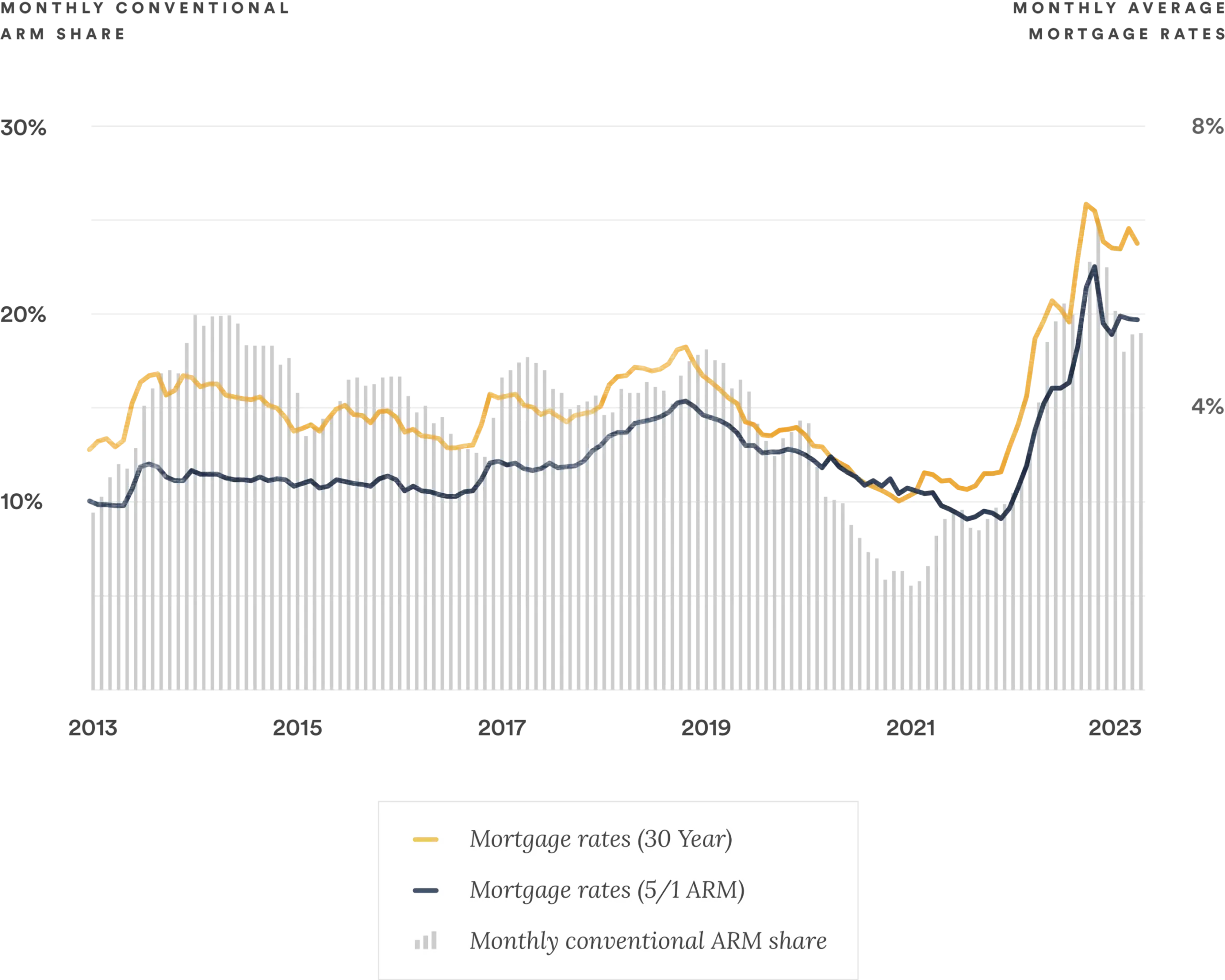

Finding the right adjustable-rate mortgage (ARM) calculator can be a daunting task, especially with the plethora of options available online. With so many tools claiming to provide accurate calculations and projections, it’s essential to discern which ones truly deliver reliable results. An effective ARM mortgage calculator should not only help you estimate your monthly payments but also offer insights into the potential fluctuations in your payment over time. Given the complexities of adjustable-rate mortgages—where interest rates can vary significantly—having a trustworthy calculator becomes crucial in making informed financial decisions.

The goal of this article is to simplify your search by reviewing and ranking the top ARM mortgage calculators available online. We aim to save you time and effort by highlighting the tools that stand out in terms of functionality and user experience.

Criteria for Ranking

In selecting the best calculators, we evaluated several key criteria:

- Accuracy: The precision of calculations is paramount. We ensured that the tools provide reliable estimates based on current market conditions and realistic assumptions.

- Ease of Use: A user-friendly interface is essential for a seamless experience. The calculators should be straightforward to navigate, allowing users to input their data without confusion.

- Features: Additional functionalities, such as the ability to factor in taxes, insurance, and closing costs, enhance the utility of these calculators. We considered tools that offer comprehensive features to provide a complete picture of mortgage costs.

- Educational Resources: We also looked for calculators that provide educational content, helping users understand the intricacies of ARMs and making informed choices.

By focusing on these criteria, we aim to guide you toward the best ARM mortgage calculators that meet your needs effectively.

Our Criteria: How We Selected the Top Tools

How We Selected the Top Tools

When it comes to selecting the best adjustable-rate mortgage (ARM) calculators, we focused on several essential criteria to ensure that each tool offers value, accuracy, and a user-friendly experience. Here’s a breakdown of the key factors that guided our selection process:

-

Accuracy and Reliability

– The primary function of any mortgage calculator is to provide accurate estimations of monthly payments based on user inputs. We evaluated tools that are backed by reputable financial institutions or have a proven track record of accuracy. This includes cross-referencing results with industry standards to ensure that the calculations reflect current market conditions. -

Ease of Use

– A good calculator should be intuitive and easy to navigate. We prioritized tools with a clear layout, straightforward instructions, and minimal jargon. The design should facilitate a seamless user experience, allowing users to quickly input their data and receive results without confusion. -

Key Features

– Effective ARM calculators should include a range of input options to tailor the calculations to individual circumstances. Key features we considered include:- Loan Amount: The total amount of the mortgage.

- Initial Interest Rate: The starting interest rate for the adjustable-rate period.

- Adjustment Period: The length of time before the first rate adjustment (e.g., 5 years).

- Rate Adjustment Frequency: How often the interest rate will adjust after the initial period.

- Lifetime Cap: The maximum interest rate increase allowed over the life of the loan.

- Property Taxes and Insurance: Options to include estimated property taxes and homeowner’s insurance for a comprehensive monthly payment estimate.

-

Cost (Free vs. Paid)

– We evaluated whether the calculators were free to use or required a subscription or one-time fee. Free tools were favored, but we also considered the value offered by paid calculators, particularly if they provided advanced features or personalized advice that could benefit users in the long run. -

Additional Resources and Educational Content

– A good ARM calculator should not only provide numerical results but also offer educational content to help users understand adjustable-rate mortgages better. We looked for tools that include explanations of ARM terms, pros and cons of ARMs versus fixed-rate mortgages, and guidance on how to interpret the results. -

Mobile Compatibility

– In today’s digital age, mobile compatibility is crucial. We selected tools that are optimized for mobile devices, ensuring users can easily access and use the calculators on smartphones or tablets.

By focusing on these criteria, we aimed to identify the most effective and user-friendly ARM mortgage calculators available online, ensuring that our recommendations meet the needs of a diverse audience seeking to understand and plan for their adjustable-rate mortgage options.

The Best Arm Mortgage Calculators of 2025

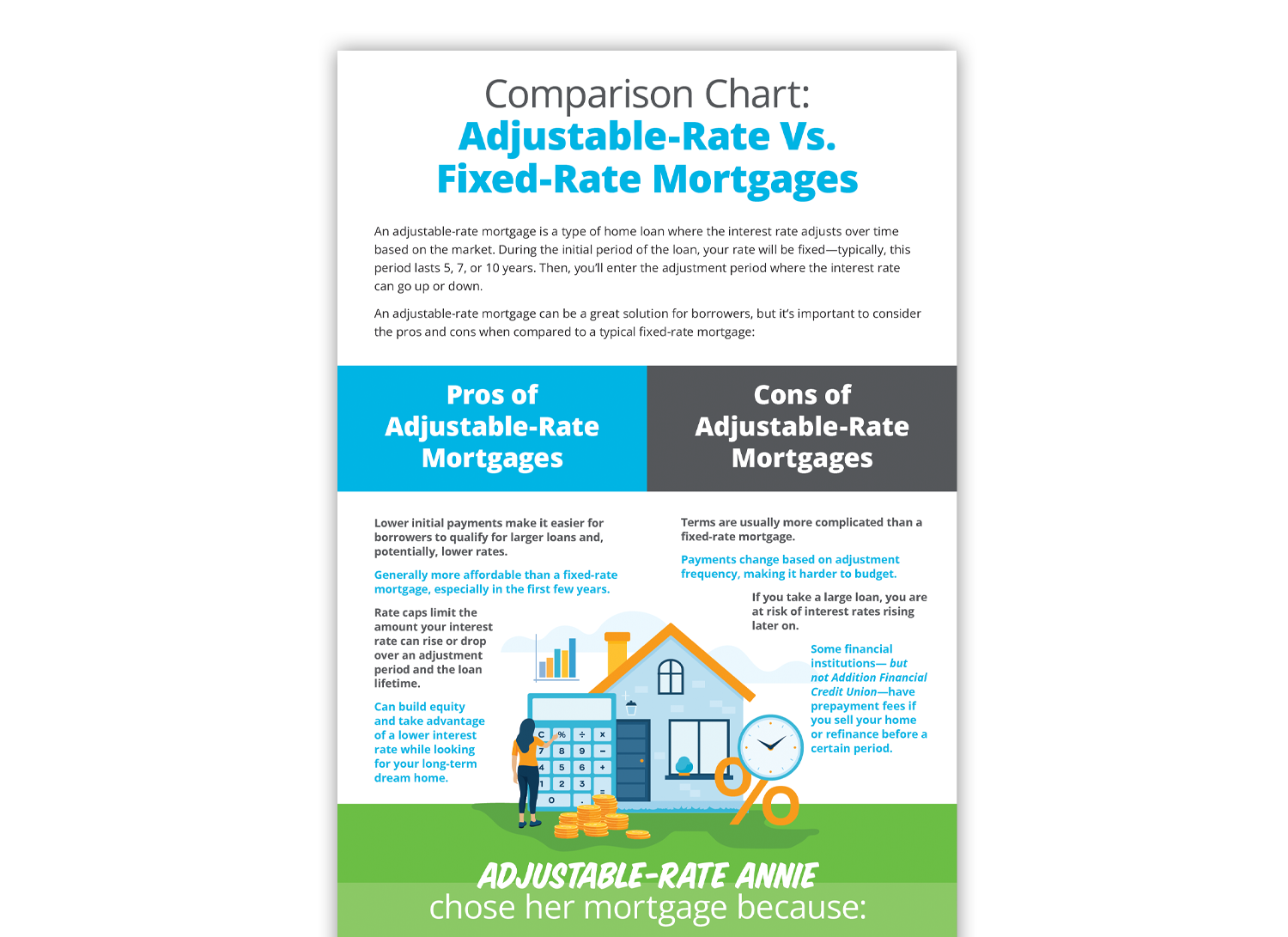

1. Adjustable Rate Mortgage Calculator

The Adjustable Rate Mortgage Calculator from Bank of Bartlett is designed to help users estimate their monthly payments on a fully amortizing adjustable-rate mortgage (ARM). This tool calculates payments necessary to pay off the entire mortgage balance over time, providing valuable insights for potential borrowers. Its user-friendly interface allows for easy input of loan details, making it a practical resource for those considering an ARM.

- Website: bankofbartlett.com

- Established: Approx. 28 years (domain registered in 1997)

3. Adjustable Rate Mortgage (ARM) Calculator

The Adjustable Rate Mortgage (ARM) Calculator from U.S. Bank is a user-friendly tool designed to help potential borrowers estimate their monthly payments for an ARM loan. By inputting key financial details, users can gain insights into how interest rate fluctuations may impact their payments over time. This calculator serves as a valuable resource for individuals considering an ARM, enabling them to make informed financial decisions.

- Website: usbank.com

- Established: Approx. 30 years (domain registered in 1995)

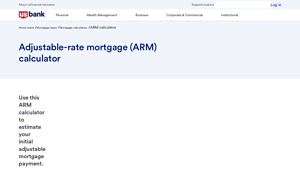

4. Traditional & Hybrid ARM Calculator: Adjustable Rate Home Loan …

The Traditional & Hybrid ARM Calculator from MortgageCalculator.org is designed to assist users in estimating their monthly payments for adjustable-rate home loans. This tool allows potential borrowers to calculate expected payments both during the initial fixed-rate period and after the rate adjustments take effect. With its user-friendly interface, the calculator provides valuable insights into the financial implications of choosing a variable-rate mortgage, helping users make informed decisions.

- Website: mortgagecalculator.org

- Established: Approx. 21 years (domain registered in 2004)

5. Adjustable

The Adjustable-Rate Mortgage Calculator from Freddie Mac is a user-friendly tool designed to help potential homeowners estimate their monthly payments based on varying interest rates associated with adjustable-rate mortgages. This calculator allows users to input different interest scenarios, providing a clear understanding of how fluctuations in rates can impact overall payment amounts, making it an essential resource for informed mortgage planning.

- Website: myhome.freddiemac.com

- Established: Approx. 30 years (domain registered in 1995)

How to Get the Most Accurate Results

Double-Check Your Inputs

When using an adjustable-rate mortgage (ARM) calculator, the accuracy of your results hinges significantly on the information you input. Be meticulous when entering your data, including the loan amount, interest rates, and adjustment periods. A small error in these figures can lead to a drastic difference in your estimated monthly payments. Before finalizing your inputs, review each field to ensure that all values are correct and reflect your current financial situation. This step is crucial for obtaining reliable estimates that will guide your decision-making process.

Understand the Underlying Assumptions

ARM calculators often make certain assumptions about your loan that can impact the outcome of your calculations. For example, they may assume a fixed-rate period of a specific length, or they might use certain standard indices to predict how interest rates will change over time. Familiarize yourself with these assumptions, as they can affect your projected payments and total interest costs. Additionally, many calculators do not account for factors such as property taxes, insurance, or private mortgage insurance (PMI), which can significantly influence your overall monthly payment. Knowing what is included and what is not will help you interpret the results accurately.

Use Multiple Tools for Comparison

No single calculator can provide a complete picture of your potential mortgage costs. To get the most accurate results, consider using several different ARM calculators. Each tool may use slightly different algorithms or assumptions, which can yield varied results. By comparing outputs from multiple calculators, you can better understand the range of possible payments and identify any discrepancies. This practice not only enhances your confidence in the numbers but also equips you with valuable insights into how different scenarios might play out.

Keep Current Market Conditions in Mind

Interest rates fluctuate frequently, and the rates used in calculators may not always reflect the most current market conditions. Before using an ARM calculator, check current rates from reliable sources, such as banks or financial news websites. Inputting up-to-date rates into the calculator will yield more relevant estimates. Additionally, consider the broader economic context, including potential future rate adjustments, as this can significantly impact your ARM payments over the life of the loan.

Consult with a Financial Professional

While online calculators can provide a helpful starting point, they are not a substitute for professional financial advice. If you have specific questions about your financial situation or the implications of an ARM, consider consulting with a mortgage advisor or financial planner. They can provide personalized insights based on your circumstances, helping you make informed decisions about your mortgage options.

Frequently Asked Questions (FAQs)

1. What is an ARM mortgage calculator and how does it work?

An ARM mortgage calculator is an online tool designed to help potential homebuyers estimate their monthly payments for an adjustable-rate mortgage (ARM). It takes into account the initial interest rate, the loan amount, the loan term, and the frequency of interest rate adjustments. By inputting these variables, users can see projected payments during the fixed-rate period and after adjustments occur, which can aid in financial planning.

2. Why should I use an ARM mortgage calculator?

Using an ARM mortgage calculator allows you to gain a clearer understanding of what your future mortgage payments might look like. Since ARMs can have fluctuating rates, this tool helps estimate how changes in interest rates can impact your monthly payments and total loan costs over time. It’s particularly useful for comparing different loan options and deciding whether an ARM is the right choice for your financial situation.

3. What factors can I input into an ARM mortgage calculator?

Most ARM mortgage calculators allow you to input several key factors, including:

– Loan Amount: The total amount you plan to borrow.

– Initial Interest Rate: The starting interest rate for the fixed period.

– Loan Term: The length of the mortgage, typically 30 years.

– Adjustment Periods: The frequency and amount of interest rate adjustments after the initial period.

– Lifetime Caps: Limits on how much the interest rate can increase over the life of the loan.

These inputs help generate a more accurate projection of your potential mortgage payments.

4. Are the results from an ARM mortgage calculator guaranteed to be accurate?

While ARM mortgage calculators provide estimates based on the information you input, the results are not guaranteed to be accurate. They are based on assumptions about interest rates and market conditions that can change over time. It’s essential to use these calculators as a guideline rather than a definitive answer and to consult with a mortgage professional for personalized advice tailored to your financial situation.

5. Can an ARM mortgage calculator help me compare ARMs to fixed-rate mortgages?

Yes, an ARM mortgage calculator can be a valuable tool for comparing adjustable-rate mortgages to fixed-rate mortgages. By inputting the same loan amount and term for both types of mortgages, you can see the differences in monthly payments, total interest paid over the life of the loan, and how the payments might change if interest rates fluctuate. This comparison can help you make a more informed decision about which type of mortgage best suits your financial goals.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.