Free Bond Yield To Maturity Calculators: Our Top 5 Picks for 2025

Finding the Best Bond Yield To Maturity Calculator: An Introduction

When it comes to investing in bonds, understanding the yield to maturity (YTM) is crucial for making informed decisions. However, with a plethora of online tools available, finding a reliable bond yield to maturity calculator can be a daunting task. Many calculators vary in complexity, features, and accuracy, making it challenging for investors—especially those new to the bond market—to determine which tool will best suit their needs.

This article aims to simplify that process by reviewing and ranking the top bond yield to maturity calculators available online. By highlighting the best options, we hope to save you valuable time and help you make sound investment decisions. Our goal is to provide a comprehensive overview of each tool, enabling you to choose one that meets your specific requirements.

To ensure a fair and thorough evaluation, we based our rankings on several key criteria. First and foremost is accuracy; a reliable calculator must provide precise YTM calculations based on the bond’s characteristics. Next, we considered ease of use, as a user-friendly interface can significantly enhance the overall experience, especially for beginners. Additionally, we evaluated features, such as the ability to input various bond parameters and access educational resources. Lastly, we looked at the availability of additional tools that complement the YTM calculator, giving users a more holistic approach to bond investment.

With these criteria in mind, we are excited to present our findings and guide you in selecting the best bond yield to maturity calculator for your investment journey.

Our Criteria: How We Selected the Top Tools

Key Criteria for Selecting the Top Bond Yield to Maturity Calculators

When evaluating the best online tools for calculating bond yield to maturity (YTM), we established a set of criteria to ensure that our selections would meet the needs of a diverse audience. The following factors were pivotal in our assessment:

-

Accuracy and Reliability

– The primary function of a YTM calculator is to provide accurate calculations based on the inputs provided. We prioritized tools that are transparent about their calculation methods and have been validated by reputable sources or user feedback. The ability to return consistent results across different scenarios was crucial in determining reliability. -

Ease of Use

– A user-friendly interface is essential for both novice and experienced investors. We looked for calculators that feature intuitive designs, clear instructions, and straightforward navigation. The complexity of bond yield calculations can be daunting; thus, tools that simplify the process without sacrificing functionality were favored. -

Key Features

– Effective YTM calculators should include essential input fields that allow users to customize their calculations. We evaluated tools based on the following inputs:- Current Bond Price: The market price of the bond.

- Face Value: The bond’s par value at maturity.

- Coupon Rate: The annual interest payment as a percentage of the face value.

- Coupon Frequency: Options for how often interest payments are made (e.g., annually, semi-annually, quarterly).

- Years to Maturity: The total number of years until the bond matures.

- Additional features, such as the ability to calculate current yield or display results in multiple formats, were considered beneficial.

-

Cost (Free vs. Paid)

– We assessed whether the calculators were free to use or required a subscription or one-time payment. Free tools that deliver comprehensive functionality without hidden fees were prioritized, as they provide accessibility for a broader audience. However, we also considered premium options that offer enhanced features, provided they justified their costs with significant added value. -

Educational Resources

– In addition to calculation capabilities, we valued tools that offer educational content explaining yield to maturity concepts. Resources such as articles, FAQs, or example scenarios enhance the user experience by aiding comprehension and encouraging informed investment decisions. -

Mobile Compatibility

– With many users accessing financial tools via smartphones or tablets, we took into account the mobile compatibility of the calculators. Tools that function seamlessly across devices were rated higher, ensuring users can perform calculations on the go. -

User Feedback and Community Engagement

– Finally, we considered user reviews and community engagement. Tools that have positive ratings and active user communities tend to reflect reliability and user satisfaction. Feedback on usability, accuracy, and customer support contributed to our overall assessment.

By applying these criteria, we aimed to identify the most effective and user-friendly bond yield to maturity calculators available online, ensuring that our recommendations would serve the needs of both novice and seasoned investors alike.

The Best Bond Yield To Maturity Calculators of 2025

1. Yield to Maturity Calculator

The Yield to Maturity Calculator from Omni Calculator is a user-friendly tool designed to help investors determine the bond yields of their investments. Utilizing the YTM formula, it provides accurate real-time calculations, allowing users to assess the potential returns of their bonds effectively. This calculator is ideal for both novice and experienced investors seeking to make informed financial decisions based on current yield data.

- Website: omnicalculator.com

- Established: Approx. 11 years (domain registered in 2014)

2. Bond Yield to Maturity (YTM) Calculator

The Bond Yield to Maturity (YTM) Calculator from DQYDJ is a valuable tool designed for investors seeking to determine the yield of their bond investments. It calculates YTM by incorporating key factors such as duration, coupon rate, and current price. The calculator offers both approximate and exact yield to maturity formulas, making it suitable for users looking for precise financial insights into their bond portfolios.

- Website: dqydj.com

- Established: Approx. 28 years (domain registered in 1997)

4. Bond Yield Calculator

The Bond Yield Calculator on CalculateStuff.com is a user-friendly tool designed to assist investors in determining the current yield and yield to maturity of various bonds. By inputting relevant bond parameters, users can quickly obtain accurate calculations, helping them make informed investment decisions. This calculator is particularly beneficial for both novice and experienced investors looking to evaluate the potential returns of their bond investments efficiently.

- Website: calculatestuff.com

- Established: Approx. 14 years (domain registered in 2011)

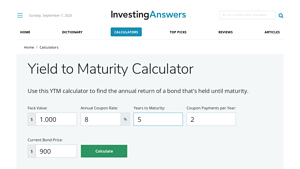

5. Yield to Maturity Calculator

The Yield to Maturity (YTM) Calculator from InvestingAnswers is a valuable tool designed to help investors determine the annual return on a bond if purchased today and held until maturity. By inputting relevant bond details, users can easily calculate the YTM, making it a practical resource for assessing investment potential and comparing different bonds. This calculator simplifies the analysis of bond investments, aiding in informed financial decision-making.

- Website: investinganswers.com

- Established: Approx. 20 years (domain registered in 2005)

How to Get the Most Accurate Results

Double-Check Your Inputs

When using a bond yield to maturity (YTM) calculator, the accuracy of your results heavily depends on the information you input. Always ensure that you have the correct values for the bond price, face value, coupon rate, payment frequency, and years to maturity. A simple typo or miscalculation can lead to significantly different outputs, which may affect your investment decisions. It’s wise to cross-reference these figures with reliable financial sources or documentation related to the bond in question.

Understand the Underlying Assumptions

Most YTM calculators operate under certain assumptions that can impact the results. For instance, many calculators assume that you will hold the bond until maturity and that all coupon payments will be reinvested at the same rate as the YTM. Be aware of these assumptions, as they may not reflect your actual investment strategy or market conditions. Understanding these factors can help you interpret the results more effectively and make informed decisions.

Use Multiple Tools for Comparison

To ensure you are getting the most accurate and reliable results, consider using multiple online YTM calculators. Different calculators may use various methodologies or algorithms to arrive at their results, and comparing outputs can help you identify discrepancies or confirm accuracy. This approach can also provide insights into how sensitive the YTM is to changes in input values, giving you a better understanding of your investment’s potential performance.

Familiarize Yourself with the YTM Formula

Having a basic understanding of the yield to maturity formula can enhance your ability to assess the outputs from the calculators. Knowing that YTM represents the internal rate of return (IRR) on the bond, you can appreciate how the various inputs—like the bond’s price and coupon payments—interact to determine the yield. Familiarity with the formula will enable you to spot any potential errors in the calculator’s output and ask informed questions if something doesn’t seem right.

Consider Market Conditions

The yield to maturity can be influenced by broader economic factors, including interest rates and inflation. Understanding current market conditions can provide context for the YTM results you receive. For example, in a rising interest rate environment, you might expect yields to increase. Keeping an eye on market trends can help you interpret your results and make more strategic investment choices.

Review Educational Resources

Many online calculators come with educational resources that explain how to interpret results and the financial concepts involved. Take advantage of these resources to enhance your understanding of YTM and other related metrics. Familiarizing yourself with these concepts can lead to more confident decision-making and a clearer view of your investment strategy.

By following these guidelines, you can maximize the accuracy and usefulness of the bond yield to maturity calculators, ultimately making more informed investment decisions.

Frequently Asked Questions (FAQs)

1. What is a bond yield to maturity (YTM) calculator?

A bond yield to maturity (YTM) calculator is an online tool that helps investors calculate the total return expected on a bond if it is held until maturity. This calculation considers the bond’s current market price, its face value, the annual coupon rate, the frequency of coupon payments, and the number of years until maturity. By inputting these variables, the calculator provides the YTM, which serves as an indicator of the bond’s profitability.

2. How do I use a bond yield to maturity calculator?

To use a bond yield to maturity calculator, follow these steps:

1. Input the current bond price: Enter the market price at which the bond is currently trading.

2. Enter the face value: This is typically the bond’s par value, which is the amount the bond will pay at maturity.

3. Specify the coupon rate: Input the annual interest rate that the bond pays.

4. Select the payment frequency: Choose how often the bond pays interest (e.g., annually, semi-annually, quarterly).

5. Input the years to maturity: Enter the number of years remaining until the bond matures.

6. Calculate: Once all the data is entered, click the calculate button to receive the yield to maturity.

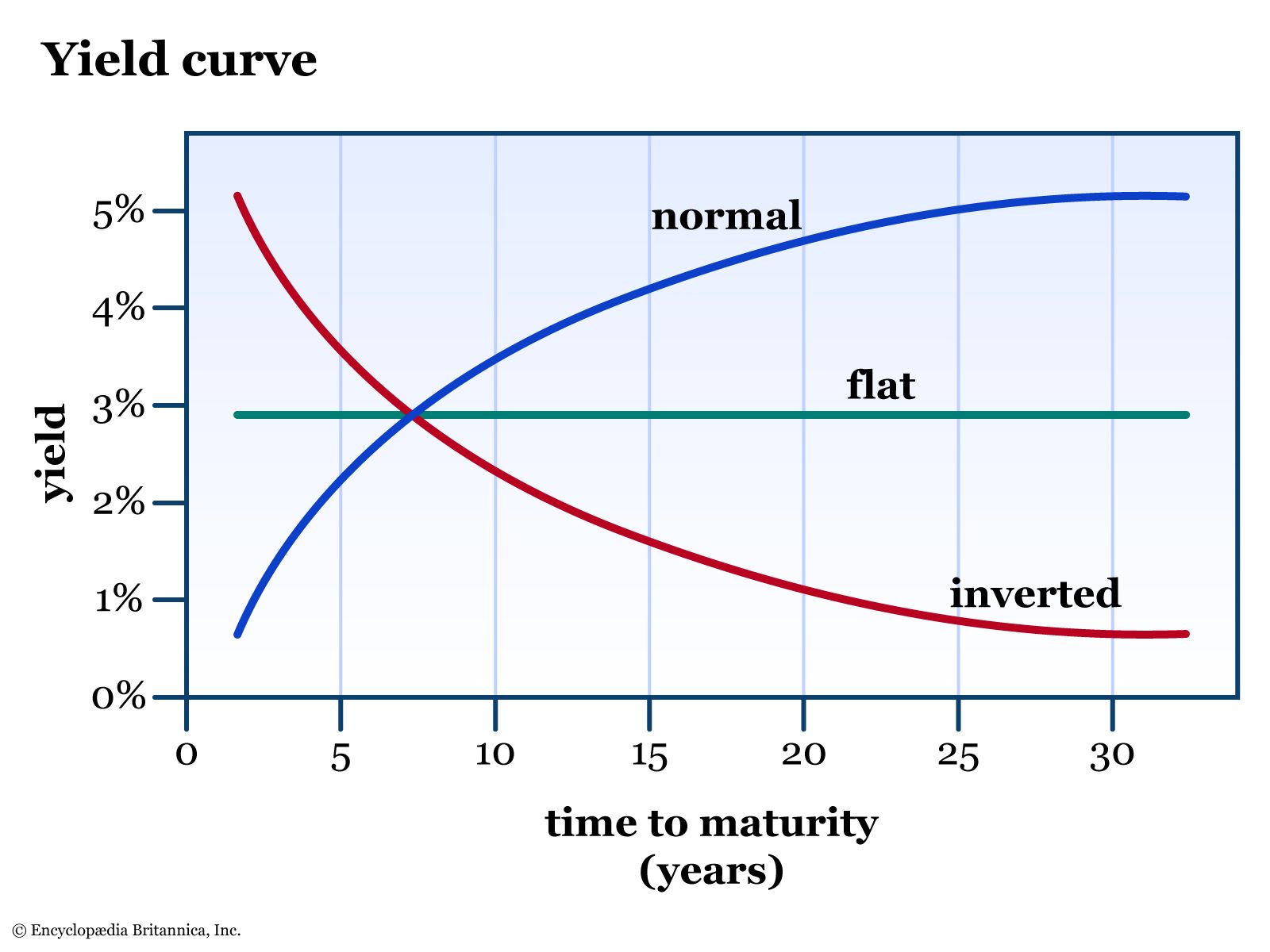

3. What factors can affect the yield to maturity of a bond?

Several factors can influence the yield to maturity (YTM) of a bond:

– Market Price: If the bond’s market price decreases, the YTM increases, and vice versa.

– Coupon Payments: Higher coupon rates generally lead to a higher YTM.

– Time to Maturity: Bonds with longer maturity periods may have different YTM due to changing interest rates and market conditions.

– Interest Rates: If general interest rates rise, existing bonds with lower rates may see their YTM increase as investors demand higher returns.

– Credit Risk: The perceived risk of the issuer defaulting can also impact YTM; higher risk usually demands a higher yield.

4. Can the yield to maturity be negative?

Yes, the yield to maturity (YTM) can be negative, though this is relatively rare. This situation typically occurs in environments where bond prices are extremely high due to demand and/or when interest rates are very low. In such cases, even if you hold the bond to maturity, the return may be less than the original investment, leading to a negative yield. This scenario is more common in times of economic uncertainty or deflation.

5. Is it necessary to hold a bond until maturity to achieve the yield to maturity?

Technically, yes. The yield to maturity (YTM) assumes that the investor will hold the bond until its maturity date and reinvest all coupon payments at the same rate as the YTM. If the bond is sold before maturity, the actual return may differ from the YTM due to changes in market conditions, interest rates, or the bond’s price fluctuations. Thus, while YTM provides a useful estimate of potential returns, actual returns can vary based on market circumstances.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.