Free Cagr Calculation Calculators: Our Top 5 Picks for 2025

Finding the Best Cagr Calculation: An Introduction

Finding a reliable online tool for calculating the Compound Annual Growth Rate (CAGR) can be a daunting task. With numerous options available, users may struggle to identify which tools provide accurate results and user-friendly experiences. CAGR is a critical metric for investors, as it allows them to assess the annual growth rate of an investment over a specified period, assuming profits are reinvested. This makes it essential for users to select a dependable calculator that meets their specific needs.

The goal of this article is to streamline that process by reviewing and ranking the top online CAGR calculators available today. By focusing on the best options, we aim to save you time and effort, allowing you to make informed decisions without sifting through countless tools.

To ensure a comprehensive evaluation, we have established several criteria for our rankings. These include:

- Accuracy: The primary function of a CAGR calculator is to deliver precise calculations. We assess each tool’s mathematical reliability to ensure users can trust the results.

- Ease of Use: A user-friendly interface is crucial. We consider how intuitive each tool is, including the simplicity of inputting data and interpreting results.

- Features: Additional functionalities, such as the ability to compare multiple investments or export results, can enhance the user experience. We evaluate each calculator’s unique offerings to identify standout features.

- Accessibility: We also consider whether the tools are free to use or require a subscription, as well as their availability on different devices.

With these criteria in mind, we present our findings to help you find the best CAGR calculation tool for your investment needs.

Our Criteria: How We Selected the Top Tools

Selecting the Best CAGR Calculation Tools

When evaluating the top online tools for calculating the Compound Annual Growth Rate (CAGR), we focused on several essential criteria to ensure that users receive the best experience and results. Here’s a breakdown of the key factors we considered:

-

Accuracy and Reliability

– The primary function of a CAGR calculator is to provide accurate results based on the inputs provided. We prioritized tools that are known for their precise calculations, utilizing the correct CAGR formula consistently. Tools backed by financial institutions or reputable websites also ranked higher due to their credibility. -

Ease of Use

– A user-friendly interface is crucial for any online tool, especially for those who may not be familiar with financial calculations. We looked for calculators that have straightforward input fields and clear instructions, ensuring that users can easily navigate the tool without confusion. The overall design and layout contribute significantly to a positive user experience. -

Key Features

– Effective CAGR calculators should offer essential functionalities that enhance the calculation process. We evaluated tools based on:- Input Flexibility: The ability to input various starting and ending values, as well as the time period (in years).

- Multiple Scenarios: Options to calculate CAGR for different investments or scenarios in one go.

- Visual Representation: Some tools provide graphs or charts to illustrate growth trends over time, which can be beneficial for users seeking to visualize their investments.

-

Cost (Free vs. Paid)

– We considered whether the tools are free or require a subscription. Many users prefer free tools, but we also included some paid options that offer advanced features or enhanced support. We ensured that the value provided by paid tools justified their costs, particularly for users who may need more comprehensive financial analysis. -

Additional Resources

– We assessed whether the calculators offer supplementary resources, such as tutorials, articles, or FAQs that educate users about CAGR and its applications. This feature is particularly useful for beginners who might not fully understand the concept or its significance in investment evaluation. -

Customer Support

– Finally, we looked into the availability of customer support for each tool. Good calculators should provide access to help, whether through live chat, email, or a comprehensive help section. This support can be invaluable for users encountering issues or needing clarification on how to use the tool effectively.

By applying these criteria, we aimed to compile a list of the best CAGR calculation tools that cater to a wide range of user needs, from casual investors to finance professionals. Each tool selected for our review meets these standards to deliver a reliable and efficient calculation experience.

The Best Cagr Calculations of 2025

1. Compound Annual Growth Rate (CAGR)

Wall Street Prep’s Compound Annual Growth Rate (CAGR) tool is designed to help users easily calculate the annual growth rate of an investment over a specified period. The tool simplifies the process by providing a clear formula that involves dividing the ending value by the beginning value and raising the result to the power of one divided by the number of compounding periods. This resource is particularly useful for investors and financial analysts looking to assess investment performance over time.

- Website: wallstreetprep.com

- Established: Approx. 22 years (domain registered in 2003)

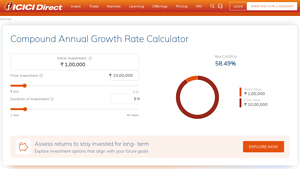

2. Calculate Compound Annual Growth Rate Online

The ICICI Direct online tool for calculating Compound Annual Growth Rate (CAGR) is designed to help users assess investment growth over time. It offers a straightforward interface for inputting initial and final values along with the investment duration, providing quick and accurate CAGR results. The tool also contextualizes growth rates, indicating that a CAGR above 8-10% is generally seen as favorable, with higher rates being common in high-growth industries.

- Website: icicidirect.com

- Established: Approx. 26 years (domain registered in 1999)

4. Decoding the Secrets of CAGR Formula Google Sheets

The article “Decoding the Secrets of CAGR Formula Google Sheets” provides a comprehensive guide on calculating the Compound Annual Growth Rate (CAGR) using Google Sheets. It simplifies the formula to CAGR = (Ending Value / Beginning Value)^(1 / Number of Years) – 1, making it accessible for users seeking to understand investment growth over time. The resource emphasizes the formula’s utility in financial analysis, enabling users to efficiently assess performance across various periods.

- Website: efinancialmodels.com

- Established: Approx. 9 years (domain registered in 2016)

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most critical steps in obtaining accurate results from a CAGR calculator is to ensure that the data you input is correct. Mistakes in entering values can lead to significantly skewed results. Carefully check the beginning value, ending value, and the number of years to make sure they reflect your investment accurately. If you are calculating CAGR from multiple investments or periods, ensure consistency in how you report each value (e.g., using the same currency or time frame).

Understand the Underlying Assumptions

CAGR calculations rest on specific assumptions, primarily that profits are reinvested and that the growth rate is steady over the investment period. Understanding these assumptions will help you interpret the results more accurately. For instance, a high CAGR may seem appealing, but it may not reflect the volatility or risk associated with the investment. Recognize that CAGR is a smoothed rate of return and may not represent actual year-to-year performance. This understanding will allow you to contextualize the CAGR in relation to your investment strategy.

Use Multiple Tools for Comparison

To ensure that you’re getting the most reliable information, consider using multiple online CAGR calculators. Different tools may have varying interfaces, assumptions, or methods of calculation, which can affect the results. By comparing outputs from different calculators, you can identify any discrepancies and gain a more rounded understanding of your investment’s performance. Additionally, some calculators may offer additional insights, such as visual graphs or historical data, that can aid in your analysis.

Analyze the Results in Context

Once you have your CAGR calculated, it’s essential to analyze it in the context of your overall investment strategy and market conditions. A standalone CAGR figure can be misleading if not compared against industry benchmarks or similar investments. For example, if your investment has a CAGR of 8% but the industry average is 12%, this could indicate underperformance. Conversely, a high CAGR in a generally low-performing sector may be a sign of exceptional management or market conditions.

Keep Track of Changes Over Time

CAGR is a valuable tool for assessing performance over a specific period, but it’s also crucial to track changes over time. Regularly updating your calculations as new data becomes available will help you stay informed about your investments’ growth trajectory. This ongoing analysis can guide future investment decisions and help you adjust your strategy as needed.

Consult Financial Resources

Lastly, consider consulting financial resources or professionals if you’re unsure about your calculations or their implications. Many online tools provide educational content that can deepen your understanding of CAGR and investment strategies. Utilizing these resources can enhance your financial literacy and empower you to make informed investment choices.

Frequently Asked Questions (FAQs)

1. What is the Compound Annual Growth Rate (CAGR)?

The Compound Annual Growth Rate (CAGR) is a measure used to calculate the average annual growth rate of an investment over a specified time period. It represents the rate at which an investment would need to grow each year to reach its final value, assuming profits are reinvested at the end of each period. The formula for CAGR is:

[

CAGR = \left( \frac{EV}{BV} \right)^{\frac{1}{n}} – 1

]

where (EV) is the ending value, (BV) is the beginning value, and (n) is the number of years.

2. How do I calculate CAGR using an online tool?

To calculate CAGR using an online tool, you typically need to input three key values: the beginning value of your investment, the ending value, and the number of years the investment was held. After entering these values, the tool will apply the CAGR formula and provide you with the annual growth rate in percentage form. Many online CAGR calculators are user-friendly and require no prior financial knowledge.

3. What are the benefits of using a CAGR calculator?

Using a CAGR calculator offers several benefits:

- Simplicity: It eliminates the need to perform complex calculations manually.

- Accuracy: Online calculators reduce the risk of human error, providing precise results.

- Comparison: By calculating the CAGR for multiple investments, you can easily compare their performances over time.

- Visualization: Some tools provide graphical representations of growth, helping you visualize investment performance.

4. What limitations should I be aware of when using CAGR?

While CAGR is a useful metric, it has some limitations:

- Smoothing Effect: CAGR assumes a steady growth rate, which may not reflect the actual volatility of an investment’s performance.

- Ignores Cash Flows: It does not account for additional contributions or withdrawals made during the investment period, which can distort the true growth rate.

- Historical Performance: CAGR is based on historical data and does not guarantee future performance, meaning that past growth rates may not be indicative of future results.

5. How can I use CAGR to evaluate investment performance?

CAGR can be used to evaluate investment performance by providing a standardized way to compare the growth rates of different investments over the same time period. For example, if you have two investments with different return patterns, calculating their CAGRs allows you to see which one has delivered better average annual growth. Additionally, CAGR can help you set future investment goals by estimating how much you need to invest today to reach a desired future value based on expected annual growth rates.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.