Free Calculadora Interes Compuesto Calculators: Our Top 5 Picks for…

Finding the Best Calculadora Interes Compuesto: An Introduction

Finding an effective and reliable ‘calculadora interes compuesto’ can be a daunting task for many users. With a plethora of online tools available, each claiming to offer unique features and benefits, it becomes increasingly challenging to identify which calculators truly provide accurate and helpful results. Whether you’re looking to estimate the future value of an investment, plan for retirement, or simply understand the power of compound interest, having access to a trustworthy calculator is essential.

This article aims to simplify your search by reviewing and ranking the best online calculators for compound interest. Our goal is to save you time and effort by providing a curated list of tools that stand out in terms of accuracy, user experience, and functionality. We understand that users have diverse needs, from basic calculations to more complex investment scenarios, and our selection reflects that variety.

Criteria for Ranking

To ensure a thorough evaluation, we assessed each calculator based on several key criteria:

-

Accuracy: The most critical factor, as precise calculations are vital for financial planning. We tested the calculators to confirm that they deliver reliable results.

-

Ease of Use: An intuitive interface and straightforward navigation are essential for users to quickly input their data and interpret the results without confusion.

-

Features: We considered additional functionalities, such as options for regular contributions, varying interest rates, and different compounding frequencies, which can enhance the user experience.

-

Accessibility: The availability of the tool across various devices and platforms was also taken into account, ensuring that users can access these calculators whenever and wherever they need them.

By adhering to these criteria, we provide you with a comprehensive guide to the top ‘calculadora interes compuesto’ options available online, helping you make informed decisions about your financial future.

Our Criteria: How We Selected the Top Tools

Selection Criteria for the Best Compound Interest Calculators

When evaluating the top online calculators for compound interest, we established a set of criteria to ensure that users can find reliable and effective tools. Here are the key factors we considered:

-

Accuracy and Reliability

– It is essential that the calculators provide precise results based on the inputs given. We assessed the formulas used by each tool to ensure they accurately reflect the principles of compound interest. The reliability of these calculators is crucial for users who are making financial decisions based on their calculations. -

Ease of Use

– A user-friendly interface is vital for a positive experience. We looked for calculators that are intuitive and easy to navigate, allowing users to input their data without confusion. Clear instructions and a straightforward design help ensure that users can quickly perform their calculations without unnecessary complications. -

Key Features

– We evaluated the range of features offered by each calculator. Essential inputs for a compound interest calculator typically include:- Initial Deposit: The starting amount of money invested.

- Annual Interest Rate: The expected rate of return on the investment.

- Compounding Frequency: Options to select how often interest is compounded (e.g., daily, monthly, annually).

- Duration of Investment: The total time period for which the investment will grow.

- Additional Contributions: The ability to specify regular contributions over time, which can significantly affect the final outcome.

-

Cost (Free vs. Paid)

– We considered whether the calculators are free to use or if they require payment. Free tools are generally more accessible, but we also looked at any premium features offered by paid calculators that might justify their cost. Our focus was on providing users with options that deliver good value for their needs. -

Additional Educational Resources

– A good calculator is complemented by educational resources that help users understand compound interest better. We favored tools that provide explanations, tips, or links to articles about managing investments and maximizing returns through compound interest. This added value enhances the overall user experience and empowers users to make informed decisions. -

Mobile Compatibility

– With the increasing use of mobile devices, we assessed whether the calculators are optimized for mobile use. Tools that function well on smartphones and tablets allow users to perform calculations on the go, making them more convenient.

-

User Reviews and Feedback

– Finally, we examined user reviews and feedback to gauge the overall satisfaction with each tool. Insights from actual users can reveal common issues or highlight particularly beneficial features that may not be immediately apparent.

By considering these criteria, we aimed to provide a comprehensive overview of the best compound interest calculators available, ensuring that users can confidently choose the tool that best fits their financial planning needs.

The Best Calculadora Interes Compuestos of 2025

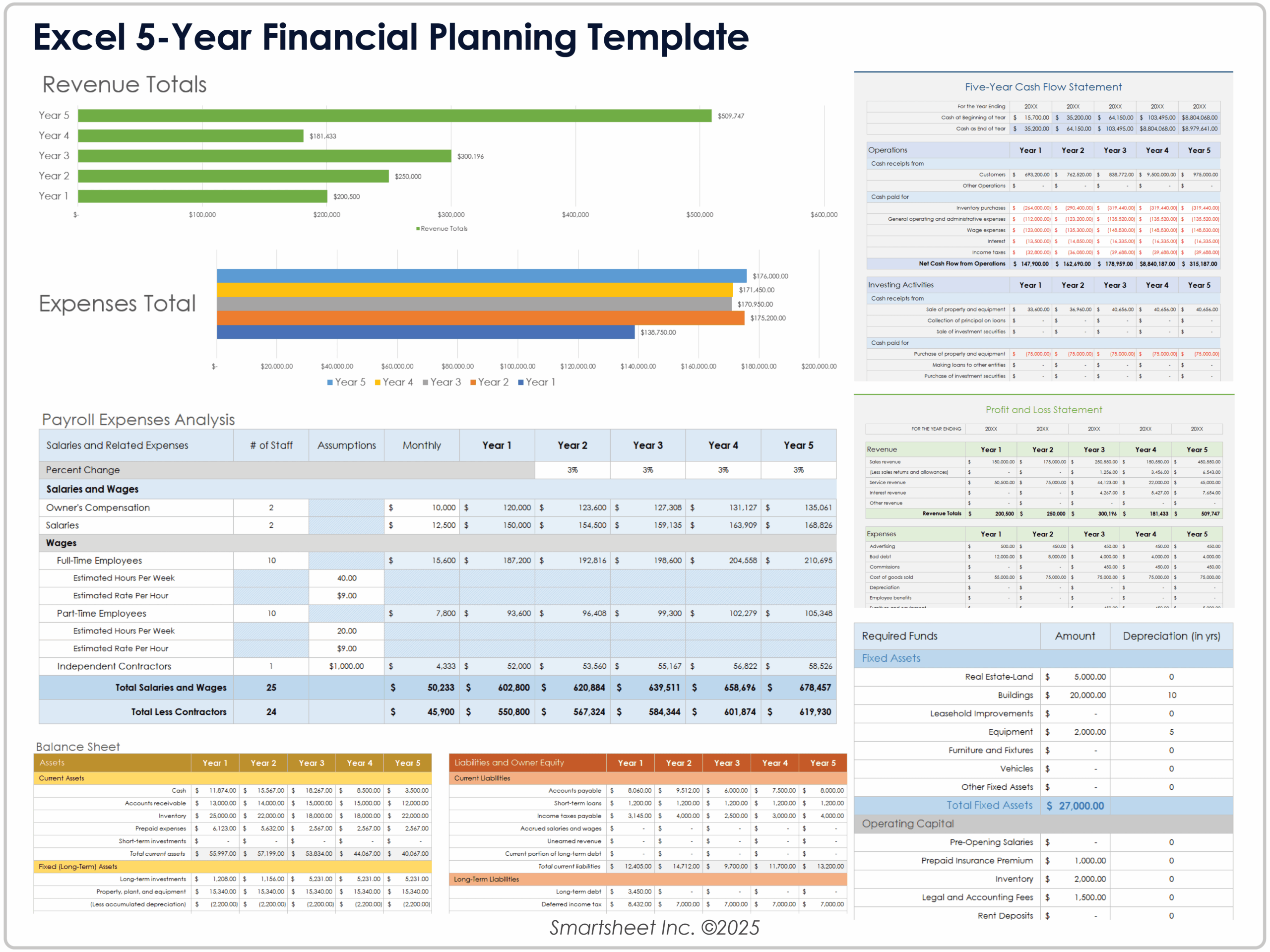

1. Calculadora de interés compuesto

The Calculadora de interés compuesto from Investor.gov is a user-friendly tool designed to help investors understand the growth potential of their investments over time. It guides users through a two-step process, starting with the initial investment amount and followed by monthly contributions. This calculator allows users to visualize how compound interest can significantly increase their investment returns, making it a valuable resource for both novice and experienced investors.

- Website: investor.gov

- Established: Approx. 18 years (domain registered in 2007)

2. Compound Interest Calculator

The Compound Interest Calculator from NerdWallet is designed to help users visualize the growth of their investments over time through the power of compound interest. This user-friendly tool allows individuals to input their principal amount, interest rate, and investment duration to estimate potential earnings. By providing clear results, the calculator empowers users to make informed financial decisions and plan for their future savings effectively.

- Website: nerdwallet.com

- Established: Approx. 16 years (domain registered in 2009)

3. Calculadora Interés Compuesto

The “Calculadora Interés Compuesto” from Invertir desde Cero is designed to help users optimize their investments by calculating potential returns and associated risks before committing funds. This user-friendly tool allows individuals to explore various investment scenarios, providing valuable insights to make informed financial decisions. With its emphasis on maximizing profitability while understanding risk factors, it’s an essential resource for both novice and experienced investors looking to enhance their investment strategies.

- Website: invertirdesdecero.com

- Established: Approx. 5 years (domain registered in 2020)

4. Calculadora de Ahorro

The “Calculadora de Ahorro” from Edmonton State Bank is a user-friendly tool designed to help users calculate their savings growth through compound interest. It emphasizes the frequency at which interest is compounded, allowing users to visualize how their investments can grow over time. This calculator is particularly useful for individuals looking to maximize their savings strategies and understand the impact of different compounding periods on their financial goals.

- Website: edmontonstatebank.com

- Established: Approx. 25 years (domain registered in 2000)

5. Calculadora de Interés Compuesto Online

The “Calculadora de Interés Compuesto Online” from fondosindexados.net is a valuable tool designed to help users estimate the compound interest they can earn on their savings and regular contributions. This intuitive calculator allows individuals to input their initial capital and periodic deposits, providing a clear projection of potential growth over time. It serves as an excellent resource for those looking to maximize their investments in index funds.

- Website: fondosindexados.net

- Established: Approx. 8 years (domain registered in 2017)

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most critical steps in using an online compound interest calculator is ensuring that all your inputs are accurate. Before hitting the calculate button, take a moment to review the following fields:

- Initial Deposit: Confirm that you’ve entered the correct starting amount you plan to invest.

- Annual Interest Rate: Make sure you’re using the correct percentage and that it is expressed as a decimal (e.g., 5% should be entered as 0.05).

- Time Frame: Verify that you have selected the correct duration for your investment, whether it’s in years or months.

- Contribution Amount and Frequency: If you plan to make additional contributions, ensure these figures are accurate, including how often you intend to contribute (monthly, annually, etc.).

Taking the time to double-check these inputs can significantly affect the accuracy of your results.

Understand the Underlying Assumptions

Every compound interest calculator operates under specific assumptions that can influence the outcomes. Familiarize yourself with these assumptions:

- Compounding Frequency: Different calculators allow for various compounding frequencies (daily, monthly, annually). Understand how this affects your total interest earned; more frequent compounding generally results in more interest.

- Rate of Return: The calculators often use a fixed rate of return, which may not reflect real-world scenarios where investment returns can fluctuate. Be cautious about relying on a specific rate without considering market conditions.

- Inflation: Many calculators do not account for inflation, which can erode your purchasing power over time. If you want a more realistic view of your future savings, consider factoring in an estimated inflation rate.

Use Multiple Tools for Comparison

To ensure that you’re making the best financial decisions, it’s wise to use multiple online calculators. Different tools may have varying methodologies or features that could lead to different results. By comparing outputs from several calculators, you can gain a more comprehensive understanding of your potential returns. Look for calculators that offer different perspectives, such as:

- Basic Compound Interest Calculators: These provide straightforward calculations based on your inputs.

- Investment Growth Calculators: These may include additional variables like market fluctuations and fees.

- Savings Goal Calculators: These can help you visualize how much you need to save to reach a specific financial goal.

Experiment with Different Scenarios

Don’t hesitate to play around with different inputs to see how they affect your results. Adjusting variables such as the initial investment amount, interest rate, and contribution frequency can provide insights into how various strategies could impact your financial future. For example, you might find that increasing your monthly contributions significantly boosts your overall returns over time.

Keep Learning

Finally, the world of finance and investment is constantly evolving. Take the time to educate yourself on compound interest and investment strategies beyond just using calculators. Understanding concepts like risk tolerance, diversification, and investment vehicles will empower you to make informed decisions about your financial future. Online courses, finance blogs, and investment forums can provide valuable information to enhance your financial literacy.

Frequently Asked Questions (FAQs)

1. What is a ‘calculadora interés compuesto’ and how does it work?

A ‘calculadora interés compuesto’ is an online tool designed to help users calculate the potential growth of their investments over time when interest is compounded. It allows you to input variables such as the initial investment amount, the interest rate, the duration of the investment, and any additional contributions. The calculator then uses these inputs to provide an estimate of the future value of the investment, showing how much interest you can earn on both your initial capital and the interest that accumulates over time.

2. Why should I use a compound interest calculator?

Using a compound interest calculator can provide valuable insights into your savings and investment strategies. It helps you visualize how different interest rates, investment periods, and contribution frequencies affect your overall returns. By experimenting with various scenarios, you can better understand the power of compound interest and make more informed decisions about saving and investing for your financial goals.

3. What information do I need to use a compound interest calculator?

To effectively use a compound interest calculator, you will typically need the following information:

– Initial Deposit: The amount of money you plan to invest initially.

– Annual Interest Rate: The expected annual rate of return on your investment (expressed as a percentage).

– Time Period: The number of years you plan to keep your money invested.

– Contribution Amount: If you plan to make additional contributions, specify how much and how often (e.g., monthly or annually).

– Compounding Frequency: Choose how often the interest is compounded (daily, monthly, annually, etc.), if applicable.

4. Can I use a compound interest calculator for different types of investments?

Yes, a compound interest calculator can be used for various types of investments, including savings accounts, stocks, bonds, mutual funds, and retirement accounts. The key is to input the appropriate interest rate and compounding frequency based on the specific investment vehicle you are considering. This versatility allows you to assess potential growth for a wide range of financial products.

5. How accurate are the results from a compound interest calculator?

While a compound interest calculator provides a good estimate based on the inputs you provide, the results should be taken as projections rather than guarantees. Actual investment returns can vary due to market fluctuations, changes in interest rates, and other factors that affect financial markets. It’s important to consider these variables and consult with a financial advisor for personalized advice tailored to your specific situation.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.