Free Calculate Missouri Sales Tax On Car Calculators: Our Top 5 Pic…

Finding the Best Calculate Missouri Sales Tax On Car: An Introduction

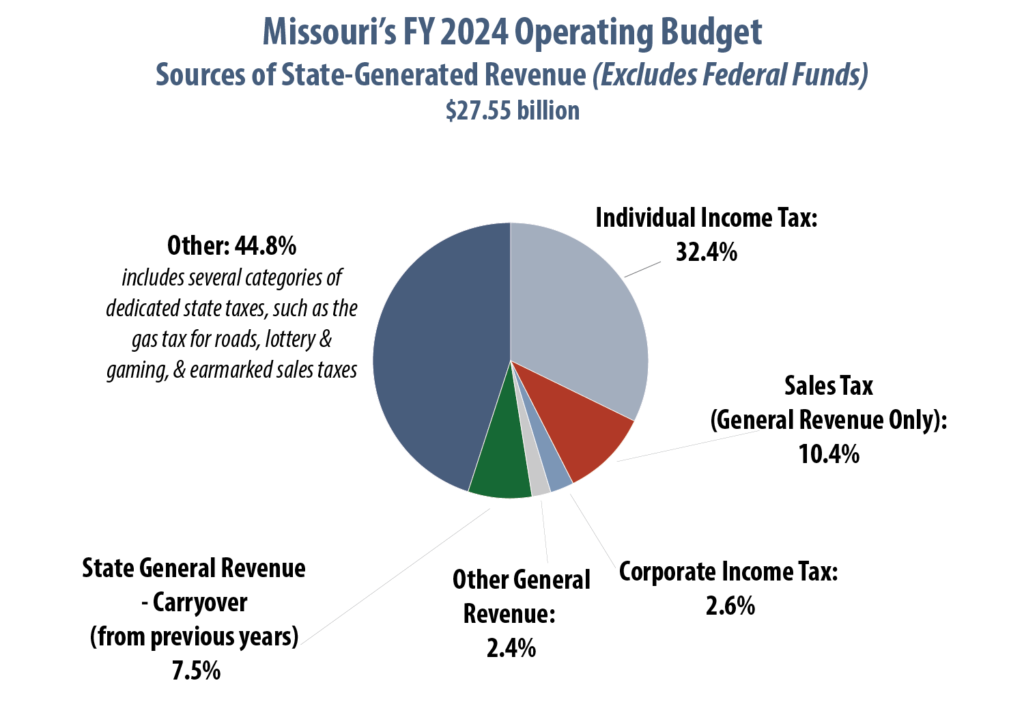

Navigating the complexities of sales tax can be a daunting task, especially when it comes to purchasing a vehicle in Missouri. With a base sales tax rate of 4.225% and additional local taxes that can vary significantly depending on your location, calculating the exact amount you owe can quickly become overwhelming. Whether you’re buying a new car or trading in an old one, understanding how these taxes are applied is crucial to avoid any unexpected costs. Unfortunately, many individuals find themselves unsure of how to accurately calculate the sales tax on their vehicle purchase, often leading to confusion and potential financial miscalculations.

The goal of this article is to streamline your experience by reviewing and ranking the best online tools available for calculating Missouri sales tax on cars. We’ve taken the time to evaluate various calculators to help you save time and ensure you get the most accurate figures possible. Our rankings are based on several key criteria, including accuracy, ease of use, and the range of features offered by each tool.

In the following sections, we will explore the top calculators designed to simplify the sales tax calculation process for Missouri car buyers. By providing you with detailed insights into each tool, we aim to empower you with the information needed to make informed decisions when purchasing your vehicle, ensuring that you understand the full financial implications of your transaction.

Our Criteria: How We Selected the Top Tools

How We Selected the Top Tools for Calculating Missouri Sales Tax on Cars

When it comes to finding the best online tools for calculating sales tax on cars in Missouri, we considered several key criteria to ensure that users have access to reliable and user-friendly calculators. Here’s a breakdown of the essential factors we evaluated:

-

Accuracy and Reliability

– The foremost criterion for any sales tax calculator is its accuracy. We ensured that the tools selected provide precise calculations based on the latest Missouri sales tax laws, including both state and local rates. This accuracy is crucial since even small errors can lead to significant financial implications when purchasing a vehicle. -

Ease of Use

– A user-friendly interface is vital for ensuring that users can easily navigate the tool without confusion. We looked for calculators that have clear instructions, intuitive layouts, and minimal steps to complete the calculation. The ability to quickly understand how to use the tool without extensive guidance is essential for a positive user experience. -

Key Features

– To effectively calculate the sales tax on a car, we considered the specific inputs that a good tool should allow:- Sale Amount: Users should be able to input the total sale price of the vehicle.

- ZIP Code or Tax Region Selection: The ability to choose a specific location to account for varying local tax rates.

- Tax Breakdown: A detailed view that shows the breakdown of state, county, city, and any special district taxes applied.

- Total Calculation: The tool should provide a total amount that combines the sale price and calculated tax for easy reference.

-

Cost (Free vs. Paid)

– We prioritized free tools that do not require any subscription or payment to access. While some paid services may offer additional features, we focused on accessible calculators that provide the necessary functionality without cost barriers. This ensures that all users can benefit from the tools without financial constraints. -

Comprehensiveness of Information

– The selected tools should not only provide calculations but also include relevant information about Missouri sales tax laws, including exemptions and current rates. This educational aspect helps users understand the broader context of their tax obligations when purchasing a vehicle. -

User Feedback and Ratings

– We also took into account user reviews and ratings to gauge the effectiveness and reliability of the calculators. Tools that have received positive feedback from real users are more likely to meet the needs of our audience.

By adhering to these criteria, we aimed to compile a list of the best online tools for calculating Missouri sales tax on cars, ensuring that users can make informed financial decisions with confidence.

The Best Calculate Missouri Sales Tax On Cars of 2025

3. Missouri Sales Tax Calculator

The Missouri Sales Tax Calculator from Omni Calculator is a user-friendly tool designed to accurately compute sales tax for transactions within Missouri. It combines the state sales tax rate of 4.225% with varying county rates, allowing users to easily determine the total sales tax on any purchase. By inputting the purchase amount, users receive a clear breakdown of the state and county taxes, ensuring they understand the full tax implications of their transactions.

- Website: omnicalculator.com

- Established: Approx. 11 years (domain registered in 2014)

4. Missouri Sales Tax On Cars

The “Missouri Sales Tax On Cars” tool from Clement Pre-Owned provides essential information on the state’s car purchase tax structure. It highlights the base sales tax rate of 4.225% and notes the possibility of additional local taxes, which can reach up to 4.5%. This resource is valuable for potential buyers in Missouri, helping them understand the total tax implications when purchasing a vehicle.

- Website: clementpreowned.com

- Established: Approx. 4 years (domain registered in 2021)

5. Missouri Sales Tax Calculator

The Missouri Sales Tax Calculator by TimeTrex is a user-friendly tool designed to help individuals and businesses accurately calculate sales tax rates based on specific ZIP codes or regions. With its straightforward interface, users can quickly obtain precise tax amounts, making it an essential resource for anyone needing to navigate Missouri’s sales tax requirements efficiently.

- Website: timetrex.com

- Established: Approx. 21 years (domain registered in 2004)

How to Get the Most Accurate Results

Double-Check Your Inputs

Accuracy starts with the information you provide. When using an online calculator for Missouri sales tax on cars, ensure that all inputs are correct. This includes the sale price of the vehicle, any trade-in value, and the specific ZIP code or tax region if required. Even a small mistake in entering these details can lead to significant discrepancies in your tax calculation. Take a moment to review your figures before hitting the calculate button.

Understand the Underlying Assumptions

Each calculator may use different methods or assumptions to derive sales tax calculations. Familiarize yourself with how the tool computes the tax. For instance, some calculators may automatically factor in local taxes, while others might require you to input them separately. Understanding these assumptions can help you interpret the results accurately and ensure that you are comparing apples to apples when using multiple tools.

Use Multiple Tools for Comparison

No single calculator is perfect. To get the most reliable estimate, consider using several online tools. Different calculators might have slightly varying algorithms or regional tax rules, which can affect the final output. By cross-referencing results from multiple calculators, you can better identify any inconsistencies and arrive at a more precise estimate of your Missouri sales tax.

Stay Updated on Tax Rates

Sales tax rates can change, and local jurisdictions may impose additional taxes that are not included in every online calculator. Make sure you are aware of the most recent rates applicable to your area. Check official state resources or local government websites for updates on tax rates before using the calculator. This will ensure that the calculations reflect the current tax landscape.

Consider Additional Fees

While the calculator will provide you with a sales tax estimate, remember that other costs are associated with purchasing a vehicle in Missouri, such as registration fees, title fees, and any applicable dealer fees. Make a comprehensive budget that includes these additional expenses to avoid surprises later.

Review Results Carefully

Once you have your calculation, take the time to review the results. Ensure that the breakdown of the state, county, city, and any special district taxes aligns with your expectations. If the results seem off, revisit your inputs or consider trying another calculator.

Consult with Experts

If you have any doubts about the results or the process, don’t hesitate to reach out to professionals. Car dealerships, tax consultants, and financial advisors can provide insights and clarify any uncertainties regarding Missouri sales tax on vehicle purchases.

Frequently Asked Questions (FAQs)

1. What is the sales tax rate for cars in Missouri?

The state of Missouri imposes a base sales tax rate of 4.225% on the purchase price of vehicles. In addition to this, there may be local taxes that vary by county and city, which can add an extra 0.5% to 4.5% to your total tax liability. However, the maximum amount of sales tax you will pay on any vehicle purchase is capped at $725.

2. How is the Missouri sales tax calculated when buying a car?

To calculate the sales tax on a car in Missouri, you take the total purchase price of the vehicle and multiply it by the applicable sales tax rate. If you are trading in an old vehicle, you can subtract its value from the purchase price before applying the tax rate. For example, if you buy a car for $35,000 and trade in a vehicle worth $5,000, you would calculate tax on $30,000 (i.e., $35,000 – $5,000), resulting in a tax of approximately $1,267.50.

3. Are there any online tools to help me calculate Missouri sales tax on a car?

Yes, there are several online calculators available that can help you determine the sales tax on your vehicle purchase in Missouri. For instance, the TimeTrex Missouri Sales Tax Calculator allows you to input your sale amount and either your ZIP code or tax region to get an accurate tax calculation. These tools are user-friendly and provide breakdowns of state, county, and city tax rates.

4. Do I have to pay sales tax if I receive a car as a gift?

No, if you receive a vehicle as a gift, you are not required to pay sales tax in Missouri. However, it is essential to ensure that the transfer of ownership is documented properly to avoid any issues with the DMV when registering the vehicle.

5. What other fees should I expect when purchasing a car in Missouri?

In addition to sales tax, when purchasing a vehicle in Missouri, you should be prepared to pay other fees, including registration fees, title fees, and possibly license plate fees. The registration fees can vary based on the vehicle’s taxable horsepower and can range from $18.25 to $51.25 for a one-year registration. It’s advisable to budget for these additional costs when planning your vehicle purchase.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.