Free Calculate Reverse Mortgage Calculators: Our Top 5 Picks for 2025

Finding the Best Calculate Reverse Mortgage: An Introduction

When considering a reverse mortgage, understanding the financial implications can be daunting. With numerous options available, selecting the right calculator to assess potential loan amounts and repayment terms is crucial. The challenge lies in finding a reliable online tool that not only provides accurate calculations but also presents the information in an easy-to-understand format. Many calculators on the market vary significantly in terms of features, user experience, and accuracy, making it essential to choose wisely.

This article aims to streamline your search by reviewing and ranking the top online tools for calculating reverse mortgages. By providing an in-depth analysis of these calculators, we hope to save you time and effort in navigating this complex financial landscape. Whether you are exploring reverse mortgages for retirement funding or managing existing home equity, having the right calculator at your fingertips can make all the difference.

To create our rankings, we evaluated each tool based on several key criteria. Accuracy is paramount; the calculations must reflect current mortgage rates and guidelines to provide a realistic estimate. We also considered ease of use, as a user-friendly interface can significantly enhance the overall experience, especially for those who may not be tech-savvy. Additionally, we examined the features offered by each calculator, such as the ability to project future loan balances, compare different scenarios, and access educational resources about reverse mortgages. By focusing on these elements, our goal is to empower you to make informed decisions about your financial future.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting the Best Reverse Mortgage Calculators

When evaluating the top online tools for calculating reverse mortgages, we focused on several key criteria to ensure that users have access to reliable, user-friendly, and informative resources. Here’s a breakdown of the essential factors we considered:

-

Accuracy and Reliability

– The primary function of a reverse mortgage calculator is to provide accurate estimates based on user inputs. We prioritized tools that are backed by reputable financial institutions or organizations and those that utilize up-to-date mortgage rate data to ensure reliability in their calculations. -

Ease of Use

– A good calculator should be intuitive and straightforward. We assessed the user interface of each tool, ensuring that it is easy to navigate, with clear instructions and minimal jargon. The goal is for users of all experience levels to easily input their information and understand the results without confusion. -

Key Features

– Effective reverse mortgage calculators should include specific inputs that are critical for accurate calculations. We looked for tools that allow users to enter:- Current home value

- Existing mortgage balance

- Borrower’s age (or ages if considering multiple borrowers)

- Interest rates

- Desired payout options (lump sum, monthly payments, line of credit)

- Additionally, features such as the ability to view projections over time, including estimated future equity, were highly valued.

-

Cost (Free vs. Paid)

– Most users prefer free tools, so we prioritized calculators that offer comprehensive services at no cost. However, we also considered paid options that provide advanced features or personalized advice, ensuring that users have a range of choices depending on their needs. -

Comprehensive Guidance

– Beyond mere calculations, we sought tools that provide educational resources. This includes articles, FAQs, or guides that explain reverse mortgages, their benefits, and potential drawbacks. This additional information can help users make informed decisions based on their unique financial situations.

-

Customer Support and Accessibility

– We evaluated the level of customer support offered by each tool, including whether there are help features, live chat options, or contact information readily available. Accessibility for users with disabilities was also considered, ensuring that all individuals can utilize the tools effectively. -

User Reviews and Feedback

– Finally, we examined user reviews and testimonials to gauge the overall satisfaction and experiences of those who have used the calculators. Positive feedback from real users can indicate the tool’s effectiveness and reliability in providing valuable insights.

By carefully considering these criteria, we aimed to present a selection of reverse mortgage calculators that not only meet the practical needs of users but also empower them with knowledge to navigate their financial options confidently.

The Best Calculate Reverse Mortgages of 2025

1. Reverse Mortgage Calculator

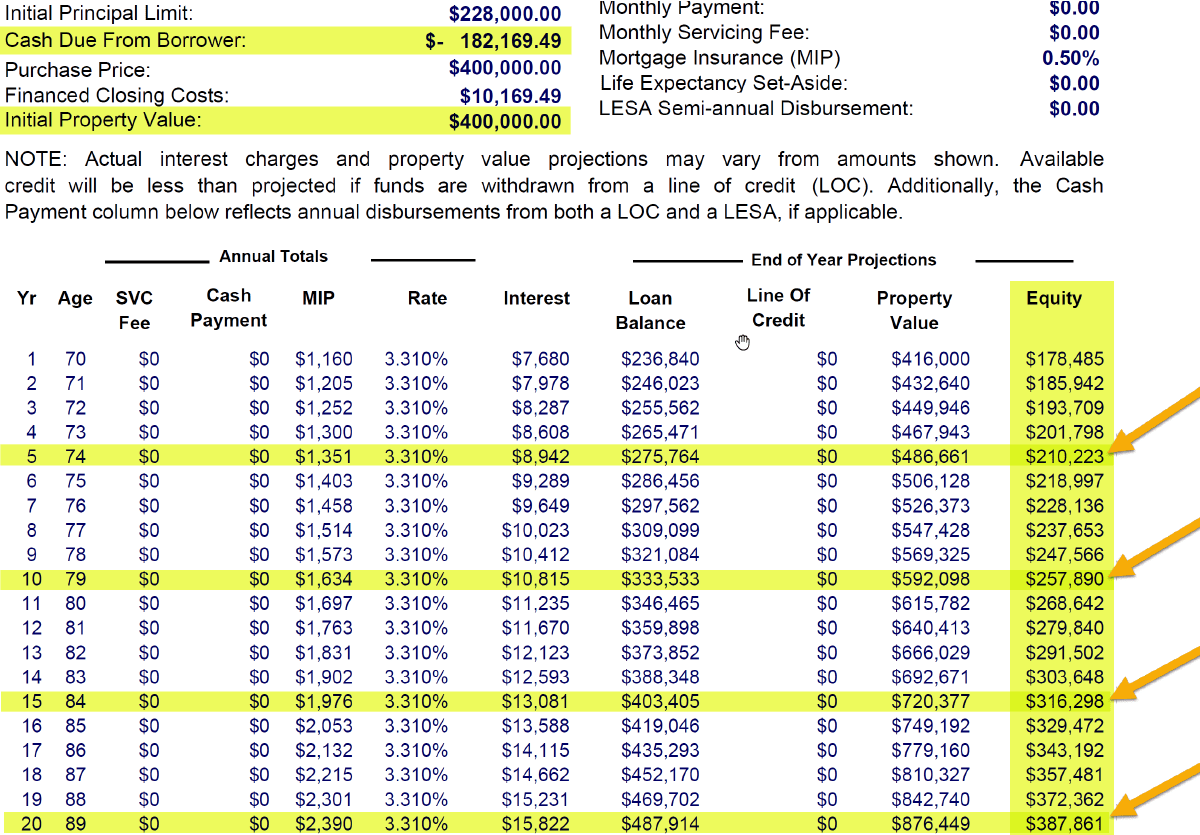

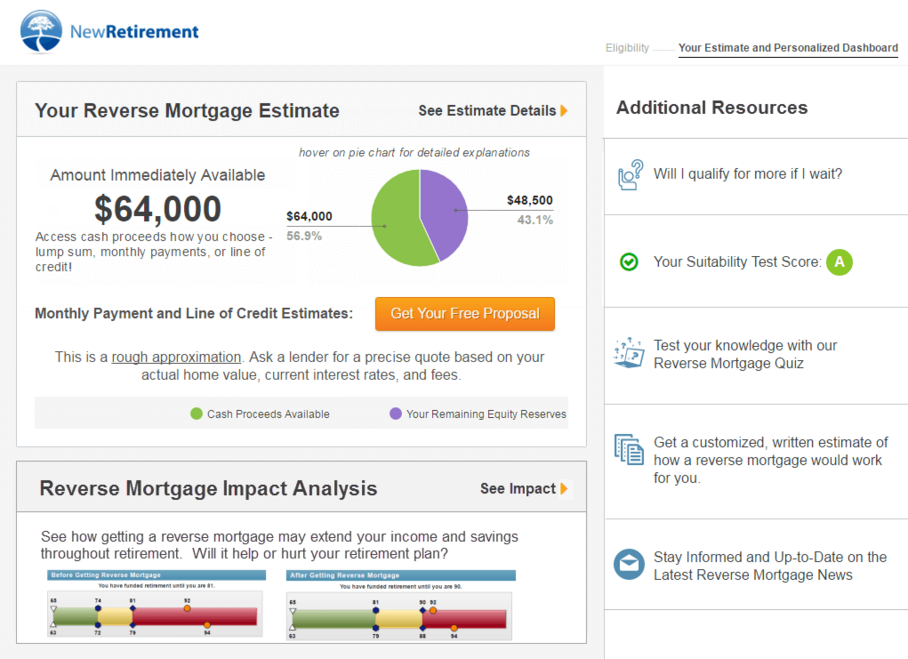

The Reverse Mortgage Calculator at mortgagecalculator.org is a valuable tool for homeowners considering a reverse mortgage. It allows users to estimate their future loan balance by factoring in the effects of compounding interest over time. This free calculator provides a clear understanding of how a reverse mortgage can impact finances, making it easier for users to make informed decisions about their home equity and retirement planning.

- Website: mortgagecalculator.org

- Established: Approx. 21 years (domain registered in 2004)

2. Reverse Mortgage Calculator

The Reverse Mortgage Calculator from Fairway Reverse is a user-friendly tool designed to help individuals estimate their eligibility for a Home Equity Conversion Mortgage (HECM) without the need for personal information. This free calculator allows users to quickly assess potential loan amounts, making it an accessible resource for those considering reverse mortgages as a financial option. Its straightforward design ensures a hassle-free experience for users seeking clarity on their qualifications.

- Website: fairwayreverse.com

- Established: Approx. 10 years (domain registered in 2015)

3. Reverse Mortgage Calculator: Discover Your Borrowing Power

The Reverse Mortgage Calculator from MoneyGeek is designed to help homeowners estimate their potential loan amount through a reverse mortgage and explore various payout options. This user-friendly tool simplifies the decision-making process by providing insights into borrowing power, allowing users to make informed financial choices regarding their home equity. Its key features include customizable inputs for age, home value, and interest rates, ensuring tailored results.

- Website: moneygeek.com

- Established: Approx. 14 years (domain registered in 2011)

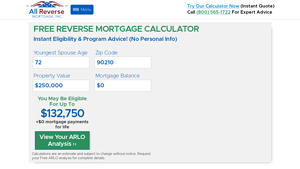

4. Reverse Mortgage Calculator: No Personal Info Required

The Reverse Mortgage Calculator from LendingTree is a user-friendly tool designed to help homeowners estimate the potential funds available through a reverse mortgage based on their home’s value. Notably, this calculator requires no personal information, ensuring privacy and ease of use. This feature makes it an appealing option for those considering a reverse mortgage without the commitment of sharing sensitive data.

- Website: lendingtree.com

- Established: Approx. 27 years (domain registered in 1998)

5. 3 Best Reverse Mortgage Calculators (No Personal Info Required)

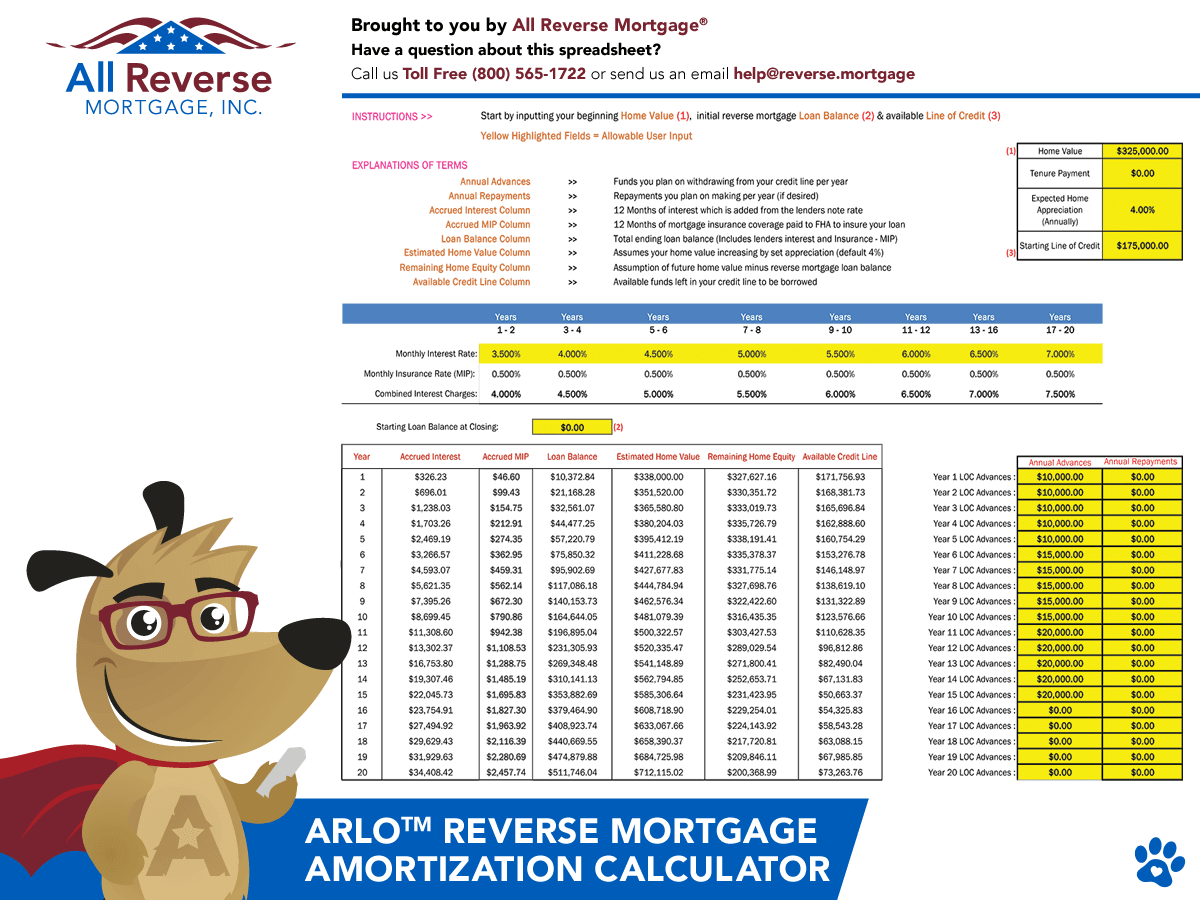

The article “3 Best Reverse Mortgage Calculators (No Personal Info Required)” highlights ARLO™, the All Reverse Mortgage calculator, which stands out for its user-friendly interface and comprehensive features. With a high rating of 4.7, this tool provides real-time rates, detailed closing costs, and personalized loan estimates without requiring personal information. This makes it an ideal choice for those seeking to explore reverse mortgage options securely and efficiently.

- Website: reverse.mortgage

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most crucial steps in obtaining accurate results from reverse mortgage calculators is to ensure that all your inputs are correct. These calculators often require specific information, such as your home’s current value, your age, and the remaining balance on your current mortgage, if applicable. Take your time to carefully enter this data, as even a small mistake can lead to significantly different outcomes. If possible, have someone else review your inputs to catch any errors you might have overlooked.

Understand the Underlying Assumptions

Every reverse mortgage calculator operates based on certain assumptions, including interest rates, loan terms, and the calculation of home equity. Familiarize yourself with these assumptions to better understand how they impact the results. For example, some calculators might use an average interest rate that may not reflect the current market conditions. Knowing how these assumptions affect your calculations will help you make more informed decisions.

Use Multiple Tools for Comparison

Not all reverse mortgage calculators are created equal. Different tools may use varying methodologies, leading to different results. To get a more comprehensive view of your potential reverse mortgage options, try using multiple calculators from reputable sources. This practice will not only provide a range of estimates but also help you identify any discrepancies that may arise, allowing you to make a more informed choice.

Review the Output Carefully

Once you’ve inputted your data and received the results, take the time to analyze the output thoroughly. Look for key figures such as the maximum loan amount you may qualify for, estimated monthly payments, and potential fees associated with the reverse mortgage. Be sure to understand how each number is derived and what it means for your financial situation. If a calculator provides you with a summary or report, review it for any red flags or areas that require further clarification.

Seek Professional Advice

While online calculators are useful for initial estimates, they cannot replace personalized financial advice. Consider consulting with a financial advisor or a reverse mortgage specialist to discuss your specific circumstances and goals. They can help you interpret the results from the calculators and provide insights tailored to your financial situation. A professional can also guide you through the complexities of reverse mortgages, ensuring you make the best decision for your retirement needs.

Stay Updated on Market Changes

Reverse mortgage calculations can be influenced by fluctuations in interest rates and housing market conditions. Make it a habit to stay informed about current trends in the housing market and changes in mortgage rates. This knowledge will enable you to make timely adjustments to your calculations and better understand how these factors may impact your reverse mortgage options in the future.

Frequently Asked Questions (FAQs)

1. What is a reverse mortgage calculator?

A reverse mortgage calculator is an online tool that helps homeowners estimate the amount of money they can borrow against their home equity through a reverse mortgage. By entering details such as the home value, existing mortgage balance, and the borrower’s age, the calculator can provide an estimated loan amount, monthly payouts, and potential future equity. This tool is particularly useful for seniors considering reverse mortgages as a financial option for retirement.

2. How do I use a reverse mortgage calculator?

To use a reverse mortgage calculator, you typically need to input several key pieces of information, including:

– The appraised value of your home

– The current mortgage balance (if applicable)

– Your age (or the age of the youngest borrower)

– Interest rates (if the calculator requires it)

Once you enter this information, the calculator will generate estimates for the loan amount you may qualify for, potential monthly payments, and how your equity might change over time. Most calculators are user-friendly and provide instant results.

3. Are the results from a reverse mortgage calculator accurate?

While reverse mortgage calculators can provide a good estimate of potential loan amounts and payments, the results should be taken as approximations. The actual amount you can borrow may vary based on specific lender criteria, current interest rates, and changes in home value. It is advisable to consult with a financial advisor or mortgage professional for a more accurate assessment tailored to your individual situation.

4. What factors influence the amount I can borrow with a reverse mortgage?

Several factors influence the amount you can borrow through a reverse mortgage, including:

– Age of the borrower: Older borrowers typically qualify for larger amounts.

– Home equity: The more equity you have in your home, the more you can borrow.

– Interest rates: Lower interest rates generally increase the amount available to borrow.

– Home value: The appraised value of your home is a key determinant in calculating your loan limit.

These factors work together to establish the maximum claim amount you may be eligible for under a reverse mortgage.

5. Can I use the results from a reverse mortgage calculator to make financial decisions?

The results from a reverse mortgage calculator can be a helpful starting point for understanding your borrowing options, but they should not be the sole basis for financial decisions. It is important to consider your overall financial situation, retirement plans, and any potential impacts on your estate. Consulting with a financial advisor or a reverse mortgage specialist can provide you with tailored advice and help you understand the implications of taking out a reverse mortgage.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.