Free California Overtime Calculators: Our Top 5 Picks for 2025

Finding the Best California Overtime Calculator: An Introduction

Finding a reliable California overtime calculator can be a daunting task for both employers and employees. With California’s complex labor laws surrounding overtime pay, it’s crucial to use a tool that accurately reflects these regulations. The challenge lies in not only understanding the various types of overtime—daily, weekly, and double time—but also ensuring that the calculator you choose can handle these nuances effectively. Miscalculations can lead to significant financial implications, including potential legal issues for employers.

This article aims to simplify your search by reviewing and ranking the top online California overtime calculators available today. Our goal is to save you time and provide you with the best options to ensure accurate and compliant overtime calculations. We understand that each user has unique needs, whether you’re an employee checking your pay or an employer managing payroll.

To create this ranking, we evaluated each calculator based on several criteria:

- Accuracy: The tool must provide precise calculations according to California’s overtime laws.

- Ease of Use: A user-friendly interface is essential, allowing users to input data without confusion.

- Features: Additional functionalities, such as the ability to calculate gross payroll or track hours across multiple days, enhance the calculator’s utility.

- Compliance: The tool must be up-to-date with the latest California labor laws to ensure legal compliance.

By considering these factors, we aim to guide you toward the best California overtime calculator that meets your needs. Whether you require a simple calculation tool or one with advanced features, our comprehensive review will help you make an informed decision.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting the Best California Overtime Calculators

When evaluating the top online tools for calculating California overtime, we considered several key factors to ensure that users find the most accurate, user-friendly, and comprehensive calculators available. Below are the criteria that guided our selection process:

-

Accuracy and Reliability

– The primary purpose of an overtime calculator is to provide precise calculations based on the complexities of California labor laws. We prioritized tools that have been vetted for accuracy, ensuring they account for various types of overtime pay, including daily overtime, weekly overtime, and double time. -

Ease of Use

– A good calculator should be intuitive and user-friendly, allowing users to input their data without confusion. We looked for calculators with clear layouts and straightforward instructions, minimizing the learning curve for new users. Features like input hints (e.g., formatting hours in decimal or hh:mm) enhance usability. -

Key Features

– We assessed the features offered by each calculator, focusing on essential inputs and outputs. Key features include:- Input Fields: Ability to enter hours worked across multiple days, starting day of the work week, and hourly pay rate.

- Output Details: Clear breakdowns of regular hours, time and a half hours, double time hours, and gross payroll.

- Additional Information: Links or resources explaining California overtime laws and exemptions that can impact calculations.

-

Cost (Free vs. Paid)

– We evaluated whether the calculators are free to use or require payment. While many of the best tools are offered at no cost, we also considered any premium features in paid versions that might offer additional value. Transparency in pricing is crucial, so tools that clearly state their cost structure were favored. -

Compliance with California Labor Laws

– Given the specific nature of California’s labor laws regarding overtime, we ensured that each calculator complies with the latest legal standards. This includes the correct application of pay rates for various scenarios, such as working over 8 hours in a day or exceeding 40 hours in a week. -

User Feedback and Reputation

– We considered user reviews and feedback to gauge the reliability and effectiveness of each calculator. Tools with positive testimonials and a strong reputation in the industry were given preference, as they reflect user satisfaction and trustworthiness. -

Additional Resources

– We valued calculators that provide supplementary resources, such as articles or FAQs, that help users understand overtime laws and calculations better. This additional context can be invaluable for both employees and employers navigating California’s complex labor regulations.

By applying these criteria, we aimed to present a curated list of the best California overtime calculators that serve the needs of both employees and employers effectively.

The Best California Overtime Calculators of 2025

1. California Overtime Wage Calculator

The California Overtime Wage Calculator by OnTheClock is a free online tool designed to help users quickly and accurately determine overtime pay rates in compliance with state regulations. With its user-friendly interface, the calculator simplifies the process of calculating wages, ensuring that employees and employers alike can navigate California’s complex labor laws with ease. This efficient tool not only saves time but also promotes fair compensation practices.

- Website: ontheclock.com

- Established: Approx. 23 years (domain registered in 2002)

2. Overtime Calculator

The Overtime Calculator from California Labor and Employment Law is a valuable tool designed to determine the maximum overtime and double overtime pay owed to employees based on California’s labor regulations. It accommodates various calculation methodologies, ensuring users can accurately assess their compensation entitlements. This user-friendly calculator is essential for both employers and employees seeking clarity on overtime pay obligations in compliance with state laws.

- Website: calaborlaw.com

- Established: Approx. 24 years (domain registered in 2001)

3. California Overtime Calculator

The California Overtime Calculator from Omni Calculator is a user-friendly tool designed to help employees accurately calculate their total pay, factoring in overtime wages. By simply inputting your hourly wage and the number of hours worked, the calculator provides a clear breakdown of regular and overtime earnings. This feature makes it an essential resource for workers seeking to understand their compensation in compliance with California’s labor laws.

- Website: omnicalculator.com

- Established: Approx. 11 years (domain registered in 2014)

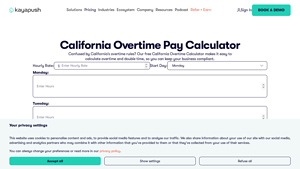

4. California Overtime Pay Calculator

The California Overtime Pay Calculator by KayaPush is a free online tool designed to help businesses accurately calculate overtime and double time pay, ensuring compliance with state labor laws. Users can input an employee’s hourly rate and start date to quickly determine the appropriate compensation for overtime hours worked, simplifying payroll processes and reducing the risk of errors in wage calculations.

- Website: kayapush.com

- Established: Approx. 4 years (domain registered in 2021)

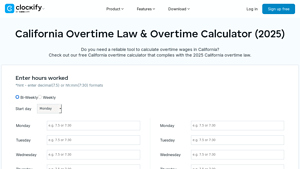

5. California Overtime Law and Wages Calculator (2025)

The California Overtime Law and Wages Calculator by Clockify is a valuable tool designed to help users understand and apply California’s overtime regulations effectively. Rated 4.7 by over 4,100 users, this free resource not only provides a comprehensive guide to state overtime laws but also includes an easy-to-use calculator for accurate wage calculations. Ideal for both employers and employees, it simplifies the often complex process of determining overtime pay.

- Website: clockify.me

- Established: Approx. 8 years (domain registered in 2017)

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most crucial steps to ensure accurate results from a California overtime calculator is to meticulously review the information you input. Mistakes in entering hours worked, pay rates, or the start day of your workweek can lead to significant errors in your calculations. To avoid this, take a moment to verify that:

- You have entered the correct number of hours for each day of the week.

- The pay rate reflects your actual hourly wage.

- You are using the correct format for entering hours (decimal or hours:minutes).

By ensuring that your inputs are accurate, you will receive results that truly reflect your overtime compensation.

Understand the Underlying Assumptions

Each calculator may have its own set of assumptions based on California’s overtime laws. Familiarize yourself with these assumptions to ensure that the calculator suits your specific situation. For instance, some calculators may automatically assume a standard workweek of 40 hours or may not account for meal breaks. Understanding these parameters will help you interpret the results more effectively and adjust your inputs accordingly.

Use Multiple Tools for Comparison

To get the most accurate results, consider using several different California overtime calculators. Each tool may have unique features or slight variations in how they handle calculations, especially concerning complex scenarios like multiple overtime rates or specific exemptions. By comparing results across multiple calculators, you can identify discrepancies and gain a clearer picture of your potential earnings. This approach also helps you become more familiar with how different tools operate, allowing you to choose the one that best fits your needs.

Consult Additional Resources

While online calculators are incredibly helpful, they should not be your only source of information regarding California’s overtime laws. To get the most accurate understanding of your rights and obligations, refer to additional resources such as:

- The California Department of Industrial Relations website, which provides comprehensive information on labor laws.

- Articles or guides that explain specific aspects of overtime eligibility and calculation.

- Consultations with labor attorneys or HR professionals if you have unique circumstances or complex questions.

Keep Updated with Changes in Labor Laws

Labor laws can change, and it is essential to stay informed about any updates that may affect your calculations. Subscribe to newsletters or follow relevant organizations that provide updates on labor laws in California. This proactive approach will ensure that you are using the most current information when calculating your overtime pay.

Document Your Calculations

Finally, keep a record of your calculations and the results from each calculator you use. This documentation can be invaluable if you need to present your findings to an employer or if you have any disputes regarding your overtime pay. By maintaining clear records, you can easily refer back to your calculations and support your claims with concrete evidence.

By following these guidelines, you will maximize the accuracy of the results you obtain from California overtime calculators and ensure you are well-informed about your rights and compensation.

Frequently Asked Questions (FAQs)

1. What is a California overtime calculator?

A California overtime calculator is an online tool designed to help employers and employees calculate the correct amount of overtime pay based on California labor laws. It typically allows users to input hours worked, pay rates, and workweek start days to accurately determine overtime, double time, and gross payroll amounts.

2. How do I calculate my overtime pay using a California overtime calculator?

To calculate your overtime pay using a California overtime calculator, follow these steps:

– Input Hours Worked: Enter the total hours you worked each day, separating regular hours from overtime hours.

– Enter Pay Rate: Input your hourly wage to determine the corresponding pay for regular, overtime, and double time hours.

– Select Workweek Start Day: Choose the first day of your workweek, as this can affect overtime calculations.

– Review the Results: The calculator will provide a breakdown of regular pay, time and a half pay, double time pay, and total gross payroll.

3. What are the different types of overtime in California?

In California, there are several types of overtime:

– Daily Overtime: Employees earn time and a half for any hours worked over 8 in a single day.

– Weekly Overtime: Employees earn time and a half for hours worked over 40 in a workweek.

– Double Time: Employees earn double their regular pay for hours worked over 12 in a single day or for hours worked over 8 on the seventh consecutive day of work.

4. Are all employees eligible for overtime pay in California?

Not all employees are eligible for overtime pay in California. Exemptions apply to certain categories of workers, including:

– Executive, administrative, and professional employees who meet specific salary and duties criteria.

– Outside salespersons and certain unionized workers under collective bargaining agreements.

It is essential to understand your classification to determine eligibility for overtime pay.

5. Can I use a California overtime calculator for different pay periods?

Yes, most California overtime calculators can accommodate various pay periods, including weekly, bi-weekly, and monthly calculations. When using the calculator, ensure to select the appropriate pay period and enter hours worked accordingly to receive accurate results.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.