Free Capital Gains Tax On Sale Of Property Calculators: Our Top 5 …

Finding the Best Capital Gains Tax Calculator On Sale Of Property: An Introduction

Finding the right capital gains tax calculator for property sales can be a daunting task, especially with the myriad of options available online. As property owners and investors navigate the complexities of real estate transactions, understanding the tax implications of capital gains becomes crucial. A reliable calculator can provide clarity on potential tax liabilities, helping individuals make informed decisions about selling their assets. However, not all calculators are created equal; some may lack accuracy, have cumbersome interfaces, or fail to account for specific local tax regulations.

The goal of this article is to save you time by reviewing and ranking the best capital gains tax calculators tailored for property sales. We have carefully analyzed various tools based on several criteria to ensure you find the most suitable option for your needs. Key factors considered include accuracy—how well the calculator reflects current tax rates and regulations—ease of use, and the features offered, such as the ability to input various parameters like purchase price, sale price, and ownership duration.

By focusing on these criteria, we aim to provide you with a selection of top-notch calculators that not only simplify the process of estimating capital gains taxes but also empower you to make more strategic financial decisions regarding your property investments. Whether you’re a seasoned investor or a first-time seller, our comprehensive review will guide you toward the best tools available, ensuring you have the information you need to navigate your capital gains tax obligations effectively.

Our Criteria: How We Selected the Top Tools

Key Criteria for Selecting the Best Capital Gains Tax Calculators

When evaluating the top online capital gains tax calculators for property sales, we focused on several key criteria to ensure that users can find the most effective tools for their needs. Below are the essential factors that guided our selection process:

-

Accuracy and Reliability

– The primary purpose of a capital gains tax calculator is to provide accurate estimates of tax liabilities. We prioritized tools that are based on up-to-date tax laws and regulations, ensuring that the calculations reflect the current federal, state, and local tax rates. Reliable calculators should also incorporate any recent changes in tax legislation that may affect capital gains. -

Ease of Use

– A user-friendly interface is crucial for any online tool. We selected calculators that are intuitive and straightforward, allowing users to enter their data without confusion. The design should facilitate quick navigation, minimizing the time spent on data entry and maximizing the focus on results. -

Key Features

– Effective calculators should offer a range of input options to cater to various user scenarios. Important features include:- Initial and Sale Value: Users should be able to input the purchase price and the sale price of the property.

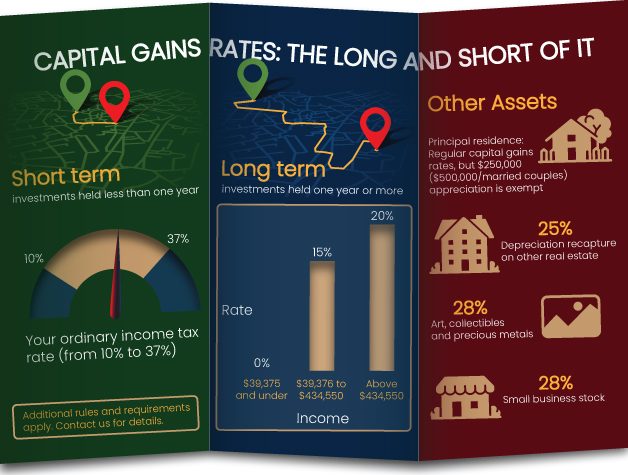

- Length of Ownership: Options to specify whether the property was held for less than or more than a year, as this significantly impacts tax rates.

- Location: The ability to select the state (and sometimes local jurisdiction) to apply the correct tax rates.

- Filing Status and Income Level: These inputs help determine the applicable tax bracket and corresponding rates for both short-term and long-term gains.

- Adjustable Inputs for Deductions: Some calculators allow for adjustments based on itemized deductions or specific exemptions, which can provide a more tailored estimate.

-

Cost (Free vs. Paid)

– We considered the cost-effectiveness of the tools. Many excellent calculators are available for free, while some may offer premium features at a cost. We evaluated the balance between the value provided and any associated fees, ensuring that users can access quality tools without unnecessary expenses. -

Additional Resources and Support

– The best calculators often come with educational resources that explain capital gains tax concepts, strategies for minimizing tax liabilities, and guidance on using the calculator effectively. We looked for tools that not only provide calculations but also enhance user understanding of capital gains tax implications.

-

User Feedback and Ratings

– Finally, we reviewed user feedback and ratings for each calculator. Tools that have positive reviews and high ratings from users are more likely to deliver a satisfactory experience. We sought out calculators that have demonstrated a track record of reliability and user satisfaction.

By applying these criteria, we ensured that the capital gains tax calculators we recommend are not only functional but also user-friendly and reliable, ultimately helping individuals make informed decisions regarding property sales.

The Best Capital Gains Tax Calculator On Sale Of Propertys of 2025

2. Capital Gain Tax Calculator

The Capital Gain Tax Calculator from Asset Preservation, Inc. is designed to assist users in estimating their capital gains and identifying potential deferral amounts under Internal Revenue Code §1031. This tool simplifies the complex calculations involved in capital gains tax, making it easier for individuals and investors to understand their tax obligations and optimize their financial strategies related to asset sales.

- Website: apiexchange.com

- Established: Approx. 27 years (domain registered in 1998)

3. Real Estate Capital Gains Calculator

The Real Estate Capital Gains Calculator from Bangerter Financial Strategies is an interactive tool designed to help users estimate potential returns on real estate investments. By inputting relevant data, users can gain insights into their capital gains, enabling informed investment decisions. The calculator emphasizes a user-friendly experience, making it accessible for both novice and experienced investors looking to maximize their financial outcomes.

- Website: bangerterfinancial.com

- Established: Approx. 14 years (domain registered in 2011)

4. Capital Gains Tax Calculator

The Capital Gains Tax Calculator from 1031 Crowdfunding is designed to help users estimate their potential tax liabilities when selling an asset. By inputting relevant details, users can quickly assess how much they might owe in capital gains taxes, making it a valuable tool for individuals looking to navigate the complexities of asset sales and tax implications efficiently.

- Website: 1031crowdfunding.com

- Established: Approx. 11 years (domain registered in 2014)

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most critical steps in obtaining accurate results from a capital gains tax calculator is to ensure that all your inputs are correct. Begin by verifying the details of your property sale, including the purchase price, sale price, and any associated costs such as closing fees or renovations. Additionally, confirm the length of time you held the property, as this will determine whether your gains are classified as short-term or long-term. Inaccurate input can lead to misleading results, so take your time to review each entry carefully.

Understand the Underlying Assumptions

Different calculators may use varying assumptions about tax rates, deductions, and other factors that can affect your capital gains tax liability. Familiarize yourself with these assumptions and how they apply to your situation. For example, some calculators may not account for state or local taxes, while others might apply generalized tax rates. Understanding these nuances will help you interpret the results more accurately and enable you to make informed decisions based on your specific tax circumstances.

Use Multiple Tools for Comparison

To get the most comprehensive view of your potential capital gains tax liability, consider using multiple calculators. Each tool may offer unique features or approaches to calculating taxes, and comparing results can help identify any discrepancies. This practice can also provide you with a range of potential tax liabilities, giving you a better sense of what to expect. When using different tools, ensure that you’re entering the same inputs across all calculators for a valid comparison.

Keep Updated on Tax Laws

Capital gains tax rates and regulations can change frequently, often on an annual basis. Make sure you are using calculators that are updated to reflect the most current tax laws. Check for any news or announcements regarding tax changes that may affect your calculations. Staying informed will help you avoid surprises come tax season and ensure that your calculations are based on the most accurate and relevant information.

Seek Professional Guidance

While online calculators are valuable tools, they cannot replace personalized advice from a tax professional. If your financial situation is complex—such as involving multiple properties, different types of investments, or specific deductions—it might be beneficial to consult with a tax advisor. A professional can help you navigate the intricacies of capital gains taxes and provide tailored guidance that online tools may not offer.

Document Your Findings

After using a capital gains tax calculator, keep a record of your results, inputs, and any assumptions made during the calculation process. This documentation can be invaluable when preparing your tax return or discussing your situation with a financial advisor. Having clear records will enable you to refer back to your calculations and clarify any questions that may arise later.

Frequently Asked Questions (FAQs)

1. What is a capital gains tax calculator and how does it work?

A capital gains tax calculator is an online tool designed to help users estimate the tax implications of selling an asset, such as property. By entering details like the purchase price, sale price, length of ownership, and tax bracket, the calculator can provide an estimate of the capital gains tax owed. This allows property sellers to understand their potential tax liability before making a sale.

2. Why is it important to calculate capital gains tax before selling property?

Calculating capital gains tax before selling property is crucial because it helps you understand how much of your profit will be taxed. This information can influence your decision on when to sell and whether to reinvest in different assets. Knowing your tax obligation can also help you plan for the financial impact of the sale and avoid any surprises during tax season.

3. What factors do I need to input into a capital gains tax calculator?

When using a capital gains tax calculator, you typically need to input several key pieces of information:

– Purchase Price: The original cost of the property.

– Sale Price: The price at which you plan to sell the property.

– Length of Ownership: How long you have owned the property (short-term vs. long-term).

– Location: Your state, as state tax rates can vary.

– Filing Status: Whether you are filing as single, married, etc.

– Annual Income: Your total income, which can affect your tax bracket.

4. Can a capital gains tax calculator account for both federal and state taxes?

Yes, many capital gains tax calculators are designed to account for both federal and state taxes. When you input your location, the calculator can estimate the state-specific tax rates applicable to your capital gains. This comprehensive approach helps provide a more accurate picture of your total tax liability from the sale of your property.

5. Are there strategies to minimize capital gains tax when selling property?

Yes, there are several strategies to minimize capital gains tax, including:

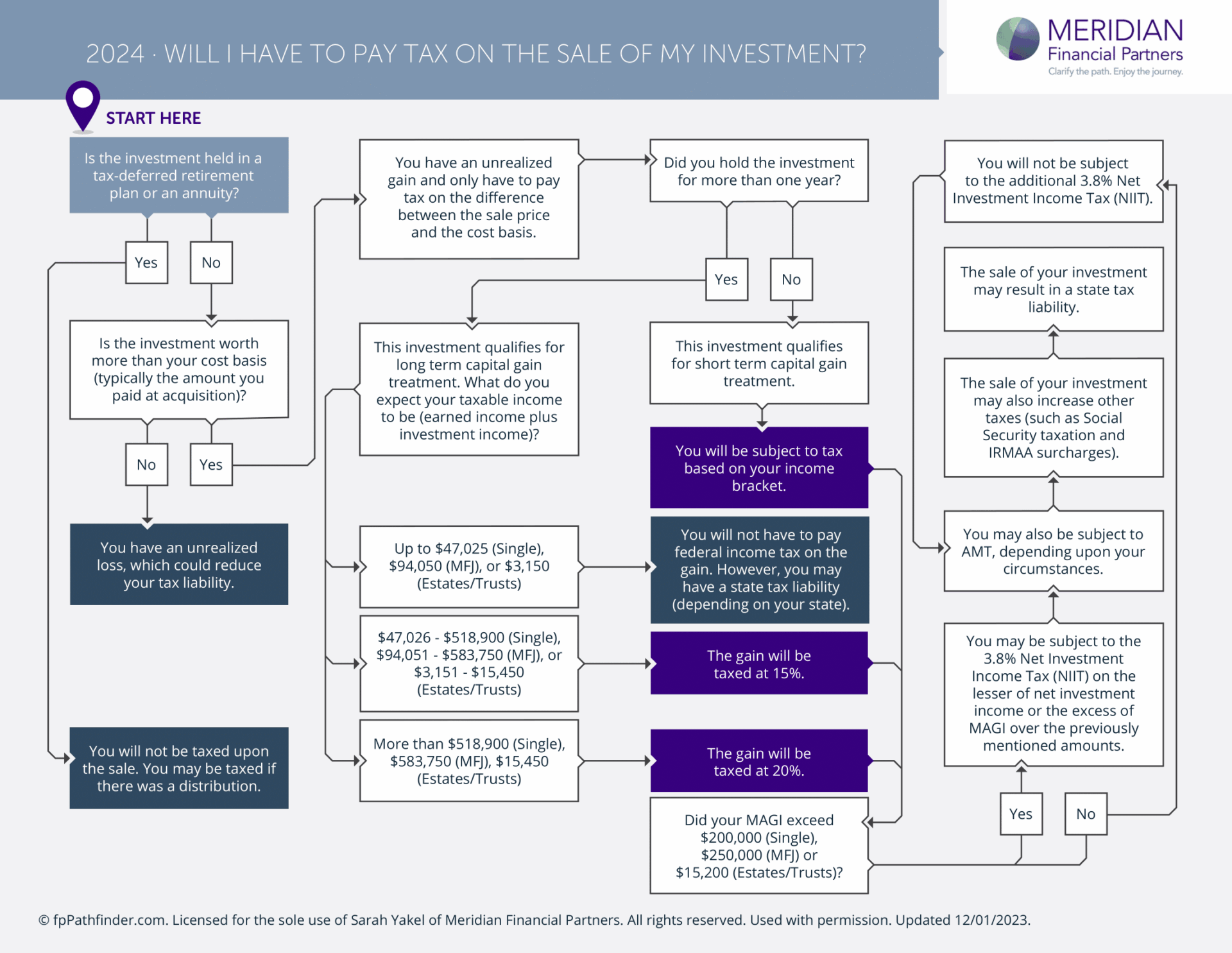

– Holding Period: Holding the property for more than one year may qualify you for lower long-term capital gains tax rates.

– Tax-Advantaged Accounts: If applicable, using accounts like IRAs or 401(k)s can allow investments to grow tax-deferred.

– Offsetting Gains with Losses: If you have other investments that have lost value, selling them in the same tax year can offset your capital gains.

– Deductions and Credits: Investigating available deductions and credits can also reduce your taxable income, thereby lowering your overall tax liability.

Utilizing these strategies can help you retain more of your profits from the sale.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.