Free Cash Flow Calculators: Our Top 5 Picks for 2025

Finding the Best Cash Flow Calculator: An Introduction

When it comes to managing personal or business finances, understanding cash flow is crucial. A cash flow calculator can simplify this task by providing insights into your income and expenses, helping you make informed financial decisions. However, with countless options available online, finding a good, reliable cash flow calculator can be challenging. Many tools claim to offer comprehensive features, but not all deliver on their promises.

The Challenge of Choosing the Right Tool

Users often face an overwhelming number of choices, each with varying degrees of functionality and user experience. Some calculators may be too simplistic, failing to capture the complexities of your financial situation, while others might be overly complicated, making it hard to extract useful information quickly. Additionally, the accuracy of the calculations can vary significantly between tools, which can lead to misguided financial planning.

Purpose of This Article

The goal of this article is to review and rank the top cash flow calculators available online. We aim to save you time and effort by providing a curated list of tools that are not only reliable but also user-friendly. Whether you are an individual looking to track personal expenses or a business owner needing to manage operational cash flow, our rankings will help you find the right tool to suit your needs.

Criteria for Ranking

In our evaluation, we considered several key factors, including accuracy, ease of use, available features, and overall user experience. We also took into account the variety of financial situations the calculators can accommodate, ensuring that they cater to a wide range of users. By focusing on these criteria, we aim to provide you with a comprehensive guide that highlights the best cash flow calculators on the market today.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting the Best Cash Flow Calculators

When evaluating the top cash flow calculators, we focused on several key criteria to ensure that our recommendations meet the needs of a general audience. Below are the essential factors we considered:

-

Accuracy and Reliability

– The calculator must provide precise calculations based on the inputs provided by the user. It should also have a clear methodology for how it arrives at its results, ensuring users can trust the data it generates. -

Ease of Use

– A user-friendly interface is crucial. We looked for tools that are intuitive, allowing users to navigate easily without requiring extensive financial knowledge. Clear instructions and a straightforward input process help users quickly input their financial data. -

Key Features

– Essential inputs for cash flow calculations include:- Income Sources: Users should be able to enter various types of income, such as salaries, rental income, and investment returns.

- Expense Categories: The calculator should allow for detailed expense tracking, including fixed costs (rent, utilities) and variable costs (entertainment, groceries).

- Net Cash Flow Calculation: The ability to calculate net cash flow, which is the difference between total income and total expenses, is essential.

- Cash Flow Projections: Some calculators offer features to forecast future cash flows based on historical data or user-defined parameters.

-

Cost (Free vs. Paid)

– We assessed whether the calculator is free to use or requires a subscription. Many users prefer free tools that provide adequate functionality, while others may opt for paid tools if they offer advanced features and enhanced support. -

Customization Options

– The best calculators allow users to customize inputs and outputs according to their specific financial situations. This includes the ability to add or remove expense categories, adjust income sources, and modify time frames for cash flow analysis. -

Accessibility and Compatibility

– We considered the accessibility of the calculators across different devices (desktop, tablet, and mobile) and browser compatibility. Tools that work seamlessly across various platforms provide greater convenience for users. -

Support and Resources

– The availability of support, such as FAQs, tutorials, or customer service, can greatly enhance the user experience. We looked for tools that offer additional resources to help users understand cash flow management better. -

User Reviews and Feedback

– Finally, we considered user reviews and feedback to gauge the overall satisfaction of those who have used the calculators. High ratings and positive testimonials can indicate a reliable tool that effectively meets user needs.

By applying these criteria, we aimed to identify cash flow calculators that not only meet the basic requirements but also provide valuable features and resources for users looking to manage their finances effectively.

The Best Cash Flow Calculators of 2025

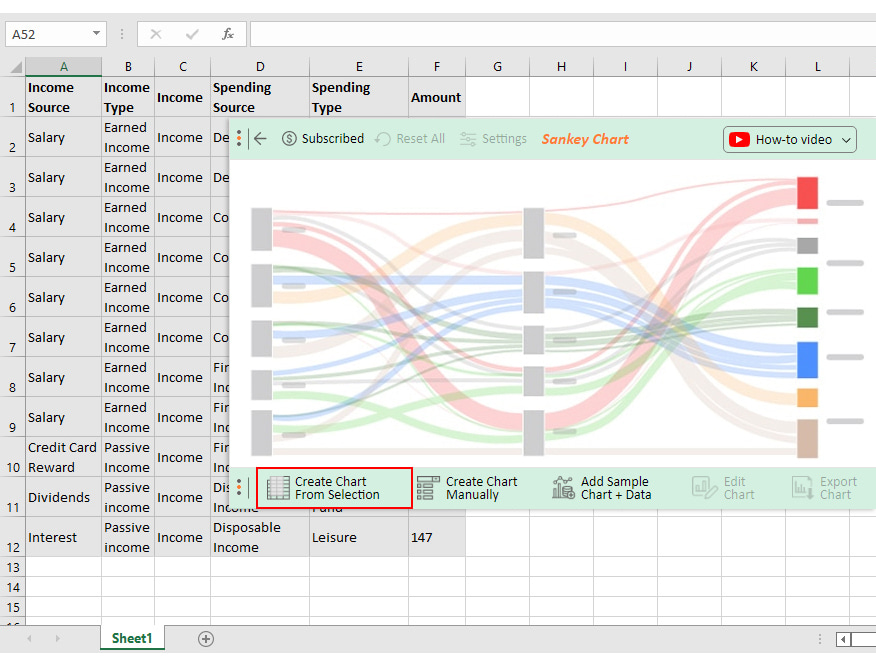

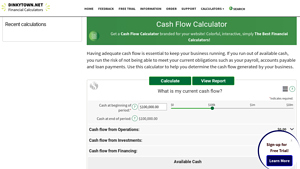

2. Cash Flow Calculator

The Cash Flow Calculator from Dinkytown.net is a practical tool designed to help businesses assess their cash flow by analyzing key financial components such as payroll, accounts payable, and loan payments. This calculator provides users with a clear understanding of their cash inflows and outflows, enabling them to make informed financial decisions and improve overall cash management. Its user-friendly interface ensures that even those with limited financial expertise can effectively utilize the tool.

- Website: dinkytown.net

- Established: Approx. 27 years (domain registered in 1998)

4. Cash flow calculator

The Cash Flow Calculator from Xero US is a user-friendly tool designed to help businesses track their financial health by monitoring the movement of money in and out. This free calculator allows users to assess their cash flow effectively, providing valuable insights that can inform financial decisions. With Xero’s intuitive interface, it simplifies cash flow management, making it accessible for businesses of all sizes.

- Website: xero.com

- Established: Approx. 28 years (domain registered in 1997)

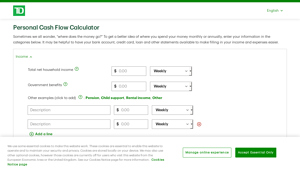

5. Personal Cash Flow Calculator

The Personal Cash Flow Calculator from TD is designed to help users analyze their monthly and annual spending habits. By inputting financial data into various categories, individuals can gain insights into their cash flow, allowing for better budgeting and financial planning. This intuitive tool simplifies the process of tracking expenses, empowering users to make informed decisions about their finances.

- Website: ix0.apps.td.com

- Established: Approx. 27 years (domain registered in 1998)

How to Get the Most Accurate Results

Double-Check Your Inputs

Accuracy starts with the data you input into the cash flow calculator. Ensure that all figures—such as income, expenses, and any other financial data—are entered correctly. Mistakes in your entries can lead to significant discrepancies in your cash flow projections. To avoid errors, take the time to gather relevant financial documents, such as bank statements, invoices, and receipts, which can help you provide precise figures. Additionally, make sure to use consistent units (e.g., all amounts in monthly or annual terms) to ensure clarity and correctness.

Understand the Underlying Assumptions

Each cash flow calculator may operate on different assumptions regarding factors like tax rates, inflation, or contribution limits. Familiarize yourself with these assumptions to understand how they may affect your results. For instance, some calculators might not account for certain types of income or expenses, which can skew the cash flow analysis. By knowing these factors, you can interpret the results more accurately and adjust your financial planning accordingly.

Use Multiple Tools for Comparison

No single calculator is perfect, and each may have its own strengths and weaknesses. To gain a more comprehensive view of your cash flow situation, consider using multiple calculators. By comparing results from different tools, you can identify inconsistencies and get a more balanced perspective on your cash flow. This practice can also help you discover features or functionalities that are unique to certain calculators, potentially providing additional insights into your financial situation.

Regularly Update Your Data

Cash flow is dynamic, and your financial situation can change frequently due to various factors like salary changes, new expenses, or shifting investment values. Make it a habit to regularly update your inputs in the cash flow calculator to reflect your current financial status. This not only helps maintain accuracy but also allows you to track your financial progress over time and make informed decisions based on real-time data.

Seek Professional Guidance

While online calculators are powerful tools for estimating cash flow, they cannot replace the insights of a financial advisor. If you’re unsure about certain inputs or need assistance in interpreting results, consider consulting a financial professional. They can provide personalized advice tailored to your unique circumstances, helping you make the most of your cash flow management strategies.

Be Mindful of External Factors

Finally, always consider external economic factors that might affect your cash flow. Elements such as market trends, interest rates, or changes in tax legislation can have a substantial impact on your financial health. Stay informed about these variables and factor them into your cash flow analysis to ensure your projections are as accurate as possible. This holistic approach will enhance the effectiveness of the cash flow calculator in guiding your financial decisions.

Frequently Asked Questions (FAQs)

1. What is a cash flow calculator and how does it work?

A cash flow calculator is a financial tool that helps individuals and businesses estimate their cash inflows and outflows over a specific period. By entering data such as income sources, expenses, and other financial commitments, users can calculate their net cash flow. This tool is especially useful for budgeting, forecasting, and understanding financial health.

2. Who can benefit from using a cash flow calculator?

Anyone can benefit from using a cash flow calculator, including individuals managing personal finances, small business owners tracking operational cash flow, and real estate investors assessing rental property profitability. It helps users make informed financial decisions by providing a clearer picture of their cash flow situation.

3. Can I use a cash flow calculator for both personal and business finances?

Yes, many cash flow calculators are designed to accommodate both personal and business finances. Personal cash flow calculators typically focus on household income and expenses, while business cash flow calculators may include additional variables such as sales revenue, operational costs, and loan repayments. Depending on your needs, you can choose a calculator that suits your financial situation.

4. Are cash flow calculators easy to use?

Most cash flow calculators are designed to be user-friendly, allowing users to input data quickly and easily. They typically feature straightforward interfaces with clear categories for income and expenses. Many online calculators also provide instant calculations and visual representations of cash flow, making it easier to understand your financial position at a glance.

5. Is my data secure when using an online cash flow calculator?

Data security varies by platform. Reputable cash flow calculators typically employ encryption and other security measures to protect user data. However, it’s essential to read the privacy policy of the specific calculator you are using to understand how your information will be handled. If you are concerned about data privacy, consider using offline calculators or software that does not require internet access.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.