Free Covered Call Calculators: Our Top 5 Picks for 2025

Finding the Best Covered Call Calculator: An Introduction

Finding a reliable covered call calculator can be a daunting task for traders and investors alike. With numerous online tools available, each claiming to offer the best features, users often find themselves overwhelmed by choices. The intricacies of options trading, particularly when it comes to executing a covered call strategy, necessitate a tool that not only simplifies calculations but also provides accurate and actionable insights. A good calculator can help users evaluate potential profits, understand risks, and make informed decisions based on their market outlook.

The goal of this article is to review and rank the top covered call calculators available online, saving you time and effort in your search. By compiling a list of the best tools, we aim to help both novice and experienced traders find a calculator that meets their specific needs.

Criteria for Ranking

To ensure a fair and comprehensive evaluation, we have established several criteria for our rankings. These include:

-

Accuracy: The precision of calculations is paramount in options trading. We assess how reliably each tool computes potential profits and losses based on user inputs.

-

Ease of Use: A user-friendly interface can significantly enhance the trading experience. We evaluate how intuitive each calculator is, including the clarity of instructions and the accessibility of features.

-

Features: Additional functionalities, such as visual payout diagrams, integration with market data, and educational resources, can add considerable value. We consider the breadth of features offered by each calculator.

-

Customer Support: Access to help and resources can be crucial, especially for new traders. We look at the support options available for users of each tool.

By focusing on these criteria, we aim to present a well-rounded view of the best covered call calculators, empowering you to make more informed trading decisions.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting the Best Covered Call Calculators

When evaluating the best online tools for calculating covered calls, we considered several essential criteria to ensure users have access to reliable, user-friendly, and feature-rich options. Below are the key factors that guided our selection process:

-

Accuracy and Reliability

– A top-tier calculator must provide precise calculations based on accurate financial models such as Black-Scholes or Binomial pricing. We evaluated each tool’s ability to deliver consistent results across various scenarios, ensuring users can trust the outputs for their investment decisions. -

Ease of Use

– User experience is paramount. We prioritized calculators that feature intuitive interfaces, allowing both novice and experienced traders to navigate the tool with ease. The best calculators should minimize the time spent on inputting data and interpreting results, making the overall experience seamless. -

Key Features

– Effective covered call calculators should offer comprehensive functionality, including but not limited to:- Input Fields: Ability to enter critical parameters such as stock purchase price, call strike price, premium received, number of contracts, days to expiration, implied volatility, interest rates, and dividend yields.

- Output Options: Clear presentation of results, including maximum profit, maximum loss, breakeven point, and profit/loss diagrams. These visual aids help users quickly grasp the potential outcomes of their trades.

- Scenario Analysis: The option to simulate various market conditions and their impact on the covered call strategy is highly beneficial for making informed decisions.

-

Cost (Free vs. Paid)

– We examined the pricing structures of each tool, weighing the benefits of free calculators against premium options. While free tools can be sufficient for basic calculations, paid tools often provide advanced features and additional support. Our review includes a variety of tools to cater to different budget levels, ensuring users can find a solution that meets their needs without compromising on quality. -

Educational Resources

– A valuable calculator should be accompanied by educational content that enhances user understanding of covered calls and options trading. We looked for tools that provide tutorials, guides, or articles explaining the covered call strategy, its benefits, and its risks. -

Customer Support

– Access to responsive customer support can significantly enhance the user experience, especially for those new to options trading. We considered the availability of help through FAQs, live chat, or customer service to assist users in navigating the tool and addressing any questions or issues. -

Reputation and User Feedback

– We reviewed user testimonials and expert opinions regarding each calculator’s performance and reliability. Tools with positive feedback and a strong reputation in the trading community were prioritized in our selection process.

By considering these criteria, we aimed to present a well-rounded list of the best covered call calculators that cater to a wide range of user needs and preferences.

The Best Covered Call Calculators of 2025

1. Covered Call Calculator

The Covered Call Calculator from Options Profit Calculator is a valuable tool designed for investors looking to optimize their covered call strategies. It allows users to project potential profits and losses over time, helping them assess the effectiveness of writing call option contracts while holding the underlying asset. With its user-friendly interface, the calculator simplifies the complex dynamics of options trading, making it accessible for both novice and experienced traders.

- Website: optionsprofitcalculator.com

- Established: Approx. 18 years (domain registered in 2007)

2. Covered Call: Profit Calculator and Payoff Visualizer

The Covered Call Profit Calculator and Payoff Visualizer from TradingBlock is designed to help traders maximize income from their stock holdings in a neutral market. This tool allows users to assess potential profits and visualize the payoff of implementing a covered call strategy, effectively mitigating risks associated with stock ownership. With its user-friendly interface, the calculator provides valuable insights for both novice and experienced traders looking to enhance their investment strategies.

- Website: tradingblock.com

3. Covered Call

The OptionStrat Options Profit Calculator for Covered Calls is a versatile tool designed to help investors evaluate the potential profitability of covered call options and over 50 other strategies. Users can easily calculate key metrics such as potential profit, maximum loss, and the probability of profit, enabling them to make informed decisions about their options trading strategies. Its user-friendly interface and comprehensive features make it a valuable resource for both novice and experienced traders.

- Website: optionstrat.com

- Established: Approx. 5 years (domain registered in 2020)

4. Using the Options calculator before I buy a covered call. 69% profit …

The Options Calculator serves as a valuable tool for investors looking to navigate the complexities of covered calls, particularly in assessing potential profits and risks. It helps users understand crucial factors like volatility and maximum loss potential, enabling informed decision-making before executing trades. By offering insights into profit margins—such as the reported 69% profit—this calculator empowers investors to strategize effectively and minimize their risk exposure in options trading.

- Website: reddit.com

- Established: Approx. 20 years (domain registered in 2005)

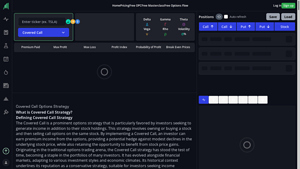

5. Covered Call Options Strategy

InsiderFinance’s Covered Call Options Strategy tool offers a comprehensive profit calculator designed for investors utilizing the Covered Call strategy. It provides real-time option price data for any ticker, enabling users to visualize potential payoffs effectively. This tool is particularly beneficial for traders looking to optimize their options trading by analyzing various scenarios and outcomes, making it an essential resource for informed decision-making in the options market.

- Website: insiderfinance.io

- Established: Approx. 5 years (domain registered in 2020)

How to Get the Most Accurate Results

Double-Check Your Inputs

Accuracy in your calculations starts with the data you provide. Before hitting the calculate button, take a moment to verify each input. Common fields include the stock purchase price, call strike price, premium received, number of contracts, days to expiration, and any relevant rates like implied volatility or dividend yield. A simple typo can lead to misleading results, so ensure that all figures are correct and relevant to your specific trading scenario.

Understand the Underlying Assumptions

Each covered call calculator operates based on specific models and assumptions, such as the Black-Scholes or Binomial models. Understanding these foundations can help you interpret the results more effectively. For instance, the Black-Scholes model assumes a constant volatility and doesn’t account for dividends unless specified. This means that if your stock pays dividends, the results may not fully reflect the actual performance of your covered call strategy. Familiarize yourself with the calculator’s methodology to better understand its outputs.

Use Multiple Tools for Comparison

No single calculator can encompass all scenarios or provide the perfect answer for every trader. To gain a more comprehensive view, consider using multiple covered call calculators. By comparing outputs from different tools, you can identify discrepancies and better gauge the potential outcomes of your strategy. Each calculator may offer unique features or perspectives, and using several can help you cross-verify your results for increased confidence in your decisions.

Review Historical Performance

To enhance your forecasting, consider reviewing historical data of the underlying stock. Look at past performance, particularly around the timeframes you are interested in trading. Understanding how the stock has reacted to market conditions, earnings reports, or major news can provide valuable context for your calculations. Some calculators may even allow you to incorporate historical volatility, which can yield more accurate projections.

Factor in Transaction Costs

Always remember to consider transaction costs, such as commissions and fees associated with options trading. These costs can significantly affect your overall profitability and should be factored into your net profit or loss calculations. Many calculators will not automatically include these fees, so make sure to account for them manually to get a clearer picture of your potential returns.

Continuously Educate Yourself

Lastly, the world of options trading and covered calls is complex and ever-evolving. Stay informed by reading articles, watching tutorial videos, or joining trading forums. Understanding market trends, strategies, and the mechanics of options can enhance your decision-making process and enable you to use these calculators more effectively. Knowledge is a powerful tool in trading, and the more you know, the better equipped you are to make informed decisions.

Frequently Asked Questions (FAQs)

1. What is a covered call calculator and how does it work?

A covered call calculator is a financial tool designed to help investors evaluate the potential outcomes of implementing a covered call strategy. By inputting various parameters such as stock purchase price, call strike price, premium received, number of contracts, and days to expiration, the calculator can provide insights into potential profits, losses, and breakeven points. It simplifies the analysis of covered calls, allowing users to make informed decisions based on their market outlook.

2. What key inputs do I need to use a covered call calculator?

To effectively use a covered call calculator, you typically need to input the following key parameters:

– Stock Purchase Price: The price at which you bought the underlying stock.

– Call Strike Price: The price at which you are willing to sell the stock if the option is exercised.

– Premium Received: The amount you earn from selling the call option.

– Number of Contracts: The number of options contracts you are trading (usually one contract covers 100 shares).

– Days to Expiration: The time remaining until the option expires.

These inputs allow the calculator to assess potential profit and loss scenarios.

3. Can a covered call calculator help with risk management?

Yes, a covered call calculator can be an essential tool for risk management. By allowing you to visualize potential outcomes based on different market scenarios, it helps you understand the risks associated with your covered call strategy. You can see how much you stand to gain or lose depending on various price movements of the underlying stock, which aids in making informed decisions about whether to proceed with the trade or adjust your strategy.

4. Are there any limitations to using a covered call calculator?

While a covered call calculator provides valuable insights, it has limitations. First, it relies on the accuracy of the inputs provided; incorrect data can lead to misleading results. Second, it may not account for all market variables, such as changes in implied volatility or market conditions that can affect option pricing. Finally, it cannot predict future price movements, making it essential to complement its use with thorough market analysis and research.

5. How can I maximize the benefits of using a covered call calculator?

To maximize the benefits of using a covered call calculator, consider the following tips:

– Use Accurate Data: Ensure that you input the most current and accurate stock prices, strike prices, and premiums.

– Understand Market Conditions: Stay informed about market trends and conditions that may impact the underlying stock’s price.

– Experiment with Different Scenarios: Use the calculator to test various strike prices and expiration dates to see how they affect potential outcomes.

– Combine with Other Tools: Consider using additional financial tools, such as options pricing models and risk assessment software, to enhance your trading strategy.

By doing so, you can make more informed decisions and potentially increase your returns when employing a covered call strategy.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.