Free Dca Calculators: Our Top 5 Picks for 2025

Finding the Best Dca Calculator: An Introduction

Finding a reliable Dollar Cost Averaging (DCA) calculator can be a daunting task for investors looking to optimize their investment strategies. With numerous options available online, it can be challenging to discern which tools offer the most accurate calculations and user-friendly interfaces. DCA is a popular investment approach that allows individuals to invest a fixed amount regularly, reducing the impact of market volatility and potentially lowering the average cost per share. However, to effectively utilize this strategy, investors need a trustworthy calculator that can provide precise projections based on historical data and their specific investment parameters.

This article aims to review and rank the top DCA calculators available online, saving you time and effort in your search for the best tool. We will evaluate each option based on several key criteria, including accuracy, ease of use, and features. An accurate calculator is essential for reliable projections, while user-friendly interfaces ensure that even novice investors can navigate the tools with confidence. Additionally, we will consider the features offered, such as customization options for investment amounts, frequency, and the ability to visualize growth over time.

By the end of this article, you will be equipped with the information needed to select the most suitable DCA calculator for your investment journey, empowering you to make informed decisions and take control of your financial future. Whether you are a seasoned investor or just starting, the right DCA calculator can enhance your investment experience and help you achieve your financial goals.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting the Best DCA Calculators

When evaluating the top dollar-cost averaging (DCA) calculators, we focused on several key criteria that are essential for ensuring users have a reliable and effective tool for their investment strategies. Below are the criteria we considered:

-

Accuracy and Reliability

– A good DCA calculator must deliver precise calculations based on the inputs provided. We assessed the accuracy of investment growth projections and the ability to handle varying market conditions. The tools selected should use historical data effectively to simulate potential investment outcomes. -

Ease of Use

– User experience is crucial, especially for those who may not be financially savvy. The calculators should have an intuitive interface that allows users to input data easily and understand the results without confusion. We looked for tools that guide users through the process with clear instructions and minimal jargon. -

Key Features

– Effective DCA calculators offer a range of functionalities. Key features we looked for include:- Customizable Inputs: The ability to input initial capital, recurring investment amounts, investment duration, and expected annual return rates.

- Visualization Tools: Graphs or charts that illustrate investment growth over time, helping users visualize the impact of their investment strategy.

- Scenario Analysis: Options to simulate different investment scenarios based on varying market conditions or contributions.

-

Cost (Free vs. Paid)

– Many users prefer free tools, but we also considered paid options that provide additional features or more sophisticated analysis. We evaluated the value offered by paid calculators against their cost, ensuring that any fees justified the benefits provided. -

Accessibility

– We prioritized calculators that are accessible across various devices, including desktops, tablets, and smartphones. This ensures that users can plan their investments anytime and anywhere, enhancing convenience. -

Customer Support and Resources

– A strong support system can greatly enhance the user experience. We checked for calculators that offer customer support, FAQs, and educational resources to help users better understand DCA and how to use the tool effectively. -

User Reviews and Reputation

– Finally, we considered user feedback and reviews from other investors. A calculator’s reputation among the investment community can provide insights into its reliability and effectiveness. We included tools that have garnered positive reviews for their accuracy and user-friendly design.

By carefully evaluating these criteria, we aimed to provide a comprehensive overview of the best DCA calculators available, helping users make informed decisions about their investment strategies.

The Best Dca Calculators of 2025

1. Dollar Cost Averaging Calculator – Maximize Your Investments

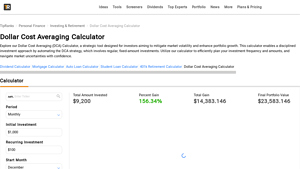

The Dollar Cost Averaging Calculator from TipRanks is designed to streamline the investment process by automating the Dollar Cost Averaging (DCA) strategy. This tool encourages a disciplined investment approach, allowing users to make regular, fixed-amount contributions over time. By utilizing this calculator, investors can effectively manage their portfolios and potentially maximize returns while minimizing the impact of market volatility.

- Website: tipranks.com

- Established: Approx. 14 years (domain registered in 2011)

2. DCA calculator (dollar

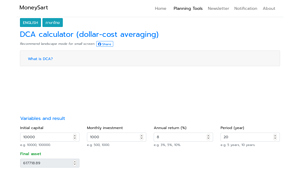

The DCA calculator from MoneySart is a user-friendly tool designed to help investors simulate the potential growth of their capital through dollar-cost averaging (DCA) strategies. Users can input their initial investment, set recurring contributions, specify a return rate, and define a time period to visualize how their investments may grow over time. This calculator is ideal for those looking to understand the benefits of consistent investing in fluctuating markets.

- Website: moneysart.com

- Established: Approx. 4 years (domain registered in 2021)

4. S&P 500 DCA Calculator

The S&P 500 DCA Calculator from Of Dollars And Data is a powerful tool designed to help users evaluate the potential growth of monthly investments in the S&P 500. It offers insights into both nominal and inflation-adjusted returns, factoring in dividend reinvestment. This calculator is particularly useful for investors looking to understand the long-term benefits of dollar-cost averaging in the stock market.

- Website: ofdollarsanddata.com

- Established: Approx. 9 years (domain registered in 2016)

How to Get the Most Accurate Results

Double-Check Your Inputs

When using a DCA calculator, accuracy in your inputs is crucial for obtaining reliable results. Take the time to carefully enter your initial investment amount, recurring investment amounts, investment duration, and any anticipated annual return rates. A small error in any of these figures can lead to significantly different outcomes. It’s also wise to verify the historical data used by the calculator, especially if it pulls information from external sources. If possible, cross-reference your inputs with financial statements or other calculators to ensure consistency.

Understand the Underlying Assumptions

Every DCA calculator operates based on certain assumptions that can affect the results. For instance, many calculators assume a consistent rate of return, which might not reflect real market conditions. Additionally, they may not account for factors such as taxes, fees, or inflation, which can impact your actual returns. Familiarize yourself with these assumptions to better interpret the results. Understanding how the calculator works will help you make more informed decisions based on the outputs.

Use Multiple Tools for Comparison

To gain a comprehensive view of your potential investment outcomes, consider using multiple DCA calculators. Different tools may employ various methodologies or offer unique features, such as visualizations or scenario simulations. By comparing results across different calculators, you can identify trends and discrepancies that may highlight the strengths and weaknesses of each tool. This multi-tool approach will not only enhance your understanding of the DCA strategy but also provide a broader perspective on potential investment scenarios.

Explore Historical Performance

While calculators can project future performance based on historical data, it’s beneficial to delve deeper into that historical performance. Research the asset you plan to invest in, and consider its past volatility and growth patterns. Look for economic indicators that could affect future performance, such as market trends or geopolitical events. This context can help you make more informed predictions about your investments and adjust your inputs accordingly.

Plan for Different Scenarios

Investing is inherently uncertain, and market conditions can change rapidly. Use the DCA calculator to simulate various scenarios, such as different investment amounts, time frames, or rates of return. This will give you insight into how your investment strategy might perform under various circumstances. Planning for best-case, worst-case, and most-likely scenarios will help you develop a robust investment strategy that accommodates potential market fluctuations.

Keep Learning

Finally, remember that financial literacy is key to successful investing. Continue to educate yourself about DCA strategies, market conditions, and investment principles. Online resources, books, and financial news can provide valuable information that enhances your understanding of the investment landscape. The more knowledgeable you become, the better equipped you will be to make sound investment decisions and utilize calculators effectively.

Frequently Asked Questions (FAQs)

1. What is a DCA calculator?

A DCA (Dollar Cost Averaging) calculator is a financial tool designed to help investors simulate the potential outcomes of regularly investing fixed amounts into an asset over a specified period. By using historical price data, the calculator can provide insights into how the investments would have performed, thereby aiding in investment planning and decision-making.

2. How does a DCA calculator work?

The DCA calculator works by allowing users to input variables such as the amount of money they wish to invest regularly, the duration of the investment, and the historical prices of the asset. The calculator then computes how many shares would have been purchased at different price points over the investment period, ultimately providing results like total investment, average cost per share, and potential returns.

3. What information do I need to use a DCA calculator?

To effectively use a DCA calculator, you will need:

– The initial investment amount (if applicable).

– The amount you plan to invest regularly (e.g., monthly).

– The duration of your investment (in months or years).

– Historical price data for the asset you are investing in.

Having this information will allow the calculator to generate accurate simulations of your potential investment outcomes.

4. Can I use a DCA calculator for different types of investments?

Yes, a DCA calculator can be used for various types of investments, including stocks, ETFs, mutual funds, and cryptocurrencies, as long as you have access to the historical price data for those assets. This versatility makes it a valuable tool for different investment strategies and asset classes.

5. Is using a DCA calculator reliable for predicting investment outcomes?

While a DCA calculator provides useful estimates and insights based on historical data, it is important to remember that actual investment performance can vary due to market conditions, economic factors, and unforeseen events. Therefore, while the calculator can help you understand potential scenarios, it should not be solely relied upon for making investment decisions. Consulting with a financial advisor is recommended for tailored advice.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.