Free Debt Service Calculators: Our Top 5 Picks for 2025

Finding the Best Debt Service Calculator: An Introduction

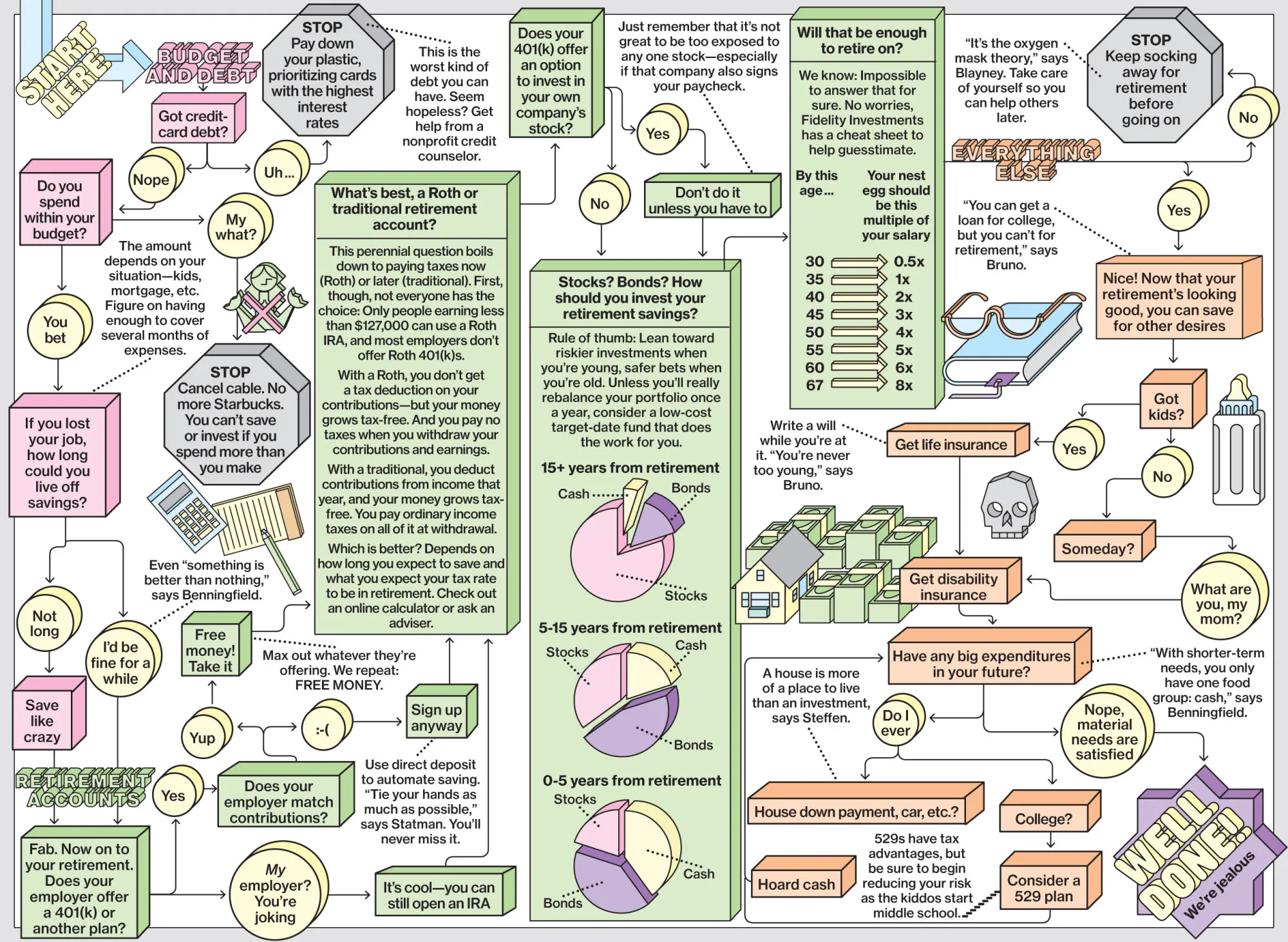

Finding an effective debt service calculator can be a daunting task, especially with the multitude of options available online. Many users, whether they are business owners looking to secure financing or individuals managing personal debt, require a reliable tool that can accurately compute their debt service coverage ratio (DSCR) or assess their ability to meet debt obligations. The challenge lies not only in finding a calculator that provides precise calculations but also in identifying one that is user-friendly and equipped with features that cater to specific financial needs.

This article aims to streamline your search by reviewing and ranking the top debt service calculators currently available on the internet. Our goal is to save you time and ensure you have access to the most effective tools for assessing your debt situation. We have evaluated various calculators based on several key criteria, including accuracy, ease of use, and the range of features offered.

Criteria for Ranking

-

Accuracy: A reliable calculator should deliver precise calculations based on the inputs provided. We examined how well each tool adheres to standard formulas and financial principles.

-

Ease of Use: The user interface plays a critical role in the overall experience. We considered how intuitive the calculators are, including the clarity of instructions and the simplicity of the input process.

-

Features: Additional functionalities, such as the ability to save results, compare different scenarios, or access educational resources, can enhance the user experience. We assessed the value of these features in making informed financial decisions.

By focusing on these criteria, we aim to provide you with a comprehensive overview of the best debt service calculators, helping you make an informed choice tailored to your financial needs.

Our Criteria: How We Selected the Top Tools

Selection Criteria for Top Debt Service Calculators

When evaluating the best debt service calculators available online, we focused on several key criteria to ensure that the tools we recommend are both effective and user-friendly. Here’s a breakdown of the essential factors that guided our selection process:

-

Accuracy and Reliability

The primary purpose of a debt service calculator is to provide accurate calculations that users can trust. We ensured that each tool is based on sound financial principles and that it uses clear formulas for calculating debt service coverage ratios (DSCR). Tools that are widely recognized and used by financial institutions were prioritized. -

Ease of Use

A good calculator should be intuitive and easy to navigate. We assessed the user interface of each tool, looking for clear instructions and a straightforward layout. The ability to quickly input data and obtain results without confusion is crucial, especially for users who may not have a strong financial background. -

Key Features

Effective debt service calculators should offer essential features such as:

– Input Fields for Net Operating Income (NOI): Users must be able to easily enter their income figures to gauge their financial standing.

– Debt Obligations: The ability to input total annual debt obligations is necessary for accurate DSCR calculations.

– Scenario Analysis: Some calculators provide options to adjust variables (like income or debt amounts) to see how changes affect the DSCR, which is a valuable feature for planning.

– Clear Output Explanation: The results should come with an easy-to-understand breakdown of what the numbers mean, helping users interpret their financial situation effectively. -

Cost (Free vs. Paid)

We considered whether the calculators are free to use or require payment. Free tools were prioritized, as they provide accessible resources for users who may not have the budget for paid financial services. However, we also included high-quality paid options that offer advanced features and support. -

Availability of Additional Resources

Tools that provide further educational content about debt service coverage and related financial concepts were favored. This includes articles, FAQs, and guides that help users understand how to use the calculator effectively and improve their financial literacy. -

Mobile Compatibility

In today’s digital age, having a calculator that works well on mobile devices is essential. We assessed the responsiveness of each tool across various devices to ensure that users can access them on-the-go without sacrificing functionality.

-

User Reviews and Feedback

We took into account user reviews and ratings for each calculator. Tools that received positive feedback for their functionality and customer support were prioritized, as they indicate a higher level of user satisfaction.

By applying these criteria, we aimed to curate a list of debt service calculators that not only meet the needs of users but also empower them to make informed financial decisions.

The Best Debt Service Calculators of 2025

2. Debt Service Coverage Ratio Calculator

The Debt Service Coverage Ratio Calculator from commercialrealestate.loans is a practical tool designed to help users assess the financial health of commercial properties. By utilizing the formula DSCR = Net Operating Income (NOI) ÷ Annual Debt Obligations, the calculator provides a straightforward way to evaluate a property’s ability to cover its debt obligations. This feature is essential for investors and lenders looking to make informed decisions regarding property financing.

- Website: commercialrealestate.loans

4. Debt

The Debt-to-Income (DTI) Ratio Calculator from Wells Fargo is a user-friendly tool designed to help individuals assess their financial health by calculating their estimated DTI ratio. By inputting current income and monthly payments, users can gain insights into their debt obligations relative to their income, aiding in financial planning and decision-making. This calculator is an essential resource for anyone looking to understand their borrowing capacity and manage their finances effectively.

- Website: wellsfargo.com

- Established: Approx. 32 years (domain registered in 1993)

How to Get the Most Accurate Results

Double-Check Your Inputs

To achieve the most accurate results from any debt service calculator, it is crucial to ensure that all your inputs are accurate and complete. This includes your net operating income (NOI), total debt obligations, and any other financial metrics that the calculator requires. Take the time to review your financial documents and input the correct figures. Small errors, such as a misplaced decimal or incorrect total, can significantly skew your results. If possible, cross-reference your inputs with multiple sources or financial statements to verify their accuracy.

Understand the Underlying Assumptions

Every debt service calculator operates based on specific assumptions and formulas. Familiarize yourself with these assumptions to better understand how the calculator works and the context of the results it provides. For example, some calculators may assume a certain interest rate or repayment term that may not align with your situation. Understanding these underlying factors can help you interpret the results more accurately and make informed financial decisions. If you’re unsure about any assumptions, consider consulting a financial advisor for personalized guidance.

Use Multiple Tools for Comparison

No single calculator can capture all aspects of your financial situation. To get a well-rounded view of your debt service capabilities, consider using multiple calculators. Different tools may use varying methodologies, which can lead to different outcomes. By comparing results from several calculators, you can identify trends and ensure that your assessments are consistent. This practice not only enhances your understanding of your financial position but also provides a safety net against potential errors from any one tool.

Keep Track of Changes Over Time

Your financial situation is not static; it can change due to income fluctuations, new debts, or changes in expenses. As such, it is beneficial to re-calculate your debt service metrics periodically. Keeping a record of your calculations over time allows you to track your financial health and make adjustments as necessary. For instance, if you notice a decline in your debt service coverage ratio, it may be time to reevaluate your spending habits or consider strategies for debt reduction.

Seek Professional Advice

While online calculators are valuable tools for estimating your financial metrics, they are not substitutes for professional advice. If you find yourself facing complex financial decisions, such as taking on a new loan or restructuring existing debt, consider consulting a financial advisor. They can provide tailored advice based on a comprehensive analysis of your financial situation and goals. This collaboration can offer insights that calculators alone cannot provide, ensuring that you make the best choices for your financial future.

By following these guidelines, you can maximize the accuracy and usefulness of debt service calculators, empowering you to make informed financial decisions.

Frequently Asked Questions (FAQs)

1. What is a debt service calculator and how does it work?

A debt service calculator is a financial tool that helps users assess their ability to pay off debt obligations. It calculates the debt service coverage ratio (DSCR), which compares a borrower’s net operating income (NOI) to their total debt obligations. By inputting relevant financial data such as income and debt amounts, users can obtain a ratio that indicates whether they have sufficient cash flow to cover their debts. A DSCR greater than 1 suggests that income exceeds debt obligations, while a ratio below 1 indicates potential financial strain.

2. Why is the debt service coverage ratio important?

The debt service coverage ratio is crucial for both borrowers and lenders. It serves as a key indicator of a borrower’s financial health and ability to repay loans. Lenders often use DSCR as a criterion for loan approval, with many requiring a minimum ratio (commonly around 1.25) to mitigate their risk. A higher DSCR indicates a stronger financial position, making it easier to secure financing for commercial properties or business loans.

3. Can I use a debt service calculator for personal loans?

While debt service calculators are primarily designed for commercial loans and real estate financing, the principles can be applied to personal loans as well. Users can modify the inputs to reflect their personal income and debt payments to understand their capacity to take on additional loans. However, personal finance calculators, such as debt-to-income (DTI) ratio calculators, may be more suitable for assessing personal loan eligibility.

4. Are there any costs associated with using a debt service calculator?

Most online debt service calculators are free to use and provide users with immediate results without any fees. However, it’s important to note that while the calculator itself is free, obtaining loans or financial advice from lenders may involve associated costs or fees. Always ensure you read the terms and conditions of any financial service provider before proceeding.

5. How accurate are the results from a debt service calculator?

The accuracy of a debt service calculator’s results largely depends on the accuracy of the data input by the user. Since calculators typically use mathematical formulas to generate results, they will provide accurate outputs based on the information given. However, users should remember that these calculators serve as tools for estimation and should not replace professional financial advice. For personalized guidance, it’s recommended to consult with a financial advisor or lender who can consider your individual circumstances.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.