Free Fi Calculators: Our Top 5 Picks for 2025

Finding the Best Fi Calculator: An Introduction

Finding the right financial independence (FI) calculator can be a daunting task. With so many options available online, each boasting unique features and functionalities, it can be overwhelming to determine which tool will best suit your needs. Whether you’re a seasoned investor or just starting your journey toward financial independence, the accuracy and usability of these calculators are crucial for making informed decisions about your future.

The goal of this article is to simplify your search by reviewing and ranking the top FI calculators currently available. We’ve taken the time to thoroughly analyze each tool to save you the hassle of sifting through countless options. Our comprehensive review aims to highlight the best calculators that can help you effectively plan for your financial future.

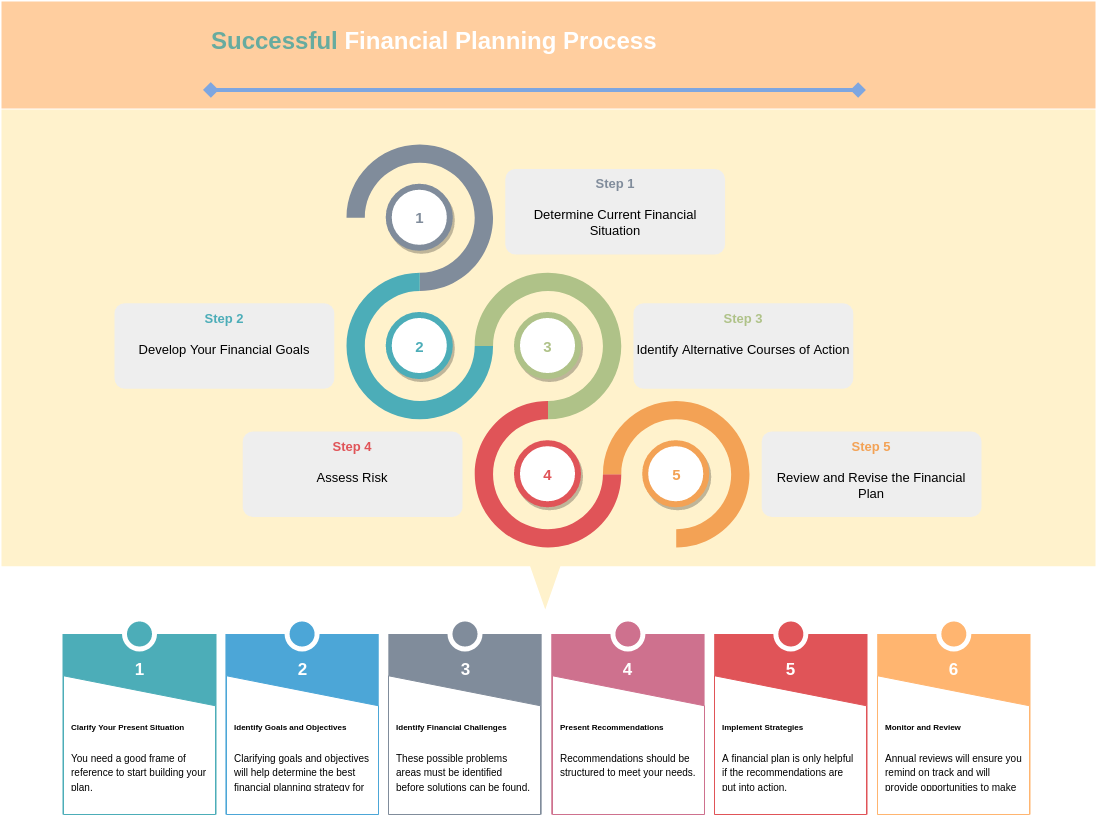

Criteria for Ranking

To ensure that our rankings are fair and beneficial, we have established several key criteria for evaluating each calculator:

-

Accuracy: We assess how reliably each tool can project your financial independence date based on your inputs, such as current savings, expected expenses, and investment returns.

-

Ease of Use: User-friendly interfaces are essential for effective financial planning. We look for calculators that are straightforward and intuitive, making it easy for users to input data and interpret results.

-

Features: The range of functionalities each calculator offers plays a significant role in our evaluation. Tools that provide additional features—such as customizable withdrawal rates, inflation adjustments, and the ability to model various income scenarios—are given higher consideration.

By focusing on these criteria, we aim to present you with a curated list of the best FI calculators that can help streamline your path to financial independence.

Our Criteria: How We Selected the Top Tools

Selecting the Best FI Calculators: Our Criteria

When it comes to choosing the best financial independence (FI) calculators, we considered several critical factors to ensure that users have access to tools that are not only effective but also user-friendly. Here are the key criteria we used in our selection process:

-

Accuracy and Reliability

– The primary function of any financial calculator is to provide accurate projections based on the data entered. We prioritized tools that have a strong reputation for reliability, ensuring that users can trust the calculations for their financial planning. -

Ease of Use

– A calculator should be intuitive and straightforward. We looked for tools that feature a clean design and user-friendly interface, allowing users to input their data without confusion. Clear instructions and helpful tooltips can significantly enhance the user experience, especially for those new to financial independence calculations. -

Key Features

– Effective FI calculators should include specific inputs that are vital for accurate forecasting:- Current Net Worth: Users can input their total savings and liquid assets.

- Annual Expenditures: The ability to enter yearly spending habits to understand how long savings will last.

- Withdrawal Rate: Options to adjust the withdrawal rate, often using the commonly referenced 4% rule.

- Yearly Savings Contributions: Users should be able to input monthly or annual savings amounts.

- Expected Rate of Return: A field to estimate investment growth, which can vary based on risk tolerance and investment strategy.

- Inflation Rate: An option to account for the impact of inflation on future expenses.

-

Cost (Free vs. Paid)

– We assessed whether the calculators are free or require payment. While free tools can be highly beneficial, some paid options offer advanced features that might justify the cost for serious planners. We aimed to include a mix of both types to cater to varying user needs. -

Customization Options

– The best calculators allow users to customize their inputs and assumptions, such as changing savings rates, adjusting for tax implications, and modeling different scenarios (e.g., selling assets, income from side hustles). This flexibility can help users tailor their calculations to their unique financial situations. -

Visualization Tools

– Tools that offer visual aids, such as graphs or charts, can help users better understand their financial trajectory. We favored calculators that provide visual representations of data to enhance comprehension and engagement. -

User Reviews and Community Feedback

– We considered user feedback and reviews to gauge the overall satisfaction and effectiveness of each tool. Insights from the FI community can provide valuable information on how well a calculator performs in real-world scenarios.

By applying these criteria, we aimed to compile a list of the top FI calculators that not only meet the diverse needs of users but also empower them to make informed financial decisions on their journey toward financial independence.

The Best Fi Calculators of 2025

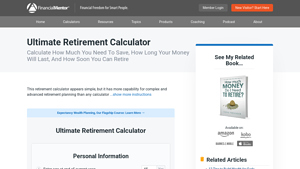

4. Best Retirement Calculator: Simple, Free, Powerful

The Ultimate Retirement Calculator by Financial Mentor is a highly regarded online tool designed to help users effectively plan their retirement finances. This simple, free, and powerful calculator allows individuals to model multiple post-retirement income streams, providing a comprehensive view of their financial future. Its user-friendly interface makes it accessible for anyone looking to optimize their retirement strategy and ensure financial security in their later years.

- Website: financialmentor.com

- Established: Approx. 26 years (domain registered in 1999)

5. Retirement Income Calculator

The Retirement Income Calculator by Vanguard is designed to assist users in evaluating their progress toward retirement goals and exploring various strategies to achieve them. This user-friendly tool allows individuals to assess their current financial situation and visualize different income scenarios, helping them make informed decisions about saving and investment strategies to secure a comfortable retirement.

- Website: investor.vanguard.com

- Established: Approx. 30 years (domain registered in 1995)

How to Get the Most Accurate Results

Double-Check Your Inputs

When using financial independence (FI) calculators, accuracy begins with the data you provide. Always ensure that you enter precise figures regarding your current savings, expected expenses, and income sources. A common mistake is to estimate these values based on assumptions rather than actual data. For instance, review your bank statements to determine your average monthly expenditures, and consider your savings contributions over the past few months to get an accurate annual savings rate. Remember, even small errors in input can lead to significant discrepancies in your results.

Understand the Underlying Assumptions

Each calculator comes with its own set of assumptions that can impact the output. These might include expected rates of return on investments, inflation rates, and withdrawal strategies. Familiarize yourself with these assumptions so you can adjust them according to your personal circumstances. For example, if you believe the average market return will be lower than what the calculator suggests, modify this input to reflect a more conservative outlook. Understanding these parameters allows you to tailor the calculator’s functionality to better suit your financial situation.

Use Multiple Tools for Comparison

No single calculator is infallible, and results can vary between tools due to differences in methodology and assumptions. To get a well-rounded view of your financial independence journey, utilize multiple calculators. For example, you might find one tool particularly useful for estimating your time to financial independence while another excels in projecting your retirement income needs. By comparing results across different platforms, you can identify trends and gain insights that a single calculator might not provide. This multifaceted approach can help you make more informed financial decisions.

Regularly Update Your Data

Financial situations can change rapidly due to various factors such as job changes, unexpected expenses, or shifts in investment performance. It’s essential to regularly revisit and update your inputs in the calculators you use. Aim to do this at least once a year, or whenever a significant life event occurs. Updating your data ensures that the calculators reflect your current financial status and goals, providing you with the most relevant insights for your path to financial independence.

Seek Professional Advice for Complex Situations

While online calculators can be incredibly useful, they are not a substitute for professional financial advice, especially in complex situations involving taxes, estate planning, or significant financial assets. If you find that your circumstances are more complicated than what a calculator can handle, consider consulting a financial advisor. They can provide personalized advice that takes into account your entire financial picture, helping you to create a more tailored and effective plan for achieving financial independence.

By following these tips, you can maximize the accuracy and utility of online financial independence calculators, making them a valuable part of your financial planning toolkit.

Frequently Asked Questions (FAQs)

1. What is a FI calculator and how does it work?

A FI calculator, or Financial Independence calculator, is an online tool designed to help users estimate how much money they need to save and invest to achieve financial independence. It works by allowing users to input various financial parameters such as current savings, expected annual expenses, retirement age, and desired withdrawal rates. The calculator then processes this information to provide insights into how long it will take to reach financial independence based on the data entered.

2. What factors should I consider when using a FI calculator?

When using a FI calculator, consider several key factors:

– Current Net Worth: Your total savings and investments, excluding illiquid assets like your home.

– Annual Expenses: Calculate your yearly living expenses, including irregular costs like vacations.

– Withdrawal Rate: The percentage of your savings you plan to withdraw annually during retirement; a common benchmark is 4%.

– Savings Rate: How much you are currently saving each month or year.

– Investment Returns: The expected annual return on your investments, which can significantly impact your financial independence timeline.

– Inflation Rate: Affects the purchasing power of your savings; a standard estimate is around 2-3%.

3. Can a FI calculator help me plan for unexpected expenses?

Yes, many FI calculators allow users to account for unexpected expenses by providing options to include lump-sum payments or irregular costs. Some calculators even let you model various scenarios, such as changes in income or expenses due to life events (e.g., healthcare costs, education for children). This flexibility makes it easier to create a more realistic financial plan that considers potential future uncertainties.

4. Are FI calculators suitable for beginners?

Absolutely! Many FI calculators are designed with user-friendly interfaces and provide explanations for each input field, making them accessible for beginners. Some calculators offer guided walkthroughs and educational resources to help users understand financial concepts, such as inflation and withdrawal rates. This makes it easier for newcomers to engage with their financial planning without feeling overwhelmed.

5. How often should I use a FI calculator?

It’s recommended to use a FI calculator regularly—ideally every 1-3 years or whenever there are significant changes in your financial situation. This could include changes in income, expenses, savings rates, or investment returns. Regularly recalculating your financial independence projections allows you to stay on track and make necessary adjustments to your savings or spending habits to ensure you are on target to meet your financial goals.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.