Free Florida Property Tax Calculators: Our Top 5 Picks for 2025

Finding the Best Florida Property Tax Calculator: An Introduction

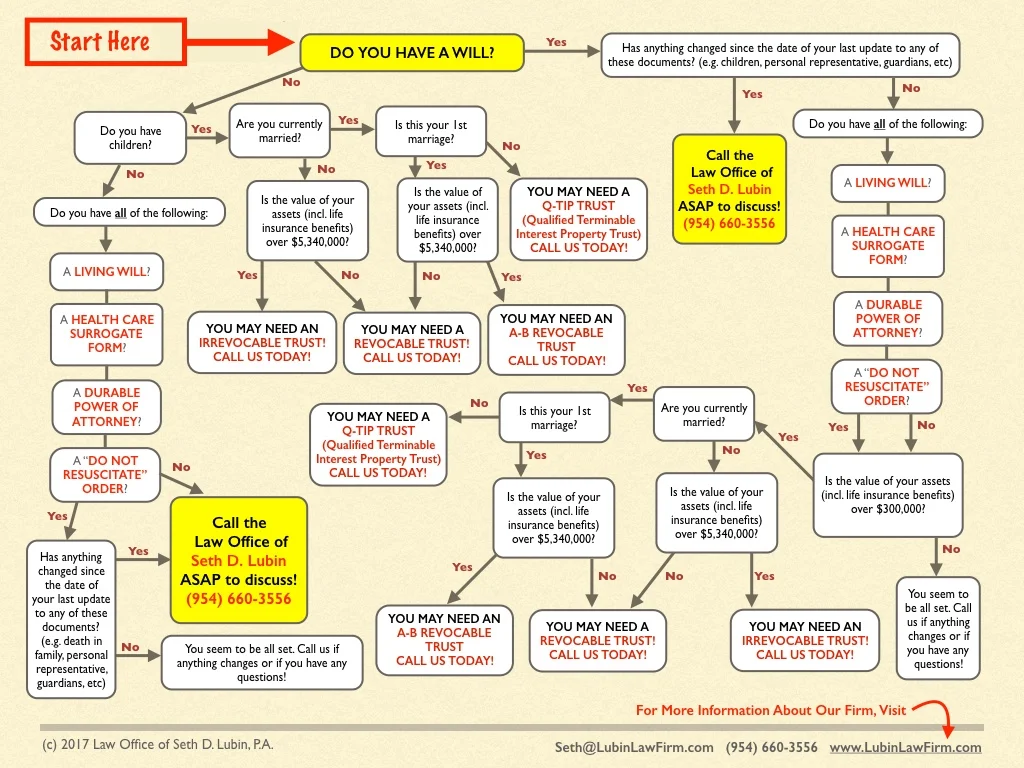

Finding the right property tax calculator can be a daunting task, especially for homeowners and prospective buyers in Florida. With various counties imposing different tax rates and exemptions, the challenge lies in identifying a reliable tool that can accurately estimate property taxes based on your specific situation. As property taxes can significantly impact your financial planning, having a dependable calculator is essential for making informed decisions.

This article aims to simplify your search by reviewing and ranking the top Florida property tax calculators available online. Our goal is to save you time and help you find a tool that meets your needs. We have analyzed a variety of calculators, focusing on essential aspects such as accuracy, ease of use, and features.

Criteria for Ranking

-

Accuracy: The ability of the calculator to provide precise estimates based on current tax rates and local regulations is paramount. We examined how well each tool incorporates local property tax rates and exemptions, ensuring users receive realistic projections.

-

Ease of Use: A user-friendly interface can make a significant difference in your experience. We considered how intuitive and straightforward each calculator is, from inputting data to interpreting results.

-

Features: Additional functionalities, such as the ability to compare tax rates across counties, access to historical data, or integration with mortgage calculators, enhance the overall utility of a property tax calculator. We assessed which tools offer these valuable features to users.

By evaluating these criteria, we hope to provide you with a comprehensive overview of the best Florida property tax calculators, allowing you to choose the right one for your needs.

Our Criteria: How We Selected the Top Tools

Key Criteria for Selecting the Best Florida Property Tax Calculators

When evaluating the top online tools for calculating property taxes in Florida, we focused on several essential criteria to ensure that users have access to the most effective and user-friendly calculators. Here are the key factors that guided our selection process:

-

Accuracy and Reliability

– The calculators must provide accurate estimates based on current property tax rates and assessed values specific to Florida counties. We prioritized tools that source their data from reliable public records and regularly update their rates to reflect any changes in local tax legislation. -

Ease of Use

– User experience is crucial for any online tool. We looked for calculators with intuitive interfaces that allow users to enter their information quickly and easily. A well-designed calculator should minimize the number of steps required to generate results and provide clear instructions throughout the process. -

Key Features

– Effective property tax calculators should include specific inputs relevant to Florida property taxes, such as:- Assessed Property Value: Users should be able to input their home’s assessed value, which is essential for accurate tax calculations.

- County Selection: Given Florida’s varying tax rates by county, a feature allowing users to select their county ensures that the calculations are tailored to their specific location.

- Homestead Exemption Considerations: The best tools should account for common exemptions like the homestead exemption, which can significantly affect tax calculations.

- Property Type Options: Options to specify whether the property is residential, commercial, or an investment property can enhance the accuracy of the calculations.

-

Cost (Free vs. Paid)

– We evaluated whether the calculators are free to use or require payment. Free tools are generally more accessible for a broader audience. However, if a paid option offers significantly enhanced features or accuracy, we considered it based on its value proposition. -

Additional Resources and Support

– A comprehensive property tax calculator should also offer additional resources, such as guides on how property taxes work in Florida, links to local tax authority websites, or contact information for further assistance. This added support can help users better understand their property tax situation and navigate related processes. -

User Reviews and Feedback

– We took into account user ratings and reviews to gauge the overall satisfaction and effectiveness of each tool. Feedback from real users can provide insights into the reliability and usability of the calculators, helping potential users make informed decisions.

By applying these criteria, we aimed to present a curated list of the best Florida property tax calculators that cater to the needs of homeowners and prospective buyers looking to understand their financial obligations in the Sunshine State.

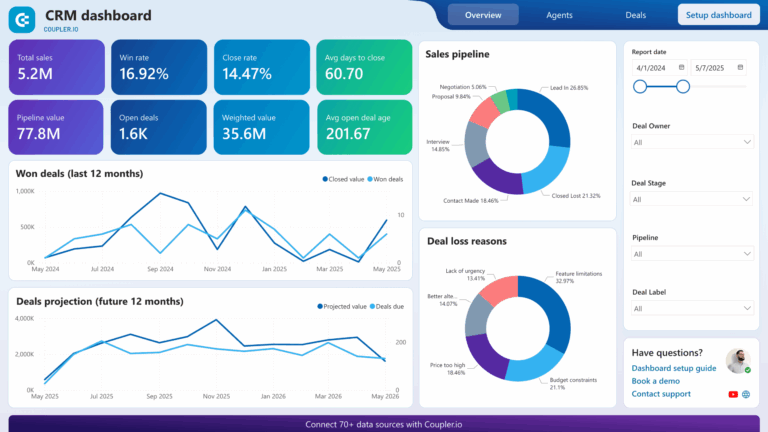

The Best Florida Property Tax Calculators of 2025

3. Tax Estimator

The Tax Estimator tool from the Miami-Dade County Property Appraiser is designed to help users calculate an estimated amount of real property taxes based on the specific information they input. This user-friendly tool allows property owners and potential buyers to gain insights into their tax obligations, facilitating better financial planning and decision-making regarding real estate investments in the county.

- Website: miamidade.gov

- Established: Approx. 25 years (domain registered in 2000)

4. Estimate Taxes

The “Estimate Taxes” tool from the Volusia County Property Appraiser’s Office is designed to help users calculate their estimated property taxes by considering various exemptions and portability options. This user-friendly calculator simplifies the tax estimation process, enabling property owners to gain insights into their potential tax liabilities. Its focus on personalized calculations makes it a valuable resource for residents looking to understand their financial obligations related to property ownership in Volusia County.

- Website: vcpa.vcgov.org

- Established: Approx. 27 years (domain registered in 1998)

5. Property Tax Calculator

The Property Tax Calculator at pbcpao.gov is a user-friendly tool designed to help property owners estimate their tax bills accurately. Users can easily search for their property and select it from a provided list, streamlining the process of obtaining an estimated tax amount. This tool is particularly useful for homeowners looking to budget for their taxes or understand their financial obligations related to property ownership.

- Website: pbcpao.gov

- Established: Approx. 3 years (domain registered in 2022)

How to Get the Most Accurate Results

Double-Check Your Inputs

Accuracy starts with the data you provide. When using Florida property tax calculators, ensure that you enter the correct details about your property. This includes the assessed value of your home, the specific county where your property is located, and any applicable exemptions, such as the homestead exemption. Misentering any of these values can lead to misleading estimates. For example, if you input the wrong home value, the tax calculation will be significantly off, potentially costing you in budgeting or planning. Always verify your inputs against official documents or local tax assessments.

Understand the Underlying Assumptions

Each property tax calculator operates based on certain assumptions and methodologies. Familiarize yourself with how the calculator derives its estimates. For instance, some tools may use average property tax rates for a county, while others might factor in specific local rates or exemptions. Understanding these assumptions will help you interpret the results correctly. Additionally, be aware that property tax rates can fluctuate yearly due to changes in local government budgets and policies. This means that the figures provided by calculators may not reflect the most current tax rates.

Use Multiple Tools for Comparison

To get a well-rounded view of your potential property taxes, consider using multiple property tax calculators. Different tools may utilize varying data sources or calculation methods, which can yield different estimates. By comparing results from several calculators, you can identify a more accurate range of what to expect. This approach also helps you understand any discrepancies in the estimates, giving you a clearer picture of your financial obligations.

Research Local Tax Rates

In addition to using online calculators, it’s beneficial to research your local tax rates. Each county in Florida has its own effective property tax rate, which can significantly affect your tax bill. Understanding these rates can provide context for the calculator results and help you make more informed decisions. Local government websites often provide detailed information about property tax rates, exemptions, and any upcoming changes that could impact your property taxes.

Consult Local Resources

If you’re still unsure about your property tax estimates, consider reaching out to local tax authorities or a financial advisor. They can provide insights specific to your area and help clarify any uncertainties regarding the calculations. Consulting professionals can also ensure that you take advantage of any exemptions or deductions for which you may qualify, ultimately lowering your tax burden.

Keep Records

Finally, maintain a record of your property’s assessed value and tax rates over time. This historical data can be invaluable for future budgeting and planning. By tracking changes in your property’s valuation and tax obligations, you’ll be better equipped to anticipate future costs and make informed decisions regarding your property investment.

By following these tips, you can maximize the accuracy of your property tax estimates and better prepare for your financial commitments in Florida.

Frequently Asked Questions (FAQs)

1. What is a Florida property tax calculator?

A Florida property tax calculator is an online tool designed to help homeowners and prospective buyers estimate their property tax obligations based on various inputs. Users typically enter their property’s assessed value and the county where the property is located. The calculator then provides an estimate of the annual and monthly property taxes based on the average tax rates for that area.

2. How do I use a Florida property tax calculator?

To use a Florida property tax calculator, follow these general steps:

1. Enter Your Property Details: Input the assessed value of your property. This is usually the market value determined by the county property appraiser.

2. Select Your County: Choose the county where your property is located, as tax rates can vary significantly across different areas.

3. Calculate: Click the calculate button to receive an estimate of your annual and monthly property taxes. The tool may also provide additional information like average tax rates for your county.

3. Are the estimates provided by property tax calculators accurate?

While property tax calculators can provide useful estimates, it’s important to note that the figures are based on average rates and publicly available data. Actual property taxes may vary due to specific exemptions, local tax assessments, and changes in tax rates. For the most accurate information, consult your county’s property appraiser or a local tax professional.

4. What factors influence property tax rates in Florida?

Several factors can influence property tax rates in Florida, including:

– Property Location: Different counties and municipalities have varying tax rates.

– Assessed Value: The value assigned to your property by the county appraiser affects your tax bill.

– Exemptions: Homeowners may qualify for exemptions like the homestead exemption, which can significantly reduce the taxable value of a property.

– Local Government Needs: Funding requirements for schools, emergency services, and infrastructure can lead to rate changes.

5. Can I appeal my property tax assessment if I believe it is too high?

Yes, in Florida, property owners have the right to appeal their property tax assessments if they believe their property has been overvalued. This process typically involves reviewing the annual Truth in Millage (TRIM) notice, which details the assessed value and tax rates. If you find discrepancies, you must file an appeal with your county’s value adjustment board within 25 days of receiving the notice. It’s advisable to gather supporting evidence, such as recent sales data of comparable properties, to strengthen your case.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.