Free Hdfc Home Loan Calculators: Our Top 5 Picks for 2025

Finding the Best Hdfc Home Loan Calculator: An Introduction

Navigating the world of home loans can be a daunting task, especially when it comes to calculating monthly payments and determining eligibility. With various tools available online, finding a good, reliable HDFC home loan calculator that meets your specific needs can be challenging. Many calculators offer different features, and not all provide accurate or comprehensive results. This inconsistency can lead to confusion and make it harder for potential homebuyers to make informed financial decisions.

The goal of this article is to simplify your search by reviewing and ranking the top HDFC home loan calculators available online. We aim to save you time and effort by providing a curated list of tools that can help you accurately calculate your home loan EMIs, assess your affordability, and understand your loan eligibility.

Criteria for Ranking

In our evaluation, we considered several key factors to ensure that the calculators we recommend are both effective and user-friendly. These criteria include:

- Accuracy: The calculator’s ability to provide precise EMI calculations based on the inputs provided.

- Ease of Use: A user-friendly interface that allows for quick and straightforward input of data.

- Features: Additional functionalities such as loan eligibility assessment, amortization schedules, and the ability to compare different loan scenarios.

- Accessibility: Availability of the calculator across various devices, including mobile compatibility.

By focusing on these criteria, we aim to present you with the most reliable HDFC home loan calculators, helping you embark on your home-buying journey with confidence. Whether you’re a first-time buyer or looking to refinance, our comprehensive review will guide you in making an informed choice.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting the Best HDFC Home Loan Calculators

When evaluating the top HDFC home loan calculators, we considered a variety of essential factors to ensure that users can make informed decisions regarding their home financing options. Below are the key criteria that guided our selection:

-

Accuracy and Reliability

– The foremost requirement for any financial calculator is its ability to provide accurate results. We assessed the underlying formulas used in each tool to ensure they align with standard financial practices for calculating Equated Monthly Installments (EMIs), total payable amounts, and interest calculations. This accuracy is crucial for users to trust the results and make confident financial decisions. -

Ease of Use

– A user-friendly interface is vital for calculators, especially for those who may not be financially savvy. We looked for tools that feature intuitive designs, minimal input requirements, and clear instructions. The ability to easily input data such as loan amount, tenure, and interest rate without confusion enhances the overall user experience. -

Key Features

– We evaluated calculators based on specific functionalities they offer, which can significantly aid users in their financial planning. Important features include:- Loan Amount Input: Users should easily specify the desired loan amount.

- Tenure Selection: The ability to select the loan tenure in years or months.

- Interest Rate Adjustment: Options to input different interest rates to see how they impact the EMI.

- Amortization Schedule: The provision of a detailed repayment schedule showing principal and interest components.

- Affordability and Eligibility Calculators: Additional tools that help users assess how much they can borrow based on their income and other financial factors.

-

Cost (Free vs. Paid)

– We focused on the availability of calculators that are free to use, as accessibility is a primary concern for our audience. While some advanced tools may offer premium features, the core functionalities should be available without any cost to ensure that all potential homebuyers can benefit from them. -

Additional Support and Resources

– We considered whether the calculators were accompanied by helpful resources, such as FAQs, customer support options, and informative articles. These resources can provide users with valuable insights into the home loan process, helping them make well-informed decisions. -

Compatibility and Accessibility

– The calculators were assessed for their compatibility across various devices, including desktops, tablets, and smartphones. Accessibility is critical, as users may want to calculate their home loan options on-the-go.

By adhering to these criteria, we aimed to present a selection of HDFC home loan calculators that not only meet user needs but also enhance their understanding of home financing options. This careful evaluation ensures that users can confidently utilize these tools to support their home buying journey.

The Best Hdfc Home Loan Calculators of 2025

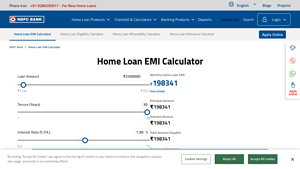

1. HDFC Bank’s Home Loan EMI Calculator

HDFC Bank’s Home Loan EMI Calculator is a valuable tool designed to help users effectively plan their cash flows for home loan repayments. With EMIs starting from ₹727 per lakh, the calculator allows potential borrowers to estimate their monthly payments based on different loan amounts and tenures. This feature enables users to make informed financial decisions, ensuring they can comfortably manage their home loan obligations.

- Website: hdfc.com

- Established: Approx. 27 years (domain registered in 1998)

2. Calculate EMI on Home, Personal and Car Loans

The HDFC Bank EMI calculator is a user-friendly online tool designed to help borrowers estimate their Equated Monthly Installments (EMIs) for various loan types, including home, personal, and car loans. By simply inputting the loan amount and tenure, users can quickly calculate their EMIs and interest rates, enabling them to make informed financial decisions. This tool simplifies the loan planning process, making it accessible for potential borrowers.

- Website: hdfcbank.com

- Established: Approx. 28 years (domain registered in 1997)

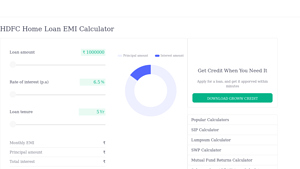

3. HDFC Home Loan EMI Calculator

The HDFC Home Loan EMI Calculator on Groww is a user-friendly tool designed to help borrowers accurately calculate their monthly EMI payments for housing loans. By inputting loan details such as amount, interest rate, and tenure, users can easily determine their repayment obligations, allowing for better financial planning and management. This calculator simplifies the loan process, ensuring that borrowers stay informed about their financial commitments.

- Website: groww.in

- Established: Approx. 9 years (domain registered in 2016)

4. HDFC Bank Home Loan EMI Calculator

The HDFC Bank Home Loan EMI Calculator by ClearTax offers a user-friendly interface that simplifies the process of estimating your monthly EMI payments on home loans. This tool allows potential borrowers to input various loan amounts and tenures, providing quick and accurate calculations to help them plan their finances effectively. Its seamless functionality makes it an essential resource for anyone considering an HDFC home loan.

- Website: cleartax.in

- Established: Approx. 14 years (domain registered in 2011)

How to Get the Most Accurate Results

Double-Check Your Inputs

When using an HDFC home loan calculator, the accuracy of your results heavily depends on the inputs you provide. Ensure that you enter the correct loan amount, tenure, and interest rate. A small error in any of these inputs can lead to significant discrepancies in your EMI calculations. For example, if you mistakenly enter a tenure of 15 years instead of 30 years, your EMI will be much higher than expected. Therefore, take a moment to review your entries before hitting the calculate button.

Understand the Underlying Assumptions

Most online calculators, including HDFC’s home loan calculator, operate on certain assumptions. These may include fixed interest rates, loan repayment timelines, and the structure of EMIs (whether they include taxes or other fees). Familiarize yourself with these assumptions to understand how they might affect your results. For instance, if the calculator assumes a fixed interest rate and you are considering a floating rate, the actual EMI may differ once the loan is sanctioned. Knowing these nuances will help you make more informed financial decisions.

Use Multiple Tools for Comparison

While the HDFC home loan calculator is a valuable tool, it is advisable to use multiple calculators from different financial institutions for a broader perspective. Different banks may offer varying interest rates and loan terms, and comparing these can provide a clearer picture of your options. Using multiple calculators allows you to see how changes in interest rates or loan amounts affect your EMI, helping you choose the best home loan product that suits your financial situation.

Consider Additional Costs

When calculating your EMI, do not forget to factor in additional costs associated with obtaining a home loan. This includes processing fees, insurance premiums, registration fees, and other charges that can significantly impact the total cost of borrowing. Some calculators may provide an option to include these costs, while others may not. Understanding the total financial commitment will ensure that you are not caught off guard by hidden costs later on.

Regularly Update Your Information

Financial conditions, including interest rates and your personal financial situation, can change frequently. Therefore, it’s important to revisit and update your calculations regularly. For instance, if your income increases or your credit score improves, you may qualify for a better interest rate. Keeping your information current can help you make timely decisions about refinancing or taking on additional loans.

Seek Professional Advice

Finally, while calculators provide a great starting point, consider consulting with a financial advisor or loan expert. They can offer personalized advice based on your specific financial circumstances, guiding you through the complexities of home loans and ensuring you understand all the implications of your decisions. Their expertise can be invaluable, especially for first-time homebuyers navigating the housing market.

By following these tips, you can maximize the accuracy of your results and make more informed decisions regarding your home loan.

Frequently Asked Questions (FAQs)

1. What is an HDFC Home Loan Calculator?

The HDFC Home Loan Calculator is an online tool that helps potential borrowers calculate their Equated Monthly Installments (EMIs) for home loans. By inputting details such as the loan amount, tenure, and interest rate, users can easily determine how much they will need to pay each month. This tool is essential for financial planning as it helps users understand their repayment commitments before applying for a loan.

2. How do I use the HDFC Home Loan Calculator?

Using the HDFC Home Loan Calculator is straightforward. Here’s how you can do it:

1. Input the Loan Amount: Enter the total amount you wish to borrow.

2. Select the Tenure: Choose the duration over which you plan to repay the loan (typically between 1 to 30 years).

3. Enter the Interest Rate: Provide the annual interest rate offered by HDFC Bank.

Once you have entered these details, click on the calculate button to see your monthly EMI and the total amount payable over the loan tenure.

3. What factors influence my EMI calculation?

Several factors can influence the calculation of your EMI through the HDFC Home Loan Calculator:

– Loan Amount: The principal amount you intend to borrow directly affects the EMI; higher amounts result in higher EMIs.

– Interest Rate: The rate at which the bank lends money significantly impacts the EMI. A higher interest rate will increase your monthly payment.

– Tenure: The duration of the loan affects the EMI; a longer tenure results in lower EMIs but increases the total interest paid over the loan’s life.

4. Can the HDFC Home Loan Calculator help me determine my loan eligibility?

Yes, the HDFC Home Loan Calculator can assist in estimating your loan eligibility indirectly. By calculating the EMIs based on different loan amounts and tenures, you can assess how much you can afford to borrow without straining your finances. This helps in setting realistic expectations regarding the loan amount you should apply for, based on your monthly income and existing financial commitments.

5. Is the HDFC Home Loan Calculator accurate?

The HDFC Home Loan Calculator provides estimates based on the inputs you provide. While it uses standardized formulas to calculate EMIs, the actual terms of your loan may vary based on specific factors like your credit score, financial history, and the bank’s lending policies. Therefore, while the calculator is a helpful tool for planning, it’s essential to consult with HDFC Bank for precise calculations and personalized loan offers.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.