Free House Selling Calculators: Our Top 5 Picks for 2025

Finding the Best House Selling Calculator: An Introduction

When it comes to selling your home, understanding the financial implications can be a daunting task. Homeowners often face the challenge of navigating various costs associated with selling, from agent commissions to closing fees. This complexity can make it difficult to estimate how much profit you might actually walk away with after the sale. Fortunately, house selling calculators have emerged as valuable tools that can simplify this process. However, with so many options available online, finding a reliable and effective calculator can be overwhelming.

This article aims to review and rank the top house selling calculators currently available, helping you save time and make informed decisions. We will evaluate each tool based on several key criteria, including accuracy, ease of use, and features offered. Accuracy is crucial, as an incorrect estimate could lead to unrealistic expectations about your home sale. Ease of use ensures that homeowners, regardless of their tech-savviness, can navigate the tool without frustration. Additionally, features such as the ability to customize inputs or view a breakdown of costs can enhance the overall user experience.

By the end of this review, you will have a clearer understanding of which calculators can best assist you in estimating your net proceeds from selling your home. Whether you are a first-time seller or an experienced homeowner, this guide will empower you to make smarter financial decisions as you embark on your selling journey.

Our Criteria: How We Selected the Top Tools

When evaluating the best house selling calculators, we focused on several key criteria to ensure that the tools included in our list provide value and assist users in making informed decisions. Below are the essential factors we considered during our selection process:

1. Accuracy and Reliability

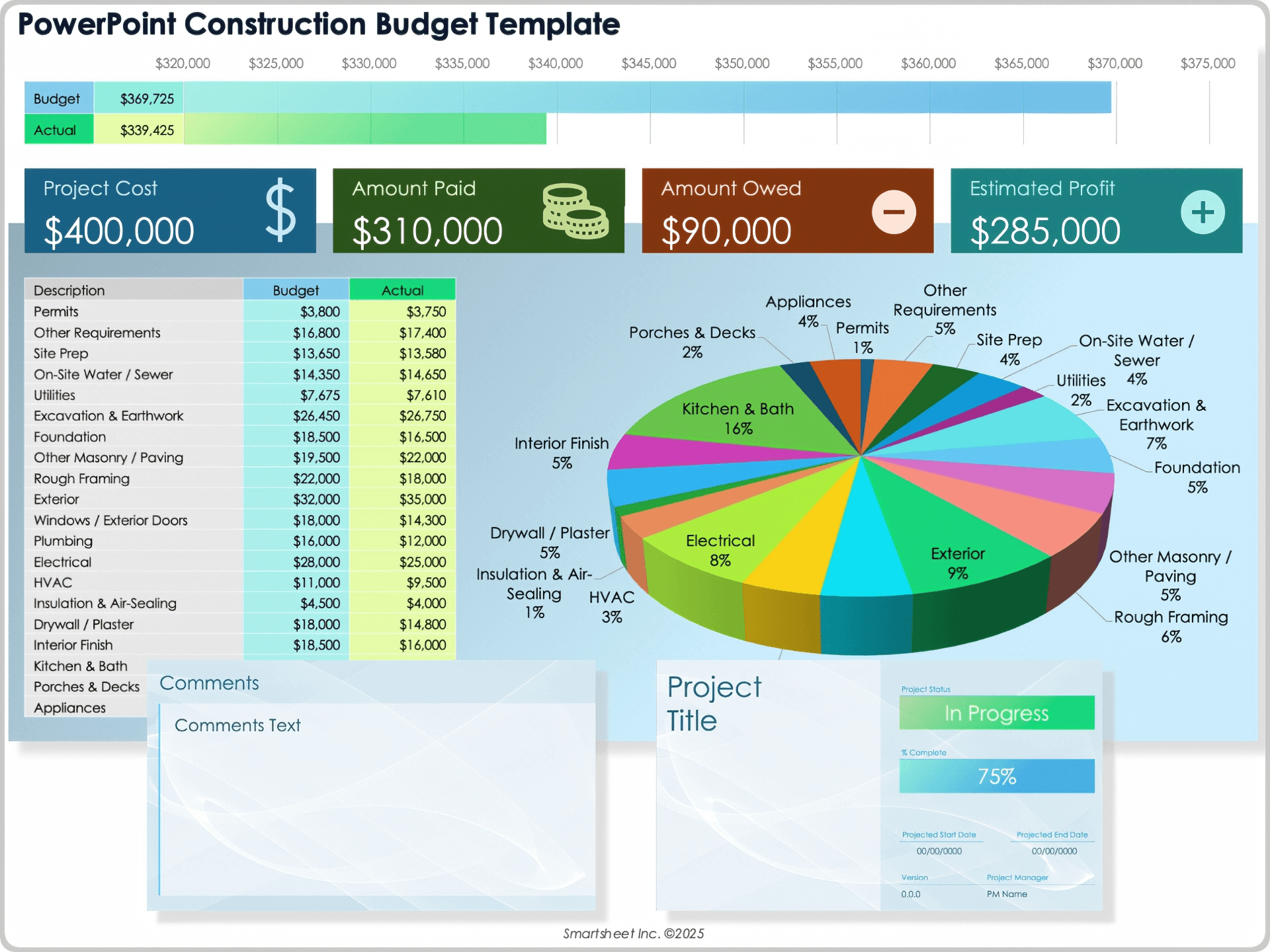

A reliable calculator should provide accurate estimates of net proceeds from selling a home. We looked for tools that incorporate current market data and allow users to input specific figures, such as the selling price, mortgage balance, and estimated selling costs. Accuracy is crucial, as even small discrepancies can significantly impact financial planning.

2. Ease of Use

The user interface of the calculator is vital for accessibility. We prioritized tools that are intuitive, allowing users to input their information with minimal effort. A straightforward design enhances the user experience, making it easier for sellers—especially those who may not be tech-savvy—to navigate the tool effectively.

3. Key Features

A comprehensive house selling calculator should include a variety of inputs that reflect the complexities of selling a home. We evaluated tools based on the following features:

– Selling Price: Users should be able to enter their desired selling price to see potential profits.

– Mortgage Balance: A field to input the remaining mortgage balance is essential for calculating net proceeds accurately.

– Selling Costs: The calculator should allow users to estimate various selling costs, including:

– Preparation and repair costs (e.g., staging, cleaning)

– Agent commissions

– Closing costs (e.g., transfer taxes, title insurance)

– Customizability: The ability to modify inputs according to individual circumstances (such as selling concessions or additional fees) enhances the calculator’s usefulness.

4. Cost (Free vs. Paid)

We considered whether the calculators are free or require a fee. Many users prefer free tools, so we focused on those that offer valuable features without costs. However, we also acknowledged that some paid options might provide enhanced functionalities or professional insights, which could justify their expense.

5. Additional Resources and Support

We looked for calculators that not only provide numerical estimates but also offer educational resources and support. This includes tips on preparing a home for sale, understanding the selling process, and links to relevant articles or guides that can help users make informed decisions beyond just the calculations.

6. Reputation and User Reviews

Finally, we assessed the reputation of each tool based on user reviews and expert opinions. Tools with positive feedback regarding their effectiveness and user satisfaction were prioritized, as they typically indicate a trustworthy resource for prospective home sellers.

By adhering to these criteria, we aimed to compile a list of house selling calculators that are not only functional but also beneficial for anyone looking to navigate the home selling process confidently.

The Best House Selling Calculators of 2025

2. Sale Proceeds Calculator

The Sale Proceeds Calculator from realtor.com is a user-friendly tool designed to help homeowners estimate their net profit from selling a property. By inputting their home address, users can easily account for various fees and expenses associated with the sale, providing a clearer picture of potential profits. This calculator is an essential resource for anyone looking to plan their next real estate move with confidence.

- Website: realtor.com

- Established: Approx. 30 years (domain registered in 1995)

3. Calculate Your Net Closing Costs on Real Estate Sales

The “Calculate Your Net Closing Costs on Real Estate Sales” tool from mortgagecalculator.org is designed to help homeowners easily estimate the closing costs involved in selling their property. This user-friendly calculator allows users to quickly determine their net proceeds after accounting for various expenses, providing a clear financial snapshot that is essential for informed decision-making in real estate transactions.

- Website: mortgagecalculator.org

- Established: Approx. 21 years (domain registered in 2004)

How to Get the Most Accurate Results

Double-Check Your Inputs

When using an online house selling calculator, the accuracy of your results heavily depends on the information you provide. Start by entering your desired selling price and current mortgage balance as accurately as possible. It’s essential to verify these figures with your lender or mortgage statements to avoid underestimating or overestimating your financial situation. Additionally, include accurate estimates for selling costs, such as agent commissions and closing fees, as these can significantly impact your net proceeds. Mistakes in these inputs can lead to misleading results, so take a moment to double-check everything before proceeding.

Understand the Underlying Assumptions

Every calculator operates on specific assumptions that can affect the outcome. Familiarize yourself with how the calculator estimates costs, such as the percentage used for closing costs or the average agent commission rate. Some calculators may use national averages, which might not reflect your local market conditions. Understanding these assumptions can help you interpret the results more accurately and make informed decisions. If a calculator suggests a certain percentage for selling costs, consider whether that aligns with your local market practices.

Use Multiple Tools for Comparison

To enhance the reliability of your estimates, utilize multiple online calculators. Different tools may have varying algorithms, leading to different results based on the same inputs. By comparing the outputs from several calculators, you can identify a range of potential proceeds from your home sale. This approach not only gives you a broader perspective but also helps you spot any discrepancies that may warrant further investigation. Look for calculators that provide detailed breakdowns of costs and proceeds to better understand how each figure is derived.

Factor in Local Market Conditions

Real estate is inherently local, and market conditions can fluctuate significantly based on location, time of year, and economic factors. While online calculators provide a valuable starting point, consider consulting local real estate professionals for insights specific to your area. They can offer a more nuanced understanding of current market trends and home values that online tools may not capture. This localized knowledge can help you adjust your calculator inputs accordingly, leading to more accurate results.

Keep Future Costs in Mind

Finally, remember that selling your home involves more than just the immediate sale proceeds. Factor in potential future costs, such as taxes on capital gains, moving expenses, and home repairs needed to prepare your home for sale. These costs can affect your overall financial picture, so it’s wise to consider them in your planning. By taking a comprehensive approach, you can ensure that your estimates are not only accurate but also practical for your financial goals.

By following these guidelines, you can maximize the accuracy of the results from online house selling calculators and make more informed decisions as you prepare to sell your home.

Frequently Asked Questions (FAQs)

1. What is a house selling calculator?

A house selling calculator is an online tool designed to help homeowners estimate the net proceeds from selling their property. By inputting various data points, such as the desired selling price, remaining mortgage balance, and estimated selling costs (like agent commissions, repairs, and closing fees), users can gain a clearer understanding of how much money they will walk away with after the sale.

2. How accurate are the estimates provided by house selling calculators?

While house selling calculators provide useful estimates, their accuracy can vary based on the information entered and the assumptions made by the tool. Most calculators use general market averages and may not account for specific local conditions or unique property features. For the most accurate assessment, it’s advisable to consult with a real estate professional who can provide a comprehensive market analysis.

3. What factors should I consider when using a house selling calculator?

When using a house selling calculator, consider the following factors:

– Desired Selling Price: Input a realistic price based on comparable sales in your area.

– Remaining Mortgage Balance: Ensure you have an accurate figure for the outstanding amount on your mortgage.

– Selling Costs: Include all potential expenses such as agent commissions, repairs, staging, and closing costs.

– Market Conditions: Be aware of current market trends, as they can affect selling prices and time on the market.

Taking these factors into account will help yield a more accurate estimate of your potential proceeds.

4. Can I use a house selling calculator to plan for future real estate investments?

Yes, a house selling calculator can be a valuable tool for planning future real estate investments. By estimating your net proceeds from a sale, you can better assess how much you can invest in your next property. Understanding your financial position can help you make informed decisions regarding your investment strategy, including how much you can afford to spend on a new home or whether to reinvest in property improvements.

5. Are there any additional costs that a house selling calculator might not include?

Yes, house selling calculators may not account for every potential cost associated with selling a home. Some additional expenses that may not be included are:

– Escrow Fees: Fees paid to a third-party company that handles the transfer of funds and documents during the closing process.

– Title Insurance: This protects against any claims or issues that could arise with the title of the property.

– Home Warranty: Offering a home warranty to buyers can provide peace of mind but adds to the selling costs.

– Capital Gains Tax: If you sell your home for a profit, you may need to pay taxes on the capital gains, depending on your situation.

It’s essential to consider these potential costs to gain a comprehensive understanding of your net proceeds.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.