Free How To Calculate Debt Service Coverage Ratio Calculators: Our …

Finding the Best How To Calculate Debt Service Coverage Ratio: An Introduction

Calculating the Debt Service Coverage Ratio (DSCR) is essential for businesses and investors alike, as it provides insights into a company’s ability to meet its debt obligations. However, navigating the plethora of online tools available for this calculation can be a daunting task. Many tools vary in terms of accuracy, user interface, and additional features, making it challenging to identify the best option for your specific needs.

The goal of this article is to streamline your search by reviewing and ranking the top online tools available for calculating the DSCR. By doing so, we aim to save you time and ensure that you select a reliable solution that meets your requirements. Whether you’re a business owner seeking to assess your financial health or an investor evaluating potential investments, having access to the right tool is crucial.

In our evaluation, we considered several key criteria to ensure a comprehensive assessment of each tool. Accuracy is paramount, as the DSCR calculation must be precise to provide meaningful insights. We also took into account ease of use, as a user-friendly interface can significantly enhance the experience, particularly for those who may not be financially savvy. Furthermore, we examined features, such as the ability to save calculations, access historical data, or generate reports, which can add value to your analysis.

With these criteria in mind, we have compiled a list of the best online tools for calculating the Debt Service Coverage Ratio, helping you make an informed decision and effectively manage your financial obligations.

Our Criteria: How We Selected the Top Tools

Key Criteria for Selecting the Best Debt Service Coverage Ratio Calculators

When evaluating online tools for calculating the Debt Service Coverage Ratio (DSCR), we considered several important factors to ensure that users have access to the most effective and user-friendly options. Below are the key criteria that guided our selection process:

-

Accuracy and Reliability

The primary function of a DSCR calculator is to provide accurate results based on user inputs. We prioritized tools that are known for their reliability and have been validated by financial professionals. Each tool must use the correct formula, which is Net Operating Income divided by Total Debt Service, to ensure users can trust the outcomes. -

Ease of Use

A user-friendly interface is crucial for any online calculator. We assessed tools based on their design, navigation, and overall usability. The ideal calculator should allow users to easily input their data without confusion, providing clear instructions and intuitive layouts to enhance the user experience. -

Key Features

Effective DSCR calculators should include specific features that enhance functionality. We looked for tools that allow users to input various components necessary for the calculation, including:

– Net Operating Income (NOI): The income generated from operations after deducting operating expenses.

– Total Debt Service: This includes both principal and interest payments due within a specific period.

– Tax Rate: Some calculators may allow users to input tax rates to adjust total debt service calculations accordingly.

Furthermore, calculators that provide the option to save or export results were favored, as this adds convenience for users who may need to reference their calculations later. -

Cost (Free vs. Paid)

The availability of free tools is a significant consideration for many users. We evaluated the cost structure of each calculator, weighing the benefits of free options against the features offered by paid tools. While some users may require advanced features available only in premium calculators, we ensured that there are sufficient free options that still deliver accurate and reliable calculations. -

Accessibility and Availability

We examined the accessibility of each tool, ensuring they are available across different devices, including desktops, tablets, and smartphones. Tools that do not require downloads or installations and can be accessed directly through a web browser were preferred for their convenience.

-

User Reviews and Reputation

Lastly, we considered user feedback and expert reviews to gauge the reputation of each calculator. Tools with positive ratings and testimonials from users who have found them helpful in real-world scenarios were prioritized, as this indicates a level of trust and satisfaction within the financial community.

By focusing on these criteria, we aimed to provide a comprehensive list of the best online tools for calculating the Debt Service Coverage Ratio, ensuring that users can make informed decisions based on their needs and preferences.

The Best How To Calculate Debt Service Coverage Ratios of 2025

4. Debt Service Coverage Ratio

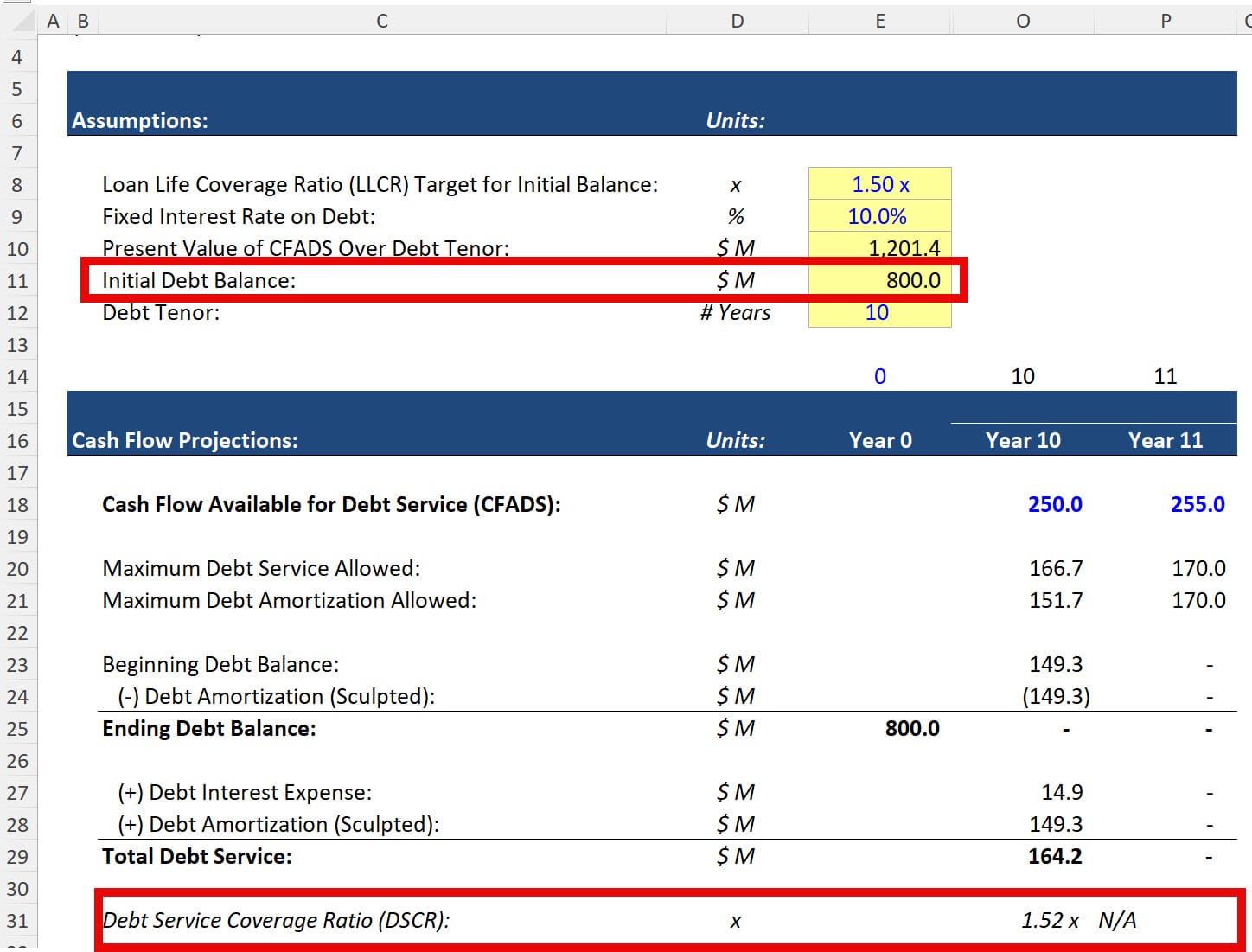

The Debt Service Coverage Ratio (DSCR) is a crucial financial metric that assesses a company’s ability to meet its annual debt obligations, including interest and principal payments, through its operating cash flow. This guide provides a comprehensive overview of how to calculate DSCR, helping businesses evaluate their financial health and ensure they can sustain their debt commitments. Key features include step-by-step calculation methods and practical examples for better understanding.

- Website: corporatefinanceinstitute.com

- Established: Approx. 10 years (domain registered in 2015)

How to Get the Most Accurate Results

Double-Check Your Inputs

When using online calculators for debt service coverage ratio (DSCR), the accuracy of your results heavily relies on the inputs you provide. Ensure that all figures—such as net operating income and total debt service—are correct and up-to-date. Take the time to verify your calculations for revenue and operating expenses. Small errors in data entry can lead to significant discrepancies in your final DSCR, potentially affecting financial decisions or loan negotiations.

Understand the Underlying Assumptions

Each online calculator may operate on different assumptions regarding financial metrics. Familiarize yourself with the specific definitions and formulas used by the tool you choose. For example, some calculators may consider depreciation or amortization differently, which could impact the net operating income figure. Understanding these nuances will help you interpret your results accurately and make informed financial decisions based on the DSCR.

Use Multiple Tools for Comparison

To enhance the reliability of your DSCR calculations, consider using multiple online tools. Each calculator may have unique features or methods for determining the debt service coverage ratio. By comparing results from different calculators, you can identify any inconsistencies and gain a more comprehensive understanding of your financial standing. This practice also allows you to cross-verify calculations, ensuring greater accuracy in your assessments.

Keep Track of Your Financial Data

Maintaining organized financial records is crucial for accurate DSCR calculations. Ensure you have a clear and detailed account of your revenues, operating expenses, and debt obligations. This not only aids in providing precise inputs to the calculators but also helps in analyzing trends over time. Regularly updating this data will allow you to monitor your financial health and make timely adjustments to your business strategies.

Review Calculation Methodologies

Before relying on a specific online calculator, take the time to review its methodology. Some calculators may allow for customization, such as adjusting for tax rates or incorporating other expenses into your net operating income. Understanding how the calculator computes the DSCR will provide insights into its accuracy and relevance to your financial situation. If possible, consult financial literature or resources to comprehend the best practices for calculating DSCR.

Consult with Financial Advisors

Lastly, if you are unsure about your financial data or the implications of your DSCR, consider consulting with a financial advisor. They can provide expert insights and help interpret the results from your calculations. This guidance can be invaluable, especially when making critical decisions regarding loans or investments based on your debt service coverage ratio. Engaging with a professional can help you avoid costly mistakes and optimize your financial management.

By following these tips, you can maximize the accuracy and utility of online calculators when determining your debt service coverage ratio.

Frequently Asked Questions (FAQs)

1. What is the Debt Service Coverage Ratio (DSCR)?

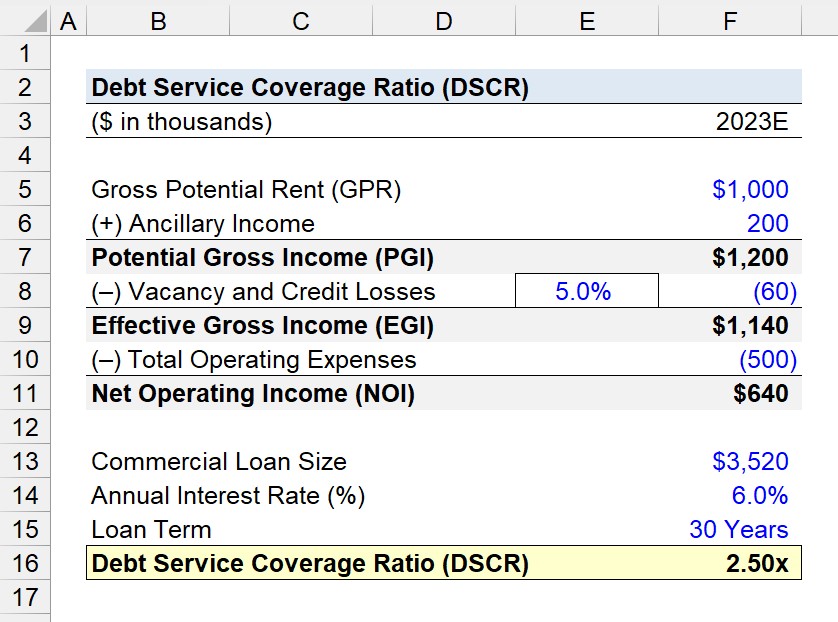

The Debt Service Coverage Ratio (DSCR) is a financial metric used to measure a company’s ability to cover its debt obligations with its net operating income. It is calculated by dividing the net operating income by the total debt service, which includes both principal and interest payments. A DSCR greater than 1 indicates that a company has sufficient income to meet its debt obligations, while a ratio below 1 suggests potential financial difficulties.

2. How do I calculate the DSCR?

To calculate the DSCR, you need two key figures: net operating income and total debt service. The formula is as follows:

[ \text{DSCR} = \frac{\text{Net Operating Income}}{\text{Total Debt Service}} ]

Where:

– Net Operating Income is the total revenue minus operating expenses (excluding taxes and interest).

– Total Debt Service is the sum of all principal and interest payments due within a specified period.

3. Why is the DSCR important for businesses?

The DSCR is crucial for businesses as it helps lenders assess a company’s financial health and ability to repay loans. A higher DSCR can indicate a lower risk for lenders, making it easier for businesses to secure financing. Additionally, monitoring the DSCR over time can help companies identify trends in their cash flow and make informed financial decisions.

4. What is considered a good DSCR?

A good DSCR generally varies by industry, but a ratio of 1.25 or higher is often considered strong, indicating that a company can cover its debt obligations comfortably. A DSCR below 1.0 means that the company does not generate enough income to meet its debt payments, which may raise concerns for lenders and investors.

5. Are there online tools to help calculate the DSCR?

Yes, there are several online calculators and financial tools that can help you easily calculate the DSCR. These tools typically allow you to input your net operating income and total debt service, providing an instant calculation of your DSCR. Look for reputable financial websites or accounting software that offer these calculators for accuracy and ease of use.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.