Free How To Calculate Operating Income Calculators: Our Top 5 Picks…

Finding the Best How To Calculate Operating Income: An Introduction

Calculating operating income is a vital process for businesses and investors alike, as it reveals the profitability of a company’s core operations. However, navigating the myriad of online tools available for this calculation can be overwhelming. Many users may struggle with finding a reliable resource that not only provides accurate results but is also user-friendly and feature-rich. The challenge lies in discerning which tools are genuinely effective in simplifying the process of calculating operating income without sacrificing accuracy or requiring extensive financial knowledge.

This article aims to streamline that search by reviewing and ranking the top online tools for calculating operating income. Our goal is to save you time and effort by providing a curated list of the best options available. We have meticulously evaluated each tool based on several key criteria: accuracy of calculations, ease of use, available features, and overall user experience.

By focusing on these aspects, we ensure that you can confidently choose a tool that meets your needs, whether you are a small business owner looking to analyze your profitability or an investor assessing the financial health of potential investments. With our insights, you will be better equipped to make informed decisions regarding your financial assessments and operations. Let’s delve into the best online resources for calculating operating income, ensuring you have the right tools at your disposal.

Our Criteria: How We Selected the Top Tools

Selection Criteria for Operating Income Calculators

When evaluating online tools for calculating operating income, we established a set of criteria to ensure that our recommendations meet the needs of a general audience seeking reliable and user-friendly options. Here are the key factors we considered:

-

Accuracy and Reliability

– The primary purpose of any financial calculator is to provide accurate results. We prioritized tools that are based on well-established financial formulas and methodologies, ensuring that users can rely on the outputs for decision-making and analysis. -

Ease of Use

– A good calculator should be intuitive and straightforward. We looked for tools with a user-friendly interface that allows users to input data without confusion. Clear instructions and a logical layout significantly enhance the user experience. -

Key Features

– Effective calculators should include essential features that cater to various user needs. We specifically evaluated tools that allow users to input:- Total Revenue

- Cost of Goods Sold (COGS)

- Operating Expenses (including SG&A and R&D)

- Optional fields for depreciation and amortization

- Tools that provide explanatory notes or examples of how to enter data were favored, as they help educate users on the calculation process.

-

Cost (Free vs. Paid)

– Accessibility is crucial. We assessed whether the calculators are free to use or require a subscription or one-time payment. Free tools that deliver high-quality results were given priority, but we also considered paid options that offer additional features or support.

-

Additional Resources

– Tools that provide supplementary materials, such as guides, tutorials, or FAQs, can enhance understanding and usability. We valued calculators that included resources to help users grasp the concept of operating income and its importance in financial analysis. -

Mobile Compatibility

– In today’s digital age, having a calculator that works seamlessly on mobile devices is essential. We considered tools that are optimized for mobile use, allowing users to perform calculations on-the-go. -

User Reviews and Reputation

– The reputation of the calculator among its users is an important consideration. We examined user reviews and testimonials to gauge overall satisfaction and identify any common issues that could affect usability or reliability. -

Data Security and Privacy

– For tools that require personal information for advanced features (like email downloads), we assessed their privacy policies and data security measures to ensure that user information is handled responsibly.

By applying these criteria, we aimed to identify the best online calculators for operating income that cater to both novice users and those with more advanced financial knowledge. Our goal is to provide a comprehensive list of tools that not only meet technical requirements but also enhance the overall user experience.

The Best How To Calculate Operating Incomes of 2025

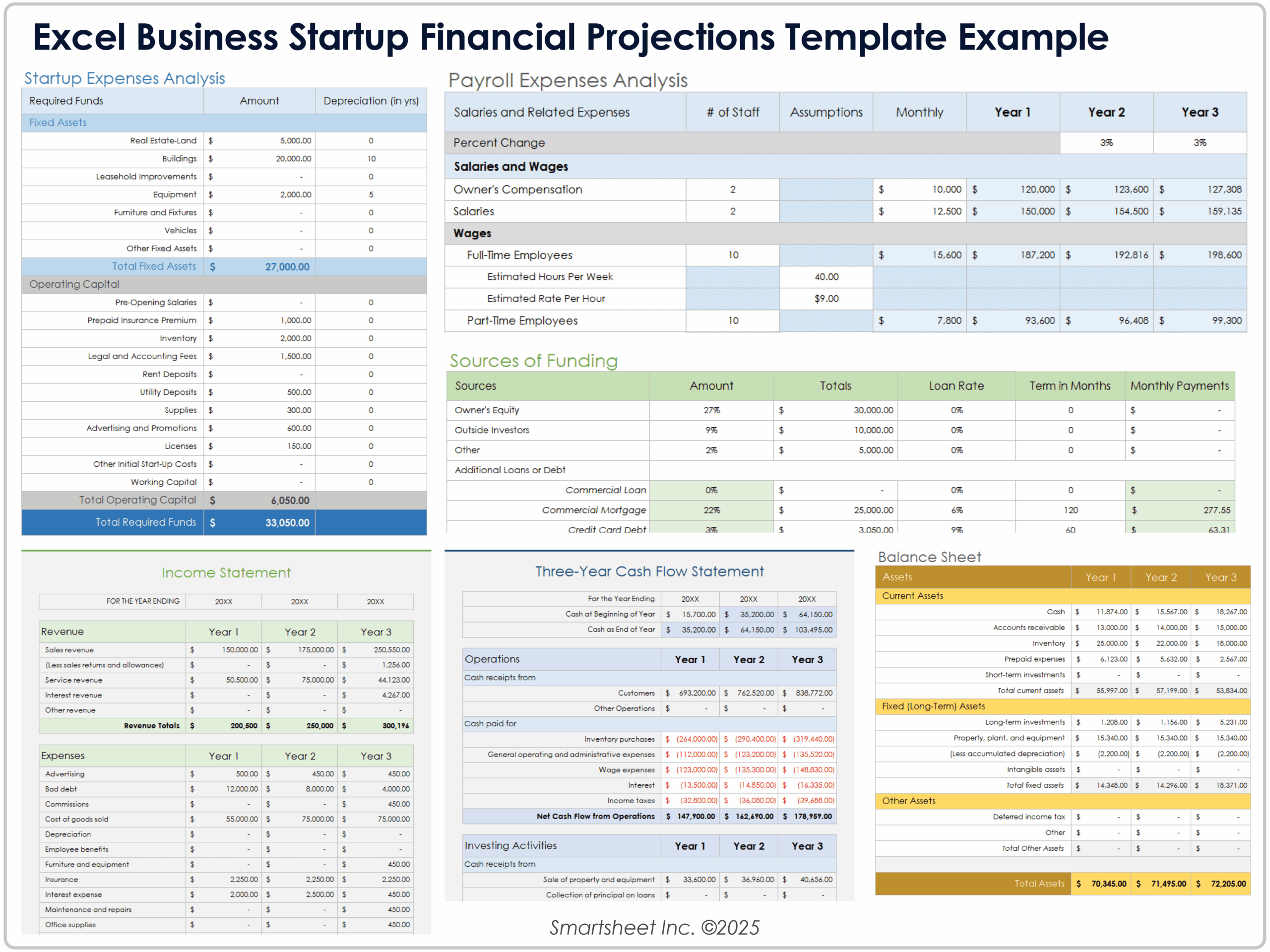

2. Operating Income: How to Calculate + Formula

The Salesforce guide on calculating Operating Income provides a clear and concise formula for determining this key financial metric. By subtracting operating expenses—such as wages, rent, and utilities—from total revenue, users can effectively assess their business’s profitability from core operations. This resource is particularly useful for business owners and financial analysts seeking to gain insights into operational efficiency and financial health.

- Website: salesforce.com

- Established: Approx. 27 years (domain registered in 1998)

4. How to Calculate Operating Income & Why It Matters

The article “How to Calculate Operating Income & Why It Matters” from 1800accountant.com provides a straightforward guide to determining operating income, a crucial financial metric. It outlines a simple three-step process: beginning with total revenues, subtracting the cost of goods sold (COGS) to find gross income, and then deducting total operating expenses. This clear methodology helps businesses assess profitability and operational efficiency, making it an essential resource for financial analysis.

- Website: 1800accountant.com

- Established: Approx. 28 years (domain registered in 1997)

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most critical steps in ensuring accuracy when using online calculators for operating income is to double-check all your inputs. The formulas for calculating operating income typically require several key pieces of data, including total revenue, cost of goods sold (COGS), and operating expenses. Ensure that the figures you enter are accurate and reflect the most recent financial data available. Even a small mistake in the numbers can lead to significant errors in the final output. When possible, cross-reference your figures with official financial statements or reliable financial news sources.

Understand the Underlying Assumptions

Every online calculator operates based on specific assumptions that can affect the results. For instance, some calculators might not factor in depreciation or amortization unless explicitly stated. Familiarize yourself with how each tool calculates operating income and any limitations they might have. This understanding helps you interpret the results more accurately and apply them effectively in your analysis. If a calculator uses a simplified formula, be aware that it may not capture all relevant costs associated with operating income, leading to a less accurate portrayal of a company’s financial health.

Use Multiple Tools for Comparison

To enhance the reliability of your results, consider using multiple online calculators. Different tools may have varying methods for calculating operating income, and comparing results from several sources can provide a more rounded view. If discrepancies arise between calculators, investigate the reasons behind them. This practice can help you identify which assumptions or data points might be causing variances in the results, leading to more informed decision-making.

Review Historical Data and Context

When calculating operating income, it’s beneficial to review historical data alongside your current results. Understanding trends in operating income over time can provide insights into a company’s performance and operational efficiency. This context can also help you assess whether the current operating income is consistent with past performance or if it indicates a shift in the company’s operational effectiveness. A tool that allows for historical comparisons may offer additional value in your analysis.

Seek Additional Resources for Clarification

If you encounter difficulties in understanding the terms or components involved in calculating operating income, don’t hesitate to seek additional resources. Educational platforms, financial blogs, and investment guides often provide detailed explanations of key concepts and calculations. Familiarizing yourself with terms like gross profit, operating expenses, and the implications of operating income can deepen your understanding and improve the accuracy of your assessments.

Stay Updated on Financial Regulations

Finally, staying informed about changes in financial regulations and reporting standards can also enhance the accuracy of your calculations. Changes in accounting standards may affect how operating income is reported and calculated. Regularly updating your knowledge will ensure that your analysis remains relevant and accurate, particularly in dynamic financial environments.

Frequently Asked Questions (FAQs)

1. What is operating income, and why is it important?

Operating income, also known as earnings before interest and taxes (EBIT), represents the profit a company earns from its core business operations after deducting operating expenses such as cost of goods sold (COGS) and other operational costs. It is crucial because it provides insight into a company’s operational efficiency and profitability, independent of its capital structure and non-operating income. Investors and analysts use this metric to assess a company’s financial health and compare performance across similar businesses in the same industry.

2. How do you calculate operating income?

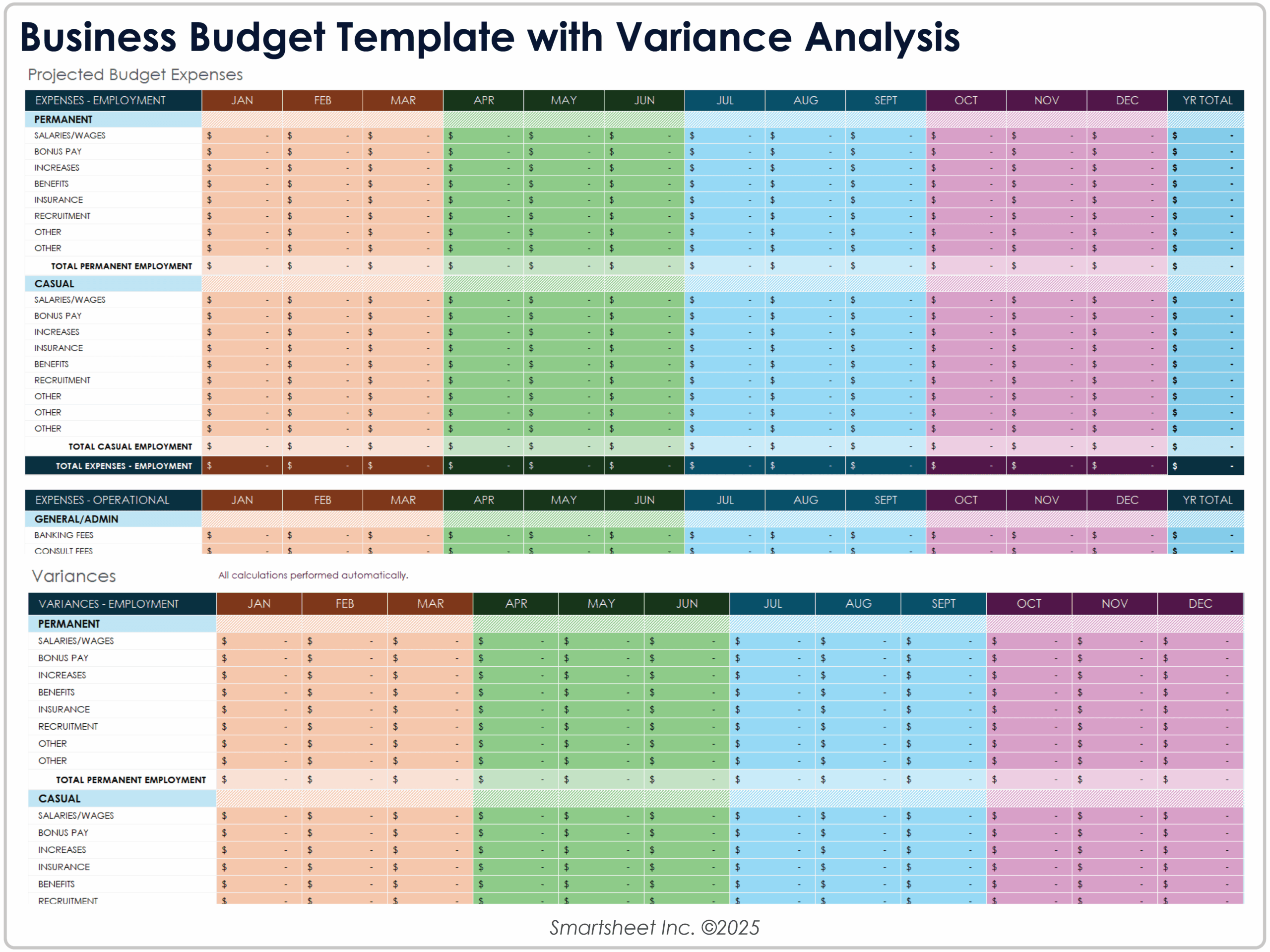

To calculate operating income, follow these steps:

-

Calculate Gross Profit: Subtract the cost of goods sold (COGS) from total revenue.

– Formula: Gross Profit = Total Revenue – COGS -

Determine Total Operating Expenses: Include all operational costs such as selling, general, and administrative expenses (SG&A), research and development (R&D), and any depreciation or amortization costs.

-

Calculate Operating Income: Subtract the total operating expenses from the gross profit.

– Formula: Operating Income = Gross Profit – Total Operating Expenses

This method gives you a clear view of how much profit is generated from operations alone.

3. Are there different formulas for calculating operating income?

Yes, there are several approaches to calculating operating income. The most common methods include:

- Top-Down Approach:

-

Formula: Operating Income = Gross Profit – Operating Expenses – Depreciation – Amortization

-

Bottom-Up Approach:

-

Formula: Operating Income = Net Income + Interest Expense + Tax Expense

-

Cost Accounting Approach:

- Formula: Operating Income = Net Revenue – Direct Costs – Indirect Costs

Each method offers a different perspective, but they ultimately aim to assess the profitability from core operations.

4. What are the key components needed to calculate operating income?

To accurately calculate operating income, you need the following components:

- Total Revenue: The income generated from sales before any deductions.

- Cost of Goods Sold (COGS): The direct costs associated with producing the goods sold by the company.

- Operating Expenses: This includes all overhead costs such as salaries, rent, utilities, and any expenses related to selling and managing the business.

- Depreciation and Amortization: Non-cash expenses that account for the reduction in value of tangible and intangible assets over time.

Having accurate figures for these components is essential for a precise calculation.

5. How can online tools assist in calculating operating income?

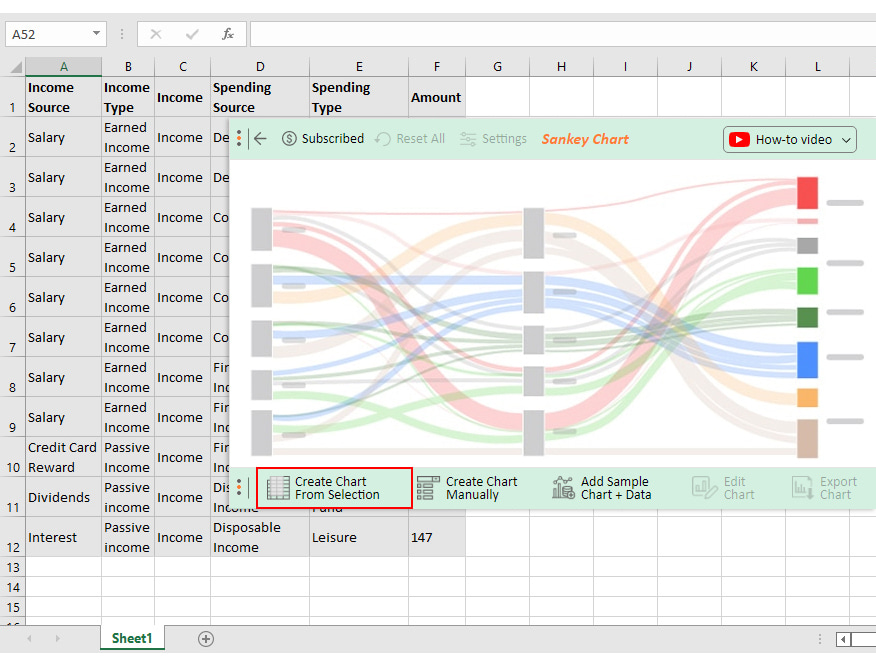

Online tools and calculators simplify the process of calculating operating income by providing pre-set formulas and interfaces where users can input their financial data. Many of these tools allow you to:

- Automatically calculate gross profit and operating income with minimal manual calculations.

- Compare operating income across different periods or with industry benchmarks.

- Generate reports and visualizations for better analysis.

Using these tools can save time and reduce the risk of errors, making financial analysis more accessible for users with varying levels of expertise.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.